- Home

- »

- Advanced Interior Materials

- »

-

Small & Medium Caliber Ammunition Market Report, 2020-2027GVR Report cover

![Small & Medium Caliber Ammunition Market Size, Share & Trends Report]()

Small & Medium Caliber Ammunition Market (2020 - 2027) Size, Share & Trends Analysis Report By Product (7.62 x 39 mm, 23 x 115 mm), By Region (Asia Pacific, MEA, Central & South America) And Segment Forecasts

- Report ID: GVR-4-68039-235-9

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Small & Medium Caliber Ammunition Market Summary

The global small & medium caliber ammunition market size was valued at USD 9.18 billion in 2019 and is projected to reach USD 12.74 billion by 2027, growing at a compound annual growth rate (CAGR) of 4.2% from 2020 to 2027. Increasing geopolitical tensions and increasing military expenditure are expected to drive market growth over the forecast period. Commercially, the ammunition is available in the market through direct supply or third-party distributors.

Key Market Trends & Insights

- The Asia Pacific dominated the market and accounted for over 67% share of revenue in 2019.

- The market in Central & South America is expected to grow at a significant rate over the forecast period.

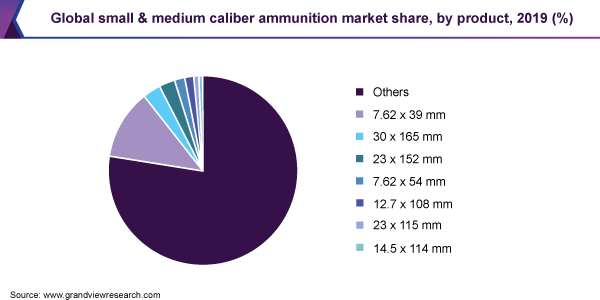

- Based on product, 7.62 x 39mm caliber led the market and accounted for more than a 12% share of the global revenue in 2019.

- Based on product, 7.62 x 54mm ammunition is one of the prominent choices of the users owing to its active consumption in military use.

Market Size & Forecast

- 2019 Market Size: USD 9.18 Billion

- 2027 Projected Market Size: USD 12.74 Billion

- CAGR (2020-2027): 4.2%

- Asia Pacific: Largest market in 2019

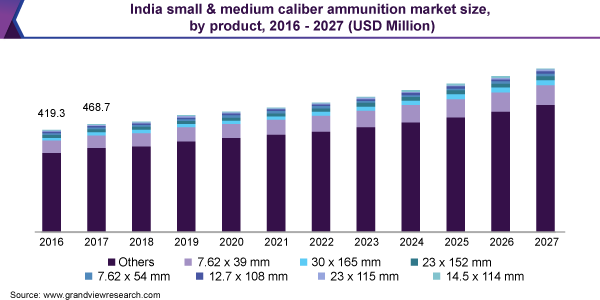

However, manufacturers can only sell their products to an entity with a federal license that can either be a retailer, wholesaler, or user. Moreover, strict laws and regulations are followed for the trade and different countries have their distinct legislations or the arms act to monitor the same. The market in India is expected to exhibit high growth over the projected period on account of armed forces development and the adoption of the latest technological weapons. Moreover, ongoing geopolitics with China coupled with the repetitive disputes with Pakistan forces over the borderline is expected to increase product procurement.

Rising defense expenditure and increasing focus of defense organizations on the improvement of their respective military combat operation with technological enhancements are expected to act as a catalyst for the market growth. Moreover, a rise in commercial hunting and sports activities is expected to aid market growth.

Products with 7.62 x 39 mm caliber are widely used on account of their easy availability, affordability, and compatibility with the AK series rifles. The growing need for the 7.62 x 39 mm caliber ammunition in the military for war fronts & training is expected to create high opportunities for the market.

Various trends and product development phases are expected to spur the growth in product demand. High demand for the same has impelled the indigenous government to target and develop its local manufacturing, in terms of arms and ammunition. For instance, in 2018, the Bangladesh Ordnance factory developed BD-08 assault rifles that use 7.62×39 mm caliber ammunition for its armed forces.

Product Insights

7.62 x 39mm caliber led the market and accounted for more than a 12% share of the global revenue in 2019 on account of an increase in the utilization due to its compatibility in the AK-47 line of rifles. Moreover, these are quite affordable due to their high availability and user acceptance across all the regions. One of the major factors addressing its usage in the AK series lineup is the gun’s moderate coil and high-knockdown power. This product type is widely used in the military as well as by civil entities, especially for sports and hunting activities.

7.62 x 54mm ammunition is one of the prominent choices of the users owing to its active consumption in military use. It is one of the rimmed rifle cartridges that are widely used by the Russian military in the Dragunov, SV-98, and other sniper rifles. Moreover, it is widely used in countries, such as India, Egypt, and Algeria, owing to its applications in general-purpose machine guns, such as Pecheneg and PKM machine guns.

30 mm caliber ammunition is an autocannon type that is generally used against armed vehicles, especially aircraft and fortified bunkers, as a result, the same is known as armor-piercing or anti-material round ammunition. The product is used in a variety of close-in weapon systems, such as the Dutch Goalkeeper CIWS and the Russian AK-630.

Regional Insights

The Asia Pacific dominated the market and accounted for over 67% share of revenue in 2019. The regional market is estimated to expand further at the fastest CAGR from 2020 to 2027 owing to growth in the procurement of bullets and other small ammunition in the armed forces as a result of geopolitical tension and terrorist activities in the region. The market in the Middle East & Africa accounted for a significant share owing to the high arms & ammunition imports in the region. Saudi Arabia accounted for the world’s largest arms imports from the U.S. In addition, the region accounted for almost 29% of the global arms and ammunition imports.

The increase in arms import and government involvement for higher arms purchases in the region, especially in countries such as Algeria, Egypt, and Kuwait, to tackle terrorism and border disputes are anticipated to propel the growth. The market in Central & South America is expected to grow at a significant rate over the forecast period on account of the high number of gun-related crimes, especially in Brazil, owing to the societal norms and relaxed law regulations. The countries, such as Brazil, Peru, and Chile, import the majority of the ammunition for civilians and the military from the U.S., and the trend is expected to continue over the forecast period.

Key Companies & Market Share Insights

The market has been witnessing an increasing trend of product development through expansion, mergers & acquisitions. The companies are trying to increase their sales through acquisition, investment, and innovation. The industry is highly competitive due to the existence of major manufacturing companies, most of which are engaged in gaining contracts from leading defense forces and large industries that supply arms and ammunition on the basis of a federal license and viable distribution network. Some prominent players in the global small & medium caliber ammunition market include:

-

Northrop Grumman Corp.

-

FN Herstal

-

General Dynamics Corp.

-

BAE Systems, Inc.

-

ARSENAL JSCo

-

MESKO S.A.

-

Nammo AS

-

Rheinmetall Defense

-

JSC Rosoboronexport

-

Nexter KNDS Group

-

ST Engineering

-

Denel SOC Ltd.

-

MAXAMCorp Holding, S.L.

-

RUAG Group

-

Poongsan Corp.

-

CBC Ammo LLC

-

STV Group a.s.

-

Yugoimport SDPR J.P

-

The Ulyanovsk Cartridge Works

-

Rostec

-

The Tula Cartridge Works

-

Klimovsk Specialized Ammunition Plant

-

V.A. Degtyarev Plant

-

State Research and Production Enterprise Bazalt

-

Central Research Institute for Precision Machine Building (TsNIITochMash)

-

North Industries Group Corp. (Norinco)

Small & Medium Caliber Ammunition Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 9.58 billion

Revenue forecast in 2027

USD 12.74 billion

Growth Rate

CAGR of 4.2% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

Asia Pacific; Middle East & Africa; Central & South America

Country scope

Bangladesh; Sri Lanka; Philippines; Malaysia; Indonesia; India; Kuwait; Egypt; Algeria; Tunisia; Morocco; Benin; Burkina Faso; Cameroon; Peru; Chile

Key companies profiled

Northrop Grumman Corp.; FN Herstal; General Dynamics Corp.; BAE Systems, Inc.; ARSENAL JSCo; MESKO S.A.; Nammo AS; Rheinmetall Defense; JSC Rosoboronexport; Nexter KNDS Group; ST Engineering; Denel SOC Ltd.; MAXAMCorp Holding, S.L.; RUAG Group; Poongsan Corp.; CBC Ammo LLC; STV Group a.s.; Yugoimport SDPR J.P; The Ulyanovsk Cartridge Works; Rostec; The Tula Cartridge Works; Klimovsk Specialized Ammunition Plant; V.A. Degtyarev Plant; State Research and Production Enterprise Bazalt; Central Research Institute for Precision Machine Building (TsNIITochMash); North Industries Group Corp. (Norinco)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global small & medium caliber ammunition market report on the basis of product and region:

-

Product Type Outlook (Revenue, USD Million, 2016 - 2027)

-

7.62 x 39 mm

-

7.62 x 54 mm

-

30 x 165 mm

-

23 x 115 mm

-

23 x 152 mm

-

12.7 x 108 mm

-

14.5 x 114 mm

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

Asia Pacific

-

Bangladesh

-

Sri Lanka

-

Philippines

-

Malaysia

-

Indonesia

-

India

-

-

Middle East & Africa (MEA)

-

Kuwait

-

Egypt

-

Algeria

-

Tunisia

-

Morocco

-

Benin

-

Burkina Faso

-

Cameroon

-

-

Central & South America

-

Peru

-

Chile

-

-

Frequently Asked Questions About This Report

b. The small & medium caliber ammunition was estimated at USD 9.18 billion in 2019 and is expected to reach USD 9.58 billion in 2020.

b. The small & medium caliber ammunition market is expected to grow at a compound annual growth rate of 4.2% from 2019 to 2027 to reach USD 12.74 billion in 2027.

b. Asia-Pacific dominated the market and accounted for over 67% share of revenue in 2019, owing to increasing geopolitical tension and terrorist activities in the region.

b. Some key players operating in the small & medium caliber ammunition market include Northrop Grumman Corporation, FN Herstal, General Dynamics Corporation, BAE Systems, Inc., ARSENAL JSCo, MESKO S.A, Nammo AS, Rheinmetall Defense, JSC Rosoboronexport, Nexter KNDS Group.

b. Key factors driving the small & medium caliber ammunition market growth include increasing geopolitical tensions and growing military expenditure across the globe. Moreover, rising incidences of armed conflicts and terrorism are likely to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.