- Home

- »

- Pharmaceuticals

- »

-

Smart Pills Market Size, Share, Growth, Industry Report 2030GVR Report cover

![Smart Pills Market Size, Share & Trends Report]()

Smart Pills Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Capsule Endoscopy, Drug Delivery, Vital Sign Monitoring), By Disease Indication, By Target Area, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-270-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Pills Market Summary

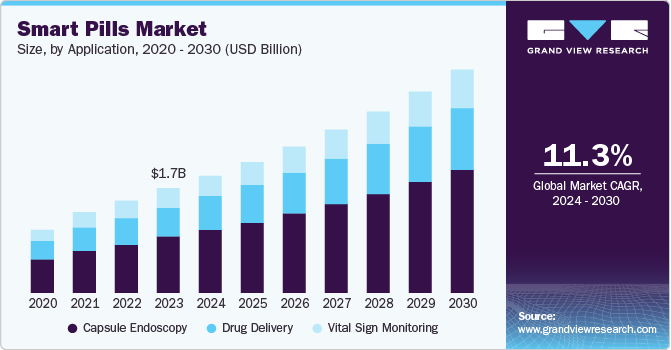

The global smart pills market size was estimated at USD 1.7 billion in 2023 and is projected to reach USD 3.64 billion by 2030, growing at a CAGR of 11.3% from 2024 to 2030. Smart pills, often called digital pills or ingestible sensors, represent a breakthrough in medical technology by combining pharmaceuticals with digital monitoring proficiencies.

Key Market Trends & Insights

- The North America smart pills market dominated the global market and accounted for the largest revenue share of 37.5% in 2023.

- The Asia Pacific smart pills market is expected to grow at a CAGR of 12.7% over the forecast period.

- By application, the capsule endoscopy dominated the market and accounted for the largest revenue share of 54.1%.

- By disease indication, the celiac disease led the market and accounted for the largest revenue share 2023.

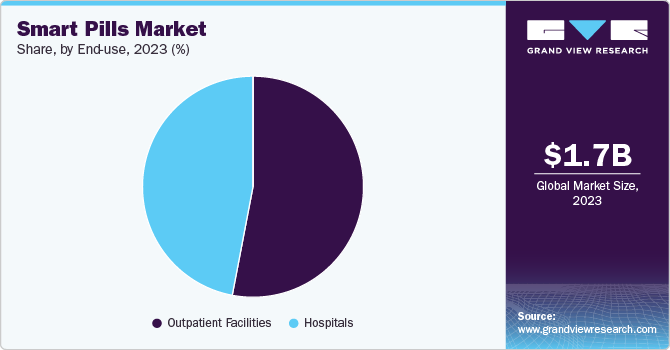

- By end-use, the outpatient facilities dominated the market with a share of 53.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.7 Billion

- 2030 Projected Market Size: USD 3.64 Billion

- CAGR (2024-2030): 11.3%

- North America: Largest market in 2023

These pills are implanted with tiny sensors that transfer data of the body's response to medication ingestion, such as vital signs or medication adherence, to devices such as smartphones or computers. By issuing real-time insights into patient health and treatment effectiveness, smart pills enable healthcare professionals to align treatment plans more precisely and intervene promptly when there is a need.Other significant growth aspects for the smart pill technologies market are attractive reimbursement circumstances, patient demand for less invasive treatments, technical improvements in endoscopic techniques, and the growing prevalence of colon cancer. In addition, the benefits of smart pill technology, such as breakthroughs in endoscopic procedures, focused medicine administration, and simple remote patient monitoring, boost the sale of smart pill technologies.

Furthermore, patients demand a non-invasive diagnostic process, and the rise of chronic diseases, aging populations, and the increasing adoption of digital health technologies have fueled the smart pills market due to the ease, convenience, less discomfort, and less risk associated with severe complications for some injuries or pain. Patients and healthcare providers seek more efficient treatment alternatives, driving the demand for innovative methods such as smart pills. Moreover, integrating artificial intelligence with smart pill technology improves data analytics competencies, facilitating better and quicker diagnosis, accurate treatment, and preventive care approaches.

Application Insights

Capsule endoscopy dominated the market and accounted for the largest revenue share of 54.1% attributed to the painless procedure of diagnosing gastrointestinal disorders. In this technique, the patient has to swallow a large vitamin pill-sized capsule that is wireless and compact with small cameras and sensors that assist in detection and tracking purposes. Hence, the procedure causes minimal discomfort and is painless, with a quick recovery. The advantages of smart pills, detailed health observation of different physiological metrics, and an accurate diagnosis result in the market expansion of smart drugs.

Drug delivery is expected to grow at a CAGR of 11.1% over the forecast period, owing to the healthcare industry's infrastructural development, patients' awareness of chronic disorders, and demand for advanced drug delivery methods, such as devices that facilitate self-medication. There is also a global demand for innovative and better drug delivery systems with less discomfort for patients.

Disease Indication Insights

Celiac disease led the market and accounted for the largest revenue share 2023 driven by the increasing prevalence of gastrointestinal disorders and chronic diseases, such as cancer and diabetes, which necessitate innovative diagnostic and treatment solutions. In addition, the rising geriatric population and the demand for minimally invasive procedures enhance the appeal of smart pills. Furthermore, technological advancements in drug delivery systems and the integration of advanced sensors further contribute to market expansion, making smart pills a vital tool in modern healthcare.

Small bowel tumors are expected to grow significantly over the forecast period. These smart pills are generally swallowed, and after passing through the tract, they gather health data, record images, and inject drugs appropriately. The growth is driven by factors such as the increasing prevalence of small bowel tumors, rising demand for non-invasive diagnostic methodologies, and innovations in artificial intelligence and IoT technologies.

Target Area Insights

Small intestine dominated the market and held the largest revenue share in 2023 driven by the rising incidence of small intestine disorders, such as Crohn's and celiac diseases. The increasing demand for noninvasive diagnostic tools and advancements in capsule endoscopy technology further enhance market potential. Furthermore, the intricate anatomy of the small intestine presents challenges for traditional diagnostic methods, making smart pills an attractive alternative. These factors collectively contribute to smart pills' expanding application and acceptance in gastrointestinal healthcare.

The stomach is expected to witness substantial growth over the forecast period. Local treatments for gastrointestinal diseases such as gastritis, Crohn's disease, and gastrointestinal cancer and systemic diseases such as diabetes, neurological disease, and vaccines require efficient drug delivery systems to overcome the gastrointestinal biological barrier and enhance local targeting. This results in the demand for capsule endoscopy as a noninvasive diagnostic procedure to visualize the inside of a patient's digestive tract.

End-use Insights

Outpatient facilities dominated the market with a share of 53.3% in 2023 owing to the rising demand for appropriate medicines and initiatives by governments to promote automated medication technologies in healthcare to minimize errors and risks. This results in significant popularity, mainly for outpatient facilities and intense care for lower-risk patients.

Hospitals are expected to grow at a CAGR of 10.4% over the forecast period. The quality infrastructure and presence of fine-quality treatment options with the expertise of healthcare practitioners led to the segment's growth in the upcoming period. In addition, the rise in cases of inflammatory bowel disease (IBD) has prompted hospitals to embrace smart pills as a crucial diagnostic tool. Smart tablets offer a practical solution for hospitals seeking intense patient care and facing the escalating challenges of IBD due to their non-intrusive nature and ability to enhance early detection and diagnosis.

Regional Insights

The North America smart pills market dominated the global market and accounted for the largest revenue share of 37.5% in 2023 attributed to the increasing prevalence of chronic diseases, particularly gastrointestinal disorders and associated cancers. The region's openness to advanced technologies to improve patient care, a sizable and discerning consumer base, and regulatory approvals for innovative devices further expand the market. In addition, the presence of key industry players creates an environment conducive to product development. At the same time, the FDA plays a significant role in shaping the market by approving cutting-edge technologies that revolutionize remote health monitoring.

U.S. Smart Pills Market Trends

The smart pills market in the U.S. dominated the North American market and accounted for the largest revenue share in 2023. The growing demand for pharmaceuticals drives this growth; a combination of increasing disease prevalence, regulatory support, technological advancements, and a robust healthcare system positions the region as a significant driver in advancing smart medical solutions.

Europe Smart Pills Market Trends

Europe smart pills market is expected to experience substantial growth over the forecast period, owing to an increasing emphasis on minimally invasive techniques, positioning smart pills as an effective substitute for conventional diagnostic methods. In addition, favorable reimbursement scenarios and rapid technological advancements in drug delivery systems are also driving the market's expansion. The growing awareness about preventive healthcare measures and the improved healthcare infrastructure in countries such as Germany, the UK, and France further contribute to the market's growth in Europe.

The smart pills market in Germany dominated the European market and accounted for the largest revenue share in 2023 attributed to the robust healthcare infrastructure supported by prestigious universities, research institutions, and pharmaceutical companies that dedicate noteworthy resources to research and development (R&D). This focus on R&D drives continuous advancements & developments in smart pill technologies, creating cutting-edge and efficient solutions.

Asia Pacific Smart Pills Market Trends

The Asia Pacific smart pills market is expected to grow at a CAGR of 12.7% over the forecast period driven by factors such as the increased demand for less invasive surgical procedures, which have given rise to innovative techniques such as capsule endoscopy. With advantages such as ease of administration and detailed assessment of the gastrointestinal tract, capsule endoscopy is expected to replace traditional methods, thereby contributing to the market’s growth.

The smart pills market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2023 attributed to incidences of chronic disorders and the demand for smart pills designed to administer medication at specific locations within the digestive system or to monitor vital signs, detect diseases, and provide real-time feedback. China's emphasis on digital healthcare, along with the incorporation of Artificial Intelligence (AI) and the Internet of Things (IoT) in the healthcare sector, is enhancing the advancement and acceptance of smart pill technologies. Smart pill technology aims to enhance patient care by enhancing diagnostic capabilities, improving treatment precision, and enabling remote health monitoring.

Key Smart Pills Company Insights

Some of the key companies in the smart pills market include Medtronic, Otsuka Holdings Co., Ltd., Olympus Corporation, CapsoCam Plus, Pentax Medical, JINSHAN Science & Technology (Group) Co., Ltd., Check-Cap Ltd. in the market are focusing on development & to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Medtronic offers an innovative PillCam technology. This ingestible capsule enables non-invasive imaging of the gastrointestinal tract, particularly the colon, aiding in the diagnosis of disorders such as colorectal cancer.

-

Olympus focuses on developing advanced imaging technologies, including its capsule endoscopes. These smart pills are designed to provide high-quality visual data from the gastrointestinal tract, facilitating the early detection of diseases.

Key Smart Pills Companies:

The following are the leading companies in the smart pills market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Otsuka Holdings Co., Ltd.

- Olympus Corporation

- CapsoCam Plus

- Pentax Medical

- JINSHAN Science & Technology (Group) Co., Ltd.

- Check-Cap Ltd.

- etectRx

- INTROMEDIC

- Shenzen Jifu Medical Technology Co., Ltd

- BodyCapUSA

Recent Developments

-

In April 2024,PENTAX Medical EMEA launched an innovative Digital Capture Module 9380 to transform medical recording competencies in ENT and speech-language pathology settings. This compact and portable device offers advanced and customizable recording features, addressing the evolving needs of healthcare professionals. The 9380 sets a new benchmark in medical imaging technology through its multi-camera source video recording, seamless recording and playback functionalities, and an intuitive software interface. The module's flexibility and customization options cater to the unique requirements of individual facilities, making it a universal solution for various applications, including stroboscopy, endoscopy, FEES, and VFSS.

Smart Pills Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.91 billion

Revenue forecast in 2030

USD 3.64 billion

Growth Rate

CAGR of 11.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, disease indication, target area, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Otsuka Holdings Co., Ltd.; Olympus Corporation; CapsoCam Plus; Pentax Medical; JINSHAN Science & Technology (Group) Co., Ltd.; Check-Cap Ltd.; etectRx; INTROMEDIC; Shenzen Jifu Medical Technology Co., Ltd; BodyCapUSA

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Pills Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart pills market report based on application, disease indication, target area, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsule Endoscopy

-

Drug Delivery

-

Vital Sign Monitoring

-

-

Disease Identification Outlook (Revenue, USD Million, 2018 - 2030)

-

Occult GI Bleeding

-

Crohn’s Disease

-

Small Bowel Tumors

-

Celiac Disease

-

Inherited Polyposis Syndromes

-

Neurological Disorders

-

Other Disease Indications

-

-

Target Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Esophagus

-

Small Intestine

-

Large Intestine

-

Stomach

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.