- Home

- »

- Next Generation Technologies

- »

-

Shortwave Infrared Market Size, Industry Report, 2030GVR Report cover

![Shortwave Infrared Market Size, Share & Trends Report]()

Shortwave Infrared Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering, By Imaging Type (Spectral Imaging, Thermal Imaging, Hyperspectral Imaging), By Technology, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-499-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shortwave Infrared Market Summary

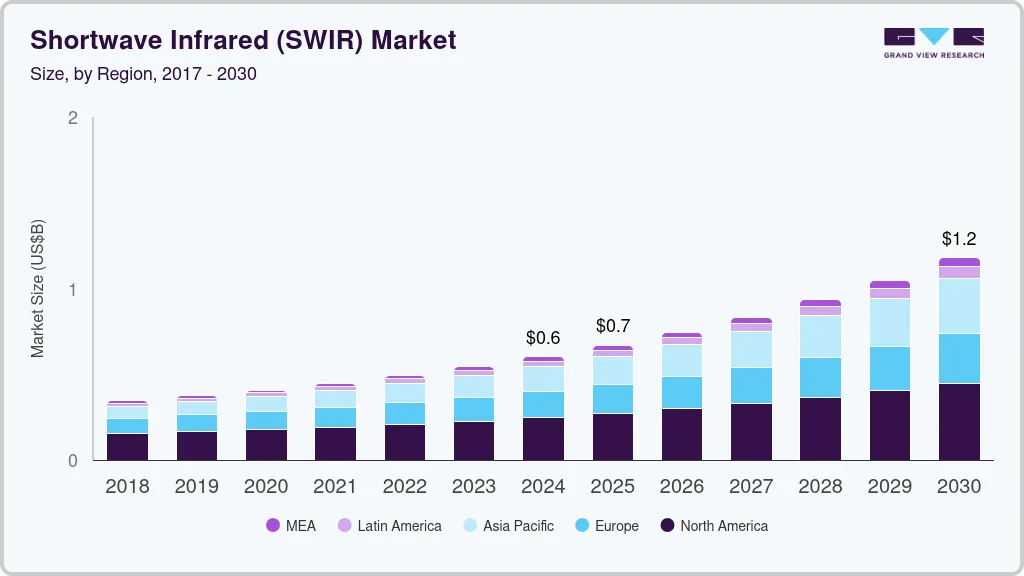

The global shortwave infrared (swir) market size was estimated at USD 603.0 million in 2024 and is projected to reach USD 1,179.6 million by 2030, growing at a CAGR of 12% from 2025 to 2030. The market growth is driven by expanding applications across industries such as defense, industrial inspection, healthcare, and security.

Key Market Trends & Insights

- North America dominated the shortwave infrared industry with a revenue share of over 38% in 2024.

- The U.S. SWIR market is expected to grow at a CAGR of 10.1% from 2025 to 2030.

- In terms of offering, The solution segment led the SWIR market in 2024, accounting for over 73% share of the global revenue.

- In terms of imaging type, The thermal imaging segment accounted for the largest market revenue share in 2024.

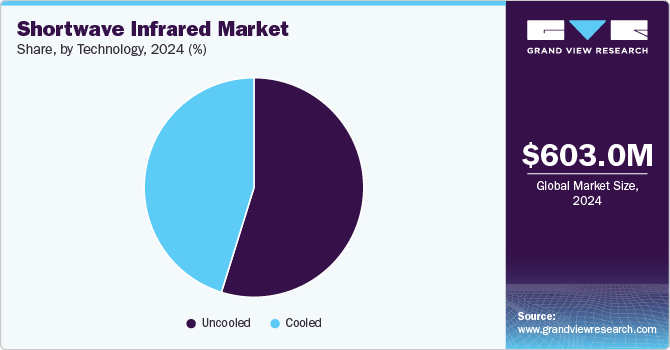

- In terms of technology, The uncooled segment accounted for the largest revenue share of the shortwave infrared industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 603.0 Million

- 2030 Projected Market Size: USD 1,179.6 Million

- CAGR (2025 - 2030): 12%

- North America: Largest market in 2024

SWIR refers to the wavelength range between 1.0 and 3.0 microns, which offers unique imaging advantages due to its ability to penetrate materials and capture high-contrast images even in low-light conditions. As industries increasingly demand enhanced imaging and sensing solutions, SWIR technology is becoming essential for applications such as surveillance, agriculture, electronics inspection, and scientific research. For instance, in April 2024, Quantum Solutions, a leader in quantum dot technology, announced the launch of its Q.Eye SWIR (short-wave infrared) image sensors. These cutting-edge sensors, with an impressive spectral range of 400-1700 nm, are poised to revolutionize imaging capabilities in machine vision and robotics applications.

One of the primary growth drivers in the shortwave infrared (SWIR) industry is its rising adoption in defense and military operations. SWIR imaging systems provide enhanced visibility during night operations and through adverse weather conditions, aiding in target detection, navigation, and situational awareness. The market is also seeing robust growth in the industrial sector, where SWIR cameras are used for quality control, non-destructive testing, and material identification, particularly in semiconductors and pharmaceuticals. Additionally, advancements in SWIR sensor technology, such as reduced costs and miniaturization, are fueling wider adoption in consumer electronics, autonomous vehicles, and environmental monitoring. The growing need for sophisticated surveillance and security systems in both public and private sectors further supports market expansion.

SWIR cameras are now utilized across a wide range of applications, including vehicle navigation, where demand has surged. These cameras are highly effective in navigating challenging conditions like fog, snow, or dust. SWIR technology's ability to distinguish between colors and analyze material properties, such as water vapor, air temperature, and chemical composition, makes it ideal for applications like spectrometry, aircraft inspection, and astronomy. The technology is also witnessing increased use in scientific research areas, such as ecosystem evaluation, climate change studies, ergonomics, microbe and disease assessment, and psychology.

Offering Insights

The solution segment led the SWIR market in 2024, accounting for over 73% share of the global revenue, primarily due to the growing demand for advanced imaging and sensing technologies across multiple industries. Solutions, including SWIR cameras, sensors, and related software, are increasingly sought after for their ability to enhance visibility in challenging environments, such as fog, smoke, and low light. Additionally, advancements in SWIR technology, such as improved resolution and cost efficiency, have made these solutions more accessible. In September 2024, TriEye LTD, a pioneer in cost-effective, mass-market SWIR sensing technology, unveiled the TES200, a 1.3MP SWIR image sensor. Operating within the 700nm to 1650nm wavelength range, the TES200 delivers exceptional sensitivity and high-resolution imaging. Featuring a high frame rate, large format, and low power consumption, it offers enhanced sensitivity and dynamic range. This makes the TES200 an ideal solution for imaging and sensing applications across industries such as industrial, automotive, robotics, and biometrics.

The services segment is predicted to foresee significant growth in the coming years, largely due to increasing demand for installation, maintenance, and customization services. As more industries adopt SWIR technologies for applications such as surveillance, industrial inspection, and environmental monitoring, the need for expert support in system integration and optimization is rising. Additionally, ongoing advancements in SWIR technologies require continuous technical assistance and training, further driving growth in the services sector. The expansion of tailored solutions for specific industries, such as defense, healthcare, and agriculture, also contributes to the heightened demand for consulting and support services, positioning this segment for robust growth throughout the forecast period.

Imaging Type Insights

The thermal imaging segment accounted for the largest market revenue share in 2024. The ability of SWIR thermal imaging to detect heat signatures and capture high-contrast images in challenging conditions like darkness, smoke, or extreme temperatures makes it invaluable for security and military operations. Additionally, industries such as manufacturing and energy are adopting thermal imaging for equipment monitoring, fault detection, and predictive maintenance. The rising focus on safety, along with advancements in sensor technology and cost efficiency, is further propelling the adoption of SWIR thermal imaging solutions across various sectors.

The spectral imaging segment is predicted to foresee significant growth in the coming years. Spectral imaging in the SWIR range allows for the identification of chemical compositions, moisture content, and material properties, making it invaluable in industries like agriculture, pharmaceuticals, and environmental monitoring. The growing demand for advanced imaging in areas such as food quality inspection, mineral mapping, and medical diagnostics is further boosting its adoption. Additionally, technological advancements in SWIR sensors and cameras, which enhance resolution and spectral sensitivity, are contributing to the rapid growth of this segment as industries seek more accurate and efficient imaging solutions.

Technology Insights

The uncooled segment accounted for the largest revenue share of the shortwave infrared industry in 2024. Unlike cooled SWIR systems, uncooled SWIR cameras do not require cryogenic cooling, making them more affordable, energy-efficient, and easier to integrate into various applications. This technology is particularly attractive for sectors like industrial inspection, automotive, and security, where lower costs and ease of use are key factors. Additionally, advancements in uncooled sensor performance, such as improved sensitivity and durability, are enabling broader adoption in diverse fields, including agriculture and environmental monitoring.

The cooled segment is anticipated to witness significant growth in the coming years. Cooled SWIR cameras, which use cryogenic cooling to minimize thermal noise, offer enhanced sensitivity and image clarity, making them ideal for critical uses in defense, astronomy, and scientific research. These systems excel in long-range detection, low-light environments, and extreme temperature conditions, which are essential for tasks like missile tracking, space exploration, and environmental monitoring. For instance, in March 2024, SVS-Vistek GmbH expanded its FXO Series of machine vision cameras with the launch of two new SWIR models, the fxo992 and fxo993. These cameras are specifically designed for high-resolution SWIR imaging at high speed, making them ideal for machine vision applications, particularly in inspection tasks. Both models also feature thermoelectric (TEC) cooling options for enhanced performance.

Vertical Insights

The military and defense segment accounted for the largest market revenue share in 2024. SWIR technology offers enhanced imaging performance in challenging conditions, such as low-light environments and through atmospheric obscurants, making it invaluable for military applications. Furthermore, the rise in defense budgets across various countries, coupled with the need for modernized equipment, is driving investment in SWIR systems for applications like target acquisition, intelligence gathering, and situational awareness. This growth is further supported by technological advancements in SWIR sensors, which improve detection range and image quality, strengthening their critical role in military operations. For instance, in October 2024, Lynred, a manufacturer and designer of IR sensors for aerospace, defense, and commercial applications, made a strategic move to strengthen its position in the IR sensor market by acquiring Paris-based New Imaging Technologies (NIT). This acquisition allows Lynred to expand its portfolio to include HD large-array SWIR sensors with small pixel pitch, further enhancing its product offerings across all wavelength bands, from shortwave to very longwave infrared.

The medical and healthcare segment is anticipated to exhibit the fastest CAGR over the forecast period, driven by the increasing adoption of advanced imaging techniques and diagnostic tools. SWIR technology provides superior imaging capabilities for various medical applications, including tissue analysis, cancer detection, and monitoring of physiological parameters. Its ability to penetrate biological tissues with minimal damage enables non-invasive diagnostics, enhancing patient safety and comfort. Furthermore, the growing emphasis on early disease detection and personalized medicine is fueling demand for SWIR imaging systems in healthcare settings.

Regional Insights

North America dominated the shortwave infrared industry with a revenue share of over 38% in 2024. The region’s strong focus on military and defense applications drives demand for SWIR systems, particularly for surveillance and reconnaissance purposes. Additionally, the burgeoning medical and healthcare sectors are increasingly adopting SWIR technology for non-invasive diagnostics and imaging solutions. Government initiatives to enhance research and development in photonics and imaging systems further bolster market growth.

U.S. Shortwave Infrared Market Trends

The U.S. SWIR market is expected to grow at a CAGR of 10.1% from 2025 to 2030. The country’s substantial investments in military and defense applications significantly boost the demand for SWIR technology, particularly for advanced surveillance, reconnaissance, and target identification systems. Additionally, the increasing use of SWIR in the medical and healthcare sectors for diagnostic imaging and monitoring further fuels market growth.

Europe Shortwave Infrared Market Trends

The SWIR market in Europe is expected to witness significant growth over the forecast period, primarily due to increasing investments in advanced imaging technologies across various sectors. The region’s emphasis on research and development, particularly in military and defense applications, is driving demand for SWIR systems used in surveillance, reconnaissance, and target acquisition.

Asia Pacific Shortwave Infrared Market Trends

The SWIR market in Asia Pacific is anticipated to register rapid growth over the forecast period. The rising defense budgets in countries like China and India are fueling investments in advanced imaging systems for surveillance and reconnaissance. The growing focus on research and development, along with supportive government initiatives, further accelerates the adoption of SWIR technology across various applications, positioning APAC as a vital growth market.

Key Shortwave Infrared Company Insights

Some key companies in the SWIR market include Teledyne FLIR LLC, Corning Incorporated, Collins Aerospace, Allied Vision Technologies GmbH, and Leonardo DRS.

-

Teledyne FLIR LLC, formerly FLIR Systems Inc., is an American manufacturer specializing in thermal imaging cameras and sensors. Teledyne FLIR offers a range of products, including handheld and fixed-mount thermal security cameras, cameras, machine vision cameras, thermography cameras, and gas detection cameras. These advanced imaging solutions serve various applications across industries such as security, law enforcement, defense, and industrial inspection, enhancing perception and awareness in challenging environments.

-

Corning Incorporated, a prominent American technology company, is a key player in the SWIR market. Leveraging its extensive expertise in materials science and optics, the company develops advanced SWIR technologies for various applications, including aerospace and defense. Notably, the company collaborated with Orbital Sidekick on the Aurora Hyperspectral Imaging satellite, utilizing high-resolution SWIR capabilities to enhance imaging performance. Corning Incorporated's innovations in SWIR technology contribute significantly to the growth and diversification of the SWIR market.

Key Shortwave Infrared Companies:

The following are the leading companies in the shortwave infrared market. These companies collectively hold the largest market share and dictate industry trends.

- Teledyne FLIR LLC

- Corning Incorporated

- Collins Aerospace

- Allied Vision Technologies GmbH

- Leonardo DRS

- Hamamatsu Photonics K.K.

- Fluke Corporation

- New Imaging Technologies (NIT)

- Raptor Photonics

- Lynred

Recent Developments

-

In July 2024, onsemi (Semiconductor Components Industries, LLC) acquired SWIR VISION SYSTEMS, INC., a company known for its advanced SWIR technology based on colloidal quantum dots (CQD). This technology allows sensors to capture images beyond the typical visible spectrum, enhancing imaging in areas like industrial automation, surveillance, and autonomous vehicles. By integrating SWIR with its CMOS sensors, onsemi aims to provide more cost-effective, high-performance imaging solutions for various sectors, including automotive and defense.

-

In April 2024, New Imaging Technologies (NIT) launched its latest advancement in SWIR imaging technology: the high-resolution SWIR InGaAs sensor precisely engineered to tackle the industry's toughest challenges. NSC2101, the new SWIR, features a high-performance InGaAs sensor with an 8µm pixel pitch, offering an impressive resolution of 2 MPIX at 1920x1080px. With an ultra-low noise level of just 25e-, it ensures outstanding image clarity even in demanding conditions.

-

In October 2023, Omron Corporation launched a new line of SWIR cameras aimed at enhancing precision inspection in manufacturing. These cameras enable visibility beyond the capabilities of standard vision systems, making them ideal for detecting defects in materials like glass, silicon, and plastics. The SWIR technology allows for higher accuracy in inspecting products during various manufacturing stages, improving quality control and reducing waste.

Shortwave Infrared Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 670.0 million

Revenue forecast in 2030

USD 1,179.6 million

Growth rate

CAGR of 12.0% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, imaging type, technology, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Teledyne FLIR LLC; Corning Incorporated; Collins Aerospace; Allied Vision Technologies GmbH; Leonardo DRS; Hamamatsu Photonics K.K.; Fluke Corporation; New Imaging Technologies (NIT); Raptor Photonics; Lynred

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shortwave Infrared Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global SWIR market report based on offering, imaging type, technology, vertical, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Imaging Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Spectral Imaging

-

Thermal Imaging

-

Hyperspectral Imaging

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Cooled

-

Uncooled

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Electronics and Communication

-

Military and Defence

-

Medical and Healthcare

-

Food & Beverage

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global shortwave infrared market size was estimated at 603.0 million in 2024 and is expected to reach USD 670.0 million in 2025.

b. The global shortwave infrared market is expected to grow at a compound annual growth rate of 12.0% from 2025 to 2030 to reach USD 1,179.6 million by 2030.

b. North America dominated the SWIR market with a share of 41.0% in 2024. The region’s strong focus on military and defense applications drives demand for SWIR systems, particularly for surveillance and reconnaissance purposes. Additionally, the burgeoning medical and healthcare sectors are increasingly adopting SWIR technology for non-invasive diagnostics and imaging solutions.

b. Some key players operating in the SWIR market include Teledyne FLIR LLC, Corning Incorporated, Collins Aerospace, Allied Vision Technologies GmbH, Leonardo DRS, Hamamatsu Photonics K.K., Fluke Corporation, New Imaging Technologies (NIT), Raptor Photonics, Lynred

b. Key factors that are driving the SWIR market growth include growing demand in industrial applications, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.