- Home

- »

- Clinical Diagnostics

- »

-

Slide Stainer Market Size & Share, Industry Report, 2030GVR Report cover

![Slide Stainer Market Size, Share & Trends Report]()

Slide Stainer Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Reagents & Kits, Equipment), By Technology (Cytology, Microbiology), By Application (Disease Diagnostics, Medical Research), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-365-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Slide Stainer Market Size & Trends

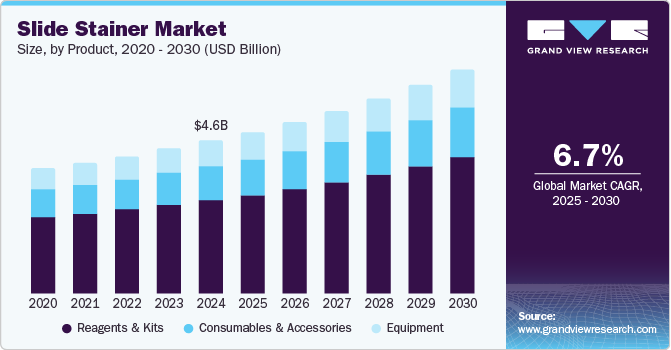

The global slide stainer market size was estimated at USD 4.61 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. According to the American Cancer Society, the global cancer incidence is projected to reach 35 million cases by 2050, underscoring an urgent need for efficient diagnostic tools, including slide stainers for histological analysis. With the burden of non-communicable diseases rising, as reported by the World Health Organization, diagnostic solutions that facilitate timely and accurate results are more critical than ever. This growing demand for precise diagnostics is driving investment and growth in the slide stainer market, effectively aligning with the health sector’s adaptation to escalating disease prevalence.

According to the OECD, health spending per capita among member countries is projected to grow at an average annual rate of 2.7%, with total health expenditure anticipated to reach approximately 10.2% of GDP. This trend reflects a significant financial capacity for hospitals and diagnostic centers to invest in advanced slide staining technologies. As healthcare budgets expand, facilities are increasingly inclined to allocate resources for high-quality diagnostic equipment that enhances operational efficiency. This targeted investment is essential for managing growing diagnostic testing demands, particularly in oncology and chronic disease sectors.

The demand for laboratory automation is also experiencing an upward trend. In November 2023, a Pathology Laboratory article highlighted that automated slide stainers can reduce turnaround times by 50% and enhance staining consistency in pathology labs. Automated slide stainers are particularly appealing, given their efficiency in processing larger sample volumes, thereby enhancing workflow and accuracy in diagnostics. Furthermore, the shift towards automation improves operational efficiency and significantly reduces turnaround times for test results, fostering improved patient outcomes. Enhanced productivity within laboratory settings directly correlates with the growing need for diagnostic solutions.

Moreover, continuous technological advancements in staining techniques and equipment are pivotal in attracting users in both research and clinical environments. With global investments in laboratory R&D projected to exceed USD 200 billion in 2024, innovations in staining methodologies-such as multiple staining techniques and the development of user-friendly systems-are enhancing the quality of staining and the compatibility with digital pathology workflows. In September 2024, Roche expanded its digital pathology open environment by integrating over 20 AI algorithms from eight collaborators, enhancing cancer diagnostics and supporting precision medicine for improved patient outcomes. As laboratories increasingly adopt automated systems, the capabilities of slide stainers will evolve, ensuring they meet the demands of an ever-changing healthcare landscape.

Product Insights

Reagents & kits dominated the market and accounted for a share of 61.2% in 2024. The demand for specialized reagents and kits, including unique cytology stains, is escalating due to the rising prevalence of chronic diseases, particularly cancer and infectious diseases. Many low-income countries experience disproportionately high cancer mortality rates despite comparatively low incidence rates, primarily due to inadequate early detection and treatment services. For instance, although Ethiopia has a 60% lower incidence rate, the country’s breast cancer mortality is twice that of the U.S. The country is facing an increasing need for accurate diagnostic tools similar to the global trend, driving segment growth.

Consumables & accessories are expected to grow at the fastest CAGR of 7.3% over the forecast period.A primary driver for segment growth is the increasing demand for consumables such as reagents, stains, and slides, which are essential components in the staining process. As laboratories and healthcare facilities try to improve efficiency and accuracy in their diagnostic procedures, there is a growing need for high-quality consumables that ensure consistent and reliable results.

Technology Insights

The hematoxylin and eosin (H&E) segment led the market and accounted for a share of 30.7% in 2024, owing to the widespread use of H&E staining in histopathology, a standard technique for visualizing tissue structures and cellular components. The increasing prevalence of chronic diseases such as cancer also led to rising demand for pathology services, thereby boosting the adoption of stainers compatible with H&E staining. Furthermore, technological advancements improved the efficiency and accuracy of staining processes, making H&E staining even more attractive to laboratories seeking reliable and consistent results.

Immunohistochemistry (IHC) is expected to register the fastest CAGR of 7.5% over the forecast period, driven by the increasing adoption of automated and digital IHC staining techniques that offer improved efficiency, consistency, and accuracy compared to traditional manual methods. In addition, technological advancements led to the development of more efficient and automated immunohistochemistry systems, reducing turnaround times and improving laboratory workflow efficiency is further anticipated to drive market growth.

Application Insights

Disease diagnostics held the largest revenue share of 63.3% in 2024, fueled by the rising global prevalence of chronic illnesses, which led to an increased need for precise and effective diagnostic instruments. The WHO reports that cardiovascular diseases (CVDs) account for around 17.9 million deaths annually. Over 80% of CVD-related fatalities are attributed to heart attacks and strokes, with approximately one-third occurring prematurely in individuals below the age of 70.

Medical research is expected to grow at the fastest CAGR of 7.2% over the forecast period due to the increasing use of tissue biopsy and slide-staining techniques in drug development and clinical research. Slide stainers play a crucial role in the analysis of tissue samples, enabling researchers to study disease pathology, identify biomarkers, and evaluate the efficacy of new drug candidates. For instance, the rising prevalence of chronic diseases such as cancer led to a surge in oncology research, which heavily relies on advanced slide-staining techniques, including IHC and in-situ hybridization (ISH), to understand tumor biology and develop targeted therapies.

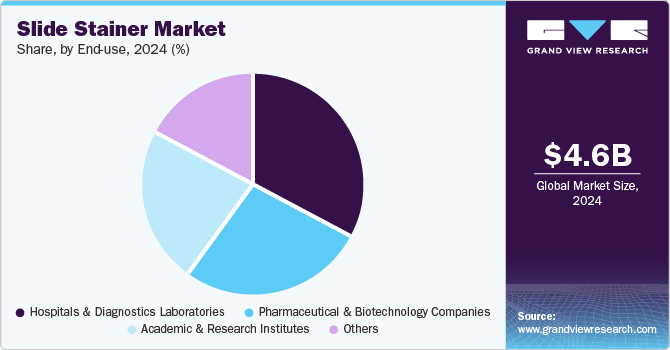

End-use Insights

Hospitals and diagnostics laboratories dominated the market and accounted for a share of 33.3% in 2024. Hospitals are significant consumers of slide stainers as they require efficient and accurate staining processes for pathology and diagnostic purposes. The demand for advanced staining technologies in hospitals is driven by rapid turnaround times, high throughput capabilities, and consistent staining quality to support timely patient diagnosis and treatment decisions.

Pharmaceutical & biotechnology companies are projected to grow at the fastest CAGR of 7.3% over the forecast period. The pharmaceutical and biotechnology industries also invest heavily in research and development to create new and innovative diagnostic tools, driving growth in this market segment. Key market players are investing in research and development to create new and innovative diagnostic tools using automated staining technology.

Regional Insights

North America slide stainer market dominated the global market with a revenue share of 42.3% in 2024 owing to the increasing prevalence of chronic diseases, including cancer, and the rising geriatric population. The region is characterized by a high level of technological advancements and innovation in healthcare, leading to the introduction of advanced slide-staining technologies. Product launches focusing on automation, efficiency, and accuracy are prevalent trends in the North American market. In addition, the demand for personalized medicine and targeted therapies is influencing the adoption of advanced slide-staining equipment in research laboratories and diagnostic centers across the region.

U.S. Slide Stainer Market Trends

The U.S. slide stainer market dominated the North America slide stainer market with a revenue share of 84.2% in 2024. Innovation is crucial in driving market growth, with companies constantly launching new products that offer enhanced performance and workflow efficiency. The U.S. market also benefits from a strong focus on research and development activities to improve diagnostic capabilities through advanced slide-staining technologies.

Europe Slide Stainer Market Trends

Europe slide stainer market held substantial market share in 2024. Europe’s healthcare providers and research institutions are increasingly focused on developing and adopting diagnostic tools that can provide tailored insights to support individualized patient care. This trend fuels the demand for advanced slide stainers that enable specialized staining techniques to identify specific biomarkers and guide targeted therapies. With an aging population contributing to increased healthcare needs, there is a rising demand for advanced diagnostic tools such as stainers that can deliver accurate results efficiently. According to the latest data, the European Union (EU) population stands at approximately 448.8 million people. Notably, more than one-fifth, or 21.3%, of this population is 65 years and above, indicating a significant proportion of elderly individuals in the region.

The slide stainer market in Germany is expected to grow lucratively between 2025 and 2030. The rising incidence of chronic diseases, particularly cancer, is significantly increasing the demand for efficient diagnostic tools, such as slide stainers for histological analysis. By 2024, projected cancer cases in Germany are expected to reach approximately 500,000, necessitating the adoption of advanced staining technologies for accurate diagnostics. Moreover, following the implementation of the 2023 Digitalisatin Strategy for Health and Care, hospitals and laboratories are projected to have the capacity to invest in modern slide staining solutions, further driving market growth amidst an aging population and a focus on laboratory automation.

Asia Pacific Slide Stainer Market Trends

Asia Pacific slide stainer market is expected to register the fastest CAGR of 8.9% in the forecast period. This region presents lucrative opportunities for growth due to factors such as a large patient pool, increasing healthcare expenditures, and expanding research activities. China and India are witnessing rapid advancements in healthcare infrastructure, leading to greater adoption of automated slide-staining technologies to improve diagnostic accuracy and efficiency. Product innovation tailored to meet the specific needs of emerging Asian Pacific markets is a key trend driving market expansion.

India slide stainer market is projected to grow at the fastest rate over the forecast period. The expansion of healthcare infrastructure and investments in laboratory automation further enhance diagnostic capacity. Government initiatives, such as the Cervical Cancer Vaccination Program, the Free Essential Diagnostics Initiative under the National Health Mission, and the Anusandhan National Research Foundation, collectively improve accessibility and innovation in diagnostic tools, reinforcing the demand for efficient slide staining solutions.

Key Slide Stainer Company Insights

Some key companies operating in the market include Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd; Danaher Corporation; among others. Key players are employing various strategies to enhance their market share, such as mergers, acquisitions, partnerships, and new product launches. For instance, in October 2024, Roche secured FDA approval for the VENTANA CLDN18 (43-14A) RxDx Assay, a companion diagnostic for VYLOY targeted treatment of gastric and gastroesophageal junction cancer.

-

Agilent Technologies, Inc. provides advanced slide staining solutions via its Artisan Link Pro system, which automates complex staining processes, enhances laboratory productivity through true walk-away automation, and integrates seamlessly with laboratory information systems for efficient histopathology workflows.

-

Biocare Medical, LLC focuses on delivering innovative slide staining solutions, including automated stainers and premium reagents for immunohistochemistry and special stains. Their products enhance staining accuracy and consistency, bolstering diagnostic capabilities and supporting efficient workflows in pathology labs.

Key Slide Stainer Companies:

The following are the leading companies in the slide stainer market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- F Hoffmann-La Roche Ltd

- Danaher Corporation

- Merck KGaA

- Agilent Technologies, Inc.

- BD

- Abcam Limited

- Siemens Healthineers AG

- General Data Company, Inc.

- Biocare Medical, LLC

Recent Developments

-

In January 2025, Roche announced FDA clearance for the VENTANA DP 600 slide scanner, enhancing its Digital Pathology Dx system and supporting pathologists with high-quality imaging for improved diagnostic accuracy and efficiency.

-

In December 2024, Leica Biosystems announced the HistoCore LIGHTNING S laser slide printer, enhancing laboratory workflows with on-demand and batch printing, eliminating consumable management, and delivering consistent print quality and efficiency.

Slide Stainer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.87 billion

Revenue forecast in 2030

USD 6.74 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd; Danaher Corporation; Merck KGaA; Agilent Technologies, Inc.; BD; Abcam Limited; Siemens Healthineers AG; General Data Company, Inc.; Biocare Medical, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Slide Stainer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global slide stainer market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Kits

-

Stains

-

Diluents & Buffers

-

Blocking Sera & Reagents

-

Mounting Media, Fixative Reagents, and Embedded Media

-

Probes

-

Antibodies

-

-

Equipment

-

Automated and Semi-automated Slide Stainer

-

Manual Staining Set

-

-

Consumables & Accessories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Hematoxylin and Eosin

-

Immunohistochemistry

-

Cytology

-

Microbiology

-

Special Stains

-

In-situ Hybridization

-

Hematology

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Disease Diagnostics

-

Breast Cancer

-

Gastric Cancer

-

Lymphoma

-

Prostate Cancer

-

Non-small Lung Cancer

-

Others

-

-

Medical Research

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Diagnostics Laboratories

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.