- Home

- »

- Medical Devices

- »

-

Sinus Dilation Devices Market Size, Industry Report, 2030GVR Report cover

![Sinus Dilation Devices Market Size, Share & Trends Report]()

Sinus Dilation Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Ballon Sinus Dilation Devices, Endoscopes, Sinus Stents), By Type (Sinuscopes, Rhinoscopes), By Procedure, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-634-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sinus Dilation Devices Market Size & Trends

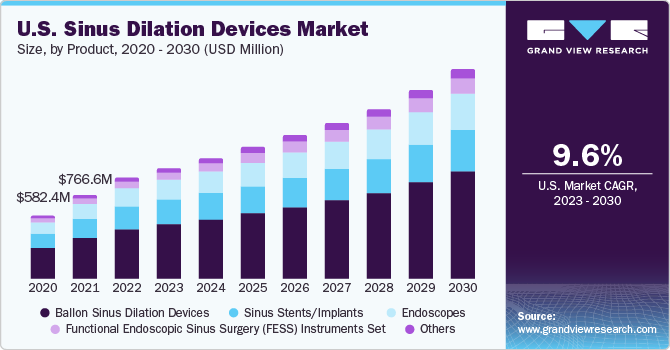

The global sinus dilation devices market size was valued at USD 2.74 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.6% from 2023 to 2030. The high preference for minimally invasive procedures, favorable reimbursement scenarios, rising awareness about the advantages of balloon sinuplasty over other conventional techniques, and the prevalence of chronic sinusitis are the major factors fostering the market growth. Developing advanced surgery techniques helps increase the market dynamics by replacing traditional procedures.

Technological advancements, such as surgical laser technologies, in sinus surgery ensure minimal ablation and have fewer side effects. Decreased turnaround time enables these procedures to be performed in outpatient departments. For instance, in 2022, the National Health Service (NHS) introduced an innovative laser treatment for patients with epilepsy. This pioneering therapy utilizes lasers to target and treat areas of the brain that cause seizures, providing a new and advanced approach to managing epilepsy and improving patients' quality of life.

The COVID-19 pandemic led to interruptions in routine patient care. Many healthcare organizations have canceled routine clinic visits and elective surgeries to increase and maintain the availability of intensive care and inpatient care beds and have reorganized medical and nursing staff. This has particularly interrupted care for patients with chronic rhinitis. The patients opted for teleconsultations and temporary options for sinus-related problems.

For instance, in Canada, there was a significant decline in the number of surgeries during the first 31 months of the pandemic, amounting to approximately 937,000 fewer surgeries (14%) compared to the pre-pandemic period. These figures were determined by comparing the surgeries performed since March 2020 to a baseline of 2019 without considering population growth or other factors. The most substantial drop in surgeries occurred in the initial four months of the pandemic (March to June 2020), when many scheduled and non-urgent procedures were postponed or canceled across the country to align with public health guidelines.

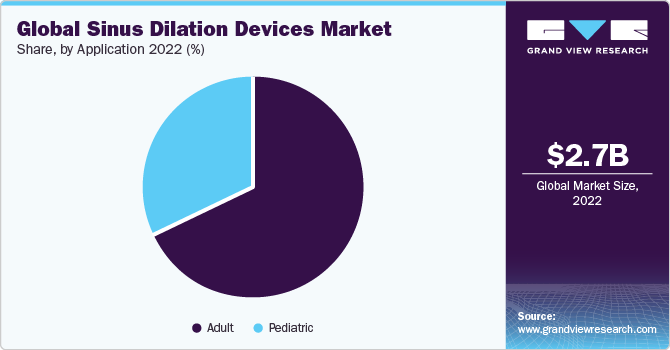

Application Insights

The adult patient segment accounted for the highest revenue share of more than 65% in 2022, owing to the high prevalence of sinusitis in adults. According to the Centers for Disease Control and Prevention (CDC), over 28 million adults in the U.S. have been diagnosed with sinusitis. This condition affects about 11.6% of all adults in the country. Sinusitis is a common health issue where the sinuses, which are air-filled spaces in the face, become inflamed and can cause symptoms such as nasal congestion, facial pain, and headaches. It's essential to manage sinusitis properly to alleviate discomfort and improve overall health.

The pediatric segment is anticipated to register the fastest CAGR of 10.2% over the forecast period. The growth can be attributed to the rise in sinusitis among children. According to the National Center for Biotechnology Information, in 2015, in the U.S., about 6 to 13% of children developed chronic rhinosinusitis and acute rhinosinusitis by the age of 3 years. In addition, several market players focus on developing products specifically for pediatric patients, securing the market position. According to NCBI, among children, about 7.5% of upper respiratory tract infections (common colds) can lead to acute bacterial sinusitis (ABS). However, ABS is sometimes not recognized in young children, and it can be challenging to diagnose and manage in primary care settings. This review provides updated information on how ABS is evaluated, diagnosed, and treated to help healthcare professionals better care for children with this condition. In simple terms, the review focuses on how doctors can identify and treat bacterial sinus infections in kids.

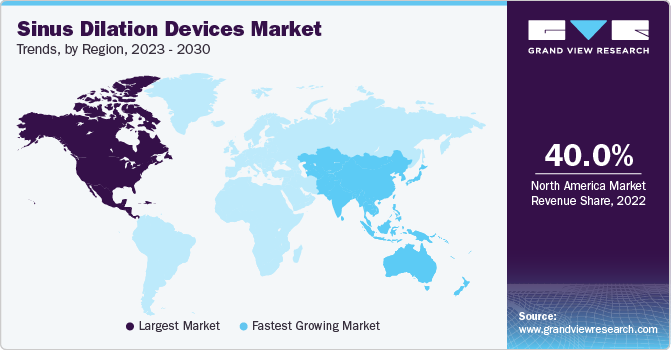

Regional Insights

North America dominates the sinus dilation devices market in terms of revenue, accounting for a share of over 40% in 2022. The dominance can be attributed to highly regulated and developed healthcare infrastructure. Moreover, the availability of advanced products due to the presence of major market players is boosting market growth.

According to The Commonwealth Fund, the healthcare system in the U.S. is a combination of public and private organizations. The federal government funds programs such as Medicare for older adults and some people with disabilities, as well as programs for veterans and low-income individuals such as Medicaid and the Children's Health Insurance Program. States also manage some local coverage and safety net programs. Many people have private health insurance provided by their employers, the most common type of coverage. The number of people without insurance has decreased over the years due to the Affordable Care Act. Both public and private insurers decide what services they will cover and how much individuals have to pay, following certain rules and regulations set by the federal and state governments. In simple terms, the US healthcare system involves a mix of government-funded and private insurance options that provide coverage to different groups of people.

Asia Pacific is expected to be the fastest-growing segment with a CAGR of 10.4% over the forecast period owing to factors such as the increase in disposable income and improvement in patient awareness about sinus surgical procedures. According to the report by OECD, emerging Asia, which includes countries such as ASEAN-10, China, and India, has shown strength even during tough times, such as the COVID-19 pandemic and a slow economy worldwide. They have managed to stay strong because of their smart money policies, doing well in selling goods to other countries and having strong demand within their own nations. It is predicted that their economy will grow by about 5.3% in 2023 and 5.4% in 2024. For ASEAN countries, which are part of Emerging Asia, their economy is expected to grow by about 4.6% in 2023 and 4.8% in 2024, showing that they can bounce back despite challenges.

Product Insights

The Balloon Sinus Dilation (BSD) devices segment captured the largest revenue share of more than 45% in 2022. BSDs are safe, small, flexible, and effective in improving symptoms of sinusitis. As the sinus dilation procedure does not involve tissue ablation, it results in quick turnaround time and patient comfort. However, BSD procedures are temporary, and patients may have to undergo repeat procedures. Balloon sinuplasty is used to treat chronic rhinosinusitis (CRS), a long-term inflammation of the sinuses.

According to NCBI, in 2020, chronic rhinosinusitis (CRS) is a prevalent chronic medical condition globally, impacting individuals of all ages. Its estimated incidence is 12.3% in the U.S., 10.9% in Europe, and 13% in China. This condition significantly reduces the quality of life for patients. Interestingly, CRS has been shown to have a more significant impact on social function than conditions such as ischemic heart disease or chronic heart failure.

The Functional Endoscopic Sinus Surgery (FESS) Instruments Set segment is anticipated to register the fastest growth rate of more than 12.5% over the forecast period. It treats recurrent acute rhinosinusitis and medically refractory chronic rhinosinusitis with or without polyps. It is a minimally invasive procedure and is highly preferred over other procedures, which is anticipated to fuel the segment's growth.

According to the Sinus & Allergy Wellness Center of North Scottsdale, sinusitis, characterized by inflamed sinuses, can complicate 0.5% of upper respiratory infections. Around 11.6% of American adults are diagnosed with this condition, causing 73 million restricted activity days and incurring a socioeconomic cost of over USD 5.8 billion annually. Notably, 47% of cases improve within a week without antibiotics, but sinusitis still leads to over 1.3 million hospital visits. Nasal saline has shown promise in promoting quicker recovery, and 84% to 100% of patients with severe asthma have abnormal CT scans. Treating chronic rhinosinusitis with antibiotics costs more than USD 150 million yearly. Sinusitis's health and economic impact necessitates effective and cost-efficient treatments to alleviate the burden on individuals and healthcare systems.

Type Insights

The sinuscopes segment captured the largest revenue share of around 60% in 2022 and is expected to grow at a CAGR of 9.5% over the forecast period. Growing preference for minimally invasive procedures and advances in sinuscope technology are expected to drive segment growth. For instance, in 2017, Stryker launched the Stryker VR Sinus Surgery Simulator, which helps surgeons train for sinus surgeries. The simulator uses a realistic 3D model of the sinuses to create a virtual environment for surgeons to practice their skills. The simulator also provides feedback on the surgeon's performance, which can help them to improve their skills.

Procedure Insights

The standalone procedure segment captured the highest revenue share of over 65% in 2022. Balloon sinus ostial dilation is performed as a standalone procedure. Standalone balloon dilation is as effective as functional endoscopic sinus surgery for treating chronic rhinosinusitis. In addition, the rising preference for minimally invasive surgical procedures due to increased adoption of health insurance is anticipated to fuel segment growth.

According to census.gov, between 2020 and 2021, there was a slight decline in the number of uninsured people in the U.S. In 2020, 8.6% of the population, equivalent to 28.3 million individuals, lacked health insurance throughout the year. This number decreased to 8.3% in 2021, with approximately 27.2 million uninsured people. Private health insurance coverage remained more common than public coverage in 2021. About 66.0% of individuals had private health insurance, while 35.7% had public coverage. Employer-based insurance was the most prevalent type among those with private health insurance, covering 54.3% of the population. On the other hand, Medicaid was the most common form of public health insurance, providing coverage to 18.9% of the population.

The hybrid procedure segment is anticipated to register the fastest growth rate of 10.5% over the forecast period. Balloon sinus ostial dilation is performed in combination with functional endoscopic sinus surgery; it is referred to as a hybrid procedure as it includes elements of both balloon sinus ostial dilation and functional endoscopic sinus surgery. Hybrid functional endoscopic sinus surgery balloon dilation procedure is effective in both pediatric and adult patients. Thus, increasing preference for hybrid procedures for adult and pediatric patients is anticipated to boost market growth.

End-use Insights

The hospitals segment accounted for the largest revenue share of around 50% in 2022 and is expected to witness considerable growth during the forecast period owing to the high volume of surgical procedures performed in hospitals. The increasing prevalence of chronic sinusitis coupled with favorable reimbursement criteria is anticipated to boost the segment growth. The availability of technologically advanced infrastructure and medical equipment along with the ability to perform complex sinus surgeries are projected to boost segment growth.

According to NCBI, each year, there are about 310 million major surgeries performed worldwide, with around 40 to 50 million in the USA and 20 million in Europe. Out of these patients, it is estimated that 1-4% may die, up to 15% might experience severe complications after surgery, and 5-15% may need to be readmitted to the hospital within 30 days. This means that major surgery is comparable to other leading causes of death such as heart disease, stroke, cancer, and injuries. In simple terms, major surgeries are common, but they also come with risks, and it's crucial for doctors to provide the best care to ensure successful outcomes and lower risks of complications.

The ambulatory surgical centers (ASCs) segment is expected to witness the fastest CAGR of 11.1% over the forecast period. The Healthcare system is interested in ASCs as a strategic option for delivering surgical services. Minimally invasive procedures, including BSD, can be easily conducted in ASCs. Moreover, cost-effectiveness along with better reimbursement scenarios than hospitals is anticipated to fuel the segment growth.

According to the Organization for Economic Cooperation and Development (OECD), in most OECD countries, more than 90% of cataract surgeries are done as ambulatory or day cases, meaning patients can go home on the same day of the surgery. However, in Lithuania, Hungary, and Mexico, fewer than 65% of cataract surgeries are performed as day cases. This difference could be due to data limitations on outpatient activities or higher reimbursement for inpatient stays, which may impact the development of day surgery in those countries. In simple terms, most cataract surgeries worldwide are done as day cases, but some countries have lower rates, possibly due to different healthcare systems and policies.

Key Companies & Market Share Insights

Key players in the market are focusing on adopting growth strategies, such as mergers and acquisitions, developing existing devices, promotional events, and technological advancements. For instance, Intersect ENT, Inc., one of the leading medical technology companies for ear, nose, and throat care, introduced a new product in the U.S. called the Straight Delivery System (SDS) along with the PROPEL Mini Sinus Implant (a medical device). The U.S. Food and Drug Administration has approved this combined packaging, making it available for use. The Straight Delivery System was previously approved in July 2020. In simple terms, Intersect ENT has launched a new product in the U.S. that includes a medical device called the SDS and the PROPEL Mini Sinus Implant, which the FDA has approved for use.

Key Sinus Dilation Devices Companies:

- Medtronic

- Smith+Nephew

- Stryker

- Intersect ENT, Inc

- Olympus Corporation

- SinuSys Corporation

- Johnson & Johnson Services, Inc.

- TE Connectivity

- InnAccel Technologies Pvt Ltd

Sinus Dilation Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.99 billion

Revenue forecast in 2030

USD 5.69 billion

Growth rate

CAGR of 9.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, procedure, application, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; Chile; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smith+Nephew; Stryker; Intersect ENT, Inc; Olympus Corporation; SinuSys Corporation; Johnson & Johnson Services, Inc.; TE Connectivity; InnAccel Technologies Pvt Ltd

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Sinus Dilation Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sinus dilation devices market based on product, type, procedure, application, end use, and region:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Ballon Sinus Dilation Devices

-

Endoscopes

-

Sinus Stents/Implants

-

Functional Endoscopic Sinus Surgery (FESS) Instruments Set

-

Others

-

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Sinuscopes

-

Rhinoscopes

-

-

Procedure Outlook (Revenue in USD Million, 2018 - 2030)

-

Standalone

-

Hybrid

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

ENT Clinics/In Office

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sinus dilation devices market is expected to grow at a compound annual growth rate of 9.6% from 2023 to 2030 to reach USD 5.69 billion by 2030.

b. North America dominated the sinus dilation devices market with a share of 40% in 2022. This is attributable to factors such as favorable reimbursement scenarios, technological advancements, and new product launches.

b. Some key players operating in the sinus dilation device market include Medtronic PLC, Smith & Nephew PLC, Acclarent, Inc., Intersect ENT, Inc., Entellus Medical, Inc., Olympus Corporation, and SinuSys Corporation.

b. The global sinus dilation device market growth was estimated at USD 2.74 billion in 2022 and is expected to reach USD 2.99 billion in 2023.

b. Key factors that are driving the sinus dilation devices market growth include the growing adoption of MIS in developed, as well as developing, countries owing to the advantages associated with it, such as reduced blood loss and less recovery time and hospital stays.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.