- Home

- »

- Biotechnology

- »

-

Single-use Assemblies Market Size, Industry Report, 2030GVR Report cover

![Single-use Assemblies Market Size, Share & Trends Report]()

Single-use Assemblies Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bag Assemblies, Filtration Assemblies), By Application (Filtration, Storage), By Solution (Customized, Standard), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-978-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Single-use Assemblies Market Summary

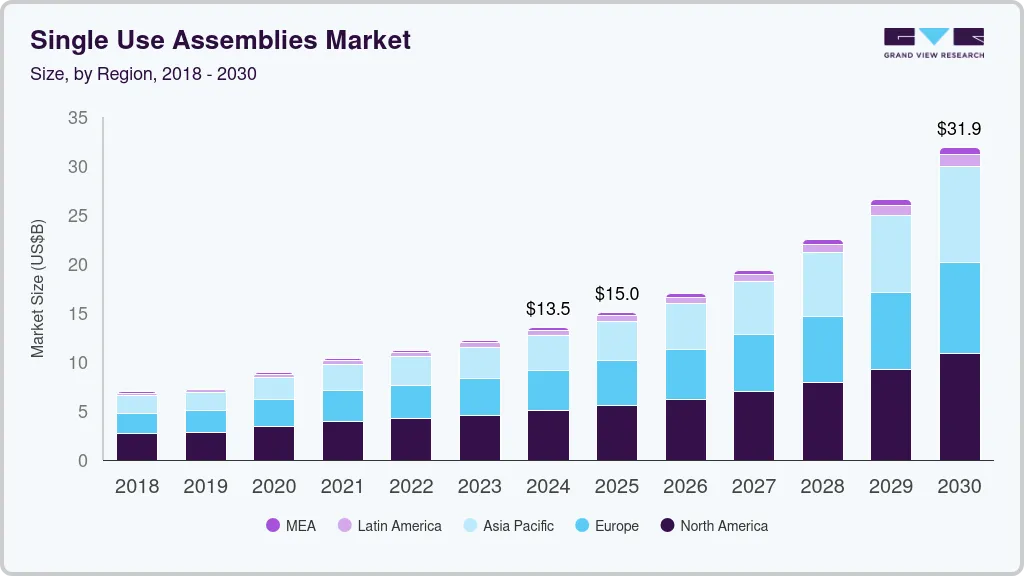

The global single-use assemblies market size was estimated at USD 13.47 billion in 2024 and is projected to reach USD 31.87 billion by 2030, growing at a CAGR of 16.24% from 2025 to 2030. Single-use (SU) assemblies are preassembled plastic fluid paths and self-contained products.

Key Market Trends & Insights

- North America dominated the regional market with a share of 37.19% in 2024.

- Asia Pacific is estimated to register the fastest CAGR of 19.53% from 2025 to 2030.

- By product, the filtration assemblies segment held the highest share of 28.87% of the overall revenue in 2024.

- By application, the filtration segment dominated the market in 2024 and accounted for the largest revenue share of 28.87%.

- By solution, the customized solutions segment dominated the global industry in 2024 with largest revenue share of 71.71%.

Market Size & Forecast

- 2024 Market Size: USD 13.47 Billion

- 2030 Projected Market Size: USD 31.87 Billion

- CAGR (2025-2030):16.24%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing biologics market, continuous technological innovations in bioprocessing, increasing biopharmaceutical R&D, and widespread adoption of single-use assemblies by various CMOs are expected to boost the single-use assemblies industry growth during the forecast period.Regulatory concerns due to leachability and extractability, waste disposal, and the vast availability of the multi-use system can hinder market penetration to a certain extent. COVID-19 has augmented an already rapidly rising demand for disposable assemblies as the technology allows for the speedy production and development of therapies and vaccines, and improves accuracy and time. For instance, the Aramus single-use bag assembly developed by Entegris, Inc. was used to store COVID-19 vaccines as the vaccines need extremely low temperatures to preserve. With low leachability and extractability and an extensive operating-temperature variety, the patented disposable bags were ideal for cold chain storage and collection.

Rising Disease Burden Fuels Demand for Biologics, Driving Growth in Single-Use Assemblies Industry

The growing prevalence of cancer and infectious diseases is increasing the production of effective novel biologics options for the diagnosis and treatment of cancer. The increasing number of cancer cases is aiding in developing novel biologic options. Furthermore, a rise in the cases of infectious diseases, such as lower respiratory infections and Human Immunodeficiency Virus (HIV), in recent years due to climate change, changing land-use patterns, and rapid urbanization are expected to aid in the industry growth. For instance, according to the WHO, lower respiratory infections ranked fourth in causing deaths globally.

Thus, infectious diseases require effective diagnosis and treatment options, such as biologics, which, in turn, are expected to boost the growth of the single-use assemblies industry. Furthermore, novel developments in vaccines for various infectious diseases are expected to contribute to industry growth.

-

For instance, in January 2022, Moderna launched a new clinical trial for an HIV vaccine that utilizes mRNA technology similar to that found in the company’s COVID-19 mRNA vaccine. This vaccine is aimed at producing antibodies that can neutralize HIV particles, and such attempts highlight the use of recently developed technologies in the biologics space.

Similarly, emerging infectious diseases that could develop into future pandemics are leading to collaborative efforts to develop new vaccine alternatives.

-

For instance, in August 2022, Lytic Solutions, which offers various molecular biology tools for research use, signed an agreement with NightHawk Biosciences to support NightHawk’s vaccine development efforts toward a new subunit monkeypox vaccine. Hence, such technological developments and collaborative efforts can significantly drive the adoption of the single-use assembly industry to produce newly developed vaccines.

The SU assemblies’ aid in the cost reduction associated with complex steps, such as maintaining steel-based bioreactors and accessories, cleaning, and sterilization. This cost reduction by the application of disposable products significantly helps reduce the R&D costs and initial investments involved in biologics production. Moreover, adopting disposable assemblies helps increase productivity in the manufacturing process by decreasing the complexity of automation and eliminating the need for changeover validation or cleaning between consecutive operations.

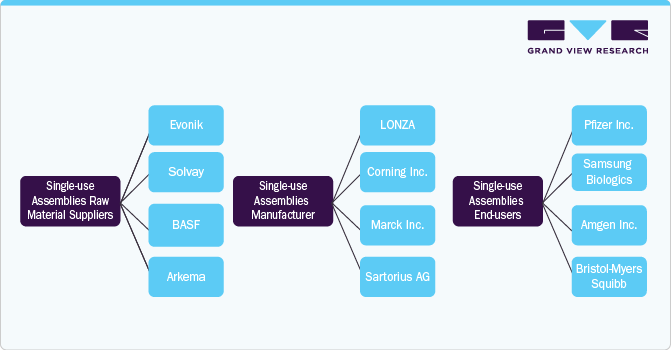

Single-Use Assemblies: Manufacturers, Suppliers, and End Users Landscape

The landscape for single-use assemblies (SUAs) involves various manufacturers, suppliers, and end users, primarily within the biopharmaceutical, biotechnology, and medical device sectors. Manufacturers focus on producing disposable, ready-to-use systems for fluid management, filtration, and cell culture, among other applications. Key suppliers provide the necessary raw materials, such as plastic films, connectors, and membranes, which meet stringent regulatory standards. End users, including pharmaceutical companies and contract manufacturers, benefit from SUAs due to their cost-efficiency, scalability, and reduced risk of cross-contamination. The increasing demand for biologics, cell and gene therapies, and vaccine production drives the market, making SUAs essential for streamlining manufacturing processes and ensuring product safety and quality. Leading players in this field include GE Healthcare, Thermo Fisher Scientific, and Sartorius. These players are continually innovating to enhance flexibility and performance in SUA solutions.

These products have observed more traction in the biologics manufacturing industry, where they are being used at multiple stages, namely in the upstream process, media & buffer preparation, downstream process, and process-intermediate storage. By outsourcing, leading companies can target new product development and rely on the CMO to meet clinical and commercial manufacturing needs. As a pipeline product moves from phase trials to a fully developed commercial manufacturing stage, the corresponding SUT development can happen concurrently at the CMO to speed up the product's single-use assemblies’ industry penetration.

Moreover, leading companies increasingly outsource their manufacturing needs to Contract Manufacturing Organizations (CMOs) to focus on new product development. As a product progresses from clinical trials to full-scale commercial production, the development of corresponding disposable technology can occur concurrently at CMOs, expediting market entry. In recent years, more CMOs have integrated single-use technologies into their bioprocesses, employing single-use assemblies to expedite processing and streamline process changeovers. The agility and turnaround time offered by single-use equipment can enhance CMO efficiency and reduce overall costs. Furthermore, increasing CMOs have transitioned to predominantly single-use setups to save costs and reduce operating expenses & capital investments. Hence, such widespread adoption of single-use technologies by CMOs represents a promising growth opportunity in the single-use assemblies industry.

Market Concentration & Characteristics

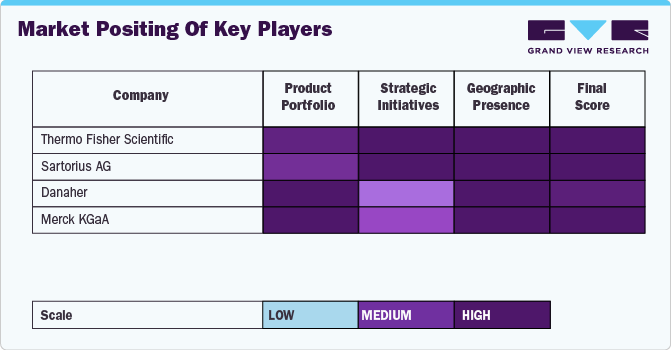

The single-use assemblies industry exhibits a moderate to high degree of innovation, driven by increasing biopharmaceutical demand for flexibility, contamination control, and faster production cycles. Companies continuously invest in R&D to enhance product integration, improve material compatibility, and support automation and process intensification. However, innovation is often incremental and focused on customization, improved standardization, and modular designs, with a few major players like Sartorius, Thermo Fisher, and Danaher leading advancements.

The industry sees a high level of collaboration, especially between biopharmaceutical manufacturers and single-use technology providers. Partnerships often focus on co-developing tailored solutions for upstream and downstream processes. Additionally, industry consortia and alliances (e.g., BPOG, BPSA) facilitate standardization and knowledge-sharing, while OEMs frequently collaborate with CDMOs and CMOs to streamline implementation across manufacturing workflows.

Regulations exert a moderate to strong impact on this market. While single-use assemblies reduce cross-contamination risks and align with GMP requirements, compliance with regulatory standards like USP <665>, USP <1665>, and EU Annex 1 has intensified focus on material testing, extractables/leachables, and quality documentation. Regulatory scrutiny pushes vendors toward better validation and traceability processes, which can be a barrier for smaller players.

The single-use assemblies industry is experiencing dynamic product expansion, with innovations in filtration and bag assemblies, a shift towards customized solutions, and strategic initiatives by key players. These developments are poised to meet the growing demands of biopharmaceutical manufacturing and contribute to the overall market growth.

The market is experiencing active regional expansion, particularly in emerging economies across Asia Pacific and Latin America. Multinational players are setting up local manufacturing, distribution, and support networks to address regional regulatory needs and reduce lead times. Countries like China and India are becoming focal points due to expanding biologics manufacturing capabilities and government incentives to boost local production.

Product Insights

The filtration assemblies segment held the highest share of 28.87% of the overall revenue in 2024. Increased regulatory prospects and the need to diminish the risk of contamination have promoted the use of filtration assemblies for bulk and final fill operations. Single-use filtration assemblies are a flexible and efficient alternative to stainless-steel systems as they eradicate sterilization steps and the related validation protocols.

The bag assemblies segment is expected to grow at the fastest CAGR from 2025 to 2030. In the biopharmaceutical industry, single-use bag assemblies of various sizes and shapes are used for many different applications, such as cell cultivation, formulation, sampling bag, buffer medium, and feed process.

Moreover, the extended application of SU bags throughout the biomanufacturing processes has further resulted in their use in drug substance transportation. SU bag assemblies allow rapid assembly and configuration of an extensive range of sterile, fluid-processing circuits. These bags also provide an attractive option for shipping and bulk freezing. Furthermore, advantages, such as lower maintenance costs and capital investment, and lower shipping costs due to less weight and no need for validation or cleaning, will further drive the adoption of bags.

Application Insights

The filtration segment dominated the market in 2024 and accounted for the largest revenue share of 28.87%. The implementation of single-use assemblies for filtration is rapidly increasing owing to their benefits. SUTs save not only expense and time, but also 90% of integrity testing, 90% of sterile connections, and up to 90% of tubing time. Unlike conventional filtration systems, single-use filtration systems also save process time as they are ready to use. The commercial success of biopharmaceuticals will require multiple manufacturing facilities to meet the increasing market demand. Biopharmaceutical manufacturers are integrating single-use facilities for faster product turnaround time and to house multiple product manufacturing processes in the same manufacturing area. The growing demand for single-use applications in the biopharmaceutical market has led the key players of this industry to expand their single-use production facilities globally.

The cell culture & mixing segment is expected to register the fastest CAGR from 2025 to 2030. The growth is mainly driven by the rising demand for biopharmaceuticals, favorable governmental policies, and increasing investment in R&D. Moreover, augmented demand for mammalian cell lines in upstream bioprocessing further drives the industry. Biopharmaceutical companies and researchers are progressively using cell culture techniques to develop vaccines for various diseases, including rubella, polio, smallpox, chickenpox, and hepatitis. Furthermore, the increasing prevalence of infectious diseases such as COVID-19 and chronic diseases globally will provide a strong impetus for market growth during the study period.

Solution Insights

Based on solutions, the global industry has been categorized into customized solutions and standard solutions. The customized solutions segment dominated the global industry in 2024. It accounted for the largest share of 71.71% of the overall revenue and is expected to grow at the fastest CAGR during the forecast period. With a single order, pharmaceutical companies, labs, and other end users can effortlessly integrate the systems into their process, streamlining production and reducing the hassle of sterilizing and cleaning. Moreover, the majority of the players offer customized solutions that meet the needs of the users. For instance, Mobius single-use assemblies manufactured by MilliporeSigma provide flexible, customized single-use solutions to fast-track pharmaceutical manufacturing and drug development.

Manufacturers who provide custom solutions to end users offer valuable insight into producing systems that address supply chain constraints, component incompatibility, and fit-for-purpose requirements while at the same time helping customers ensure that the system evolves to meet forthcoming needs.

Major market players such as Sartorius AG, Thermo Fisher Scientific, Inc, Merck, and Danaher have been continuously advancing technologies for these SU systems and providing a wide variety of custom products to meet the growing demand of the biopharmaceutical industry. Furthermore, the ongoing developments and expansion of product portfolios have further driven the bioprocessing industry to integrate these customized products in the bio manufacturing processes.

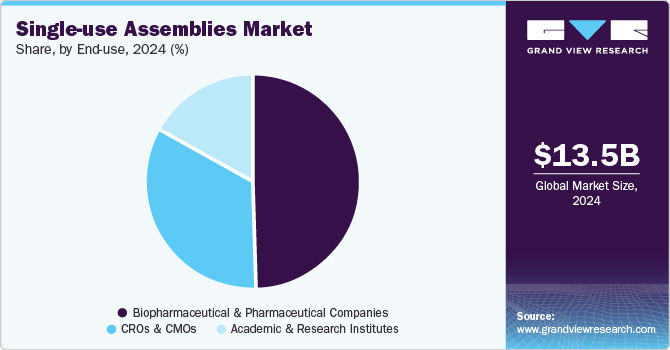

End Use Insights

The biopharmaceutical & pharmaceutical companies segment dominated the global industry in 2024 and accounted for the highest share of 49.45% of the overall revenue. The growth of biopharmaceuticals manufacturing facilities drives the demand for single-use assemblies. For instance, in June 2022, Alexion invested USD 70 million in novel drug production warehousing facilities and equipment to enhance Alexion’s manufacturing in Ireland. The expansion aims to expand the biologics drug substance portfolio. Similarly, in May 2022, Upperton Pharma Solutions announced an investment of USD 16 million in the facility expansion that can significantly aid in the increase in R&D space and a 10-fold increase in GMP manufacturing space.

The CROs & CMOs segment is expected to grow at the highest CAGR during the forecast period. In recent years, CMOs have been integrating SUT into most or all of their bioprocess. CMOs broadly use single-use assemblies for quicker processing and process changeover time. The short turnaround time and flexibility between process runs and various client projects allowed by single-use equipment can enhance the CMO's efficiency, which, in turn, aids in the reduction of the overall costs. In addition, the growing number of CMO facilities is a fully single-use facility. CMOs adopting single-use technology can save on campaign and facility costs, which supports reducing operating costs and capital investments.

Regional Insights

North America dominated the regional market with a share of 37.19% in 2024. This major share can be attributed to the growth in the biotechnology and pharmaceutical industries, advancement in products, and increasing incidence of diseases such as cancer, coupled with investments and funding in drug discovery research. For instance, in August 2022, Thermo Fisher Scientific Inc. opened its single-use technology manufacturing site in Greater Nashville. The 400,000-square-foot USD 105 million facilities allow the company to meet the increasing demand for the bioprocessing materials required to produce breakthrough therapies and vaccines for cancer and other diseases.

U.S. Single-use Assemblies Market Trends

The U.S. market is driven by the rapid expansion of biologics and cell & gene therapy manufacturing, alongside a mature biopharmaceutical industry that demands flexible, contamination-free, and scalable manufacturing solutions. The rise of personalized medicine and CDMOs, combined with strong regulatory oversight encouraging GMP compliance, has fueled the adoption of single-use assemblies across clinical and commercial production.

Europe Single-use Assemblies Market Trends

Stringent regulatory frameworks, a strong biosimilars pipeline, and increasing biomanufacturing automation are key growth drivers in Europe. The region's commitment to sustainable and cost-effective operations, coupled with growing investments in modular facilities, accelerates the use of single-use technologies in R&D and commercial settings. Multinational collaborations and regional biopharma clusters further promote innovation.

Post-Brexit, the UK market for single-use assemblies has seen heightened focus on strengthening its domestic biopharma capabilities. The rise of advanced therapy medicinal products (ATMPs), supportive government initiatives, and investments in innovation hubs like the Golden Triangle (Oxford–Cambridge–London) make the UK a growth hotspot for single-use assemblies. Ease of implementation, flexibility, and speed to market are particularly valued.

Germany single-use assemblies market leads in biotech innovation and has a strong footprint of biopharmaceutical manufacturers and contract service providers. The country’s focus on high-quality production, precision engineering, and adherence to EU regulatory standards supports adopting single-use systems. Government funding and digitalization efforts in biomanufacturing further enhance uptake.

Asia Pacific Single-use Assemblies Market Trends

Asia Pacific is estimated to register the fastest CAGR of 19.53% from 2025 to 2030, owing to the strategic activities of key players. For instance, in 2021, Sartorius made extensive investments in China and Beijing, creating additional cleanroom space to produce bags and single-use filters. Moreover, in September 2021, Cytiva announced plans to build a disposable manufacturing facility in South Korea with an investment of USD 52.5 million. This expansion aims to deliver single-use bags to the bioprocessing industry used in COVID-19 vaccine production.

China single-use assemblies market is witnessing rapid biopharma infrastructure development, fueled by government incentives, local manufacturing expansion, and the return of overseas talent. The shift from generics to biologics, emphasis on biopharma self-sufficiency, and the rise of domestic CDMOs drive demand for single-use assemblies. However, pricing sensitivity and regulatory harmonization remain critical considerations.

The market for single-use assemblies in Japan is mostly affected by the aging population and growing biologics demand, which further stimulates the adoption of efficient, contamination-free manufacturing. While the market is conservative with tech adoption, recent shifts toward process modernization and the government's push for pharmaceutical innovation are accelerating the integration of single-use systems, particularly for small-batch, high-value therapies.

MEA Single-use Assemblies Market Trends

The MEA region is in the early growth stage, with increasing focus on healthcare infrastructure, local pharma manufacturing, and biosecurity. Countries like the UAE and South Africa are exploring biotech investments, while governments aim to attract foreign players and reduce import dependency. The cost efficiency and ease of deployment of single-use assemblies align well with emerging market needs.

The Saudi Arabia market for single-use assemblies is expected to grow significantly. The country’s Vision 2030 and National Industrial Development initiatives aim to boost local pharmaceutical and biotech production. Public-private partnerships and investment in local manufacturing hubs, such as the Sudair Industrial City, are creating demand for modern biomanufacturing tools like single-use assemblies that ensure GMP compliance and quick scalability.

The Kuwait single-use assemblies market is gradually strengthening its local pharma production to ensure healthcare security. Although the biotech sector is nascent, government support for innovation and healthcare localization opens opportunities for single-use technologies. Partnerships with international players and healthcare modernization initiatives contribute to steady market traction.

Key Single-use Assemblies Company Insights

A heat map analysis in the single-use assemblies industry reveals that Danaher (via Cytiva and Pall) and Thermo Fisher Scientific are dominant players with extensive global reach, robust manufacturing capabilities, and comprehensive product portfolios spanning upstream and downstream applications. Sartorius follows closely, particularly strong in Europe and Asia, leveraging its integrated bioprocessing platforms and strategic partnerships. Merck (MilliporeSigma) maintains a strong position, especially in material science and filtration integration, supported by its innovation-driven approach and regulatory expertise. Other players, including Saint-Gobain, Avantor, and Repligen, occupy niche yet growing spaces, offering specialized components or excelling in certain regional markets. The competitive intensity is highest in North America and Europe, with Asia-Pacific emerging rapidly due to local biomanufacturing investments and strategic expansions.

Key Single-use Assemblies Companies:

The following are the leading companies in the single-use assemblies market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Sartorius AG

- Danaher Corporation

- Avantor

- Lonza

- Saint-Gobain

- Corning Incorporated

- Entegris

- KUHNER AG

Recent Developments

-

In April 2024, SaniSure introduced Fill4Sure, a customized single-use filling assembly aimed at accelerating the time to market for drug products while enhancing security, operational efficiency, and process repeatability in drug product filling.

-

In May 2023, Getinge announced an agreement to acquire the complete shares of Purity New England, Inc. Purity New England, Inc. is a market leader in single-use technologies for bioprocessing applications.

-

In April 2023, Merck KGaA launched Ultimus, a SU process container film, to provide superior strength & leak resistance in single-use assemblies.

-

In April 2022, Thermo Fisher Scientific developed a new SU manufacturing site in Utah, U.S. With this Utah facility (part of the USD 650 million multi-year expansion plan), the company envisions providing bioprocessing solutions at even inland locations.

Single-use Assemblies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.02 billion

Revenue forecast in 2030

USD 31.87 billion

Growth rate

CAGR of 16.24% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, solution, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Sartorius AG; Danaher Corporation; Avantor; Lonza; Saint-Gobain; Corning Incorporated; Entegris; KUHNER AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope.

Global Single-use Assemblies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global single-use assemblies market report based on product, application, solution, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bag Assemblies

-

2D bag assemblies

-

3D bag assemblies

-

-

Filtration Assemblies

-

Bottle Assemblies

-

Tubing Assemblies

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Filtration

-

Cell Culture & Mixing

-

Storage

-

Sampling

-

Fill-finish Applications

-

Other

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Customized Solutions

-

Standard Solutions

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Pharmaceutical Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global single-use assemblies market size was estimated at USD 13.47 billion in 2024 and is expected to reach USD 15.02 billion in 2025.

b. The global single-use assemblies market is expected to witness a compound annual growth rate of 16.24% from 2025 to 2030 to reach USD 31.87 billion in 2030.

b. The filtration assemblies segment held the highest share of 28.87% of the market in 2024. Increased regulatory prospects and the need to diminish the risk of contamination have promoted the use of filtration assemblies for bulk and final fill operations.

b. The key market players key competing in the single-use assemblies market include Thermo Fisher Scientific, Inc, Sartorius AG, Danaher Corporation, Merck KGaA, and others.

b. The growing biologics market, continuous technological innovations in bioprocessing, increasing biopharmaceutical R&D and widespread adoption of single-use technology by various CMOS are some of the major factors driving the growth of the single-use assemblies market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.