- Home

- »

- Electronic & Electrical

- »

-

Smart Baby Monitor Market Size And Share Report, 2030GVR Report cover

![Smart Baby Monitor Market Size, Share & Trends Report]()

Smart Baby Monitor Market Size, Share & Trends Analysis Report By Product (Tracking Devices, Audio & Video), By Distribution Channel (Offline, Online), By Region (North America, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-557-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global smart baby monitor market size was estimated at USD 1,347.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The growing emphasis on child safety and security is a significant driver. Smart baby monitors provide parents with real-time monitoring solutions for their infants, enabling them to keep a constant eye on their well-being. The ability to remotely access live video feeds and receive alerts about their baby's activities or vital signs provides a sense of reassurance and peace of mind to caretakers. Baby monitors allow for real-time contact between parents and infants due to numerous technological advancements. The growing population of working parents and the need to track the activities of babies are driving the demand for this product.

These monitors can be connected to smart devices using wireless technology such as Wi-Fi and can be used to interact with and monitor a child. For instance, Willcare Newborn Baby Monitor comes with a long-range monitor and night vision, along with features such as lullaby tracks, temperature monitors, and a clock. Demand for baby monitors is expected to witness a significant rise in the next few years due to technological advancements and easy deployment. Smart baby monitors allow parents and caregivers to keep tabs on a child's activities in their absence. They also provide pertinent environmental data, such as the room temperature, and come with numerous additional features, including nightlights and lullabies. Growing knowledge about child and infant safety is driving many parents to buy these devices.

The increasing adoption of smart home technologies is contributing to the growth of the market. As more households embrace connected devices and the Internet of Things (IoT), integrating a smart baby monitor into a larger smart home ecosystem becomes a natural choice. Parents can conveniently access the monitor's features through their smartphones, tablets, or smart speakers, enhancing the overall user experience. The increasing nuclear family structure has placed a greater burden on parents, increasing the demand for smart baby equipment for parents. Equipment such as baby monitors is crucial for parents to protect their children while they are away from home.

According to the 2022 population survey by the U.S. Census Bureau, there were 13.3 million single-parent households in the country, wherein 10.7 million single-parent family groups were maintained by a mother and 2.6 million by a father. This is a significant rise compared to the 12.9 million one-parent households in 2020. Moreover, the increasing participation of women in the workforce is a prominent global trend, owing to the growing social and economic opportunities available to them. According to the World Bank, women accounted for 39.3% of the global labor force as of 2021, with the U.S. and the UK reporting the highest female labor force of 46.2% and 47.4%, respectively.

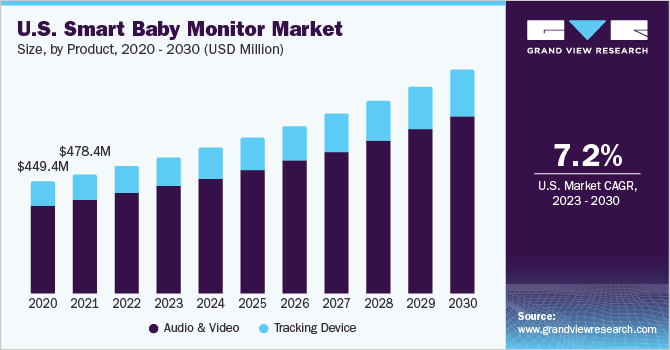

Product Insights

The audio & video segment dominated the market with a share of 79.6% in 2022.An audio and video-based smart monitor is assisted with features, such as extra receivers, motion sensors, night lights, talk-back, or temperature display. It possesses a portable speaker to hear the baby from a mic-equipped base station placed around the infant. These devices are offered at a price range of USD 25 to 150. A large number of audio and video smart baby monitors are featured with room temperature and humidity sensors, two-way audio, and automatic mobile notifications.

For instance, in September 2022, Taiwan-based SpotCam launched the 1080P FHD high-resolution, AI-based SpotCam BabyCam that ensures a clear view during both day and night. Its cloud technology allows users to monitor activity via mobile iOS and Android devices and web browsers anywhere and anytime. The baby tracking feature allows the camera to pan and tilts instantly as the baby walks or crawls around the room. As the infant approaches a specified dangerous location in the surroundings, SpotCam BabyCam delivers real-time alerts. In addition, the webcam has built-in lullabies that can be played either automatically or manually based on a schedule.

The tracking devices segment is expected to grow at a CAGR of 7.7% from 2023 to 2030. These smart baby monitors connect directly to the child’s body for better monitoring. They track room temperature, movement, heart rate, oxygen levels, sleep pattern, and temperature of the child, thereby providing information about his/her health to the parents. These trackers also send alerts to parents in case of any problems. The potential lifesaving assistance of these devices encourages parents to buy such smart tracking devices.

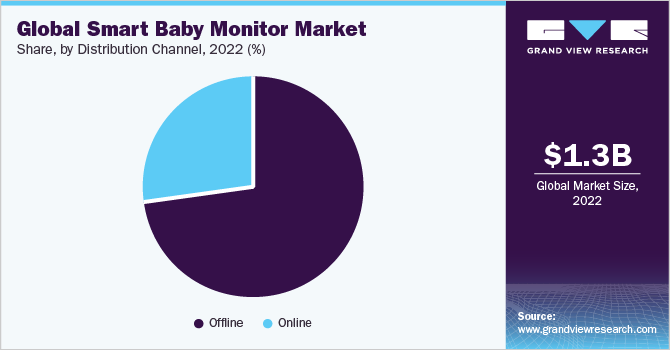

Distribution Channel Insights

The offline distribution channel segment dominated the market with a share of 73.1% in 2022. Specialty stores, supermarkets & hypermarkets, and pharmacies are the major distributors of smart baby monitor products. Departmental and retail stores are also known to sell these products. These channels make a significant contribution to the overall sales. In addition, other retail stores, such as Babies“R”Us/Toys“R”Us, Burlington Coat Factory, Meijer, Sears, and Walmart, have an added advantage of staffing and training. Most employees are trained for related baby care products and are better aware of the kind of product suitable for certain specific needs of babies and parents.

Their knowledge about merchandise comes in handy while assisting customers in choosing the appropriate product. Hence, offline baby stores have an upper hand over online retailers. The online distribution channel segment is expected to exhibit the fastest CAGR of 9.2% from 2023 to 2030. A growing number of tech-savvy consumers and an increasing variety of goods available on online platforms are the major factors expected to favor the growth of the online channel in the coming years. Moreover, the increasing presence of online retailers, such as Amazon, FirstCry, Baby Shop, and Walmart, is expected to drive segment growth.

Regional Insights

North America held the largest revenue share globally accounting for around 46.4% in 2022. The growing population of working women in the region, coupled with increasing hectic lifestyles/schedules, is driving the need for smart baby monitors to avoid injuries or mishaps. These monitors help ease anxiety and stress among parents by allowing them to keep a real-time check on the activities of their children while being busy with their work. In the U.S., families with infants and toddlers spend 50% more on childcare as compared to those with a preschooler. With rising dual-income households across the country, consumers are heavily investing in child safety products, such as smart baby monitors. These devices help parents keep track of their baby, even when they are not physically present at the same location.

However, Asia Pacific is anticipated to register the fastest CAGR of 8.6% from 2023 to 2030. Long working hours and busy schedules of parents in urban households in this region are resulting in a growing dependence on remote monitoring of infants to ensure their security and maintain schedules. This is driving the adoption of smart baby monitoring products. The convenience offered by these products, along with constantly improving product features and options, is encouraging consumers to opt for smart baby monitors. Parents in emerging economies, such as Malaysia, Thailand, and Indonesia, have become increasingly conscious regarding the health and hygiene of their babies and are willing to spend more on better-quality products.

As consumers seek unique products, manufacturers focus on high-end innovations and new product launches. For instance, Bonoch, in February 2023, launched a long-range baby monitor that does not require a Wi-Fi connection. The monitor gives full-house coverage and has an upgraded frequency solution of 900 MHz. Frequency-Hopping Spread Spectrum (FHSS), a wireless communication technology utilized in this device, transmits data using radio waves to minimize interference and enhance security. Europe is expected to witness a steady growth rate of 8.2% over the forecast period. New parents in this region are extremely conscious regarding the safety of their children, which drives product demand. This factor, along with the ease of integration with smart home devices, has led to an increased demand for smart baby monitors.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key players are focusing on strategies, such as new product launches, partnerships, mergers & acquisitions, global expansions, and others. Some of the initiatives include:

-

In November 2022, Arlo Technologies, Inc. launched its latest Pro 5S 2K Security Camera. Features of the product include dual-band Wi-Fi Support, SecureLink connection, increased battery life, built-in smart siren, two-way audio, and compatibility with major platforms, such as Amazon Alexa, Google Assistant, and IFTTT

-

In August 2022, Arlo Technologies, Inc. launched its Protect Your Everything national advertising campaign. Spots were secured on major TV networks and streaming platforms, including Bravo, Discovery, ESPN, HGTV, and Hulu. The campaign banks on consumer anxieties to offer products and services that give a sense of control and peace of mind, enabled by smarter protection

Some prominent players in the global smart baby monitor market include:

-

VTech Communications, Inc.

-

Motorola, Inc.

-

Dorel Industries Inc.

-

Panasonic Corp.

-

Samsung Electronics Co. Ltd.

-

Netgear Inc.

-

Lorex Technology Inc.

-

Summer Infant, Inc.

-

Arlo Technologies, Inc.

-

iBaby Labs, Inc.

Smart Baby Monitor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,448.7 million

Revenue forecast in 2030

USD 2,476.0 million

Growth rate

CAGR of 7.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; China; India; Brazil; UAE

Key companies profiled

VTech Communications, Inc.; Motorola, Inc.; Dorel Industries Inc.; Panasonic Corp.; Samsung Electronics Co. Ltd.; Netgear Inc.; Lorex Technology Inc.; Summer Infant, Inc.; Arlo Technologies, Inc. iBaby Labs, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Baby Monitor Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart baby monitor market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Audio & Video

-

Tracking Device

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart baby monitor size was estimated at USD 1,347.1 million in 2022 and is expected to reach USD 1,448.7 million in 2023.

b. The global smart baby monitor is expected to grow at a compounded growth rate of 7.9% from 2023 to 2030 to reach USD 2,476.0 million by 2030.

b. Audio and video dominated the market with a share of 79.2% in 2022. Audio and video baby monitors offer convenience by allowing parents to keep an eye on their baby from different rooms or even remotely through smartphone apps. This feature gives parents the freedom to attend to other tasks while still being connected to their baby, offering peace of mind.

b. Some key players operating in smart baby monitor market are VTech Communications, Inc., Motorola, Inc., Dorel Industries Inc., Panasonic Corporation, Samsung Electronics Co. Ltd., Netgear Inc., Lorex Technology Inc., Summer Infant, Inc., Arlo Technologies, Inc. iBaby Labs, Inc.

b. Key factors that are driving the market growth include increasing importance of child safety and security, the convenience, the availability of enhanced monitoring features, technological advancements in audio and video technologies, rising parental awareness about monitoring solutions, growing disposable incomes, and the shift towards smart homes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."