- Home

- »

- Consumer F&B

- »

-

Shrimp Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Shrimp Market Size, Share & Trends Report]()

Shrimp Market (2026 - 2033) Size, Share & Trends Analysis Report By Species (L. Vannamei, Trachipenaeus Curvirostris, Pandalus Borealis), By Source (Wild, Aquaculture), By Form (Green/Head-off, Peeled, Cooked), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-936-2

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Shrimp Market Summary

The global shrimp market size was estimated at USD 79.2 billion in 2025 and is projected to reach USD 121.4 billion by 2033, growing at a CAGR of 5.5% from 2026 to 2033. The global market is primarily driven by rising consumer demand for high-protein, low-fat seafood, increasing popularity of ready-to-cook and frozen shrimp products, and expanding awareness of the health and nutritional benefits of shrimp consumption.

Key Market Trends & Insights

- Asia Pacific held the largest share of the global shrimp industry in 2025, accounting for 52.0%.

- The U.S. shrimp industry led the North American market in 2025, holding the largest market share with 84.2% of the region’s total revenue.

- By species, the L. vannamei segment held the largest market share accounting for 44.3% in 2025.

- By source, the aquaculture segment held the largest share, accounting for a share of 60.1% in 2025.

- By form, the green/head-on market held the largest share, accounting for a share of 24.9% in 2025.

Key Market Trends & Insights

- 2025 Market Size: USD 79.2 Billion

- 2033 Projected Market Size: USD 121.4 Billion

- CAGR (2026-2033): 5.5%

- Asia Pacific: Largest market in 2025

- Middle East & Africa: Fastest growing market

The global demand for seafood, especially shrimp, is increasing as a result of shifting dietary preferences and growing health awareness among consumers. In addition, heightened awareness of the nutritional benefits of seafood, particularly shrimp, which is rich in essential nutrients such as omega-3 fatty acids and considered a healthier protein source, is further driving market growth.The global shrimp industry is propelled by shifting consumer preferences toward premium seafood and gourmet dining experiences. Increasing adoption of sustainable aquaculture practices is attracting environmentally conscious buyers. Technological improvements in breeding and disease control are boosting farm productivity. In addition, the growth of online seafood retail is expanding market access and convenience for consumers worldwide.

Moreover, growing demand for convenient and value-added seafood products is boosting shrimp consumption. Expansion of cold chain infrastructure supports wider distribution and longer shelf life. Rising incomes in emerging economies are increasing per capita seafood intake. Supportive government policies and export incentives are encouraging shrimp farming investments.

In addition, the global market is experiencing growth due to the rising popularity of high-protein diets and keto-friendly foods. Urbanization and changing lifestyles are driving demand for quick-to-cook, frozen shrimp meals. Tourism and hospitality industry expansion is further increasing shrimp consumption globally. Moreover, international trade liberalization is making shrimp more accessible across diverse markets.

Consumer Insights for Shrimp

Consumers are increasingly choosing shrimp for its high protein content, versatility, and premium positioning in seafood diets. Demand is rising for sustainably sourced products, with buyers placing greater emphasis on traceability and disease-free farming, indirectly influencing the shrimp disease diagnostics market. Moreover, consumers worldwide increasingly prefer convenient and time-saving seafood options, driving strong momentum in the frozen shrimp industry. Busy lifestyles, rising dual-income households, and growing acceptance of frozen foods as high quality have led to more purchases of ready-to-cook and value-added shrimp products. Buyers seek consistent taste, easy storage, and longer shelf life, encouraging brands to innovate with pre-marinated and portion-controlled packs. E-commerce growth has also expanded access to frozen shrimp in urban and semi-urban regions. Overall, convenience, accessibility, and improved cold-chain logistics are shaping modern global shrimp consumption patterns and enhancing category penetration among mainstream consumers.

In addition, changing culinary habits and the growing popularity of seafood-based ingredients have increased consumer interest in value-added shrimp formats, supporting the shrimp powder market. Health-conscious shoppers are choosing natural, protein-rich seasonings for snacks, soups, instant noodles, and functional foods. The rising popularity of global cuisines, particularly Asian and Latin American dishes, has further boosted demand for shrimp-derived powders used for flavor enhancement. Consumers seeking clean-label, MSG-free alternatives appreciate shrimp powder’s versatility and nutritional benefits. As food manufacturers develop innovative seafood-based ingredients, shoppers are embracing diverse shrimp formats that fit into modern cooking styles, meal kits, and home-chef experimentation.

Species Insights

The L. vannamei segment accounted for the largest share of 44.3% of the revenue in 2025. The growth of the L. vannamei segment is driven by its fast growth rate, high survival levels, and adaptability to varied farming conditions. Its lower production cost compared to other species makes it highly attractive for commercial aquaculture. Advances in selective breeding have improved disease resistance and yield efficiency. Increasing global demand for affordable, mild-flavored shrimp further supports its dominance in exports. In addition, government support in key producing countries such as India, Vietnam, and Ecuador is accelerating L. vannamei cultivation. For instance, according to the FAO, 80% of the cultured shrimp produced are of L. vannamei species. Approximately 4.4 million tons of shrimp of L. vannamei were produced.

The P. chinensis segment is projected to grow at the fastest CAGR of 8.4% from 2026 to 2033. The Penaeus chinensis market is driven by its high commercial value and strong demand in East Asian cuisines, particularly in China, Korea, and Japan. Its larger size and tender texture make it a preferred choice for premium seafood dishes. Regional aquaculture initiatives and research investments are enhancing breeding techniques and disease control for P. chinensis. Coastal farming zones in China are being revitalized to support its cultivation amid sustainability goals. In addition, rising domestic consumption and export potential are encouraging producers to scale up operations.

Source Insights

The aquaculture shrimp segment accounted for the largest share of 60.1% of the revenue in 2025. Farmed shrimp, also known as aquaculture or cultured shrimp, has gained significant popularity in recent years for several key reasons. Aquaculture enables a stable and year-round supply of shrimp, helping to meet the rising global demand. This method of production also reduces the reliance on wild shrimp, easing pressure on natural populations. Since overfishing can lead to the depletion of wild stocks and damage marine ecosystems, shrimp farming offers a potentially more sustainable solution.

The wild shrimp segment is projected to grow significantly at a CAGR of 4.5% from 2026 to 2033. The wild shrimp segment is driven by strong consumer preference for its natural taste, texture, and perceived premium quality. Demand is especially high in gourmet and specialty seafood segments where wild-caught origin adds value. Traditional fishing communities continue to supply established markets, supported by cultural and culinary preferences. In addition, regulatory efforts promoting sustainable wild catch practices are helping maintain long-term market viability.

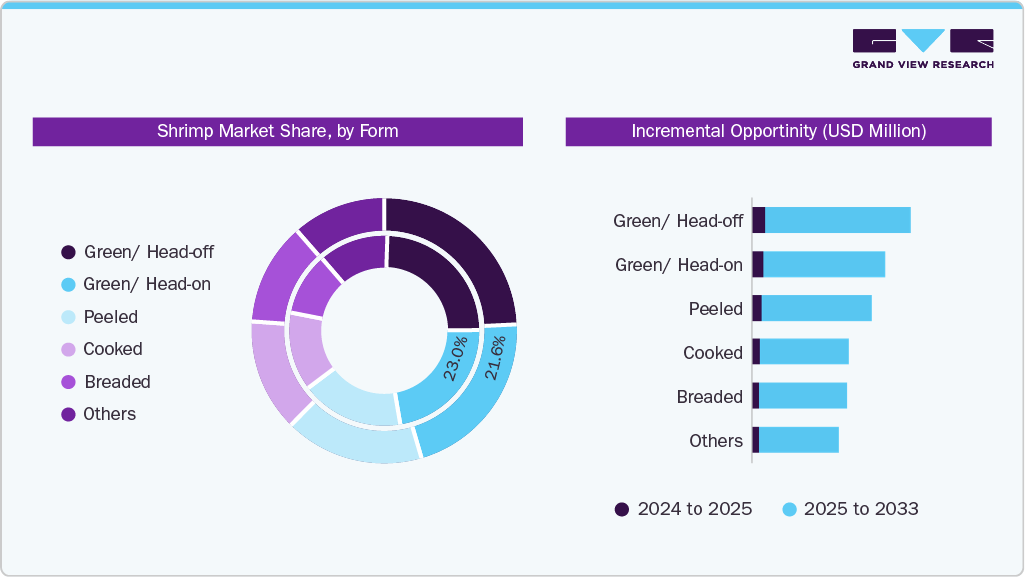

Form Insights

The green/head-on shrimp segment accounted for the largest share of around 24.9% of the global revenue in 2025. The market for green/head-on shrimp is driven by its freshness, visual appeal, and strong demand in traditional and gourmet cooking. Chefs and consumers often prefer head-on shrimp for its richer flavor and suitability in whole-shrimp presentations. It is especially popular in Asian and Mediterranean cuisines, boosting regional and international demand. In addition, minimal processing appeals to buyers seeking more natural and less altered seafood options.

The breaded shrimp segment is projected to grow at the fastest CAGR of 6.6% from 2026 to 2033. The segment is fueled by growing consumer demand for convenient, ready-to-cook seafood options. Its popularity in fast food and casual dining sectors drives consistent consumption. Innovations in flavor and coating varieties attract a broad customer base. In addition, increasing frozen food retail availability enhances accessibility and market growth worldwide.

Moreover, growing preference for simplified meal preparation also supports the shelled shrimp segment, as consumers increasingly choose pre-cleaned and easy-to-use shrimp formats. This trend complements breaded shrimp growth, reflecting a broader shift toward convenience-driven seafood purchasing across global retail and foodservice channels.

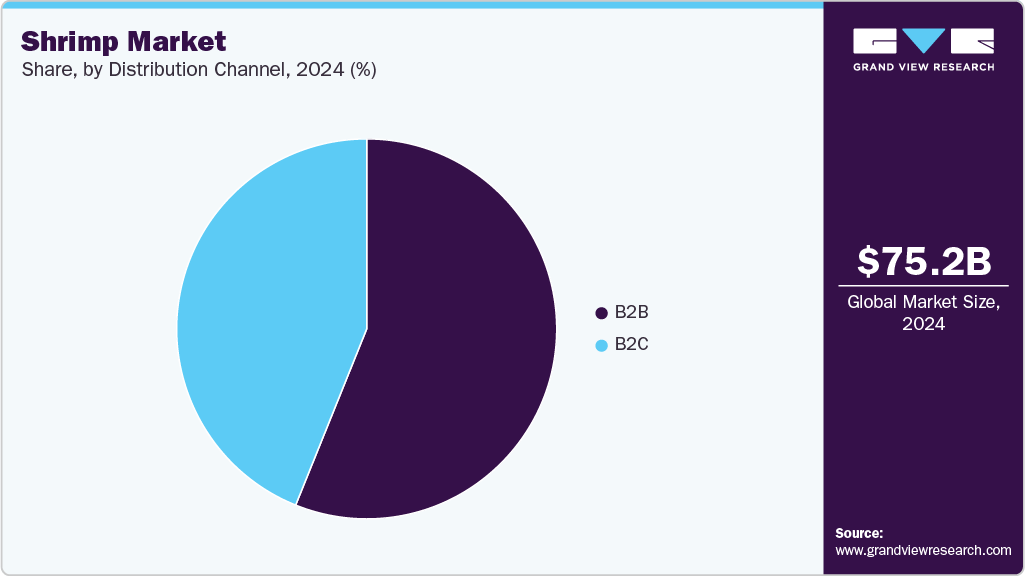

Distribution Channel Insights

The sales of shrimp through B2B distribution channel accounted for the largest share of around 55.9% of the global revenue in 2025. Sales of shrimp through B2B distribution channels are driven by strong demand from foodservice providers, including restaurants, hotels, and catering companies. Bulk purchasing and streamlined supply chains offer cost efficiencies and consistent product availability. Growing institutional consumption and export opportunities further boost B2B sales. In addition, advancements in cold chain logistics ensure shrimp quality during large-scale distribution.

The sales of shrimp through B2C distribution channel is projected to grow at the fastest CAGR of 5.9% from 2026 to 2033. Sales of shrimp through B2C channels are driven by increasing consumer preference for convenient and ready-to-cook seafood products. The rise of online grocery shopping and home delivery services has expanded accessibility. Health-conscious consumers seeking protein-rich diets also boost direct shrimp purchases. Moreover, effective marketing and attractive packaging enhance product appeal at the retail level. In October 2024, Walmart has launched the North Star Program in collaboration with Ecuadorian shrimp producer Omarsa, feed supplier Skretting, and The source Conservancy (TNC) to promote sustainable shrimp farming. The initiative focuses on clean energy production, deforestation-free soy sourcing, and reducing reliance on marine ingredients to enhance environmental responsibility in the shrimp industry.

Regional Insights

The Asia Pacific shrimp industry led the global market and accounted for the largest market share of 52.0% in 2025. The Asia Pacific market is propelled by rapidly rising disposable incomes and expanding middle-class populations with evolving food preferences. Traditional consumption habits favor shrimp, with strong demand across China, India, Japan, and Southeast Asia. Technological advances in aquaculture and government support for sustainable farming enhance production capacity. Urbanization and the growth of modern retail formats boost market reach. Export opportunities from major producers like India and Vietnam also significantly influence the regional market.

The region is also witnessing rising interest in value-added products, with the dried shrimp Asian market gaining traction due to its use in traditional dishes, longer shelf life, and strong demand from consumers seeking authentic, versatile seafood ingredients.

North America Shrimp Market Trends

North America shrimp industry accounted for the market share of 22.6% in 2025. The North America market is driven by increasing consumer demand for healthy, protein-rich foods amid growing health awareness. Rising popularity of ethnic cuisines, especially Asian and Latin American, has expanded shrimp consumption. Enhanced cold chain infrastructure ensures shrimp freshness across vast geographies. Sustainability concerns push demand for certified and responsibly sourced shrimp. In addition, retail innovations and online grocery growth are making shrimp more accessible to a wider audience. In March 2022, Del Pacifico Seafoods LLC, headquartered in Sinaloa, Mexico, known for its expertise in wild-caught Mexican shrimp, introduced a range of sustainably farmed shrimp and oysters at the Seafood Expo North America in Boston, Massachusetts.

Moreover, growing interest in alternative seafood options is also shaping regional demand, with the plant-based vegan shrimp industry gaining momentum among health-conscious and environmentally aware consumers seeking sustainable, allergen-free substitutes that replicate traditional shrimp’s taste, texture, and nutritional appeal.

The U.S. shrimp industry led the North American market in 2025, holding the largest market share with 84.2% of the region’s total revenue. In the U.S., convenience and ready-to-eat shrimp products are major growth drivers, aligning with busy lifestyles and on-the-go eating habits. Food service channels such as fast-casual dining and seafood restaurants contribute significantly to shrimp sales. Increasing interest in low-carb and keto diets encourages shrimp consumption as a healthy protein alternative. Domestic aquaculture advances are reducing import dependency. Moreover, food safety regulations and traceability initiatives build consumer confidence in shrimp products. In February 2022, SeaPak has introduced its new frozen product, Southern Style Jumbo Shrimp, available nationwide across the U.S.

Europe Shrimp Market Trends

The shrimp industry in Europe is projected to grow significantly at a CAGR of 5.3% from 2026 to 2033. Europe’s market growth is largely fueled by rising demand for sustainably sourced and organic seafood products. Health-conscious consumers seek shrimp as part of balanced diets rich in omega-3 fatty acids. The expansion of retail chains specializing in fresh and frozen seafood supports accessibility. Regional preferences for specific shrimp varieties influence market trends, alongside culinary traditions favoring shell-on shrimp. For instance, according to the data published in December 2024, in 2023, Southern Europe consumed USD 5.75 billion worth of shrimp annually.

The shrimp industry in the Spain is projected to grow at the fastest CAGR of 5.1% from 2026 to 2033. The Spain market is driven by strong consumer demand for fresh and high-quality seafood, deeply rooted in the country’s culinary traditions. Growing tourism boosts shrimp consumption in restaurants and hospitality sectors. Increasing preference for sustainably sourced and certified shrimp is shaping purchasing decisions. In addition, Spain’s strategic position as a major seafood importer and distributor enhances market availability and variety. For instance, according to the data published in December 2024, in 2023, Southern Europe imported approximately 332,000 tonnes of shrimp from non-EU suppliers, with Spain and France driving the region’s market growth.

Middle East & Africa Shrimp Market Trends

The shrimp industry in the Middle East & Africa is projected to grow at the fastest CAGR of 6.2% from 2026 to 2033, supported by rising seafood consumption, expanding retail distribution, and increasing urbanization. Growing investments in aquaculture infrastructure, particularly in countries such as Saudi Arabia, Egypt, and South Africa, are enhancing production capacity. Favorable government initiatives promoting sustainable aquaculture and import diversification further stimulate market development. In addition, the region’s hospitality, tourism, and foodservice sectors are driving demand for high-quality shrimp products across various formats.

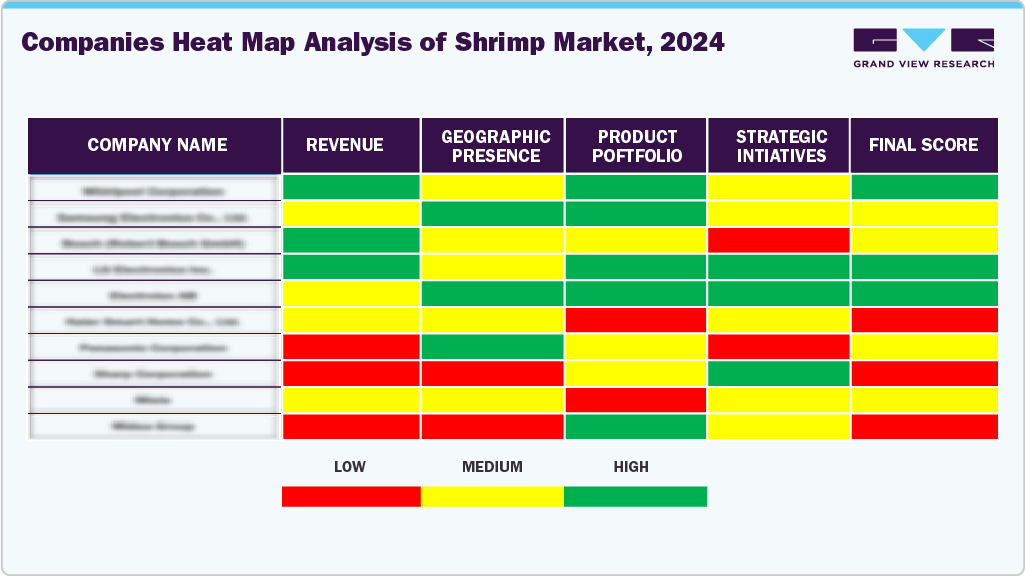

Key Shrimp Company Insights

Many brands in the global shrimp industry have recognized untapped opportunities within their product portfolios and are actively working to capitalize on these gaps. This includes launching innovative designs, expanding customization options, and tailoring marketing strategies to align with evolving consumer tastes and cultural trends. By addressing niche segments and emerging preferences, these brands aim to increase their market share and strengthen their competitive positioning worldwide.

Key Shrimp Companies:

The following are the leading companies in the shrimp market. These companies collectively hold the largest market share and dictate industry trends.

- Thai Union Group PCL

- Clearwater Seafoods

- Avanti Feeds Limited

- High Liner Foods

- Surapon Foods Public Company Limited

- Mazzetta Company, LLC

- Aqua Star

- Nordic Seafood A/S

- The Waterbase Limited

- Wild Ocean Direct

Recent Developments

-

In May 2024, Natural Shrimp, Inc. announced that, due to significantly increased production at its Webster City facility, the company is currently identifying, contacting, and securing new commercial outlets for the sale of its sushi-grade shrimp.

-

In March 2024, Thai Union Group introduced a groundbreaking program aimed at substantially cutting greenhouse gas (GHG) emissions within the shrimp supply chain. Developed in partnership with The source Conservancy (TNC) and Ahold Delhaize USA, the Shrimp Decarbonization initiative represents a major advancement toward more sustainable aquaculture practices.

Shrimp Market Report Scope

Report Attribute

Details

Market value size in 2026

USD 83.6 billion

Revenue Forecast in 2033

USD 121.4 billion

Growth rate (Revenue)

CAGR of 5.5% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative (Revenue) units

Revenue in USD million, volume in metric tons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Species, source, form, distribution channel, region

Regional Scope

North America; Europe; Asia-Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Lithuania; China; Japan; India; Thailand; Vietnam; South Korea; Brazil; South Africa

Key companies profiled

Thai Union Group PCL; Clearwater Seafoods; Avanti Feeds Limited; High Liner Foods; Surapon Foods Public Company Limited; Mazzetta Company, LLC; Aqua Star; Nordic Seafood A/S; The Waterbase Limited; Wild Ocean Direct

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shrimp Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global shrimp market report based on species, source, form, distribution channel, and region:

-

Species Outlook (Volume, Metric Tons; Revenue, USD Million, 2021 - 2033)

-

L. vannamei

-

Trachipenaeus curvirostris

-

Pleoticus muelleri

-

P. monodon

-

Acetes japonicus

-

Pandalus borealis

-

P. chinensis

-

Others

-

-

Source Outlook (Volume, Metric Tons; Revenue, USD Million, 2021 - 2033)

-

Wild

-

Aquaculture

-

-

Form Outlook (Volume, Metric Tons; Revenue, USD Million, 2021 - 2033)

-

Green/ Head-off

-

Green/ Head-on

-

Peeled

-

Cooked

-

Breaded

-

Others

-

-

Distribution Channel Outlook (Volume, Metric Tons; Revenue, USD Million, 2021 - 2033)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

-

Regional Outlook (Volume, Metric Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Lithuania

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

Vietnam

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shrimp market size was estimated at USD 79.2 billion in 2025 and is expected to reach USD 83.6 billion in 2025.

b. The global shrimp market is expected to grow at a compound annual growth rate (CAGR) of 5.5 % from 2026 to 2033 to reach USD 121.4 billion by 2033.

b. The L. vannamei market accounted for a revenue share of 44.3% in 2025, driven by its fast growth rate, high survival levels, and adaptability to varied farming conditions.

b. Some key players operating in the global shrimp market include Thai Union Group PCL, Clearwater Seafoods, Avanti Feeds Limited, High Liner Foods, Surapon Foods Public Company Limited, Mazzetta Company, LLC, Aqua Star, Nordic Seafood A/S, The Waterbase Limited, Wild Ocean Direct.

b. Key factors driving growth in the global shrimp market include increasing consumer demand for high-protein, low-fat seafood, and growing awareness of the health benefits associated with shrimp consumption. Expanding global trade, advancements in aquaculture practices, and the adoption of sustainable farming methods are also fueling market expansion. In addition, the rising popularity of ready-to-eat and frozen shrimp products, coupled with improved cold chain logistics and efficient distribution networks, supports broader market accessibility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.