- Home

- »

- Electronic & Electrical

- »

-

Smart Doorbell Market Size & Share Analysis Report, 2030GVR Report cover

![Smart Doorbell Market Size, Share & Trends Report]()

Smart Doorbell Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Wired Doorbell, Wireless Doorbell), By End-user (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-017-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Doorbell Market Summary

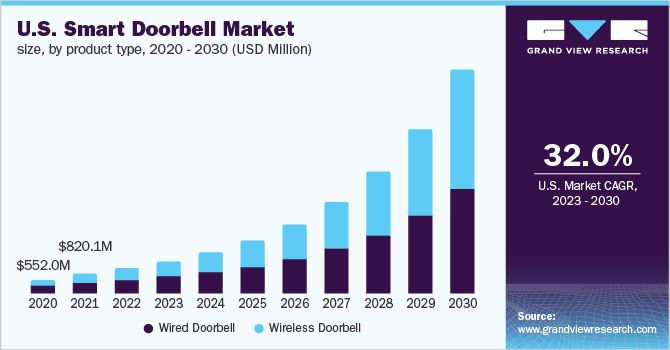

The global smart doorbell market size was estimated at USD 3,480.1 million in 2022 and is projected to reach USD 33,428.5 million by 2030, growing at a CAGR of 33.4% from 2023 to 2030. Rising awareness regarding home safety is expected to boost the product demand. Moreover, growing concerns regarding the security, safety, and well-being of individuals and families are expected to play a key role in increasing the scope of doorbell cameras.

Key Market Trends & Insights

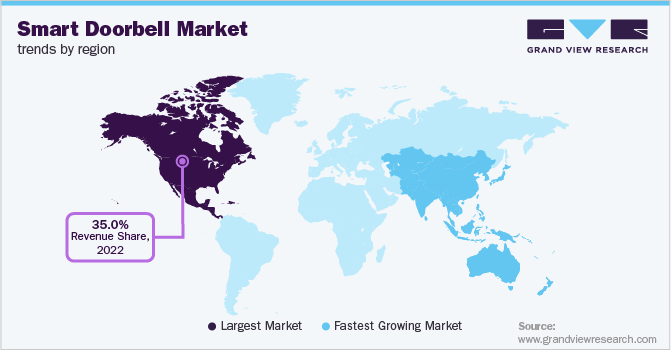

- North America accounted for the highest market share of around 35.0% in 2022.

- By product, the wireless segment is expected to expand with the fastest CAGR of 35.5% during the forecast period.

- By end use, the commercial segment is expected to expand with a CAGR of 31.9% during the forecast period.

- By distribution channel, the online segment is likely to expand with the fastest CAGR of 34.3% during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 3,480.1 Million

- 2030 Projected Market Size: USD 33,428.5 Million

- CAGR (2023-2030): 33.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The industry growth is further supported by the growing awareness among the masses regarding integrating artificial intelligence in to a general routine for comfort and luxury. Significant expansion in the commercial space is likely to generate a high demand for the installation of security devices, thereby driving the market growth. The rising prevalence of counterfeit doorbell cameras continues to impede market growth. Counterfeit/fake doorbell cameras are those products that are falsely sold and marketed at a relatively cheaper price. Increasing incidents of cybercrime and data breaches are restricting the growth of the market.

The growing popularity of smart security devices, such as doorbell cameras, owing to their benefits, such as real-time protection and greater convenience, makes consumers susceptible to various cyber security threats. For instance, a smart doorbell manufactured by Ring, a Los Angeles-based startup, sends user video and audio data to Amazon Web Services servers.

The COVID-19 has witnessed high demand in residential use and thus smart doorbell market observed positive growth in 2020. The residential segment has seen significant growth in implementing smart doorbells in 2020. Most companies have seen a rise in their net revenue due to the large volume of smart doorbells sold during the pandemic. Amazon sold more than 400,000 ring smart doorbell devices and accessories to homeowners, globally. The market is expected to grow at a rapid pace during the forecast period due to the increasing smart homes and growing use of smart doorbells in commercial places.

A smart doorbell is a doorbell with a camera connected to the owner’s phone through wi-fi. This connection lets the owner see and communicate with the visitor. It has opened up a new purpose for the doorbell. These functionalities include that when ringing a smart doorbell, not only does a sound go off in the house, but the owner’s phone also receives a notification. In 2013 the first smart doorbell was launched by a company later known as Ring. The product was the first version of the Ring Video Doorbell and proved to be the start of a new era of doorbells entering the streets.

Tech-hardware companies are manufacturing products that have leveraged AI features to modify and update their products and cater to the evolving consumers’ requirements. For instance, most doorbell cameras have been integrated with a two-way audio system to assist users with better communication with the visitor. Doorbell cameras can be easily connected to smartphones or tablets to facilitate easy entry of the visitors, even in the absence of homeowners.

Product Type Insights

The wireless segment is expected to expand with the fastest CAGR of 35.5% during the forecast period. At a macro level, the increasing demand for the wireless sensor networks, improved reliability, and technological advancements are the notable factors driving demand for the wireless doorbell cameras, worldwide. As there is no wiring involved, wireless installation is a convenient option for the homeowners. Thus, the wireless segment is expected to develop by the fastest CAGR during the forecast period.

The wired segment dominated the market in terms of share and is estimated to develop by a CAGR of 31.6% during the forecast period. Wired or hard-wired doorbell cameras are available in a wide range of styles, from vintage to traditional to contemporary. Wired doorbell cameras are less expensive than battery-operated doorbell cameras. This, in turn, makes wired doorbell cameras more affordable to the consumers, thereby justifying their relatively higher consumption worldwide. It generated large revenue in 2022.

End-user Insights

The commercial segment is expected to expand with a CAGR of 31.9% during the forecast period. Owing to the implementation of stringent safety practices at commercial places, the demand for doorbell cameras has increased among consumers for the safety purposes. Moreover, rapid infrastructural development in the commercial segment is fueling the need for high-end security in hotel rooms, lobbies, corporate offices, and such other commercial spaces.

For instance, according to the London Hotel Development Monitor Report 2018, the hotel industry in London was expected to add 11,600 rooms to its hotel market by the end of 2020. Therefore, it is estimated that the segment will expand at a steady CAGR during the forecast period.

The residential segment dominated the market in 2022 and is expected to develop by the fastest CAGR of 33.7% during the forecast period. Increasing demand for the home automation and the rising adoption of the smart appliances are the factors paving the way for technologically advanced security products, such as doorbell cameras.

The ability to control these devices through smartphones has also boosted their adoption, due to the growing digitalization and penetration of internet-controlled devices in security & home automation. Doorbell cameras can be easily connected to smartphones or tablets to facilitate easy entry of the visitors, even in the absence of homeowners. Thus, the segment generated large revenue in 2022.

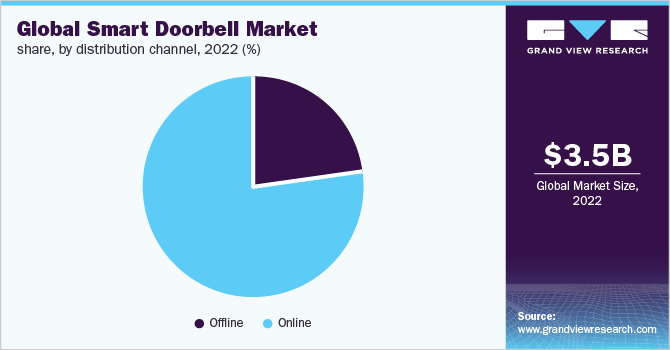

Distribution Channel Insights

The online segment is likely to expand with the fastest CAGR of 34.3% during the forecast period. The proliferation of online retailers worldwide is a key factor contributing to the segmental growth. Various developments have been witnessed during recent years in the ways doorbell cameras reach consumers. In this respect, the offline segment’s share is being acquired by direct/online sales. While such trends are most apparent in the developed markets of North America and Europe, similar trends are being witnessed in Asian countries like India and China. These factors will continue to bode well for the segment during the forecast period.

The offline segment grabbed a large market in terms of share and is estimated to expand at a CAGR of 30.0% during the forecast period. Specialist retailers operating within the industry continue to face intense competition from online/e-commerce retailers. The high costs associated with maintaining physical stores continue to limit their ability to compete with e-commerce retailers. A majority of consumers continue to prefer offline distribution channels as the sales representatives in these channels/platforms/retail stores help them gain adequate product knowledge. Therefore, the offline segment accounted for large revenue in 2022.

Regional Insights

Asia Pacific is anticipated to develop by the fastest CAGR of 35.8% during the forecast period. The growing crime rate in countries such as Pakistan, Iran, Afghanistan, India, the Philippines, South Korea, Qatar, and China is expected to increase the utility of doorbell cameras. The high crime rate in these countries has made people immensely vulnerable and has compelled them to opt for the domestic security measures.

According to an official document issued by the government in 2020, the government aims to build a nationwide video surveillance network for ensuring public security that will be fully controlled in residential areas. Thus, the region is likely to grow at the fastest CAGR during the forecast period.

North America accounted for the highest market share of around 35.0% in 2022.The growing trend of smart homes, which comprise home automation solutions and the rising concerns regarding house safety are the factors driving demand for the doorbell cameras in the region. For instance, according to the U.S. Department of Justice report, in 2017, burglaries accounted for 18.2% of the estimated number of property crimes in the U.S. Moreover, close to 57.5% of the burglaries involved forcible entry, 36.2% were unlawful entries, and 6.3% attempted forcible entry. Thus, the region has accounted for a large revenue generation in 2022.

Key Companies & Market Share Insights

Most of the key players operating in the market are launching new products to gain maximum customer penetration.

-

In December 2021, Hikvision announced a partnership with Irida Labs, a European AI vision solution provider. This development will offer intelligent vision AI solutions for the logistics and manufacturing sectors to perform real-time management of plants and warehouses

-

In November 2021, Latch, Inc. announced a partnership with Marks USA, as well as Town Steel, Inc., coupled with another imminent partnership with dormakaba Holding AG. This string of developments is expected to boost the acceptance of LatchOS among new guests, residents, and property managers

-

In July 2021, Vivint Smart Home, Inc. announced a strategic partnership with Freedom Forever. This partnership will enable consumers to pamper themselves with smart homes that are capable to generate the energy required for their daily use

Some of the prominent players in global smart doorbell market include:

-

Ring Inc.

-

Vivint, Inc.

-

Smart wares Group

-

Intelligent Technology Co. Ltd.

-

Sky Bell Technologies Inc.

-

Aeotec Technology (Shenzhen) Co. Ltd.

-

Arlo Technologies Inc.

-

August Home Inc.

-

Eques Inc.

-

iseeBell Inc.

Smart Doorbell Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4448.1 million

Revenue forecast in 2030

USD 33,428.5 million

Growth rate

CAGR of 33.4%from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

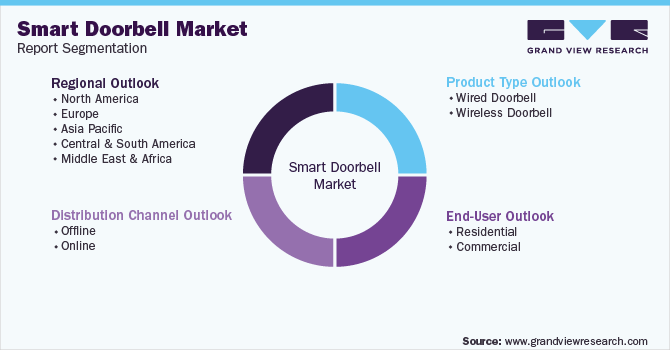

Product type, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; China; India; Japan; UAE; Brazil.

Key companies profiled

Ring Inc.; Vivint, Inc.; Smart wares Group; Intelligent Technology Co. Ltd.; Sky Bell Technologies Inc.; Aeotec Technology (Shenzhen) Co. Ltd.; Arlo Technologies Inc.; August Home Inc.; Eques Inc.; iseeBell Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Smart Doorbell Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global smart doorbell market report based on the product type, end-user, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Wired Doorbell

-

Wireless Doorbell

-

-

End-User Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart doorbell market size was estimated at USD 3,480.1 million in 2022 and is expected to reach USD 4,448.1 million in 2023.

b. The global smart doorbell market is expected to grow at a compound annual growth rate of 33.4% from 2023 to 2030 to reach USD 33,428.5 million by 2030.

b. North America accounted for the highest market share of around 35.0% in 2022. The growing trend of smart homes which comprise home automation solutions and the growing concerns regarding house safety is driving the demand for doorbell cameras in the region.

b. Some of the key companies include Ring Inc., Vivint, Inc., Smartwares Group, Intelligent Technology Co. Ltd., SkyBell Technologies Inc., Aeotec Technology (Shenzhen) Co. Ltd., Arlo Technologies Inc., August Home Inc., Eques Inc., and iseeBell Inc.

b. Key factors that are driving the smart doorbell market growth include the rising awareness regarding home safety is expected to the product demand. Moreover, growing concerns regarding the security, safety, and well-being of individuals and families are expected to play a key role in increasing the scope of doorbell cameras. The industry growth is further supported by the growing awareness among the masses regarding integrating artificial intelligence into a general routine for comfort and luxury.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.