- Home

- »

- Next Generation Technologies

- »

-

Smart Retail Market Size And Share, Industry Report, 2033GVR Report cover

![Smart Retail Market Size, Share & Trends Report]()

Smart Retail Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Hardware, Software), By Application (Visual Marketing, Smart Label, Smart Payment System), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-588-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Retail Market Summary

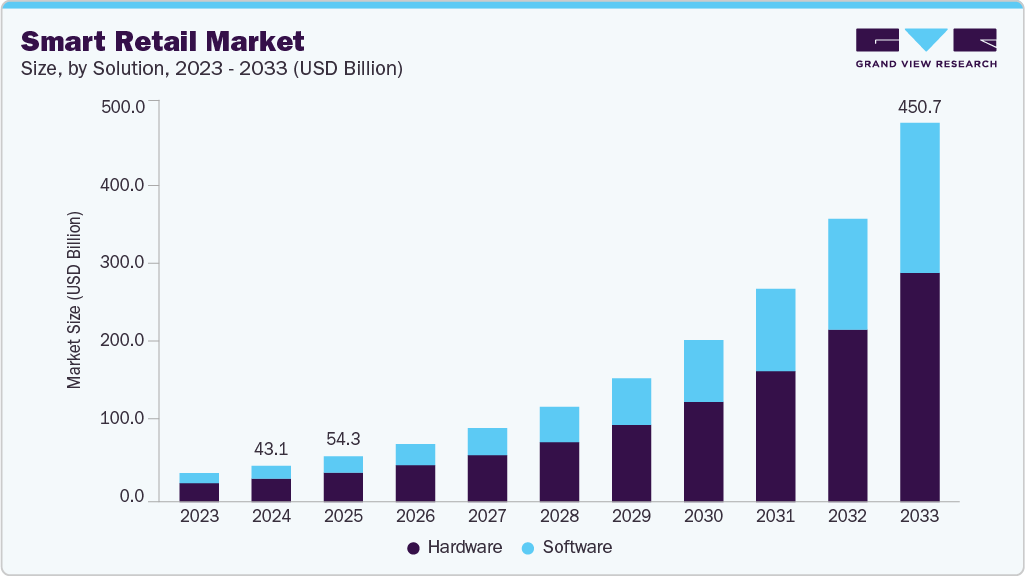

The global smart retail market size was estimated at USD 43.13 billion in 2024 and is projected to reach USD 450.69 billion by 2033, growing at a CAGR of 30.3% from 2025 to 2033, due to the increasing adoption of Internet of Things (IoT) and smart devices. Retailers are increasingly leveraging IoT-enabled technologies, such as smart shelves, beacons, and RFID systems, to gain real-time insights into inventory levels, customer footfall, and shopping patterns.

Key Market Trends & Insights

- North America dominated the global smart retail market with the revenue share of 34.1% in 2024.

- The smart retail industry in the U.S. is expected to grow significantly over the forecast period.

- By solution, hardware segment led the market and held the revenue share of 64.5% in 2024.

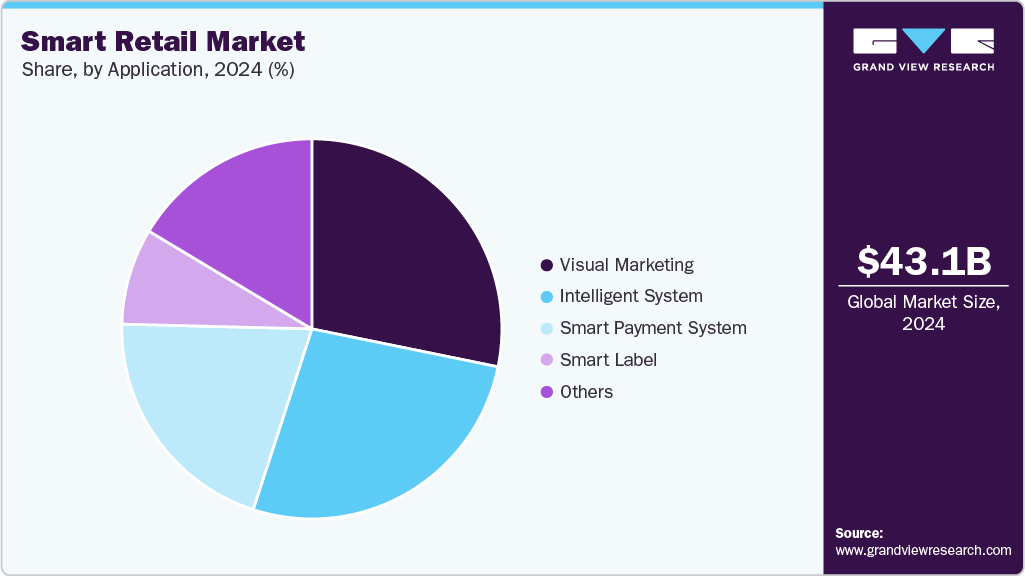

- By application, visual marketing segment led the market and held the revenue share of 28.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 43.13 Billion

- 2033 Projected Market Size: USD 450.69 Billion

- CAGR (2025-2033): 30.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These technologies enhance operational efficiency, reduce shrinkage, and improve the overall customer experience. The growing need for automation and real-time tracking in physical stores has accelerated the deployment of smart infrastructure across retail outlets globally.The rapid integration of artificial intelligence (AI) and data analytics also contributes to the smart retail industry. Retailers are utilizing AI-driven tools for demand forecasting, customer behavior analysis, personalized marketing, and dynamic pricing strategies. AI-powered chatbots and virtual assistants are also transforming customer service by offering 24/7 support and tailored recommendations. This personalization helps increase customer loyalty and average order value, making AI a crucial enabler of smart retail growth. For instance, in March 2025, Advantech Co., Ltd., a Taiwan-based IoT intelligent systems provider enhanced its iVisionSuite with LLM integration, enabling retail mall operators to improve customer engagement and streamline operations. Combined with VisionSense’s AI features, such as object detection and facial analysis, and Advantech’s edge hardware, the solution boosts efficiency and enhances the shopping experience.

The rising popularity of omnichannel retailing is also contributing to the expansion of the smart retail market. Consumers increasingly expect a seamless experience across online and offline channels. To meet this demand, retailers are deploying smart solutions that unify in-store, mobile, and web-based experiences. Technologies such as smart checkout systems, mobile payments, and digital signage support an integrated retail approach, improving customer satisfaction and retention. Moreover, the shift in consumer preferences toward contactless shopping, especially after the COVID-19 pandemic, has accelerated the adoption of smart retail technologies. Self-checkout kiosks, cashier-less stores, QR code scanning, and mobile wallet integration have gained traction as consumers prioritize convenience, safety, and speed. These changes in shopping behavior are pushing retailers to invest in touchless, tech-driven solutions to remain competitive.

Solution Insights

The hardware segment dominated the market and accounted for the revenue share of 64.5% in 2024, driven by the advancements in edge computing and sensor technologies, which enable faster data processing directly at the source, reducing latency and reliance on cloud infrastructure. The proliferation of smart point-of-sale (POS) systems, interactive kiosks, electronic shelf labels (ESLs), and surveillance cameras is also fueling demand, as retailers seek to modernize store infrastructure for real-time decision-making and security. In addition, the integration of 5G connectivity is enhancing the capabilities of retail hardware by supporting high-speed, low-latency communication between devices, paving the way for more responsive and immersive in-store experiences such as augmented reality (AR) mirrors and smart fitting rooms.

The software segment is anticipated to grow at the highest CAGR during the forecast period due to the growing need for centralized platforms that can manage diverse in-store technologies and unify customer, inventory, and sales data across channels. Retailers are increasingly investing in software solutions for real-time analytics dashboards, inventory optimization, workforce management, and supply chain visibility to streamline operations and reduce costs. Moreover, the demand for cloud-based retail management software is rising due to its scalability, ease of updates, and remote access capabilities, especially for retailers with multi-location operations.

Application Insights

The visual marketing segment dominated the market and accounted for the largest revenue share in 2024, driven by the growing demand for personalized and immersive customer experiences. Retailers leverage digital displays, smart mirrors, augmented reality (AR), and video walls to create visually engaging environments that resonate with shoppers' preferences and buying behaviors. These tools allow brands to tailor content dynamically, promoting targeted products and promotions based on real-time data and customer demographics, ultimately enhancing conversion rates.

The smart payment system segment is expected to grow at a significant CAGR over the forecast period due to the increasing consumer demand for seamless, fast, and secure transaction experiences. Retailers are adopting advanced payment solutions such as biometric authentication such as facial recognition, fingerprint scanning, voice-based payments, and mobile wallet integration to cater to tech-savvy shoppers and minimize checkout time. The rise of decentralized finance (DeFi) and digital currencies, including cryptocurrency acceptance in select retail environments, is also influencing the adoption of smart payment systems.

Regional Insights

North America dominated the global market with the largest revenue share of 34.1% in 2024, driven by a widespread adoption of omnichannel retail strategies and the presence of major retail technology innovators and solution providers. Retailers in the region are early adopters of AI-driven inventory management and predictive analytics tools, enabling more efficient supply chain operations. Moreover, the rise of sustainability-driven tech adoption, such as energy-efficient smart refrigeration and waste tracking systems, is further supporting market growth.

U.S. Smart Retail Market Trends

The smart retail market in the U.S. is expected to grow significantly at a CAGR of 28.4% from 2025 to 2033, due to strong consumer preference for hyper-personalized shopping experiences leading to the adoption of advanced CRM systems and AI-powered recommendation engines. The country's dense network of tech startups and retail R&D hubs is fostering continuous innovation in customer engagement solutions. In addition, the increasing focus on workforce automation, through robotics for shelf scanning, inventory replenishment, and in-store fulfillment, is significantly influencing the adoption of smart retail technologies.

Europe Smart Retail Market Trends

The smart retail market in Europe is anticipated to register considerable growth from 2025 to 2033 due to strong regulatory support for digital transformation and a heightened focus on ethical and transparent retail practices. Retailers are increasingly integrating smart traceability tools, such as blockchain for product origin tracking and IoT sensors for cold chain monitoring to align with environmental and consumer protection standards.

The UK smart retail market is expected to grow rapidly in the coming years, owing to phygital (physical + digital) retail formats, such as pop-up smart stores and AI-assisted kiosks. British retailers are also leveraging smart queue management and crowd analytics systems to enhance footfall management in high-traffic urban areas.

The Germany smart retail market held a substantial market share in 2024 due to its industrial prowess and integration of Industry 4.0 technologies into the retail supply chain. German retailers are emphasizing robotics and machine vision systems for warehouse automation and store restocking. In addition, the preference for privacy-respecting technologies has led to the development of edge AI solutions that process data locally without transmitting customer information to the cloud, enabling compliant yet intelligent systems.

Asia Pacific Smart Retail Market Trends

Asia Pacific smart retail held a significant share in the global market in 2024 due to high smartphone penetration, a booming e-commerce ecosystem, and strong governmental support for digital infrastructure. Retailers across the region are increasingly adopting AI-based customer behavior prediction systems and gamified loyalty apps to attract and retain younger, mobile-first consumers. Moreover, the integration of social commerce tools within physical retail environments is enhancing consumer engagement and sales conversion rates.

The Japan smart retail market is expected to grow rapidly in the coming years due to its aging population and shrinking workforce, which are pushing retailers to invest heavily in robotics and automation, such as humanoid customer service bots and self-service restocking machines. High consumer expectations for precision and convenience are driving innovations in ultra-fast checkout, multilingual digital signage, and personalized shopping assistance technologies. Japan’s strong electronics manufacturing base also supports local development of advanced retail hardware.

The China smart retail market held a substantial market share in 2024. Major Chinese retailers are deploying facial recognition payment systems, unmanned stores, and AI-driven shelf management at scale. The country's highly integrated digital ecosystem-including super apps such as WeChat and Alipay, provides a seamless platform for smart retail innovations. Moreover, state-backed initiatives encouraging AI and 5G adoption in commerce are accelerating growth across urban and tier-2 cities.

Key Smart Retail Company Insights

Key players operating in the smart retail industry are Google, Intel Corporation, IBM Corporation, Cisco Systems, Inc., Amazon.com, Inc., and NVIDIA Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Intel Corporation, in collaboration with ASUSTeK Computer Inc. a Taiwan-based manufacturer of computer hardware and electronics products introduced a new AI developer toolkit designed to simplify and speed up the creation of AI applications. Aimed at reducing development time, the toolkit enables developers to focus on implementing and fine-tuning solutions for specific industry needs. In the Smart Retail sector, it supports the development of applications that analyze customer behavior and optimize product placement.

-

In January 2025, Google introduced new AI-driven solutions aimed at helping retailers modernize operations and elevate customer experiences. Central to this launch is Google Agentspace, a platform that enables retailers to create intelligent AI agents. These agents support personalized shopping journeys through features such as real-time assistance and product recommendations, while also automating key functions such as inventory control, customer support, and loss prevention. The tools are designed to enhance efficiency and drive smarter business decisions across the retail sector.

Key Smart Retail Companies:

The following are the leading companies in the smart retail market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Cisco Systems, Inc.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Ingenico, Fiserv, Inc.

- Intel Corporation

- LG Display Co., Ltd.

- NCR Corporation

- NVIDIA Corporation

- NXP Semiconductors

- PAX Global Technology Limited

- SAMSUNG

- Verifone Systems

Smart Retail Market Report Scope

Report Attribute

Details

Market size in 2025

USD 54.27 billion

Revenue forecast in 2033

USD 450.69 billion

Growth rate

CAGR of 30.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amazon.com, Inc.; Cisco Systems, Inc.; Google; Honeywell International Inc.; Huawei Technologies Co., Ltd.; IBM Corporation, Ingenico; Fiserv, Inc.; Intel Corporation; LG Display Co., Ltd.; NCR Corporation; NVIDIA Corporation; NXP Semiconductors; PAX Global Technology Limited; SAMSUNG; Verifone Systems

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Retail Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart retail market report based on solution, application, and region.

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Visual Marketing

-

Smart Label

-

Smart Payment System

-

Intelligent System

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart retail market size was estimated at USD 43.13 billion in 2024 and is expected to reach USD 54.27 billion in 2025.

b. The global smart retail market is expected to grow at a compound annual growth rate of 30.3% from 2025 to 2033 to reach USD 450.69 billion by 2033.

b. North America dominated the smart retail market, with a share of 34.1% in 2024, driven by the widespread adoption of omnichannel retail strategies and the presence of major retail technology innovators and solution providers.

b. Some key players operating in the smart retail market include Amazon.com, Inc., Cisco Systems, Inc., Google, Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Ingenico, Fiserv, Inc., Intel Corporation, LG Display Co., Ltd., NCR Corporation, NVIDIA Corporation, NXP Semiconductors, PAX Global Technology Limited, SAMSUNG, Verifone Systems

b. Key factors driving the growth of the smart retail market include the increasing adoption of the Internet of Things (IoT) and smart devices. Retailers are increasingly leveraging IoT-enabled technologies, such as smart shelves, beacons, and RFID systems, to gain real-time insights into inventory levels, customer footfall, and shopping patterns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.