- Home

- »

- Next Generation Technologies

- »

-

Smart Manufacturing Market Share & Growth Report, 2030GVR Report cover

![Smart Manufacturing Market Size, Share & Trends Report]()

Smart Manufacturing Market Size, Share & Trends Analysis Report By Component, By Technology (Product Lifecycle Management, 3D Printing, Enterprise Resource Planning), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-028-6

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global smart manufacturing market was valued at USD 254.24 billion in 2022 and is anticipated to grow at a CAGR of 14.9% from 2023 to 2030. The market is expanding at a faster rate due to factors such as rising Industry 4.0 adoption, more government engagement in supporting industrial automation, increased emphasis on industrial automation in manufacturing processes, surging demand for software systems that save time and cost, increasing supply chain complexities, and increased emphasis on regulatory compliances. COVID-19 pandemic had an impact on or induced the shutdown of all industries and elements involved in industrial automation. The global supply chains and operational logistics were suddenly affected during initial worldwide lockdown.

The market became more focused on manufacturing essential products to survive during the pandemic as demand for non-essential products reduced. However, the market was able to grow during pandemic as enterprises needed to provide their services and products safely and quickly. The market grew during this unusual event as a direct result of demand, government financial assistance, and technical support.

Information technology and automobile industries are two most prevalent industries for industry 4.0. The market has helped automotive manufacturers build automated assembly lines not only for parts but also to manufacture the entire car. For instance, in 2021, Audi used its Production Lab (P-Lab) department to create real-life use cases for modern technology in everyday manufacturing. Industrial automation has developed an in-depth and in-demand market based solely on benefits and opportunities it offers other industries. Regardless of industry, every company or manufacturer aims to apply smart manufacturing to their processes, thus increasing the overall market.

Additionally, information technology industry is at forefront of the existence of the market and also its development. The market has grown standardized due to the widespread standardization and recent installation of internet of things (IoT). Internet of Things has normalized entry-level manufacturing, application, and execution of market technology worldwide. Information technology industry uses augmented reality, virtual reality, machine learning, artificial intelligence, and many other modern solutions to keep industry on the front foot to meet contemporary challenges and demands. For instance, in July 2021, Qualcomm began applying its advanced 5G technology to smart manufacturing by unleashing the power of IoT.

Furthermore, the industry is growing momentum in developing countries like India, Mexico, and Brazil. As developing countries are experiencing industrialization at an excessive rate, companies and industrial plants see this as an opportunity. Along with technological and logistical advancements, governments in developing countries enact laws that benefit businesses, allowing the market to thrive.

Market Dynamics

GROWING PROLIFERATION OF INTERNET OF THINGS

The global manufacturing sector has embraced the Internet of Things (IoT) due to its significant advantages, such as cost reduction and heightened efficiency. IoT systems are now prevalent on shop floors and in supply chains, offering real-time insights and monitoring capabilities for product manufacturing. Modernization of manufacturing industry is driven by two main approaches: connected products for discrete manufacturers and connected supply chains for process manufacturers. Sensor networks deployed across manufacturing facilities and logistics play a pivotal role in IoT ecosystems, enhancing operational intelligence, quality, and reliability. The widespread adoption of IoT is evident in increasing use of sensors across various applications. Moreover, key players promoting IoT development include General Electric, IBM Corporation, Cisco Systems, Inc., Intel Corporation, Siemens, ABB, Fanuc Corporation, and Yokogawa Electric Corporation, collaborating to raise awareness and foster adoption of IoT solutions, thereby driving the market growth.

GOVERNMENT INITIATIVES AND COMPLIANCE TO SUPPORT DIGITIZATION

Industries face increasing regulatory demands concerning product safety, quality standards, environmental impact, and data privacy. Smart manufacturing technologies play a crucial role in helping manufacturers adhere to these regulations through real-time monitoring, traceability, and quality control mechanisms. Compliance issues for manufacturers fall into process and product categories, both effectively addressed by smart manufacturing practices. These practices are particularly beneficial for achieving time and quality metrics at reduced costs, making them ideal for companies striving for efficiency. Moreover, digitization of manufacturing supports various tasks, including engineering changes, risk assessment, process improvement, enhanced visibility, and on-demand data provision. As a result, the imperative for compliance to gain a competitive edge is expected to drive significant growth in smart manufacturing industry.

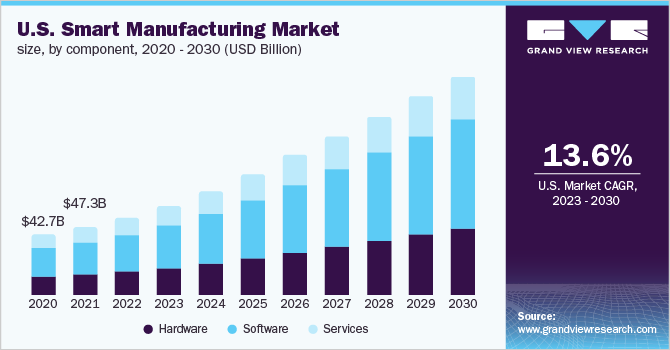

Component Insights

Software segment accounted for a largest revenue share of 49.6% in 2022 and is likely to dominate the market over the forecast period. As industry is pushing towards full automation, the software component is the backbone of the industry. Advanced software will help run robots, drones, and other machines without human interruption, reducing the chance of any error. With the help of software, the market can make large strides in development and research for newer and more versatile solutions.

Hardware segment is projected to grow at a highest CAGR of 13.8% from 2023 to 2030. Advanced software requires high-level and compatible hardware to run. For the advanced software to be executed, it requires modern hardware to operate. Manufacturing plants use hardware that consumes less power but is agile and can work without human touch. Modern hardware also has to be compatible with IoT to assist market with standardization.

Technology Insights

Discrete control system segment accounted for a largest market share of 16.1% in 2022 and is predicted to lead the market over the forecast period. Discrete control system technology runs in background and offers control and monitor functions to the administrator. The market offers basic and advanced level technological control and overview of every process. This combination of technology and industrial automation makes the market accessible even remotely.

3D printing segment is anticipated to grow at a highest CAGR of 17.8% over the forecast period. 3D printing allows smart manufacturers to print any small or big part by drawing it on 3D software. 3D printing saves time and cost for a smart manufacturing plant by being easy to draw and print then and there. The market is a huge investor and purchaser of 3D printing equipment and software.

End-Use Insights

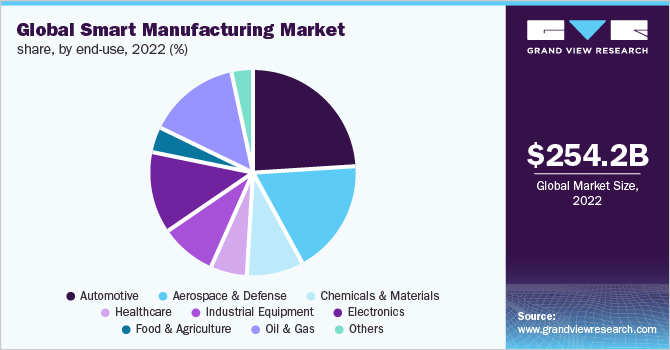

Automotive industry registered a largest revenue share of over 24% in 2022 and is anticipated to grow at a highest CAGR of 15.6% over the forecast period. Many automotive manufacturers are running at very minimal profits, so they turn towards smart manufacturing to reduce waste and cost and to increase their margins. The market also helps automotive companies maintain a high level of standardization of their products. Primarily, industry 4.0 helps automotive industry to run around the clock and reduce labor wages if any.

Aerospace & defense industry segment is predicted to register a significant CAGR of 16.6% from 2023 to 2030. This industry is investing heavily in smart manufacturing as precision in the product is key. For space research, multiple flights are needed for testing which can only be achieved by smart manufacturing rockets at a rapid pace. The defense industry invests significantly in industrial automation to be able to come up with modern defense mechanisms to mitigate any new threats.

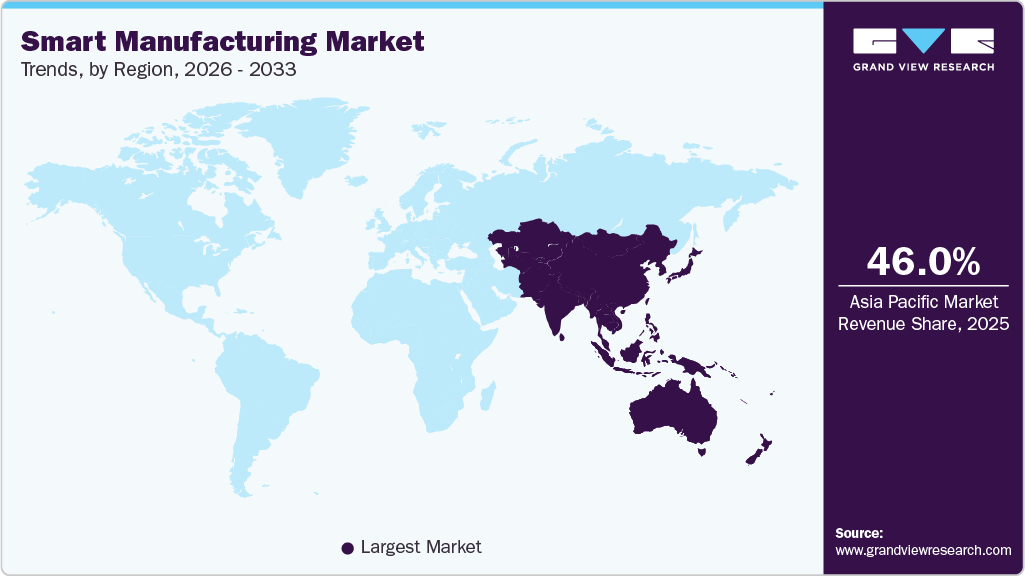

Regional Insights

Asia Pacific region accounted for a largest market share of 36.7% in 2022. The region is also anticipated to be the fastest-growing region over the forecast period. Developing countries like India and China have vast unexplored opportunities and are aiming toward full automation in smart manufacturing. These countries also want to be independent in terms of production and manufacturing, so they invest heavily in industry 4.0. Latin America is expected to grow at a significant CAGR of 15.3% during the forecast period.

Latin American market for innovation and automation is aggressively penetrated, resulting in normalization of smart manufacturing. Since the modern technological revolution has only recently begun in Latin America, opportunities in smart manufacturing are expanding. The region is also close to and accessible to various raw materials, which aids in smart manufacturing and drives the growth of the market.

Key Companies & Market Share Insights

The global smart manufacturing market has a high number of small and medium-level players who are often operating for big established manufacturers. Many small-level players in the market are in the Asia Pacific region as the market is still developing here. As technology evolves, so does the specification and type of products to be manufactured, with industrial automation the process is streamlined, and the market grows alongside the evolution. The North American and European markets are dominated by large and medium-level companies in the market.

Competition in this market is high, although technological advancements are allowing companies to save time and cost while increasing their efficiency and effectiveness. Constant research and development are leading to the industry becoming more common and standard even if it requires some investment. Due to globalization, the smart manufacturing trend is present in global markets over boundaries. Seeing the growth potential, even governments are offering schemes and policies for investors to bring markets to their countries. Some of the prominent players operating in the global smart manufacturing market include:

-

ABB Ltd.

-

Siemens

-

General Electric

-

Rockwell Automation Inc.

-

Schneider Electric

-

Honeywell International Inc.

-

Emerson Electric Co.

-

Fanuc UK Limited

Recent Developments

-

In April 2023, Honeywell International, Inc. acquired Compressor Controls Corporation (CCC), a provider of turbomachinery control and optimization solutions, for USD 670 million. This acquisition is expected to strengthen their presence in automation, industrial control, and process solutions. The ongoing development is expected to help industry grow exponentially in coming years.

-

In April 2023, ABB is expected to invest USD 170 million in the U.S. market to create highly skilled jobs in manufacturing, innovation, and distribution operations. This investment is expected to create more demand for electrification and automation products.

-

In April 2023, Robert Bosch GmbH partnered with Rhenus Automotive and REMONDIS subsidiary TSR Recycling, to develop Europe’s first fully automated battery-discharging plant. The plant will be a fully automated system for disassembling and discharging battery modules, which is expected to augment the industry growth further.

-

In June 2023, Schneider Electric partnered with ArcelorMittal Nippon Steel India for hi-tech training on smart manufacturing. The partnership also includes smart labs and training labs for NAMTECH, an education initiative by AM/NS India, which will be developed by Schneider Electric.

-

In May 2023, Rockwell Automation Inc. collaborated with autonox Robotics, for the expansion and invention of robot mechanics. This partnership is expected to bring Kinetix motors and drives of Rockwell along with the autonox’s robot mechanics to achieve new manufacturing possibilities.

-

In March 2022, Mitsubishi Electric Corporation updated their software iQ Works2 and RT Toolbox3. A new visual editor for SCADA and six-axis industrial robot programming is part of their latest update in the software. The upgrade also includes improved user-friendliness, which is expected to simplify the setup of automated applications.

Smart Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 297.20 billion

Revenue forecast in 2030

USD 787.54 billion

Growth rate

CAGR of 14.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; Japan; India; Brazil; Mexico

Key companies profiled

ABB Ltd; Siemens; General Electric; Rockwell Automation, Inc.; Schneider Electric; Honeywell International Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Manufacturing Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest market trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart manufacturing market report based on component, technology, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Machine Execution Systems

-

Programmable Logic Controller

-

Enterprise Resource Planning

-

SCADA

-

Discrete Control Systems

-

Human Machine Interface

-

Machine Vision

-

3D Printing

-

Product Lifecycle Management

-

Plant Asset Management

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Chemicals & Materials

-

Healthcare

-

Industrial Equipment

-

Electronics

-

Food & Agriculture

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global smart manufacturing market size was estimated at USD 254.24 billion in 2022 and is expected to reach USD 297.20 billion in 2023.

b. The global smart manufacturing market is expected to witness a compound annual growth rate of 14.9% from 2023 to 2030 to reach USD 787.54 billion by 2030.

b. The automotive segment held the largest share of 24% in 2022 due to the increasing number of IoT devices, connected machinery, and rise in data-driven operations in the auto industry.

b. Some key players operating in the smart manufacturing market include Siemens AG; General Electric; Rockwell Automation Inc.; Schneider Electric; Honeywell International Inc.; and Emerson Electric Co.;

b. Knowledge-based manufacturing, connected supply chains, rising implementation, adoption of Industry 4.0 and increase in the automation are some of the factors driving the smart manufacturing market.

b. The software segment accounted for the largest share of more than 49% in 2022 in the smart manufacturing market and is expected to continue its dominance over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."