- Home

- »

- Medical Devices

- »

-

Skin Boosters Market Size & Share, Industry Report, 2030GVR Report cover

![Skin Boosters Market Size, Share & Trends Report]()

Skin Boosters Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Mesotherapy, Micro-needle), By Gender (Female, Male) By End-use (Dermatology Clinics, MedSpa), By Ingredient (Hyaluronic Acid, Exosomes), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-911-9

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Skin Boosters Market Summary

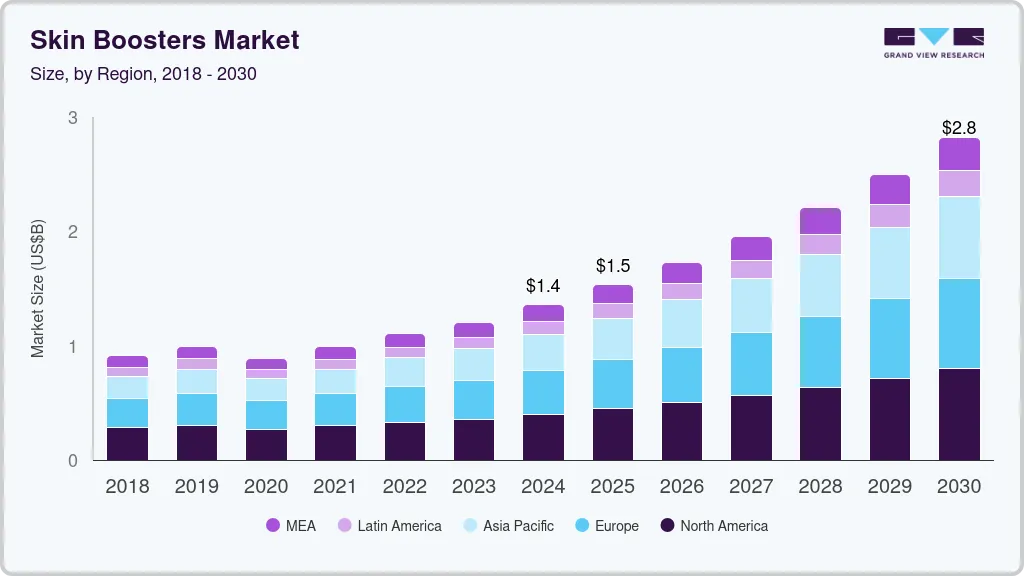

The global skin boosters market size was estimated at USD 1.36 billion in 2024 and is projected to reach USD 2.82 billion by 2030, growing at a CAGR of 13.0% from 2025 to 2030. Skin boosters are micro-injections of hyaluronic acid, vitamins, and minerals injected into the epidermis to revitalize, hydrate, and rejuvenate the skin for a natural glow.

Key Market Trends & Insights

- North America skin boosters market dominated and accounted for 29.5% share in 2024.

- Skin boosters market in the U.S. held the largest revenue market share of 72.8%.

- Based on type, mesotherapy segment led the market and accounted for 54.6% of the global revenue in 2024.

- Based on ingredient, hyaluronic acid (HA) skin boosters segment led the market with a revenue share of 54.9% in 2024.

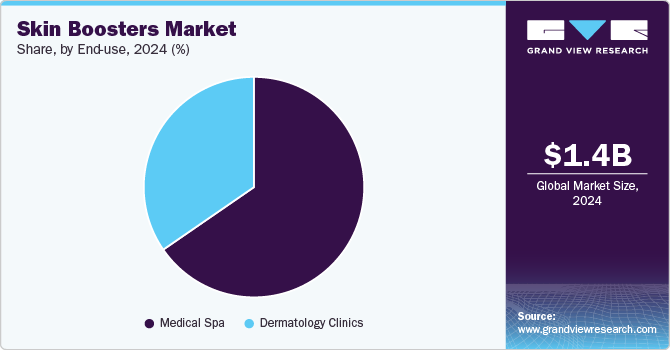

- Based on end-use, medical spa segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.36 Billion

- 2030 Projected Market Size: USD 2.82 Billion

- CAGR (2025-2030): 13.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market is expected to grow due to factors such as changing beauty standards in developing and developed countries, growing financial accessibility to nonsurgical cosmetic procedures, increasing regulatory approval for new-age skin boosters, and growing cosmetic demand from the aging population.

The COVID-19 pandemic, which is now an endemic in major regions and countries had a negative impact on the skin booster market. According to the International Society of Aesthetic Plastic Surgery report, a marginal downfall in nonsurgical aesthetic procedures was reported in 2020. Consequently, in December 2020, Merz Pharma, which manufactures Belotero, reported a moderate 10.3% decline in its yearly revenues due to COVID-19. The introduction of various insurance schemes for cosmetic procedures has contributed to the increase in awareness, acceptance, and growth in the skin booster market. For instance, Hamilton Fraser, the UK-based insurance company, is specifically dedicated to providing insurance for a range of aesthetic procedures, including laser treatments, dermal fillers, chemical peels, and facial treatments. Furthermore, in April 2022, AbbVie and PatientFi extended their partnership; as per the agreement, the latter firm agreed to provide financing options to AbbVie’s aesthetic product line. Such marketing agreements are expected to boost the demand for the skin booster market during the forecast period.

The growing adoption of minimally invasive cosmetic procedures is expected to drive market growth through the forecast period. The growing popularity of nonsurgical skincare treatment options is one of the primary factors responsible for an increase in the number of patients seeking skin boosters and plastic surgery services. Thus, increased demand for nonsurgical cosmetic procedures can be attributed to the fact that more people are becoming aware of the risks and complications associated with invasive surgical procedures, including delayed healing, risk of incision scars, and adverse reactions to anesthesia.

Furthermore, the growing popularity of skin booster treatment is attributed to the increase in the global geriatric population. According to the United Nations Population Fund, between 1974 and 2024, the global population aged 65+ nearly doubled from 5.5% to 10.3%, and it is expected to double again to 20.7% by 2074. The 80+ age group will grow even faster, more than tripling in the same period, driven by rising life expectancy and lower birth rates. Some of the key aging signs include wrinkles and skin sagging due to low facial elasticity, dark spots, etc. Thus, the presence of a large population liable to various signs of aging is boosting the demand for facial treatments such as skin boosters.

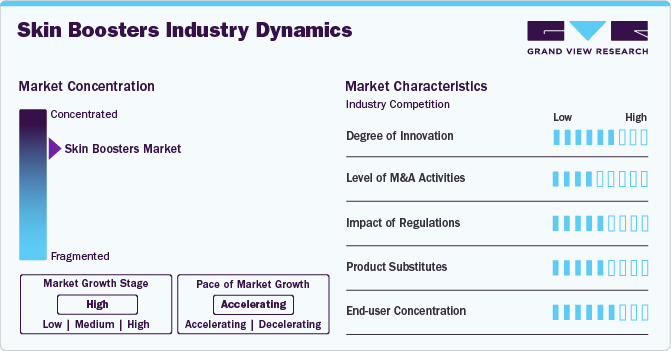

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. Owing to technological advancements, the skin booster market is characterized by a moderate-to-high degree of innovation. The providers emphasize greater patient comfort during the procedure, and market players are investing in innovative technologies and products to keep up with the demand.

The skin booster market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. For instance, in July 2023, ExoCoBio Inc., a player in exosome-based regenerative aesthetics, acquired a majority stake in BENEV COMPANY INC, a U.S.-based medical aesthetics company. This acquisition aims to enhance the global commercialization of exosome technology by leveraging BENEV's existing medical device and PDO thread businesses.

The skin booster market is also subject to increasing regulatory scrutiny. The increasing number of regulatory changes are introduced for facial injectables such as skin booster. For instance, after the initiation of Medical Device Regulation (MDR) within Europe, facial injectables were classified under class III medical device (the highest possible risk class), which implies that it has to comply with more requirements.

There are a limited number of direct product substitutes for skin boosters. However, several treatments can be used to achieve similar outcomes to skin boosters, such as chemical peels, microdermabrasion, laser treatments, and other over-the-counter vitamin C products. However, the available treatments are not permanent solutions for fine lines, wrinkles, and other signs of aging.

End-user concentration is a key factor in the skin boosters market. Since there are a number of end-user providers such as hospitals, dermatology clinics, and Medspas that are driving demand for such injectable procedures. Owing to the presence of various products by different manufacturers with similar patient benefits and results, practitioners demand additional discounts and rebates from distributors to use their products for aesthetic procedures.

Type Insights

Mesotherapy led the market and accounted for 54.6% of the global revenue in 2024. Mesotherapy elevates personalization by providing a customized treatment approach to address individual skincare issues. This method involves micro-injections of vitamins, minerals, and hyaluronic acid, delivering targeted hydration to the deeper layers of the skin. It proves productive in addressing fine lines, wrinkles, and dullness. Furthermore, the growing prevalence of facial wrinkles due to chronic obstructive pulmonary disorder (COPD) is expected to drive growth. According to an article by the NCBI in February 2023, patients suffering from COPD are expected to witness significant wrinkle formation. In addition, the growing number of COPD patients in younger age-group is expected to grow the target population for the market.

Mesotherapy is also expected to register the fastest CAGR during the forecast period. One of the key drivers of mesotherapy is that it can be adapted to treat a variety of skincare concerns, allowing it to be a versatile option for individuals with different skin types and issues. Furthermore, patients typically experience minimal downtime after mesotherapy, allowing them to resume their daily activities relatively quickly compared to more intensive cosmetic procedures.

Ingredient Insights

Hyaluronic acid (HA) skin boosters led the market with a revenue share of 54.9% in 2024. The skin boosters market has witnessed significant growth due to the unique properties and benefits of HA. Its exceptional hydration capabilities, skin quality improvement, versatility across age groups, non-invasive treatment option, and combination with other active ingredients have made HA a powerful ingredient in skincare. For instance, in July 2023, Allergan Aesthetics (AbbVie) introduced SKINVIVE by JUVÉDERM, the FDA-approved hyaluronic acid microdroplet injectable, to enhance cheek skin smoothness. This treatment boosts hydration, providing a lasting glow for up to six months.

Polydeoxyribonucleotides (PDRN) segment is expected to register the fastest CAGR over the forecast period. Derived from salmon sperm DNA, PDRN plays a vital role in cellular repair and regeneration, stimulating fibroblast activity that enhances collagen production and improves skin firmness and elasticity. Its ability to accelerate wound healing makes PDRN particularly appealing for individuals with acne scars and skin damage, while its anti-inflammatory properties soothe redness and irritation.

End-use Insights

Medical spa segment dominated the market in 2024. Skin booster procedures are primarily performed by medspas owing to low patient downtime and non-invasive nature of cosmetic surgery. According to Global Payments Integrated, med spas receive an impressive 155.8 million visits each year. According to Medica Depot, on average, patients allocate USD 536 for each visit to a med spa, which includes a range of cosmetic treatments. Botox treatments typically cost USD 10 to USD 15 per unit, while chemical peels range from USD 150 to USD 300. Moreover, medspas offer customer-friendly services such as subscription discounts, loyalty programs, and others, which augments their demand.

The Medspas sector is projected to witness the fastest growth rate over the forecast period. The growth is attributed to the inclusion of non-surgeons or non-medical professionals in this line of business. In addition, patient spending in medspas has grown by nearly 20% from 2020 to 2022 within the U.S., and the survey response from the American Med Spa Association in 2022 indicated that nearly 74% of the MedSpa owners expect an annual business growth of 10% or more.

Gender Insights

The female segment accounted for the largest market revenue share in 2024. This is because women show early signs of aging and dullness majorly due to hormonal fluctuations and related concerns. In addition, due to societal norms and values, a significant number of women undertake aesthetic procedures. According to the International Society of Aesthetic Plastic Surgery's 2023 Global Survey, women accounted for 85.5% of all aesthetic procedures, while men comprised 14.5%. Among women, the most popular surgical procedures were liposuction (approximately 1.8 million procedures, a 29% increase from 2021), breast augmentation, and eyelid surgery.

The female segment is projected to witness the highest growth rate over the forecast period. According to the Yale Medicine, Acne affects around 85% of people aged 12-24, but it can persist into adulthood, with over 25% of women and 12% of men in their 40s experiencing it. Acne is a prevalent dermatological issue for adult women, with clinical studies indicating that it impacts 50% of women in their 20s, 33% in their 30s, and 25% in their 40s. While often linked to adolescence, acne remains prevalent across different age groups. American Journal of Physical Anthropology stated that aging and collagen loss in females 50 years and above take place faster due to a decline in estrogen levels.

Regional Insights

North America skin boosters marketdominated and accounted for 29.5% share in 2024. High personal disposable income and substantial healthcare expenditure facilitate access to aesthetic treatments, increasing the demand for skin boosters. In Canada, about 20% of women express dissatisfaction with their appearance, propelling them towards nonsurgical aesthetic options. Meanwhile, in Mexico, a growing number of millennials, coupled with a rapidly aging population-currently 12% of the population is aged 60 and older-contribute to heightened demand for affordable aesthetic procedures.

U.S. Skin Boosters Market Trends

Skin boosters market in the U.S. held the largest revenue market share of 72.8%, owing to various factors, such as technological advancements, relatively high disposable income, and availability of several esthetic procedures in the country. The ISAPS 2023 study reported HA fillers accounting for 712,225 of the total 4.4 million nonsurgical procedures performed in the U.S. This growing interest in non-invasive treatments, particularly among millennials, whose aesthetic procedure adoption has surged in recent years, highlights a shift toward self-care practices influenced by social media trends.

Europe Skin Boosters Market Trends

Skin boosters market in Europe held the second largest revenue market share during the year 2024. Growing awareness of dermatological conditions is a significant factor driving the skin boosters market. A University of Valencia survey revealed that 65% of Spanish participants were dissatisfied with their skin’s appearance, with women aged 20-35 representing 80% of those concerns. In addition, technological advancements are enhancing the effectiveness of skin boosters.

Germany skin boosters market held the largest market share of 25.7%, various factors, such as increased popularity of cosmetic procedures, technological advancements, and rise in beauty consciousness, are driving growth of the market. Furthermore, rising urban population, novel product approvals, advancements in noninvasive procedures, and availability of skilled professionals are some of the other factors leading to market growth. However, the high cost of esthetic procedures is likely to impede market growth. As reported by the ISAPS Global Survey for 2023, Germany experienced over 780,000 injectable filler procedures, 310,000 of which were hyaluronic acid fillers, representing 39.7% of all nonsurgical procedures. This indicates a strong and ongoing demand for hyaluronic-based treatments in the country.

Skin boosters market in France showed the second largest market share in 2024. France is currently the global leader of cosmetic industry. It is among the top 10 countries with many cosmetic procedures, accounting for 2.2% of all procedures performed worldwide. This can be attributed to high esthetic & fashion consciousness in the country. Increased awareness among customers about potential benefits of esthetic procedures, coupled with growing adoption of minimally invasive procedures, is fueling growth of the market.

Italy skin booster market is anticipated to witness highest CAGR of 13.4% during the forecast period. According to International Medical Journal, in 2020, the most preferred nonsurgical procedure was hyaluronic acid filler treatment, accounting for 41% of the total procedures performed in the country. This indicates that hyaluronic acid-based treatments, which include skin boosters, are likely to witness high growth in the country. Increasing esthetic consciousness is boosting the demand for & popularity of cosmetic procedures in the country. Rising geriatric population, increasing esthetic consciousness, rising interest of consumers in minimally invasive injectable procedures, and easy availability of certified practitioners have resulted in improved accessibility to esthetic procedures, thereby growth of the market.

Asia Pacific Skin Boosters Market Trends

Asia Pacific skin boosters market is anticipated to grow with the fastest CAGR of 14.7% during the forecast period. This can be attributed to the growing medical tourism industry, especially in these countries. A large number of aesthetic procedures can be attributed to the easy availability of advanced techniques and cost-effective treatment options. For instance, in January 2024, Empro unveiled the SpaceLift Face Booster, a groundbreaking lifting solution, at its soft launch in Kuala Lumpur, Malaysia, aiming to expand its presence to 30 countries globally by year-end.

Skin boosters market in South Korea held the largest revenue market share of 27.9% and is anticipated to grow at the fastest rate during the forecast period. The demand for skin boosters in South Korea is rising due to cultural beauty standards, advanced technology, and increasing skin concerns. Cosmetic treatments are widely accepted, with some parents even gifting them to children for milestones such as graduation. For instance, in 2021, skincare cosmetics accounted for 34.17% of total cosmetic imports, indicating significant public interest in these solutions. Notable technological innovations, such as low molecular weight hyaluronic acid and novel peptide complexes, have enhanced product efficacy.

China skin boosters market held the second largest revenue market share, and is anticipated to grow at the significant rate during the forecast period. Increasing demand for noninvasive esthetic treatment by is anticipated to boost the market growth in China. For instance, men accounted for nearly 15% of the customers in China’s esthetic treatment market. According to a report by the Chinese magazine Sixth Tone, out of 22 million people who underwent invasive and noninvasive esthetic procedures, 54% (12 million) people were under the age of 28, and teenagers accounted for 8%, the major reason being increasing workplace competition. Moreover, the presence of major players, such as Bloomage Biotechnology, which is one of the world’s largest producers of hyaluronic acid-based fillers, is expected to contribute to the market growth.

Skin boosters market in India is expected to grow second fastest CAGR of 15.2% during the forecast period. The skin boosters market in India is expanding due to rising awareness about skincare and the impact of pollution and unhealthy lifestyles. The growth of the beauty and wellness industry, alongside a focus on personal grooming, further drives this demand. A 2023 survey reported that 72% of consumers trusted celebrity endorsements when considering skincare products. By 2024, the number of social media influencers in the beauty sector was expected to grow, with top influencers having millions of followers.

Latin America Skin Boosters Market Trends

Latin America skin boosters market is expected to witness a lucrative growth during the forecast period. Latin America is one of the fastest-growing cosmetic industries in the world. Wellness and the desire for a healthy and holistic lifestyle have given momentum to the functional beauty segment. Organic and natural cosmetics and personal care products continue to be a growing niche in the region. There has been significant growth in medical tourism, which is boosting the development of the healthcare industry. The presence of untapped opportunities in developing countries, such as Mexico and Brazil, is also expected to propel the market growth in the region.

Skin boosters market in Brazil dominated the region with the largest revenue share of 54.8% during the forecast period. Brazilian cosmetics are recognized globally for their innovation in several categories, the use of ingredients from our biodiversity is a real differentiating asset to attract new customers. Brazil is the 4th global market for personal hygiene and beauty products and the 3rd country for the number of product launches.

MEA Skin Boosters Market Trends

MEA skin booster market is expected to grow at a lucrative growth. This region is technologically developed, however, there is negligible awareness pertaining to esthetic treatments. Moreover, some countries in the African region lack healthcare infrastructure, thus the market is expected to exhibit moderate growth of 11.8% during the forecast period. Despite the COVID-19 pandemic, the Middle East esthetic sector continues to show flexibility, with optimistic signs that the sector is expected to start recovering over the forecast period.

Skin boosters in Saudi Arabia held the largest revenue market share of 35.4% during 2024. In Saudi Arabia, there has been an increasing consumer preference for non-surgical aesthetic procedures, with skin boosters gaining popularity for their ability to enhance skin hydration and texture with minimal downtime. Key drivers of this demand include changing beauty standards emphasizing natural enhancement, raising awareness and education about skincare fueled by social media influencers, and technological advancements in formulation.

Key Skin Boosters Company Insights

Companies in the market undertake different strategies to strengthen their product portfolios and undertake expansions on a regional level to offer diverse, technologically advanced, innovative products to their customers. This is a prominently adopted strategy by companies to attract more customers. Furthermore, several market leaders acquire smaller players to strengthen their market positions. This strategy enables them to increase their capabilities, expand their product portfolios, and improve their competencies. Key players engaged in this growth strategy include Galderma and Allergan Aesthetics (Abbvie).

Key Skin Boosters Companies:

The following are the leading companies in the skin boosters market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie, Inc (Allergen)

- Galderma

- Sinclair

- Merz Pharma

- Teoxane

- Medytox, Inc.

- PharmaResearch Co., Ltd.

- VAIM Co., Ltd

- Bloomage Biotechnology

- IBSA Farmaceutici Italia Srl

- Dexlevo Co., Ltd.

- LINKUS GLOBAL Co., Ltd.

- ExoCoBio Inc.

Recent Developments

-

In October 2024, Merz Pharma launched its Research & Development Innovation Center (RDIC) in Raleigh, North Carolina, which will serve as its global headquarters. The center is designed to foster collaboration across R&D functions and drive innovation to expand its product portfolio.

-

In October 2024, IBSA Farmaceutici Italia Srl introduced a new product in its Profhilo line. It utilizes patented Nahyco technology to restore facial adipose tissue affected by aging. This innovation targets deeper skin layers, promoting tissue regeneration for a youthful appearance.

-

In September 2024, Allergan Aesthetics (Abbvie) launched SKINVIVE by Juvéderm in Thailand, an injectable skin booster featuring hyaluronic acid and Aquaporin-3. It enhances skin hydration, texture, and radiance, offering long-lasting results for millennials and Gen Z beauty enthusiasts.

Skin Boosters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.53 billion

Revenue forecast in 2030

USD 2.82 billion

Growth rate

CAGR of 13.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, ingredient, gender, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

AbbVie, Inc (Allergen); Galderma; Sinclair; Merz Pharma; Teoxane; Medytox, Inc.; PharmaResearch Co., Ltd.; VAIM Co., Ltd; Bloomage Biotechnology; IBSA Farmaceutici Italia Srl; Dexlevo Co., Ltd.; LINKUS GLOBAL Co., Ltd.; ExoCoBio Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Skin Boosters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global skin boosters market report based on type, ingredient, gender, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mesotherapy

-

Micro-needle

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Hyaluronic acid (HA)

-

Polydeoxyribonucleotides (PDRN)

-

Poly-L-Lactic Acid (PLLA)/ Poly-D, L-Lactic Acid (PDLLA)

-

Polycaprolactone (PCL)

-

Exosomes

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Female

-

Male

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medspas

-

Dermatology Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global skin boosters market size was estimated at USD 1.36 billion in 2024 and is expected to reach USD 1.53 billion in 2025.

b. The global skin boosters market is expected to grow at a compound annual growth rate of 13.0% from 2025 to 2030 to reach USD 2.82 billion by 2030.

b. North America dominated the skin boosters market with a share of 29.4% in 2024 owing to the increasing demand for cosmetic procedures by both adults and the geriatric population. It was observed that North America had the highest procedure volume of non-surgical aesthetic treatments globally.

b. Some key players operating in the skin boosters market include Allergan, Gladerma, Merz Aesthetics, Bloomage Biotechnology, Teoxanne, Filorga, Professional Derma SA, and IBSA – InstituteBiochemical SA

b. The desire to look youthful among the millennials and rising consumption of aesthetic procedures by both men and women, especially from the emerging economies are majorly estimated to drive the skin boosters market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.