- Home

- »

- IT Services & Applications

- »

-

Smart Process Application Market Size, Industry Report, 2030GVR Report cover

![Smart Process Application Market Size, Share & Trends Report]()

Smart Process Application Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Solution, Services), By Deployment (On-premise, Cloud), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-569-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Process Application Market Trends

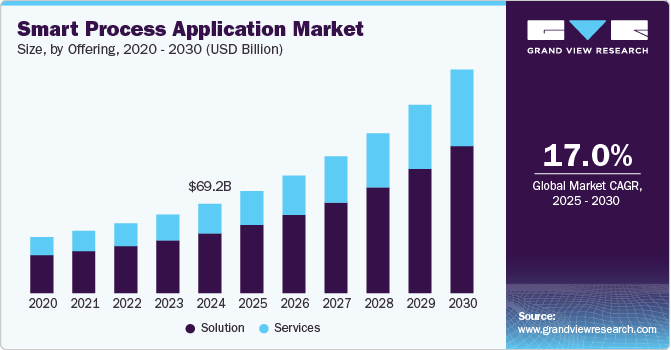

The global smart process application market size was estimated at USD 69.24 billion in 2024 and is anticipated to grow at a CAGR of 17.0% from 2025 to 2030. The rising adoption of digital transformation strategies by businesses globally is driving smart process application market growth. Companies across sectors such as finance, healthcare, manufacturing, and retail are shifting toward digital-first models, which necessitate applications that are not only automated but also intelligent. Smart process application (SPA) offer the ability to dynamically adapt processes in response to changing inputs or conditions, which is essential in today’s fast-paced and data-driven environments. By enabling real-time data processing and analytics-driven decision-making, SPAs empower organizations to be more responsive, agile, and customer-centric.

The rise in remote and hybrid work models has created a strong demand for digital tools that facilitate seamless collaboration and automated workflows across distributed teams. SPAs support these models by enabling mobile access, secure document sharing, task tracking, and integrated communication channels. As workforce dynamics continue to evolve, businesses are turning to SPAs to maintain productivity, ensure continuity, and improve employee engagement in decentralized work environments.

The increasing use of cloud-based solutions is also accelerating the growth of the smart process application market. Cloud platforms offer easier deployment, lower upfront costs, and the ability to integrate SPAs with existing enterprise systems. Cloud-based SPAs can be accessed from anywhere, which aligns well with global operations and mobile workforces. Additionally, cloud environments support continuous updates, scalability, and integration with emerging technologies such as AI, IoT, and blockchain, enhancing the overall value and performance of smart process applications.

Furthermore, the emergence of low-code and no-code development platforms is making it easier for businesses to adopt and customize smart process applications. These platforms allow users with minimal technical expertise to design, deploy, and iterate business processes with drag-and-drop interfaces and prebuilt templates. As a result, even non-IT departments can develop and manage SPAs tailored to their operational needs, reducing dependency on developers and shortening implementation timelines. This democratization of application development is expanding the reach of SPAs across all levels of an organization, from HR and finance to sales and compliance.

Offering Insights

The solution segment accounted for the largest market share of over 66.0% in 2024 in the smart process application market. The convergence of SPA solutions with other enterprise applications is also fueling market expansion. Smart process applications are being embedded into or integrated with existing ERP, CRM, and ECM platforms to enhance their functionality. For instance, a SPA solution integrated into a customer relationship management system can automate onboarding workflows, validate data inputs, and trigger customer communications based on real-time events. This level of interoperability not only amplifies the value of existing enterprise investments but also simplifies implementation, driving greater demand for comprehensive SPA offerings.

The services segment is anticipated to grow at the highest CAGR during the forecast period. The growing focus on post-deployment optimization and continuous improvement is propelling the demand for managed and support services in the SPA market. Businesses are increasingly seeking long-term partnerships with service providers that can monitor system performance, troubleshoot issues, and implement updates as processes evolve or new technologies emerge. These ongoing services are critical for maintaining the effectiveness and relevance of smart process applications in dynamic business environments.

Deployment Insights

The on-premises segment dominated the market and accounted for a revenue share of over 57.0% in 2024 in the smart process application market. The on-premises model is also bolstered by total cost of ownership (TCO) predictability for large enterprises with stable and long-term IT budgets. While cloud deployments may offer lower initial costs, they often involve ongoing subscription fees, bandwidth expenses, and costs associated with compliance add-ons. In contrast, on-premises deployments, although capital-intensive upfront, provide clearer long-term financial visibility and often prove more economical over a multi-year horizon-especially when amortized against existing infrastructure and IT staffing.

The cloud segment is expected to register the highest CAGR from 2025 to 2030. Cloud-based SPA solutions are also being adopted due to the accelerated digital transformation initiatives across industries. As organizations continue to adopt remote work models and digital-first strategies, cloud platforms provide the necessary infrastructure to support decentralized, collaborative workflows. These systems allow remote teams to access, manage, and automate business processes from any location, increasing productivity and reducing the dependence on physical office infrastructure. The demand for cloud SPAs rose sharply during the COVID-19 pandemic and has remained strong as hybrid work becomes the new normal.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for a revenue share of over 61.0% in 2024 in the smart process application industry. Large enterprises are increasingly adopting hybrid work models and globalized operations, which require scalable and collaborative technology platforms. Smart process applications, especially those hosted on the cloud, enable geographically dispersed teams to work cohesively and access the same real-time information. This capability ensures continuity and resilience in operations, even amid external disruptions like pandemics or geopolitical instability. For large organizations with distributed teams and supply chains, this level of flexibility is both strategic and necessary.

The small and medium enterprises (SMEs) segment is expected to register the highest CAGR of 18.1% from 2025 to 2030. The rise of e-commerce and online business models is another important driver for SME adoption of SPAs. As more SMEs expand their operations into digital channels, they require process automation tools that can handle everything from order management to customer support. SPAs that are integrated with e-commerce platforms can automate inventory tracking, streamline order fulfillment, and enhance customer interaction. This ability to manage the complexities of online retail operations with minimal manual intervention allows SMEs to focus on growing their business and improving their online presence rather than getting bogged down in repetitive administrative tasks.

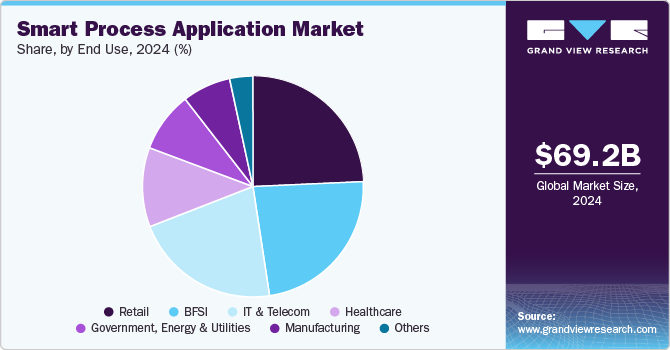

End Use Insights

The retail segment accounted for the largest market share of over 24.0% in 2024 in the smart process application industry. The integration of smart process applications with Internet of Things (IoT) devices is another growing driver in the retail industry. With the expansion of IoT, retailers can now gather real-time data from connected devices, such as smart shelves, sensors, and RFID tags, to monitor inventory levels, track product movement, and gain visibility into store operations. SPAs that integrate with IoT devices allow retailers to automate processes based on real-time data, such as reordering stock or adjusting prices dynamically. This real-time monitoring and automation enable retailers to streamline operations, reduce waste, and enhance operational efficiency, all of which are crucial in maintaining competitiveness in the retail market.

The BFSI segment is anticipated to register the highest CAGR during the forecast period. The increasing shift toward mobile and digital banking is driving market growth. As consumers embrace mobile banking, financial institutions must deliver seamless, user-friendly, and secure digital services. SPAs are essential in enabling banks and financial service providers to automate and optimize digital interactions with customers, such as mobile app transactions, account management, and customer support. With SPAs, financial institutions can ensure that their mobile banking platforms offer an enhanced user experience by automating tasks such as transaction approvals, balance inquiries, and document uploads, ultimately driving customer satisfaction and loyalty.

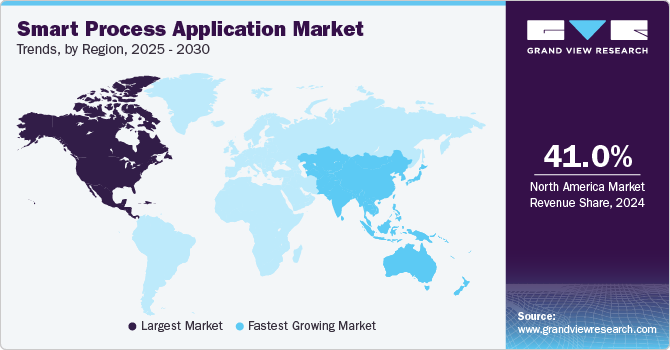

Regional Insights

North America Smart Process Application Market Trends

North America held the major share of over 41.0% of the smart process application industry in 2024. The adoption of Industry 4.0 technologies is accelerating the demand for smart process applications in manufacturing and other industrial sectors in North America. With the integration of the Internet of Things (IoT), robotics, and automation technologies, manufacturing companies are increasingly relying on SPAs to monitor production lines, optimize resource allocation, and automate quality control processes. As manufacturers adopt these advanced technologies, SPAs help them streamline operations, improve product quality, and reduce downtime. The ability to automate industrial processes through SPAs is crucial for manufacturers striving to remain competitive in a rapidly evolving market.

U.S. Smart Process Application Market Trends

The U.S. smart process application market is projected to grow during the forecast period. The growing demand for personalized customer experiences is driving the adoption of SPAs across industries in the U.S. Consumers increasingly expect businesses to offer tailored services and products that meet their individual needs and preferences. SPAs help organizations meet this demand by automating the process of customer segmentation, delivering personalized marketing campaigns, and optimizing customer service interactions. For instance, in the retail sector, SPAs can automate personalized product recommendations and promotions based on customers' browsing and purchasing histories. By automating customer engagement and service processes, SPAs enable businesses to improve customer satisfaction, enhance loyalty, and increase revenue.

Europe Smart Process Application Market Trends

The smart process application market in Europe is expected to grow at a CAGR of 17.5% from 2025 to 2030. The cloud computing trend is another significant driver for the SPA market in Europe. The shift to cloud-based infrastructure offers numerous benefits, such as scalability, flexibility, and cost-effectiveness. As European organizations move their operations to the cloud, they are increasingly turning to cloud-based SPAs to streamline processes without the need for substantial investments in on-premises infrastructure. Cloud-based SPAs enable companies to access applications from anywhere, collaborate more easily across borders, and ensure that their operations are always up-to-date with the latest features and capabilities. The ability to scale operations without heavy upfront costs, coupled with the ease of integration with other cloud-based services, is encouraging many European businesses to adopt cloud-based SPAs to optimize their workflows.

The smart process application industry in the Germany is grow during the forecast period. The growth of the gig economy and flexible workforce is also influencing the demand for SPAs in Germany. As more individuals engage in freelance or temporary work, businesses are adopting SPAs to manage workflows, contracts, and payments efficiently. SPAs help automate the management of freelance workers, track project progress, and ensure timely payments, reducing administrative overhead. In industries such as tech, marketing, and creative services, where freelance workers play a crucial role, SPAs are enabling companies to streamline their engagement with the gig workforce, improve productivity, and enhance operational flexibility. As the gig economy continues to grow, SPAs are becoming an essential tool for businesses in Germany to manage their flexible workforce effectively.

Asia Pacific Smart Process Application Market Trends

The demand for smart process application in the Asia Pacific is expected to register the highest CAGR of 18.5% from 2025 to 2030. The growth of e-commerce and digital platforms in the APAC region is driving the market growth. The region has seen explosive growth in online shopping and digital services, particularly in countries such as China, India, and Southeast Asia. To cater to the growing demand for seamless digital experiences, businesses are adopting SPAs to automate customer interactions, manage inventories, process transactions, and personalize marketing campaigns. E-commerce platforms are using SPAs to optimize their order fulfillment and customer service operations, ensuring quick and efficient responses to customer queries and product orders. Furthermore, as customer expectations for personalized and real-time service continue to rise, businesses are leveraging SPAs to deliver targeted recommendations, promotions, and seamless shopping experiences across multiple channels.

The China smart process application industry is projected to grow during the forecast period. The growing demand for real-time analytics and business intelligence is also a significant driver for the SPA market in China. As businesses are increasingly required to make faster, data-driven decisions, the role of real-time data processing has become critical. SPAs are being used to automate data collection, analysis, and reporting, enabling companies to respond swiftly to changes in market conditions, customer preferences, and business performance. In industries such as finance, retail, and logistics, where real-time decision-making is crucial, SPAs integrated with big data analytics and machine learning are helping businesses gain a competitive advantage by providing timely insights.

Key Smart Process Application Company Insights

Some of the key companies operating in the market Salesforce, Inc., and Dell Technologies, among others are some of the leading participants in the smart process application market.

-

Salesforce, Inc., is an American cloud-based software company. Salesforce has expanded its offerings to encompass a comprehensive suite of enterprise applications. These applications span various domains, including sales, customer service, marketing automation, analytics, and application development. Salesforce's approach to smart process applications integrates advanced technologies such as artificial intelligence (AI), automation, and data analytics into its cloud-based platforms. This integration enables organizations to streamline and enhance their business processes across various functions, including sales, customer service, and marketing.

-

Dell Technologies is a global information technology company providing a comprehensive range of products and services that empower organizations to transform their operations digitally. Dell Technologies is at the forefront of integrating intelligent Automation into enterprise operations, leveraging a combination of Digital Process Automation, Robotic Process Automation, and Artificial Intelligence to create Smart Process Applications. These applications are designed to automate complex business processes, enhance decision-making, and improve operational efficiency across various industries.

Appian Corporation Inc., and Blue Yonder Group, Inc., Inc are some of the emerging market participants in the smart process application market.

-

Appian Corporation is a prominent player in the field of enterprise software, specializing in low-code application development platforms. The company offers a comprehensive suite of tools that enable organizations to design, automate, and optimize complex business processes with minimal hand-coding. Appian's approach to smart process applications integrates low-code development with advanced technologies such as artificial intelligence (AI), robotic process automation (RPA), and process mining. This integration allows businesses to automate workflows, gain insights into process performance, and make data-driven decisions.

-

Blue Yonder Group, Inc., is a provider of digital supply chain and omnichannel commerce fulfillment solutions. The company operates as a subsidiary of Panasonic Corporation, which acquired it in 2021. Blue Yonder's approach to smart process applications integrates artificial intelligence (AI), machine learning (ML), and advanced analytics into their supply chain solutions. This integration allows businesses to automate complex processes, optimize decision-making, and enhance operational efficiency across various functions, including demand forecasting, inventory management, and order fulfillment.

Key Smart Process Application Companies:

The following are the leading companies in the smart process application market. These companies collectively hold the largest market share and dictate industry trends.

- Appian Corporation Inc.

- Blue Yonder Group, Inc.

- Dell Technologies

- IBM Corporation

- Open Text Corporation

- Pegasystems Inc.

- Salesforce Inc.

- SAP SE

- Thomas Bravo

- Verint Systems Inc.

Recent Developments

-

In January 2025, OPEXUS and Casepoint announced a merger, accompanied by a majority investment from Thoma Bravo. This strategic move aims to create a more comprehensive and innovative platform for process management and discovery, serving both government and commercial clients across North America. The merger, along with Thoma Bravo’s backing, will accelerate the growth of the combined company. By joining forces, OPEXUS and Casepoint will form a unique entity with greater scale and an expanded suite of products, enabling them to address the increasingly complex needs of their customers. The ultimate objective is to enhance the efficiency of workflow processes within government and corporate environments.

-

In April 2024, TELUS International expanded its partnership with Appian Corporation to offer an intelligent Automation-as-a-Service (AaaS) platform. This collaboration enables a unified, AI-powered IT ecosystem that integrates AI, machine learning, and RPA with a data fabric architecture across cloud and on-premises environments. Appian’s low-code platform supports faster, more accessible application development, helping organizations overcome skills gaps.

-

In April 2024, Appian Corporation Inc. signed a Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS) to enhance the accessibility of generative artificial intelligence (AI) within enterprise business processes. As part of this partnership, Appian will dedicate substantial resources to explore innovative integrations of its native AI features and data fabric with Amazon Bedrock’s large language models (LLMs) and the machine learning (ML) capabilities of Amazon SageMaker.

Smart Process Application Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 79.24 billion

Revenue forecast in 2030

USD 173.60 billion

Growth rate

CAGR of 17.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Salesforce Inc., SAP SE, Appian Corporation Inc., Dell Technologies, IBM Corporation, Blue Yonder Group, Inc., Verint Systems Inc., Thomas Bravo, Open Text Corporation, Pegasystems Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Process Application Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the smart process application market report based on offering, deployment, enterprise size, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Enterprise Content Management

-

Business Process Management

-

Customer Experience Management

-

Business Intelligence and Analytics

-

Others

-

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Healthcare

-

IT & Telecom

-

BFSI

-

Manufacturing

-

Government, Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart process application market size was estimated at USD 69.24 billion in 2024 and is expected to reach USD 79.24 billion in 2025.

b. The global smart process application market is expected to grow at a compound annual growth rate of 17.0% from 2025 to 2030 to reach USD 173.60 billion by 2030.

b. North America held the major share of over 41.0% of the smart process application industry in 2024. The adoption of Industry 4.0 technologies is accelerating the demand for smart process applications in manufacturing and other industrial sectors in North America.

b. Some key players operating in the market include Salesforce Inc., SAP SE, Appian Corporation Inc., Dell Technologies, IBM Corporation, Blue Yonder Group, Inc., Verint Systems Inc., Thomas Bravo, Open Text Corporation, Pegasystems Inc.

b. The rising adoption of digital transformation strategies by businesses globally and the increasing use of cloud-based solutions is driving smart process application market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.