- Home

- »

- Electronic & Electrical

- »

-

Smart Refrigerators Market Size, Share, Growth Report 2030GVR Report cover

![Smart Refrigerators Market Size, Share & Trends Report]()

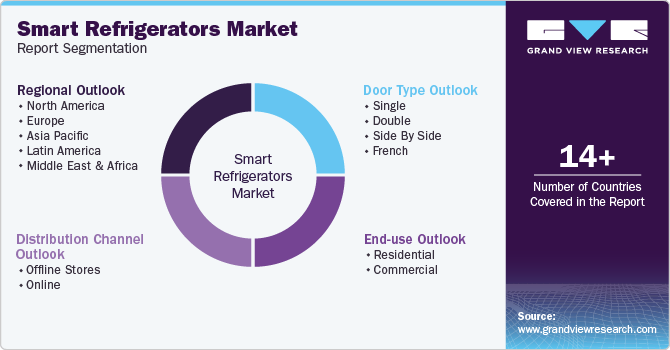

Smart Refrigerators Market (2024 - 2030) Size, Share & Trends Analysis Report By Door Type (Single, Double, Side by Side, French), By End user (Residential, Commercial) By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-870-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Refrigerators Market Summary

The global smart refrigerators market size was valued at USD 3.89 billion in 2023 and is projected to reach USD 6.19 billion by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The market growth is attributed to the increasing consumer desire for convenience and connected devices and growing emphasis on health and food freshness.

Key Market Trends & Insights

- North America smart refrigerators market dominated with 30.1% share in 2023.

- Europe market is anticipated to witness significant CAGR in the coming years.

- Based on door type, double door segment accounted for the largest market revenue share of 33.5% in 2023.

- Based on end-use, the residential segment accounted for the largest market revenue share of 65.1% in 2023.

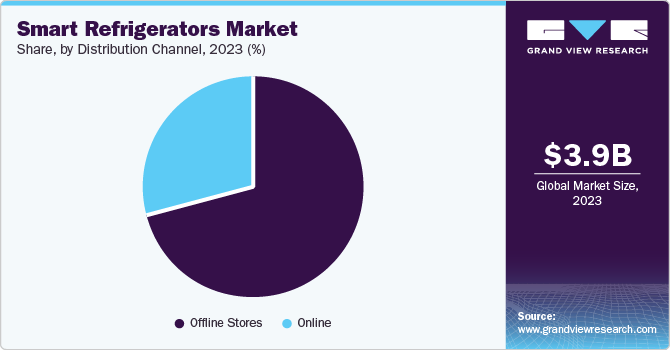

- Based on distribution channel, offline stores segment dominated the market with 71.4% share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.89 Billion

- 2030 Projected Market Size: USD 6.19 Billion

- CAGR (2024-2030): 7.1%

- North America: Largest market in 2023

Technological advancements enabling new features, rising disposable incomes fueling premium product purchases, and a growing focus on energy efficiency and sustainability are further fueling market growth. Rapid advancements in the IT infrastructure and wireless communication enable easy assimilation of refrigerators with mobile devices such as smartphones, laptops, and tablets. It allows consumers to control and optimize refrigerators operations from remote locations.

Busy lifestyles have led to a surge in demand for time-saving appliances. Smart refrigerators offer features such as food inventory management and remote temperature control, enhancing convenience. Innovations in technology, particularly in Internet of Things (IoT), have enhanced the functionality of smart refrigerators. Innovations in sensors, displays, and connectivity have enabled sophisticated features in smart refrigerators. Integration with smartphones and voice assistants further adds to the appeal. This demand for connected appliances is a significant driver of market growth.

Consumers are increasingly conscious of their diet and food freshness. Smart refrigerators help monitor food expiration dates, reduce food waste, and promote healthier eating habits. Smart refrigerators are gaining traction in restaurants, hotels, and grocery stores for inventory management, energy efficiency, and food safety. The trend towards urbanization has led to smaller living spaces where efficient use of space is crucial. Smart refrigerators often come with features designed for compact living environments, making them appealing to urban dwellers who prioritize functionality without sacrificing style.

Door Type Insights

Double door refrigerators accounted for the largest market revenue share of 33.5% in 2023. This is due to their spaciousness, efficient storage options, and aesthetic appeal. Consumers are increasingly opting for these models to accommodate larger families or those with substantial food storage needs. The ability to organize food items effectively, coupled with advanced features such as temperature control and inventory management, is driving their popularity.

French refrigerators are expected to register the fastest CAGR of 7.4% during the forecast period. These doors offer a blend of style and functionality, providing ample storage space while allowing easy access to both fresh and frozen foods. This design is particularly appealing to consumers who prioritize organization and convenience in their kitchen spaces. In August 2022, Samsung launched 3 door convertible French door refrigerators which has been designed for compact kitchens. They come in black matt finish and stainless steel in 2 capacities- 580 L without water dispenser and 579 L with water dispenser.

End-use Insights

The residential segment accounted for the largest market revenue share of 65.1% in 2023 due to the increasing adoption of smart home technology, rising disposable incomes, and a growing emphasis on health and wellness. Consumers are seeking convenient, efficient, and connected appliances that enhance their daily lives. Smart refrigerators, with features such as inventory management, recipe suggestions, and energy efficiency, align perfectly with these demands, driving market expansion.According to the Centers for Disease Control and Prevention (CDC), around 48 million Americans are affected by foodborne diseases every year. Thus, increasing demand for fresh and safe food is driving the manufacturers to develop smart products.

The commercial segment is expected to register the fastest CAGR of 7.5% during the forecast period. This growth is due to the need for efficient inventory management, food safety, and cost reduction. Restaurants, hotels, and grocery stores are leveraging smart refrigerators to optimize operations, minimize food waste, and improve customer satisfaction. Moreover, the integration of smart features such as temperature monitoring, energy consumption tracking, and remote diagnostics is enhancing operational efficiency and profitability.

Distribution Channel Insights

Offline stores dominated the market with 71.4% share in 2023. Consumers often prefer to physically examine and experience products before making a purchase, especially for high-ticket items such as refrigerators. Moreover, offline stores provide opportunities for personalized sales assistance and immediate product delivery. While online sales are gaining momentum, offline channels remain crucial for building brand trust and customer relationships.

The online segment is projected to grow at CAGR of 7.0% over the forecast period due to the increasing penetration of internet and e-commerce. Consumers are gravitating towards online platforms for product research, price comparison, and convenient purchasing. The ability to explore various models, read customer reviews, and avail attractive discounts has significantly boosted online sales. Moreover, the growing trend of online marketplaces is further fueling the growth of this channel.

Regional Insights

North America smart refrigerators market dominated with 30.1% share in 2023 due to factors such as a high disposable income, early adoption of technology, and a strong emphasis on convenience and home automation. Furthermore, the presence of key market players and robust research and development activities contribute to the market's growth.

U.S. Smart Refrigerators Market Trends

The smart refrigerators market in the U.S. held a significant market share in 2023. The increasing focus on health and wellness, coupled with the growing trend of meal prepping and home cooking, has stimulated market expansion.

Europe Smart Refrigerators Market Trends

Europe market is anticipated to witness significant CAGR in the coming years. The region's emphasis on sustainability and energy efficiency aligns perfectly with the eco-friendly features offered by smart refrigerators. In addition, the growing trend of smart homes and increasing disposable incomes are contributing to the market's growth.

The UK smart refrigerators market is expected to grow rapidly in the coming years due to increasing focus on food quality and freshness. The increasing number of dual-income households and busy lifestyles have led to a preference for time-saving and convenient products such as smart refrigerators.

Asia Pacific Smart Refrigerators Market Trends

Asia Pacific smart refrigerators market was identified as a lucrative region in 2023. This is attributed to rapid urbanization, rising disposable incomes, and a growing middle class. The region's burgeoning population, coupled with a preference for modern and technologically advanced products, is driving demand.

The significant market share of smart refrigerators in China in 2023 can be attributed to a massive consumer base and rapid economic growth. The country's increasing urbanization and changing lifestyles have led to a surge in demand for modern home appliances, including smart refrigerators.

Key Smart Refrigerators Company Insights

Some key companies in smart refrigerators market Samsung Electronics, LG Electronics, Whirlpool Corporation, Haier Group, and others.

-

Samsung Electronics is a South Korean multinational corporation and a key player in the consumer electronics, information technology, and mobile communications sectors. Company’s extensive product portfolio includes a wide range of electronic devices and appliances such as televisions, refrigerators, washing machines, air conditioners, computers, mobile phones, and various related accessories.

Key Smart Refrigerators Companies:

The following are the leading companies in the smart refrigerators market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics

- LG Electronics

- Whirlpool Corporation

- Haier Group

- Panasonic Corporation

- Robert Bosch GmbH

- Siemens

- AB Electrolux

- Midea Group

- Frigidaire

Recent Developments

-

In March 2024, Haier India unveiled the new graphite series refrigerators. Haier India’s new range is available in bottom-mounted, top-mounted, Direct Cool,3-door side-by-side and 2-door side-by-side Wi-Fi enabled smart range. The company is offering a 2-year product warranty and a 10-year compressor warranty on the series.

-

In October 2023, LG Electronics India redefined the refrigeration experience by introducing Wi-Fi Convertible Side by Side Refrigerator. It enables users to convert freezer section to a fridge by using LG ThinQ App from anywhere.

Smart Refrigerators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.09 billion

Revenue forecast in 2030

USD 6.19 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Door Type, end-use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Brazil, and South Africa

Key companies profiled

Samsung Electronics, LG Electronics, Whirlpool Corporation, Haier Group, Panasonic Corporation, Robert Bosch GmbH, Siemens, AB Electrolux, Midea Group, Frigidaire

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Refrigerators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart refrigerators market report based on door type, end-use, distribution channel and region.

-

Door Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single

-

Double

-

Side by Side

-

French

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.