- Home

- »

- Electronic & Electrical

- »

-

Smart Home Security Camera Market Size Report, 2033GVR Report cover

![Smart Home Security Camera Market Size, Share & Trends Report]()

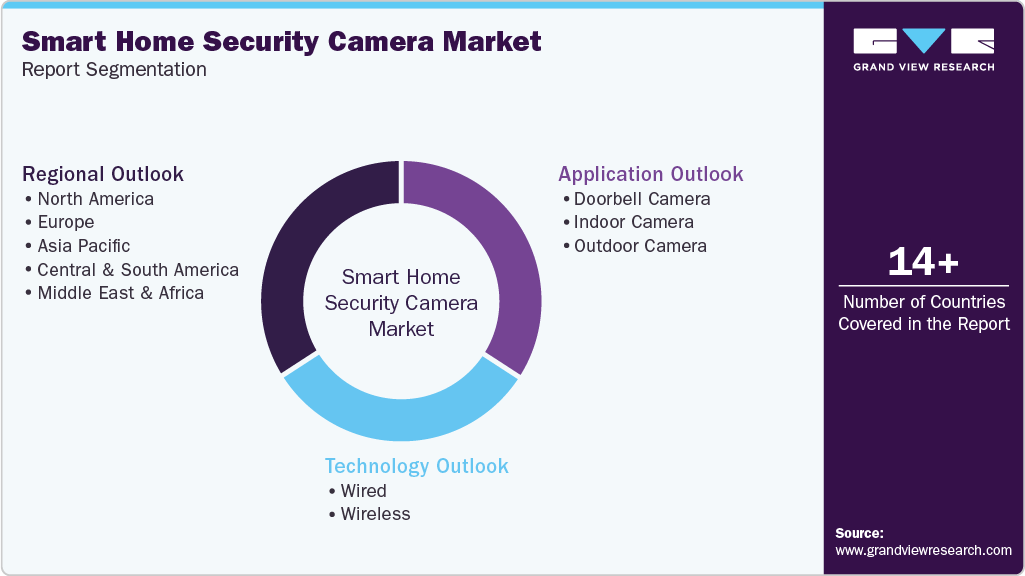

Smart Home Security Camera Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Wired, Wireless), By Application (Doorbell Camera, Indoor Camera, Outdoor Camera), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-529-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Home Security Camera Market Summary

The global smart home security camera market size was estimated at USD 9.98 billion in 2024 and is projected to reach USD 56.47 billion by 2033, growing at a CAGR of 21.7% from 2025 to 2033. The growing need for safer homes and dependable surveillance is driving steady growth in the global smart home security market.

Key Market Trends & Insights

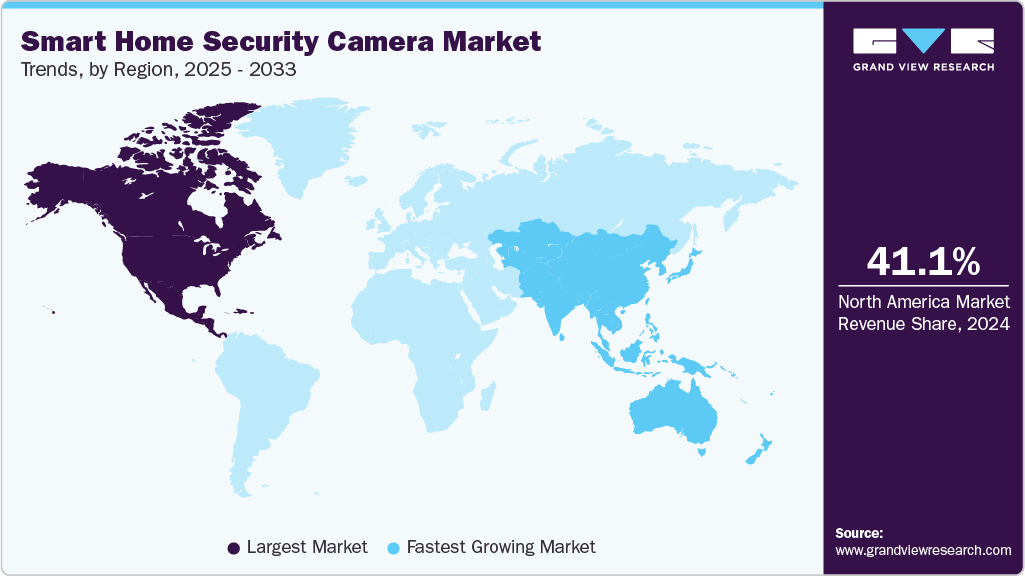

- North America held the largest share of the global smart home security camera market in 2024, accounting for 41.1%.

- The Asia Pacific smart home security camera market is experiencing significant growth, projecting a CAGR of 22.9%.

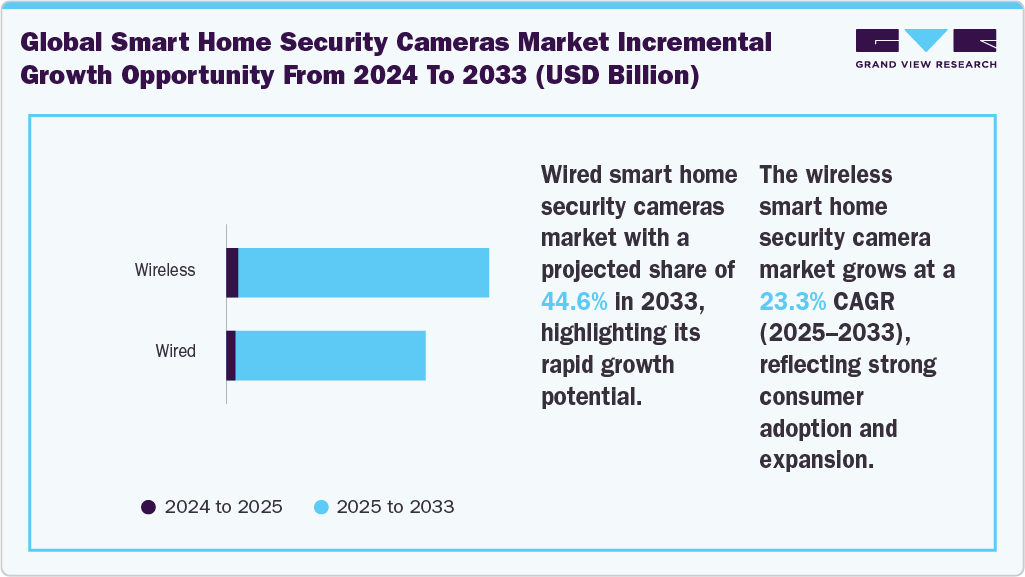

- By technology, wired smart home security cameras held the largest market share, accounting for 51.0%.

- The wireless smart home security camera market is experiencing the fastest growth, projecting a CAGR of 23.3%.

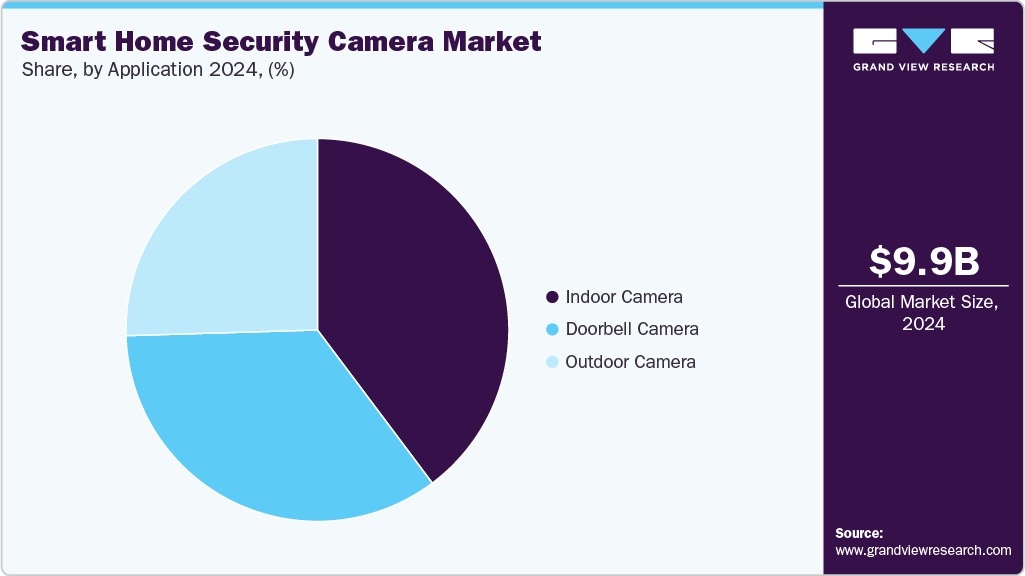

- Smart indoor cameras accounted for a revenue share of 39.8% in 2024 in the smart home security camera market.

Market Size & Forecast

- 2024 Market Size: USD 9.98 Billion

- 2033 Projected Market Size: USD 56.47 Billion

- CAGR (2025-2033): 21.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

More people are turning to smart security cameras because they are easy to use and come packed with advanced features. At the same time, the rise in IoT technology and how smoothly these devices now work within smart home setups is helping speed up this shift even more. Increasing consumer awareness about home security and the need for remote monitoring solutions are key drivers in the home security market. Furthermore, advancements in artificial intelligence (AI) and machine learning technology are improving the functionality and appeal of smart home security cameras. In January 2025, Xthings Inc. introduced new Ulticam home security cameras at CES 2025, featuring edge artificial intelligence (AI) technology and subscription-free cloud storage. The cameras offer enhanced security capabilities without recurring costs, aiming to revolutionize home surveillance.The increase in thefts and break-ins has many people searching for smarter ways to protect their homes, with smart security cameras becoming a popular choice. As property crimes rise in urban areas, both homeowners and business owners are paying closer attention to security. The possibility of losing valuable belongings or suffering damage has made it clear that taking precautions is essential. Smart cameras offer live monitoring, help discourage criminals, and provide peace of mind, which is why their demand continues to grow among those looking to safeguard their properties. According to SafeHome.org, published in February 2025, about 26% U.S. consumers considered purchasing a home security camera.

Ongoing advancements in technology are driving forward the smart home security camera market. Innovations such as AI-powered facial recognition and enhanced image quality are quickly gaining popularity, making these cameras more reliable and appealing to users. For instance, in June 2024, OMNIVISION, a semiconductor manufacturing firm, announced a single intelligent sensor designed for presence detection, facial recognition, and always-on applications. This sensor combines advanced technologies such as mono-IR and AON to enhance security and user experience in various devices. Its applications include home security cameras, doorbells, monitors & webcams.

The rising trend of home automation has also played a part, with more people wanting security systems that work smoothly with their other smart devices. At the same time, the popularity of DIY security options, known for being both convenient and affordable, has helped smart cameras catch the interest of a wider audience. Plus, growing awareness about the importance of security, especially following high-profile incidents, is driving more people to invest in these solutions. According to the Deep Sentinel Corp. data published in January 2025, homes without security systems in place are 300% more likely to be targeted by burglars.

Moreover, according to SafeHome.org, published in February 2025, about 94.5 million U.S. residential properties use some kind of security systems, including cameras, alarms, and access control tools. In addition, about 42% users in the U.S. have installed video surveillance systems.

In addition, according to data from the Office for National Statistics, in the year 2023/2024, there were 181,617 reported home burglaries across England and Wales, averaging 498 burglaries per day, which equates to a house being burgled every 173 seconds. The London Metropolitan area recorded the highest number of burglaries at 37,416, translating to 103 per day or one every 14 minutes. Other regions with significant burglary rates included the West Midlands and Greater Manchester. Notably, 70% of burglaries involved entry through doors, and over 50% occurred while someone was home. The statistics show that while no area is entirely safe, burglary rates vary significantly by region, highlighting the need for awareness among potential victims. This trend is likely to boost the demand and growth of the smart home security camera market in the coming years.

According to the 2023 package theft annual research by Security.org, porch pirates stole USD 8 billion worth of goods, and 44% of Americans experienced package theft at some point. Doorbell cameras tell users when a package has been delivered immediately, and they can even give delivery drivers instructions on where to leave it. If someone comes near or tries to steal the package, the user gets an instant alert and can talk to the person through the camera’s speakers. These smart security cameras also provide 24/7 real-time notifications when connected to a smartphone or other device. Many models include features such as two-way audio, motion detection, video analytics, and high-definition video. These advanced features are expected to fuel strong growth and demand in the smart home security camera market in the years ahead.

Demographic Analysis

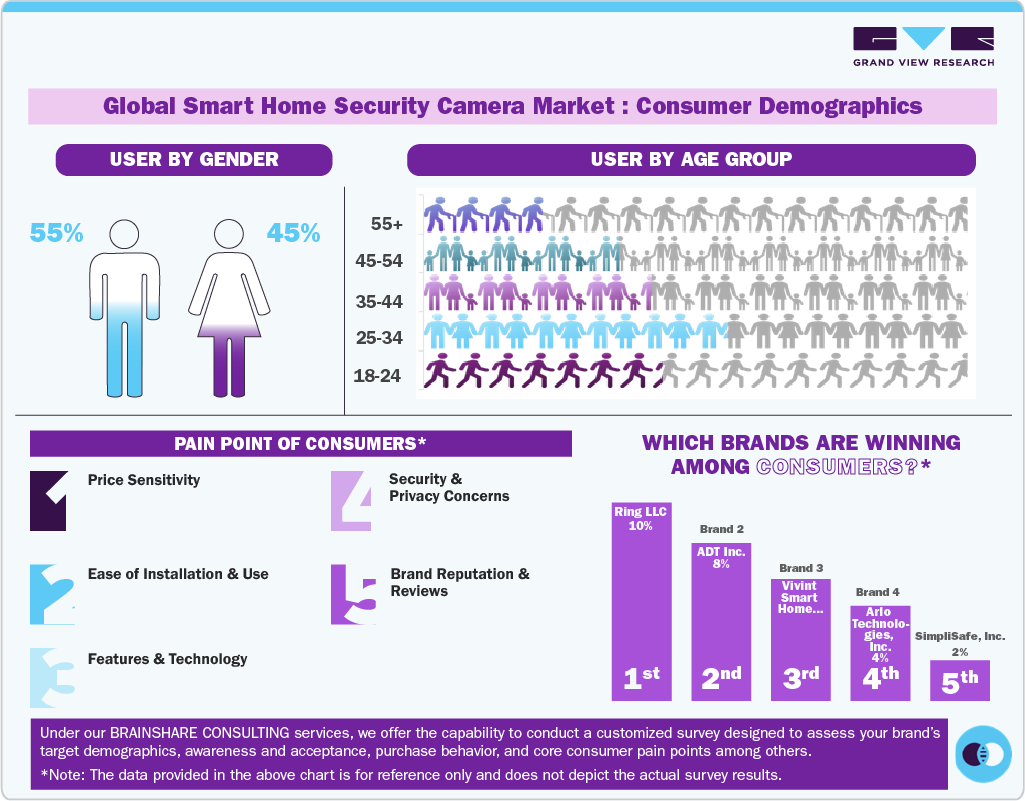

According to a 2023 survey by LendingTree, a U.S.-based online lending marketplace, most American homeowners, surpassing 50%, utilize home surveillance technology, which includes the deployment of cameras. When it comes to integrating electronic surveillance into their homes, younger homeowners show a higher inclination compared to their older counterparts.

Millennial homeowners, falling within the age range of 27 to 42, lead this trend with an adoption rate of 72%, closely followed by Gen Z homeowners (aged 18 to 26) at 69%. Meanwhile, Gen X homeowners (aged 43 to 58) exhibit a usage rate of 47%, and baby boomer homeowners (aged 59 to 77) follow with a 30% adoption rate.

Technology Insights

Wired smart home security cameras accounted for a revenue share of 51.0% in 2024 in the smart home security cameras market. As thefts, burglaries, and security breaches continue to rise, more homeowners are turning to dependable surveillance systems to protect their properties. Wired smart home security cameras provide a stable and reliable connection, allowing for constant monitoring and instant alerts if anything suspicious happens. Crime rates vary widely around the world, influenced by many different factors. Some of the safest countries with the lowest crime rates include Switzerland, Denmark, Norway, Japan, and New Zealand. Growing concerns about safety are expected to boost the home security market. According to World Population Review, the 5 countries with the highest crime rate (crimes per 100,000 people) as identified in 2023 are: Venezuela, Papua New Guinea, South Africa, Afghanistan, and Honduras. This increase in crime rates in countries shows notable opportunities for the smart home security cameras market during the forecast period.

The wireless smart home security camera market is expected to grow at a CAGR of 23.3% from 2025 to 2033. The demand for wireless smart security cameras is on the rise, largely because people want flexible and easy-to-install systems that they can access remotely and that integrate smoothly with their smart home setups. Growing awareness about home security, combined with improvements in wireless technology, is helping to boost the market. On top of that, new features like customizable monitoring areas, hybrid connection options, floodlight cameras, and the ability to distinguish between pets, vehicles, and other animals are driving even more interest in these devices. For instance, in July 2024, Vantiva launched Vantiva Peek, a smart camera with integrated motion featuring long-range & low-power wireless technology, night vision, and long battery life of up to two years with replaceable AA batteries. In addition, with a growing preference for wireless security systems, the camera offers a flexible, easy-to-install solution. For instance, SafeHome.org, published in February 2025, found that about 67% users select wireless systems owing to the convenience of DIY installations.

Application Insights

Smart indoor cameras accounted for a revenue share of 39.8% in 2024 in the smart home security camera market. The growing need for home security and convenience is fueling the demand for smart indoor security cameras. Consumers want solutions that offer real-time monitoring, remote access, and easy integration with other smart home devices. With an increase in burglaries, package thefts, and vandalism, more people are turning to proactive surveillance systems. Advances in AI and machine learning, such as motion detection and facial recognition, are making these cameras smarter and more appealing. As awareness around home security rises and wireless technology becomes more reliable, the market for smart indoor cameras continues to expand.

The smart doorbell security camera market is expected to grow with a CAGR of 22.3% from 2025 to 2033. The smart doorbell camera market is booming as more people become concerned about home security and want the ability to monitor their homes in real time. Many are drawn to features such as remote access and two-way audio, which let them talk to visitors, or even potential intruders, no matter where they are. With package thefts and break-ins on the rise, there’s a growing need for reliable security devices that can send instant alerts when something’s wrong. For instance, according to Parcel Pending LLC, published in November 2024, porch pirates stole USD 473.7 million worth of parcels across the UK, cashing in on crime. Advances in video quality, motion detection, and AI-powered features like facial recognition are enhancing the effectiveness of these devices. As more homes embrace smart technology, the adoption of smart doorbell cameras is expected to continue rising. According to the survey conducted by Security.org polling above 1,000 Americans, about 30% U.S. Americans have installed a doorbell camera.

Regional Insights

The North America smart home security camera market accounted for a revenue share of 41.1% in 2024. The North American home security market is seeing significant growth as more people, especially in urban areas, become aware of security risks. With property crimes like theft and break-ins on the rise, homeowners are increasingly turning to smart security systems to keep a closer watch on their homes. For instance, according to the FedEx data published in November 2024, about 67% of the online shoppers in Canada are concerned about porch pirates. In addition, technological advancements, such as AI-powered cameras and cloud integration, are boosting the appeal of smart home security cameras. The availability of high-speed internet and mobile connectivity further supports the adoption of these systems. As a result, North America is expected to remain a dominant region in the home security market.

U.S. Smart Home Security Camera Market Trends

The U.S. smart home security camera market is expected to grow at a CAGR of 22.5% from 2025 to 2033. In the U.S., the home security market is being propelled by a growing preference for DIY security systems and smart home integration. With the increasing frequency of home invasions and package thefts, consumers prioritize real-time monitoring, remote access, and features such as motion detection. According to SafeHome.org, published in February 2025, the adoption of security systems in the U.S. increased from 42% in 2023 to 52% in 2024, while video doorbell adoption rose to 45% in 2024. The rise of e-commerce and the related increase in home deliveries have further driven the demand for doorbell cameras and indoor surveillance systems. According to LOMBARDO HOMES INC., about 34% Americans have had a package stolen, and 35% installed a security system after having such experiences. As smart home adoption continues, the U.S. will continue to lead the way in market growth. In addition, as per the 2023 Home Security Market Report published by SafeHome, a significant 72% of households across the U.S. are equipped with at least one home security device. Among these households, 51 million have opted for video surveillance systems, while 39 million have installed alarm systems. These statistics show high demand for the smart home security camera market in the U.S. during the forecast period.

Europe Smart Home Security Camera Market Trends

The European smart home security camera market is expected to grow at a CAGR of 21.2% from 2025 to 2033. The European home security market is steadily growing, fueled by a rising focus on safety as property crime increases and urban areas expand. With higher disposable incomes and a growing interest in smart home technology, smart security cameras are becoming more accessible to homeowners across the region. In addition, Europe’s strict data privacy and security laws have pushed for the adoption of encrypted and reliable surveillance systems. As more people recognize the advantages these cameras provide, the market is expected to keep expanding. Video doorbell cameras are also becoming increasingly popular in many parts of Europe, thanks in part to their versatile power options, which can either run on rechargeable batteries or be hardwired, further driving demand for smart home security solutions in the coming years.

The smart home security camera market in Germany is projected to grow at the fastest CAGR of 22.2% from 2025 to 2033. The market is seeing steady growth, driven largely by rising concerns over burglary and vandalism, especially in major cities. The country’s strong manufacturing industry has helped produce high-quality smart security products that are increasingly popular with homeowners. On top of that, government initiatives encouraging energy-efficient smart home devices have boosted interest in integrated security systems. With the rapid growth of the Internet of Things (IoT) and smart home technology in Germany, it’s becoming easier for consumers to adopt wireless security cameras. As people become more focused on protecting their homes, the demand for home security solutions is expected to continue rising.

Asia Pacific Smart Home Security Camera Market Trends

The Asia Pacific smart home security camera market is expected to grow at a CAGR of 22.9% from 2025 to 2033. The market in the Asia Pacific region is growing rapidly, thanks to fast-paced urbanization, higher disposable incomes, and growing concerns about home safety. In countries such as China, India, and Japan, more and more people are turning to smart security cameras, attracted by their affordable prices and advanced features. According to the data published in July 2023, China has over 700 million surveillance cameras installed, accounting for a camera for every two citizens. With rapid technological advancements, the Asia Pacific region is poised to become a key player in the global home security market. According to a survey by Comparitech in 2023, 16 out of the top 20 most surveilled cities (based on the number of cameras per 1,000 people) are in China. Indore, Hyderabad, and Delhi (all in India) were the only cities outside China to make the top 20, taking the fourth, twelfth, and sixteenth places, respectively. Delhi, Chennai, Singapore, Seoul, and Mumbai all feature within the top 20. Delhi and Chennai (India) have more cameras per square mile than any Chinese city. These figures prove that the Asia Pacific is a highly lucrative market for smart home security cameras, which is expected to drive the regional market during the forecast period.

Key Smart Home Security Camera Company Insights

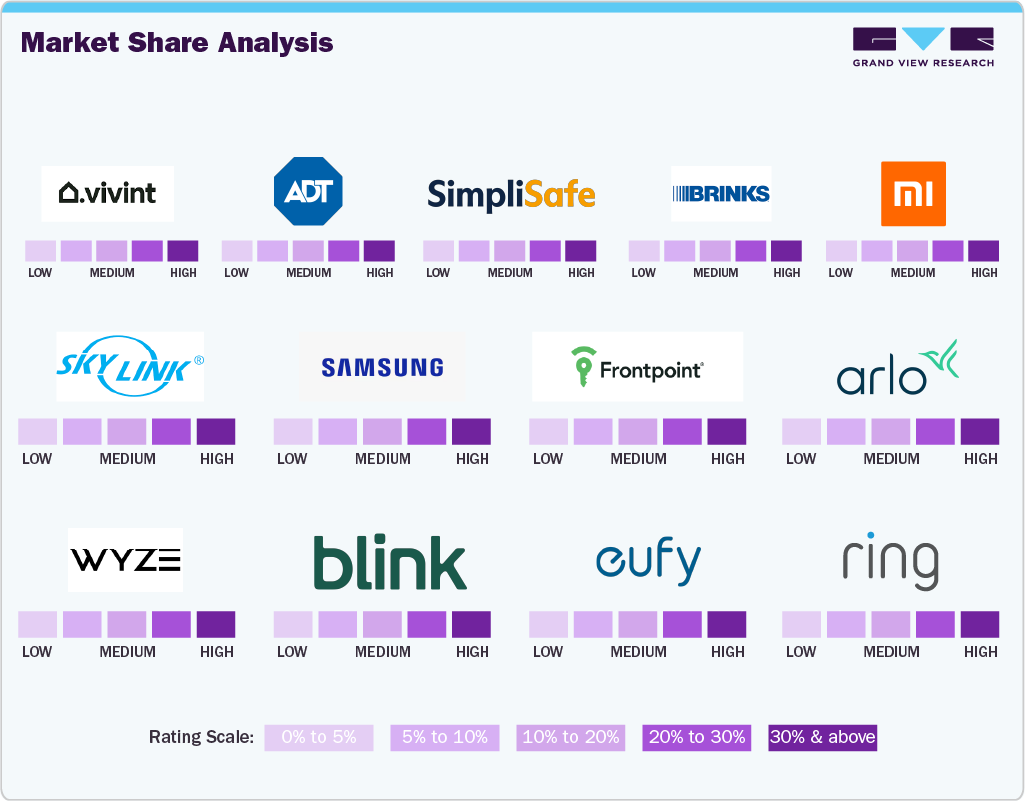

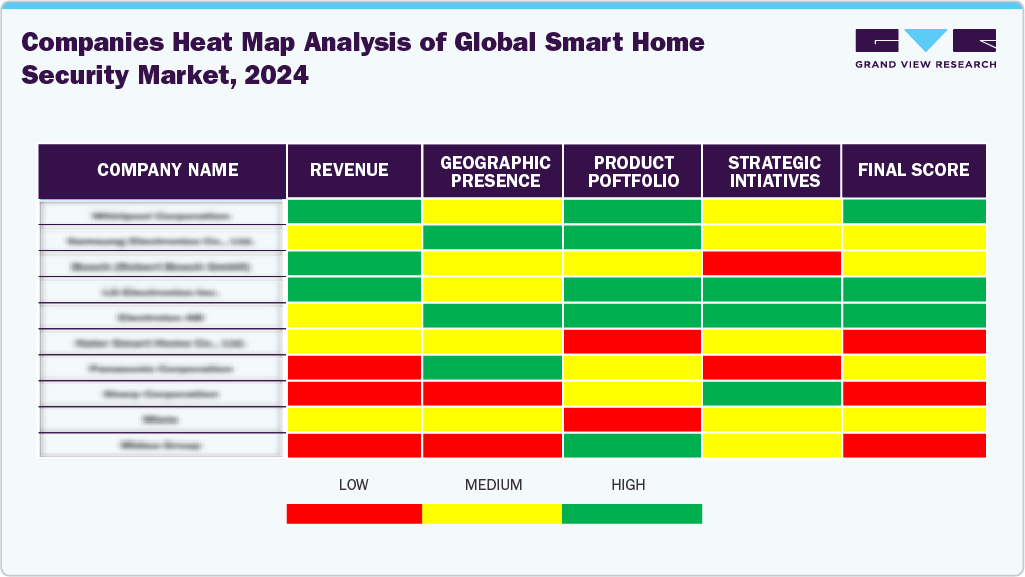

ADT Inc., Vivint Smart Home, Inc., Nest Labs, and Samsung Electronics Co, Ltd. are some of the dominant players operating in the market.

-

Vivint Smart Home, Inc. provides a range of smart home devices, including locks, lights, cameras, thermostats, smoke and carbon monoxide detectors, garage door control, car protection, and security sensors. In addition, they offer comprehensive home systems, featuring in-home consultations, professional installations, and ongoing support services.

-

ADT Inc. operates and markets across three reportable segments such as operates through Commercial, Consumer and Small Business, and Solar segments.

-

Samsung Electronics Co, Ltd. operates at several facilities across the U.S., Asia, Europe, and Central & South America and has reached more than 74 markets through direct sales and distributors.

Wyze Lab, Inc., blink, Skylinkhome, Frontpoint Security Solution, LLC and Xiaomi Inc. are some of the emerging market players functioning in smart home security camera sector. Wyze Labs, Inc., known simply as Wyze, specializes in smart home products and wireless cameras. Xiaomi Inc.’s product range is diverse, extending from smartphones to televisions, wearable items, and a variety of smart home products within its Internet of Things and Xiaomi Smart Home ecosystems.

Key Smart Home Security Camera Companies:

The following are the leading companies in the smart home security camera market. These companies collectively hold the largest market share and dictate industry trends.

- Vivint Smart Home, Inc.

- ADT Inc.

- SimpliSafe, Inc.

- Brinks Home Security

- Xiaomi Inc.

- Skylinkhome

- Samsung Electronics Co, Ltd.

- Frontpoint Security Solution, LLC

- Arlo Technologies, Inc.

- Wyze Lab, Inc.

- blink

- eufy (Anker Innovations)

- Ring LLC

Recent Developments

-

In November 2024, Sensormatic Solutions, a leading global retail brand under Johnson Controls, partnered with Thruvision, a pioneer in walk-through security screening technology, to enhance people screening in retail environments. This collaboration aims to provide retailers with advanced passive terahertz camera technology that complements Sensormatic's loss-prevention solutions. The technology enables efficient detection of concealed items, such as weapons and stolen goods, from a distance of up to seven meters without emitting radiation or compromising individual privacy.

-

In October 2024, Ring LLC added 24/7 recordings in its security cameras. This will allow a camera to record continuously rather than just when it detects motion, which is how Ring’s cameras and video doorbells normally operate.

-

In May 2024, Eufy introduced the Eufy S330, which is a fully autonomous LTE surveillance camera featuring a 360-degree field of vision and a solar panel for continuous power. This innovative camera not only delivers high image quality but also moves on its own, utilizing AI tracking to monitor expansive areas with ease. Now available, the Eufy S330 redefines home security with its advanced technology and reliable performance.

Smart Home Security Camera Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.77 billion

Revenue forecast in 2033

USD 56.47 billion

Growth rate

CAGR of 21.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Vivint Smart Home, Inc.; ADT Inc.; SimpliSafe, Inc.; Brinks Home Security; Xiaomi Inc.; Skylinkhome; Samsung Electronics Co, Ltd.; Frontpoint Security Solution, LLC; Arlo Technologies, Inc.; Wyze Lab, Inc.; blink; eufy (Anker Innovations); Ring LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Home Security Camera Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global smart home security camera market report on the basis of technology, application, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Doorbell Camera

-

Indoor Camera

-

Outdoor Camera

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors fueling growth in the global smart home security cameras market include rising consumer focus on home safety and the convenience of remote monitoring. Increasing adoption of smart home ecosystems and advancements in camera technology, such as AI-powered motion detection and high-definition video, are improving user experience and security effectiveness. Additionally, growing internet penetration, affordable pricing, and the integration of security systems with voice assistants are helping drive wider acceptance and market expansion.

b. The smart home security camera market size was estimated at USD 9.98 billion in 2024 and is expected to reach USD 11.77 billion in 2025.

b. The smart home security camera market is expected to grow at a compound annual growth rate (CAGR) of 21.7% from 2025 to 2033 to reach USD 56.47 billion by 2033.

b. The wired smart home security cameras market accounted for a revenue share of 51.0% in 2024, driven by growing concerns over home safety and the need for real-time monitoring, the wired smart home security camera market is rapidly expanding. Consumers also prefer these systems for their reliability and constant power supply.

b. Some key players operating in the smart home security camera market include Vivint Smart Home, Inc, ADT Inc, SimpliSafe, Inc, Brinks Home Security, Xiaomi Inc, Skylinkhome, Samsung Electronics Co, Ltd, eufy (Anker Innovations)., and Ring LLC.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.