- Home

- »

- Medical Devices

- »

-

Sleep Apnea Devices Market Size And Share Report, 2030GVR Report cover

![Sleep Apnea Devices Market Size, Share & Trends Report]()

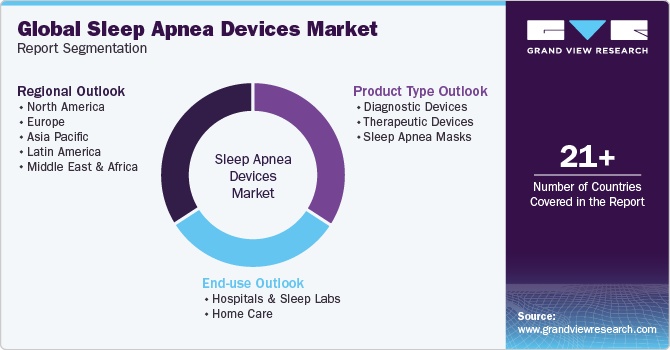

Sleep Apnea Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Diagnostic Devices, Therapeutic Devices, Sleep Apnea Masks), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-265-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sleep Apnea Devices Market Summary

The global sleep apnea devices market size was estimated at USD 4.5 billion in 2023 and is projected to reach USD 6.9 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. As of October 2023, National Council on Aging data indicates that Obstructive Sleep Apnea (OSA), characterized by irregular breathing and reduced oxygen supply to the brain, affects about 39 million adults in the U.S. and an estimated 936 million adults globally.

Key Market Trends & Insights

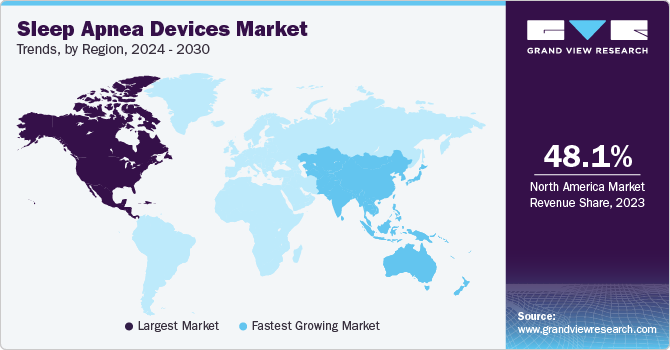

- North America segment dominated the market with share of 48.1% in 2023.

- Asia Pacific segment is anticipated to grow at the fastest rate of 7.7% over the forecast period.

- Based on product type, therapeutic devices segment led the market with a 79.0% share in 2023.

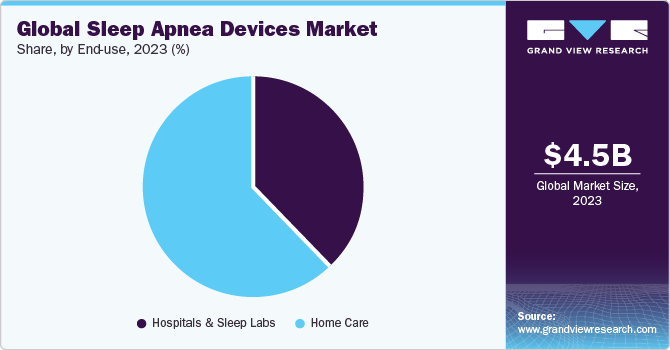

- Based on end use, homecare settings segment held a dominant market share of over 60% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.5 Billion

- 2030 Projected Market Size: USD 6.9 Billion

- CAGR (2023-2030): 6.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The high prevalence of sleep apnea in an elderly population often goes undiagnosed due to factors like lack of awareness and non-specific symptoms. With the global population aged 60 and above projected to reach 2 billion by 2050 and the elderly population expected to double from 12% to 22%, the incidence of sleep disorders, particularly OSA, is on the rise. OSA affects 13% to 32% of individuals aged 65 and above. The growing geriatric population's vulnerability to sleep apnea is expected to drive the adoption of sleep apnea devices. Notably, as reported by the U.S. Securities and Exchange Commission, over 8 million CPAP interfaces are sold annually in the U.S., with an additional 2.5 million sold globally.

Market expansion is driven by the entry of new players and an increased focus on innovative product development, resulting in technologically advanced solutions. For instance, the FDA-approved Inspire implant stands out as a unique OSA therapy, addressing the root cause of sleep apnea internally, ensuring regular breathing, and promoting sound sleep.

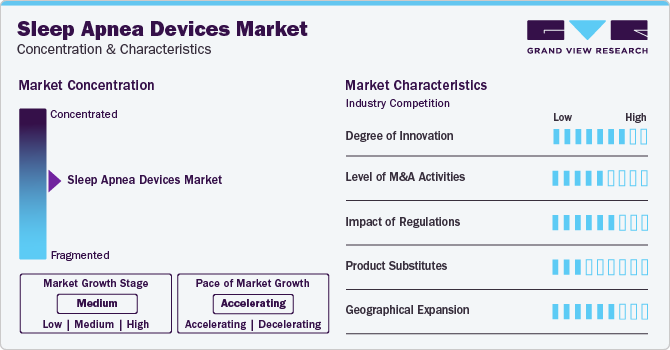

Market Concentration & Characteristics

The sleep apnea devices market is currently in a moderate growth stage, with an accelerating pace. This is driven by factors such as a growing geriatric population, a significant patient pool with sleep apnea, an increased prevalence of comorbidities linked to sleep apnea, and the development of advanced devices. For example, NovaResp Technologies Inc. is developing an AI-enabled CPAP algorithm compatible with various CPAP devices, predicting apnea events during sleep.

Market players are utilizing key strategies, including new product launches, expansions, acquisitions, partnerships, etc. For instance, in September 2023, ResMed announced a strategic partnership with Nyxoah to enhance awareness of obstructive sleep apnea and increase therapy penetration in Germany, contributing to market growth in the forecast period.

Degree of Innovation: The sleep apnea devices market has witnessed advancements focused on improving patient comfort, compliance, efficacy, and overall treatment outcomes. Integration of smart technology and digital sensors to enhance therapy management is a key driving factor in the market,

Level of M&A Activities: Mergers and acquisitions in the Sleep Apnea Devices Market are on the rise. Companies are leveraging multiple acquisitions to strengthen product offerings, expand their global footprint, diversify portfolios, integrate technologies, and enhance industry positioning.

Regional Expansion: The global prevalence of sleep apnea presents opportunities and competition across regions. Growing markets in the United Kingdom (UK), Germany, France, Italy, and Spain are driven by aging populations, lifestyle factors, healthcare reforms, and regulatory harmonization. Meanwhile, the well-established U.S. and Canada markets are characterized by high prevalence rates of sleep apnea and advanced healthcare systems.

Product Type Insights

In 2023, therapeutic devices segment led the market with a 79.0% share. This category includes Positive Airway Pressure devices, nasal devices, oral devices, and chin straps. Market players are introducing innovations such as comfortable and lightweight masks, softer materials, smaller masks, and noise-reduction features. Advanced technologies are being integrated to enhance PAP device efficiency and deliver optimal clinical outcomes. The growing patient compliance rate, supported by favorable insurance coverage tied to adherence standards for PAP therapy, is driving widespread adoption, with studies indicating that 80% of diagnosed obstructive sleep apnea patients opt for PAP devices.

Sleep apnea mask segment is anticipated to grow at the fastest rate of 7.6%, driven by the widespread adoption of these masks, increasing prevalence of comorbidities related to OSA, and higher adoption of CPAP machines in disease management. Key players are actively looking to innovate product strategies to meet the rising demand. For instance, in October 2023, Fisher & Paykel Healthcare Corporation Limited launched the F&P Solo mask in New Zealand and Australia for obstructive sleep apnea (OSA) treatment. This AutoFit nasal and pillow mask simplifies the setup process, enhancing user convenience. Such initiatives are expected to fuel the segment's growth.

End Use Insights

In 2023, homecare settings held a dominant market share of over 60%. Technological innovations have resulted in the creation of more portable, user-friendly, and quieter sleep apnea devices suitable for home use. Compact CPAP, BiPAP, and APAP machines, accompanied by lightweight masks and accessories, allow patients to manage their sleep apnea treatment at home comfortably. This preference for homecare settings, driven by enhanced comfort and convenience, contributes to the growth of this segment.

Hospital and sleep lab segment is anticipated to experience substantial growth as sleep apnea devices play a crucial role in these settings for diagnosing, monitoring, managing, treating, and supporting patients with sleep-related breathing disorders. In addition, in critical care settings like ICUs, hospitals utilize sleep apnea devices such as Continuous Positive Airway Pressure (CPAP) and Bi-level Positive Airway Pressure (BiPAP) to aid patients with compromised respiratory functions, thereby driving segment growth.

Regional Insights

North America segment dominated the market with share of 48.1% in 2023. Changing lifestyles, growing disposable income, presence of renowned players, growing obese population, rising prevalence of respiratory diseases, growing awareness about OSA, and favorable government initiatives are some of the key factors driving the growth. Some of the key participants present in North America are Philips Respironics; Somnetics International Inc.; and ResMed. These companies have a strong business presence and have well-established supply & distribution channels across North America.

Asia Pacific segment is anticipated to grow at the fastest rate of 7.7% over the forecast period owing to the growing geriatric population and rising prevalence of lifestyle diseases such as cardiovascular diseases, cancer, hypertension, diabetes, and chronic respiratory diseases. As per the OECD iLibrary article on Asia/Pacific 2020, approximately 227 million individuals are diagnosed with type 2 diabetes in the Asia Pacific. The growing prevalence of chronic conditions is expected to contribute to the surge in OSA and drive the adoption of sleep apnea devices in countries in the Asia Pacific.

Key Companies & Market Share Insights

The competitive sleep apnea devices market is characterized by a few notable players, including ResMed, Philips Respironics (a division of Philips), Fisher & Paykel Healthcare, among others. These manufacturers are actively pursuing strategic initiatives such as mergers and acquisitions to strengthen their market positions. For instance, in July 2023, ResMed acquired Somnoware, a U.S. leader in sleep and respiratory care Home Care software.

Key Sleep Apnea Devices Companies:

- ResMed

- Respironics (a subsidiary of Koninklijke Philips N.V.)

- Fisher & Paykel Healthcare Limited

- Curative Medical, Inc.

- React Health (Respiratory Product Line from Invacare Corporation)

- Somnetics International, Inc.

- BMC Medical Co., Ltd.

- Natus Medical Incorporated

- SOMNOmedics GmbH

- Compumedics

- Itamar Medical Ltd.

- Nihon Kohden Corporation

Recent Developments

-

In November 2023, Vivos Therapeutics obtained FDA 510(k) Clearance for its CARE (Complete Airway Repositioning and/or Expansion) oral devices tailored for adults with severe obstructive sleep apnea (OSA). This clearance covers the company's prominent DNA, mRNA, and mmRNA oral appliances.

-

In October 2023, ResMed and Bittium Biosignals Ltd, a Bittium Corporation subsidiary, entered an agreement where ResMed becomes a distributor of Bittium Respiro, an advanced Home Sleep Apnea Test and Analysis Solution. The comprehensive solution includes the Bittium Respiro measuring device, its accessories, and the Bittium Respiro Analyst software analysis tool and service platform. The non-exclusive agreement covers Norway, the United Kingdom (UK), Switzerland, the Republic of Ireland, Finland, and Sweden

Sleep Apnea Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.5 billion

Revenue forecast in 2030

USD 6.9 billion

Growth Rate

CAGR of 6.2% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Product Type, End Use and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ResMed; Respironics (a subsidiary of Koninklijke Philips N.V.); Fisher & Paykel Healthcare Limited; Curative Medical, Inc.; React Health (Respiratory Product Line from Invacare Corporation); Somnetics International, Inc.; BMC Medical Co., Ltd.; Natus Medical Incorporated; SOMNOmedics GmbH; Compumedics; Itamar Medical Ltd.; Nihon Kohden Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sleep Apnea Devices Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sleep apnea devices market report based on product type end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Devices

-

Actigraphs

-

Polysomnography (PSG) device

-

Respiratory Polygraphs

-

Pulse Oximeters

-

-

Therapeutic Devices

-

Positive Airway Pressure (PAP) Devices

-

CPAP

-

APAP

-

Bi-PAP

-

-

Oral Devices

-

Nasal Devices

-

Chin Straps

-

-

Sleep Apnea Masks

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Sleep Labs

-

Home Care

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

U.A.E.

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sleep apnea devices market size was estimated at USD 4.2 billion in 2022 and is expected to reach USD 4.5 billion in 2023.

b. The global sleep apnea devices market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 6.9 billion by 2030.

b. Therapeutic devices dominated the sleep apnea devices market with a share of 79.4% in 2021. This is attributable to promising reimbursement guidelines in various countries.

b. Some key players operating in the sleep apnea devices market include Curative Medical Inc.; Philips Respironics; ResMed; Fisher & Paykel Healthcare; Cadwell Laboratories; and Invacare Corporation.

b. Key factors that are driving the sleep apnea devices market growth include the increasing number of patients suffering from obstructive sleep apnea (OSA).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.