- Home

- »

- IT Services & Applications

- »

-

Smart Contracts Market Size, Share & Analysis Report, 2030GVR Report cover

![Smart Contracts Market Size, Share, & Trends Report]()

Smart Contracts Market (2023 - 2030) Size, Share, & Trends Analysis Report By Platform, By Blockchain Type, By Contract Type, By Enterprise Size, By End-use (BFSI, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-073-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Contracts Market Summary

The global smart contracts market size was valued at USD 684.3 million in 2022 and is projected to reach USD 73,773.0 million by 2030, growing at a CAGR of 82.2% from 2023 to 2030. The growth is primarily driven by the increasing adoption of blockchain technology, technological innovation, increased efficiency, cost savings, and the growing demand for Decentralized Finance (DeFi).

Key Market Trends & Insights

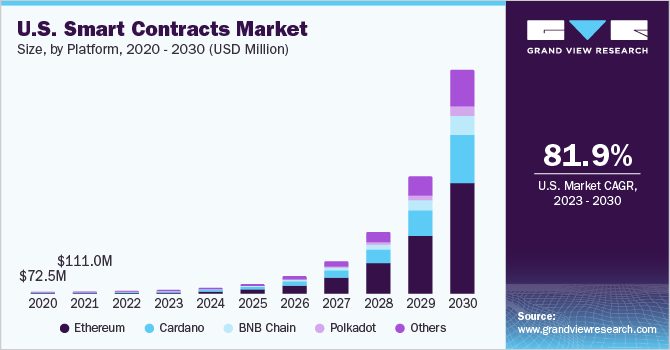

- North America dominated the smart contracts industry in 2022 and accounted for a revenue share of more than 31.0%.

- The Ethereum segment dominated the market in 2022 and accounted for a revenue share of more than 49.0%.

- Based on blockchain type, The public segment dominated the market in 2022 and accounted for a revenue share of 60.0%.

- Based on enterprise size, The large enterprise segment dominated the market in 2022 and accounted for a revenue share of 67.0%.

Market Size & Forecast

- 2022 Market Size: USD 684.3 million

- 2030 Projected Market Size: USD 73,773.0 million

- CAGR (2023-2030): 82.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market in 2022

Smart contracts are powered by blockchain technology, which is becoming increasingly popular as businesses seek more secure, efficient, and transparent ways to manage data and execute transactions. Additionally, smart contracts are a critical component of the DeFi ecosystem, which has grown rapidly in recent years. As more people adopt DeFi, the demand for smart contracts will likely increase. Smart contracts are digital programs that can be programmed to automatically execute specific actions when predetermined conditions are met. For instance, a smart contract could be encoded to automatically transfer funds from one account to another when a specific date is reached or when a particular event occurs, such as a product being delivered or a service being completed. By automating contract execution in this way, smart contracts can reduce the need for manual intervention, increasing efficiency and reducing the risk of errors and disputes. Smart contracts can also automate a wide range of other business processes, such as insurance claims processing, real estate transactions, and even voting systems.

Fintech plays a vital role in the development and growth of the smart contracts market. Fintech companies are at the forefront of innovation in the financial industry, and many are leveraging smart contract technology to improve the efficiency, security, and transparency of financial transactions. Fintech companies are also working to integrate smart contract technology with existing financial systems, such as payment processors and banking systems. This integration can streamline financial processes and reduce the costs associated with manual intervention and intermediaries.

Regulatory compliance plays an important role in the smart contracts market, as smart contracts can be used to execute legally binding agreements and transactions. Smart contracts must comply with relevant laws and regulations to be legally enforceable. Smart contracts often involve the collection and processing of personal data, which may be subject to data protection laws such as the General Data Protection Regulation (GDPR) in the EU or the California Consumer Privacy Act (CCPA) in the U.S. Smart contract developers must ensure that their contracts comply with these regulations, and that appropriate data protection measures are in place.

The key challenges faced by the smart contracts market are the lack of knowledge and understanding among potential users and stakeholders, the shortage of skilled professionals, and the complexity of smart contract systems. The lack of awareness limits adoption, as potential users may not understand the value proposition of smart contracts or may be hesitant to invest in a technology they do not fully understand. In addition, there is a shortage of skilled professionals with the expertise to develop and implement smart contracts. This talent shortage can limit the growth and adoption of smart contracts, as companies may struggle to find qualified developers and consultants to help them implement this technology.

COVID-19 Impact Analysis

The COVID-19 pandemic positively impacted the growth of the smart contracts market. With the pandemic forcing many businesses to operate remotely, there has been a significant increase in the adoption of digital technologies. Smart contracts provide a secure and efficient way to automate business processes and reduce the need for manual intervention, making them a natural fit for businesses seeking to operate remotely. Additionally, the pandemic also led to a greater demand for contactless transactions as people seek to minimize physical contact and avoid spreading the virus.

Platform Insights

The Ethereum segment dominated the market in 2022 and accounted for a revenue share of more than 49.0%. Ethereum's large and active developer community has contributed to the platform's growth and development. This community has built many valuable tools and frameworks that make developing and deploying smart contracts on the Ethereum platform easier. For instance, Truffle is a development environment, testing framework, and asset pipeline for Ethereum. It provides tools that help developers build, test, and deploy smart contracts on the Ethereum network.

The Polkadot segment is anticipated to register significant growth over the forecast period. The growth of the segment can be attributed to the scalability and interoperability provided by it. Polkadot is designed to be extremely scalable, which means that it can process a large number of transactions per second. This is achieved through its sharding architecture, which allows it to process multiple transactions in parallel. In Polkadot, the network is divided into multiple shards, each capable of processing transactions independently. These shards are then coordinated by a central relay chain, which helps to ensure that transactions are processed correctly and efficiently.

Blockchain Type Insights

The public segment dominated the market in 2022 and accounted for a revenue share of 60.0%. Public blockchains are networks that are decentralized and open to everyone who wants to join and participate. Public networks use consensus mechanisms such as proof-of-stake or proof-of-work to ensure security, and all participants have equal access and rights on the network. Additionally, all transactions and smart contracts on public blockchains are transparent, making them accessible to anyone who wants to view them.

The private segment is anticipated to register significant growth over the forecast period. Private blockchains offer enhanced privacy and security features, making them a more attractive option for businesses and organizations that must protect sensitive data and transactions. Private blockchains offer greater control over network security, as they are typically managed and maintained by a single entity or organization. Moreover, private blockchains can be customized to meet business operations or organizational needs, empowering them to develop tailored solutions that are not possible on public blockchains.

Contract Type Insights

The Decentralized Autonomous Organizations (DAO) segment dominated the market in 2022 and accounted for a revenue share of 37.0%. A decentralized autonomous organization (DAO) is designed to distribute ownership, management, and decision-making authority across a network of participants rather than being controlled by a single entity. This makes them more secure and resistant to censorship and ensures that all decisions are made by consensus. Additionally, DAOs are open to anyone who wishes to participate, which means that they are accessible to developers and users from around the world. This helps to foster innovation and growth in the ecosystem.

The application logic contracts segment is anticipated to grow significantly over the forecast period. Application logic contracts enable secure and autonomous device operations, offering benefits such as improved automation, lower transaction costs, and scalability. They consist of code specific to an application, typically integrated with other blockchain contracts, and facilitate communication between Internet of Things (IoT) devices and blockchain technology. Additionally, application logic contracts can be integrated with existing systems, such as enterprise resource planning (ERP), to automate and streamline business processes.

Enterprise Size Insights

The large enterprise segment dominated the market in 2022 and accounted for a revenue share of 67.0%. Large enterprises have the resources to invest in blockchain technology and smart contracts. They can afford to hire experts to develop and implement smart contract solutions and train their employees on how to use them. Additionally, large enterprises often operate in highly regulated industries, such as finance and healthcare, where compliance is critical. Smart contracts can help ensure compliance by automating processes and reducing the risk of human error.

The small & medium enterprises segment is expected to grow significantly over the forecast period. The segment's growth can be attributed to the cost-effectiveness and improved efficiency offered by smart contracts to small & medium enterprises. Smart contracts help small & medium enterprises to reduce costs by automating many of their processes. As small & medium enterprises often have limited resources, the cost-effectiveness of smart contracts is a significant advantage. Smart contracts also help small & medium enterprises improve efficiency by automating manual processes, reducing the risk of errors, and speeding up transaction times.

End-Use Insights

The BFSI segment dominated the market in 2022 and accounted for a global revenue share of above 37.0%. Smart contracts are self-executing, tamper-resistant, and self-verifying. They are being adopted by the BFSI industry, allowing peer-to-peer transactions, error-free insurance claim processing, transparent audits, and seamless KYC processing. Traditional contracts require significant paperwork and meticulous record-keeping to ensure financial auditing. Smart contracts offer advanced bookkeeping solutions by being tied to the distributed incorruptible code of the blockchain network.

The retail segment is anticipated to grow significantly over the forecast period. Smart contracts can help automate and streamline supply chain management in the retail industry, ensuring transparency, efficiency, and cost savings. Through smart contracts, all parties involved in the supply chain can access and verify information about products, including their origin, quality, and movement, creating a transparent and tamper-proof record of the supply chain. This transparency can help reduce the risk of fraud, counterfeit products, and unethical practices while ensuring compliance with regulations and industry standards.

Regional Insights

North America dominated the smart contracts industry in 2022 and accounted for a revenue share of more than 31.0%. The presence of prominent smart contracts providers, such as ScienceSoft USA Corporation; iTechArt; IBM; and Algorand, makes North America a promising market for smart contracts. Additionally, the early adoption of blockchain technology and the supportive ecosystem for startups in North America has led to the development of many smart contract-based startups in the region. This has given North American companies a head start in the market, contributing to the region's dominance in the smart contracts industry.

The Asia Pacific regional market is expected to emerge as the fastest-growing market over the forecast period. The Asia Pacific regional market's growth can be attributed to the increasing adoption of blockchain technology in the region, particularly in countries such as China and South Korea. Both countries have been actively investing in blockchain technology and its applications, including smart contracts. In China, the government has recognized the potential of smart contracts in various sectors, such as supply chain management, real estate, and e-commerce. The government has been promoting the adoption of blockchain technology, which has led to the growth of smart contract-based startups and investments in the country.

Key Companies & Market Share Insights

The smart contracts industry is constantly evolving, and providers are adopting various trends to meet the growing demand for smart contract solutions. Some of the latest trends smart contract providers adopt include platform interoperability, customizable smart contract templates, low-code or no-code smart contract development, and integration with decentralized finance (DeFi). Low-code or no-code smart contract development refers to using tools and platforms that enable non-technical users to create smart contracts without having to write code. This trend is driven by the desire to make smart contract development more accessible to a broader range of users, including those without extensive technical knowledge.

Prominent smart contracts companies are investing in strategic initiatives, such as mergers and acquisitions, partnerships, and product launches, to offer innovative solutions to their customers and stay ahead of the competition. For instance, in March 2023, Chainlink, a web3 services platform provider, launched a serverless and self-service platform for developers to connect their smart contracts and decentralized applications (dApps) to Web 2.0 API. The new platform, Chainlink Functions, allows builders to run customizable computations on Web 2.0 APIs through its network.

Additionally, in March 2022, Algorand, a technology company that provides a platform for advanced blockchain-based applications, announced a significant technical update that allows the creation of sophisticated decentralized applications (dapps) within the Algorand ecosystem. This represents a significant achievement in cross-chain interoperability, as developers can now build complex dapps using smart contract-to-contract calling. Some prominent players in the global smart contracts industry include:

-

ScienceSoft USA Corporation

-

Innowise Group

-

iTechArt

-

4soft

-

Algorand

-

IBM

-

TATA Consultancy Services Limited

-

Chainlink

-

ELEKS

-

Waves Technologies

Smart Contracts Industry Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,106.3 million

Revenue forecast in 2030

USD 73,773.0 million

Growth rate

CAGR of 82.2% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Platform, blockchain type, contract type, enterprise size, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ScienceSoft USA Corporation; Innowise Group; iTechArt; 4soft; Algorand; IBM.; TATA Consultancy Services Limited; Chainlink; ELEKS; Waves Technologies

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Contracts Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global smart contracts industry report based on platform, blockchain type, contract type, enterprise size, End-Use, and region.

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Ethereum

-

Cardano

-

BNB Chain

-

Polkadot

-

Others

-

-

Blockchain Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Contract Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Smart Legal Contracts

-

Decentralized Autonomous Organizations (DAO)

-

Application Logic Contracts

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End-Use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

Real Estate

-

Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart contracts market size was estimated at USD 684.3 million in 2022 and is expected to reach USD 1,106.3 million in 2023.

b. The global smart contracts market is expected to grow at a compound annual growth rate of 82.2% from 2023 to 2030 to reach USD 73,773.0 million by 2030.

b. North America dominated the smart contracts market with a share of 31.24% in 2022. The presence of prominent smart contracts providers, such as ScienceSoft USA Corporation, iTechArt, IBM, and Algorand, makes North America a promising market for smart contracts.

b. Some key players operating in the smart contracts market include ScienceSoft USA Corporation; Innowise Group; iTechArt; 4soft; Algorand; IBM.; TATA Consultancy Services Limited; Chainlink; ELEKS; and Waves Technologies.

b. Key factors that are driving the smart contracts market growth include the increasing adoption of blockchain technology and the advantages of smart contracts over traditional contracts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.