- Home

- »

- Specialty Polymers

- »

-

Smart Polymers Market Size, Share & Trends Report, 2030GVR Report cover

![Smart Polymers Market Size, Share & Trends Report]()

Smart Polymers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Physical Stimuli Responsive Polymers, Chemical Stimuli Responsive Polymers, Biological Stimuli Responsive Polymers, Other Types), By End Use And Segment Forecasts

- Report ID: GVR-1-68038-212-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Polymers Market Summary

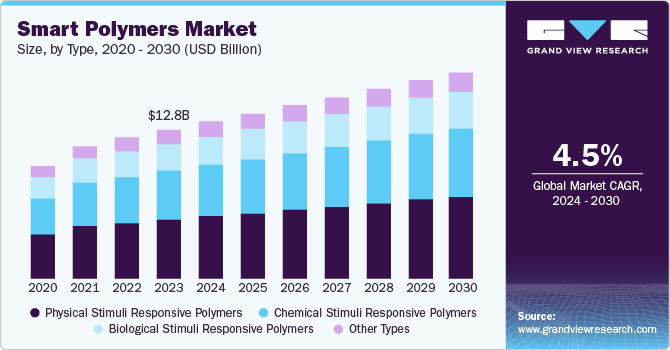

The global smart polymers market size was valued at USD 12.84 billion in 2023 and is projected to reach USD 17.76 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. Smart polymers are engineered to respond to specific biological signals, allowing customized drug delivery systems and personalized medical devices.

Key Market Trends & Insights

- Asia Pacific smart polymer market accounted for the largest revenue share of 38.1% in 2023.

- The U.S. smart polymers market is expected to witness significant growth over the forecast period.

- By type, the physical stimuli responsive polymers segment dominated the market and accounted for a revenue share of 39.7% in 2023.

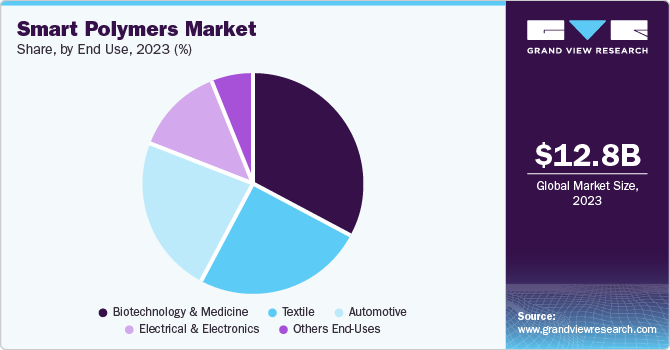

- By end-use, the automotive segment is expected to witness the fastest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 12.84 Billion

- 2030 Projected Market Size: USD 17.76 Billion

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2023

The growth in personalized medicine enables the development of advanced smart polymers with specialized functionalities. The trend toward personalized medicine drives demand for smart polymers customized to individual patient needs. Smart polymers are increasingly utilized in consumer goods and electronics due to their unique properties. In the electronics industry, smart polymers are utilized to create flexible electronic devices and sensors. In consumer goods, they are incorporated into products such as adaptive clothing and self-cleaning surfaces. The growing demand for innovative and high-performance materials in these sectors is fueling the expansion of the smart polymers market.

Collaborations between industry players, academic institutions, and research organizations are fostering the development and commercialization of smart polymers. Strategic partnerships facilitate knowledge exchange, access to advanced technologies, and shared resources, accelerating the growth of the smart polymers market. These collaborations aid in driving innovation and bringing new products to market more efficiently. For instance, in March 2023, Adidas partnered with Rheon to introduce a high-tech apparel range, Techfit Control. The collaboration combines Adidas' innovative material constructs with Rheon's intelligent polymer technology to provide advanced support during training and high-energy movements. The highly strain-rate-sensitive polymer reacts to the body's movement and offers responsive support.

Type Insights

The physical stimuli responsive polymers segment dominated the market and accounted for a revenue share of 39.7% in 2023. The demand for smart textiles incorporating physical stimuli-responsive polymers is driving market growth. These textiles respond to external stimuli such as temperature changes or mechanical stress, providing functionalities such as self-healing, shape memory, and adaptive insulation. The increasing consumer interest in high-performance and interactive clothing, coupled with advancements in textile technology, is fueling the adoption of these polymers in the fashion and sportswear industries.

The chemical stimuli responsive polymers segment is expected to witness the fastest CAGR over the forecast period. Chemical stimuli-responsive polymers are increasingly utilized in drug delivery systems. These polymers are engineered to respond to specific chemical signals, such as changes in pH or the presence of certain enzymes, to release therapeutic agents in a controlled manner. Additionally, In smart coatings and surfaces, chemical stimuli-responsive polymers are utilized to create coatings that react to environmental changes, such as exposure to different chemicals or changes in pH. These coatings provide self-cleaning properties, corrosion resistance, or protective barriers that adapt to changing conditions. The demand for advanced and multifunctional coatings in the automotive, aerospace, and construction industries is driving the growth of chemical stimuli-responsive polymers.

End-Use Insights

The biotechnology & medicine segment accounted for the largest market revenue share in 2023. Smart polymers are increasingly used in medical devices and implants due to their ability to provide dynamic responses to physiological changes. These polymers are incorporated into drug-eluting stents, dynamic orthopedic implants, and responsive contact lenses. The demand for advanced medical devices and implants that offer improved functionality and patient outcomes drives this sector's growth of smart polymers.

The automotive segment is expected to witness the fastest CAGR over the forecast period. Smart polymers are used to enhance the performance and durability of automotive components. These polymers return to their original shape after deformation or automatically repair damage, reducing maintenance needs and extending the lifespan of components. Smart polymers are incorporated into airbags and seatbelt systems to enhance their performance in different conditions. The automotive industry's emphasis on improving safety standards and meeting regulatory requirements fuels the demand for advanced smart polymers.

Regional Insights & Trends

North America smart polymers market is expected to witness significant growth over the forecast period. North America has a well-established industrial and manufacturing base, providing a strong foundation for producing and applying smart polymers. The region’s advanced manufacturing capabilities support the development of high-performance smart polymer components for various end-use industries. This industrial infrastructure facilitates the scaling up of smart polymer technologies and their integration into commercial products.

The U.S. smart polymers market is expected to witness significant growth over the forecast period. Smart polymers are increasingly utilized in drug delivery systems, tissue engineering, and diagnostic applications. The U.S. healthcare industry’s focus on personalized medicine, innovative treatment options, and advanced medical technologies creates a significant market for smart polymers with specific functionalities and responsive properties, driving the growth of smart polymers in the U.S. market.

Asia Pacific Smart Polymers Market Trends

Asia Pacific smart polymer market accounted for the largest revenue share of 38.1% in 2023. A growing consumer demand for high-tech and interactive products drives smart polymer's adoption in the Asia Pacific region. Consumers increasingly pursue products with advanced functionalities, such as responsive textiles, flexible electronics, and self-healing materials. This demand for innovative and high-performance products across various sectors, including electronics, fashion, and healthcare, fuels the growth of smart polymers in the region.

The China smart polymers market is expected to witness significant growth over the forecast period. Developing smart cities in China involves integrating advanced materials and technologies, including smart polymers. These polymers are utilized in smart infrastructure, adaptive building materials, and responsive urban systems. The investment in smart city projects and the focus on creating intelligent and sustainable urban environments drive the adoption of smart polymers in infrastructure and construction applications.

Europe Smart Polymers Market Trends

The Europe smart polymers market is expected to witness significant growth over the forecast period. The region’s automotive sector, which focuses on innovation, safety, and performance, incorporates smart polymers in lightweight components, adaptive materials, and advanced safety systems. Additionally, the aerospace industry’s demand for high-performance, durable materials drives the use of smart polymers in aircraft and spacecraft components. The growth and technological advancements in these industries support the expansion of the smart polymers market in Europe.

The UK smart polymers market is expected to witness significant growth over the forecast period. The UK consumer goods and electronics sectors are increasingly adopting smart polymers for their innovative properties and functionalities. Smart polymers are used in flexible displays, responsive textiles, and adaptive packaging applications. The country's focus on consumer electronics innovation and the demand for high-performance and customizable products drive the use of smart polymers in these industries.

Key Smart Polymers Company Insights

Key players in smart polymers market include The Lubrizol Corporation, BASF SE, Covestro AG, Huntsman International LLC., and others.

-

The Lubrizol Corporation, a subsidiary of Berkshire Hathaway, is a global specialty chemical company. It specializes in producing advanced specialty chemicals, including additives, ingredients, and technologies that enhance the performance of products in the transportation, industrial, and consumer markets.

-

BASF SE operates in various industries, providing innovative solutions and products that include chemicals, performance products, functional materials and solutions, agricultural solutions, and oil and gas. Their extensive portfolio features a variety of products, such as petrochemicals, intermediates, industrial gases, plastics, coatings, and crop protection chemicals.

Key Smart Polymers Companies:

The following are the leading companies in the smart polymers market. These companies collectively hold the largest market share and dictate industry trends.

- The Lubrizol Corporation

- BASF SE

- Covestro AG

- Huntsman International LLC.

- DuPont

- Evonik Industries AG

- SMP Technologies Inc.

- Merck KGaA

- Akina, Inc.

- Autonomic Materials

- NIPPON SHOKUBAI CO., LTD.

Recent Developments

-

In May 2024, Kydex and Kasiglas collaborated on a transparent aviation polymer. Kydex is a thermoplastics brand initially designed for use in aircraft interiors and is now manufactured by Sekisui Kydex, LLC. The scratch-resistant, advanced polymer technology is used for highly specialized accents or decorative panels in the cabin.

Smart Polymers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.60 billion

Revenue forecast in 2030

USD 17.76 billion

Growth Rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, The Netherlands, Denmark, Sweden, Norway, China, India, Japan, South Korea, Thailand, Indonesia, Brazil, Argentina, South Africa, South Arabia and UAE

Key companies profiled

The Lubrizol Corporation , BASF SE, Covestro AG, Huntsman International LLC., DuPont, Evonik Industries AG, SMP Technologies Inc., Merck KGaA, Akina, Inc., Autonomic Materials, NIPPON SHOKUBAI CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Polymers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the smart polymers market report based on type, end use, and region.

-

Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Physical Stimuli responsive Polymers

-

Chemical Stimuli responsive Polymers

-

Biological Stimuli Responsive Polymers

-

Other Types

-

-

End Use Outlook (Volume, Kilo Tons; Revenue USD Million, 2018 - 2030)

-

Biotechnology & Medicine

-

Textile

-

Automotive

-

Electrical & Electronics

-

Others End-Uses

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

The Netherlands

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

South Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.