- Home

- »

- Alcohol & Tobacco

- »

-

Snus Market Size, Share Growth And Trends Report, 2030GVR Report cover

![Snus Market Size, Share & Trends Report]()

Snus Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Loose, Portion), By Flavor (Original/Unflavored, Flavored), By Distribution Channel (Tobacco Stores, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-232-7

- Number of Report Pages: 92

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Snus Market Summary

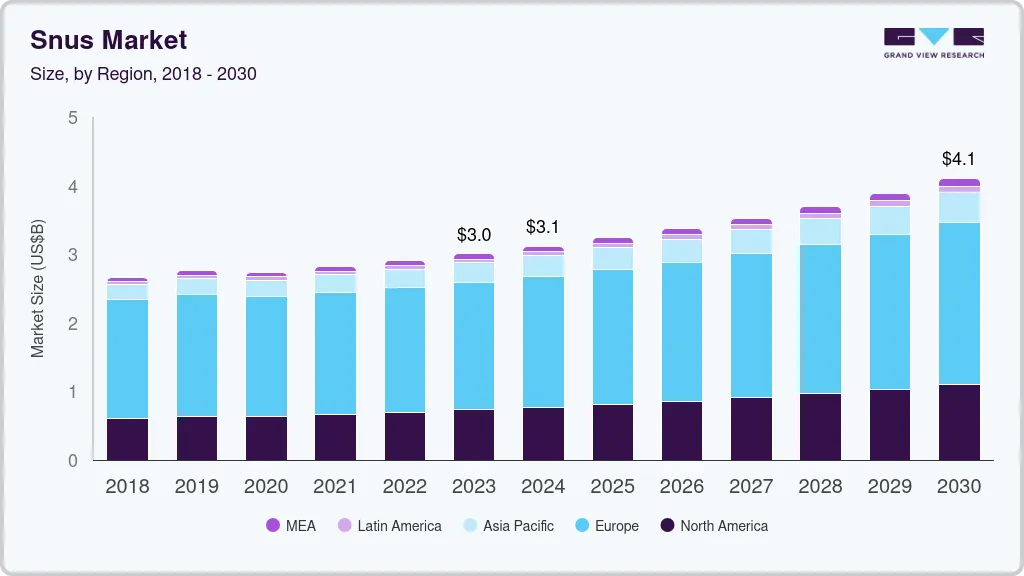

The global snus market size was estimated at USD 3.01 billion in 2023 and is projected to reach USD 4.10 billion by 2030, growing at a CAGR of 4.7% from 2024 to 2030. The rising popularity of snus due to the ease of the application it provides to its users is a major factor driving the market.

Key Market Trends & Insights

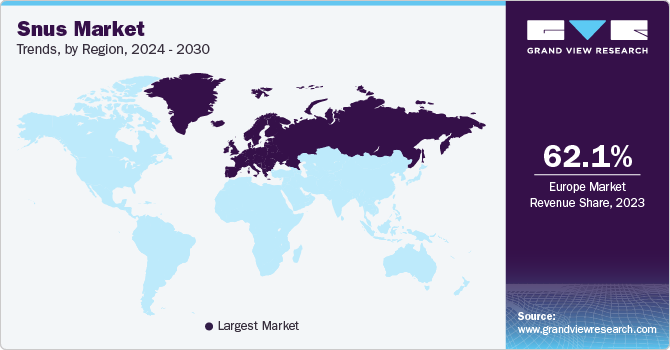

- The snus market in Europe held a share of 62.1% of the global revenue in 2023.

- The U.S. snus market is expected to grow at a CAGR of 5.9% from 2024 to 2030.

- By product, the portioned snus segment accounted for a revenue share of 83.08% in 2023.

- By flavor, the flavored snus segment accounted for a revenue share of around 90.37% in 2023.

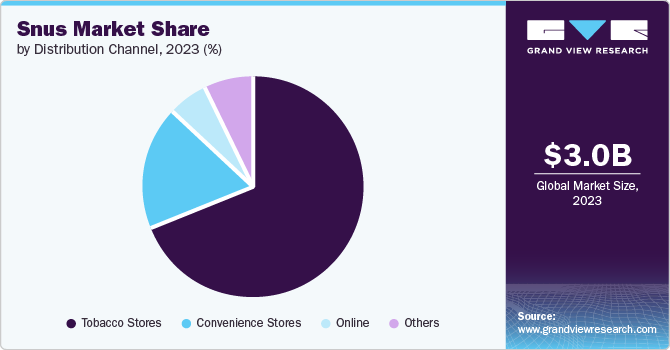

- By distribution channel, the tobacco stores segment accounted for a revenue share of around 68.65% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.01 Billion

- 2030 Projected Market Size: USD 4.10 Billion

- CAGR (2024-2030): 4.7%

- Europe: Largest market in 2023

The ease with which the product can be used anywhere, as compared to cigarettes, which cannot be used in public or no-smoking zones due to the negative impacts of combustion, has played an important role in promoting snus use. The COVID-19 pandemic had a negative effect on the global market. Smokers are much more vulnerable to the infection because the act of consuming any tobacco or snus product brings fingers into contact with lips, increasing the possibility of virus transmission from hand to mouth. Indication from regions reporting COVID-19-related fatalities suggests that people who have pre-existing non-communicable diseases are more likely to become severely ill with the infection.

A rise in the daily use of snus among young women has driven market growth over the last few years. Statistics Norway’s 'Tobacco, alcohol, and other drugs' report revealed a significant trend in snus consumption patterns in 2022. Among individuals aged 16 to 74, 15% reported using snus daily, with an additional 4% using it occasionally. Notably, regular snus use was markedly higher among younger demographics than older age groups. Specifically, within the age bracket of 25 to 34, a staggering 27%, or approximately 1 in 4 individuals, reported using snus daily in 2022. This figure represents a notable surge compared to the statistics recorded in 2012, indicating a pronounced shift in snus consumption habits over the past decade.

Moreover, marketing efforts targeting female consumers and the introduction of flavored and aesthetically appealing snus products have likely played a role in driving increased adoption among this demographic. The availability of a wide range of flavors and product formats tailored to diverse preferences has made snus more accessible and appealing to young women, contributing to the observed rise in daily usage. The growing popularity of CBD-infused snus products is reshaping the landscape of the market, representing a significant market driver with far-reaching implications. CBD, or cannabidiol, has emerged as a sought-after ingredient known for its potential therapeutic benefits, including stress relief, relaxation, and pain management.

One of the most prominent opportunities lies in the growing consumer interest in smokeless tobacco products as alternatives to traditional smoking. With increasing awareness of the health risks associated with smoking, many consumers are actively seeking out smoke-free nicotine delivery options, and snus offers a convenient and discreet solution. Moreover, the rise of e-commerce presents a promising avenue for companies operating in the market. The convenience and accessibility of online shopping have fueled the growth of e-commerce platforms as viable distribution channels for tobacco products. Companies can leverage e-commerce channels to reach a broader audience, enhance brand visibility, and offer personalized shopping experiences to consumers. By investing in robust e-commerce infrastructure and digital marketing strategies, companies can capitalize on the shift toward online retail and strengthen their competitive position in the market.

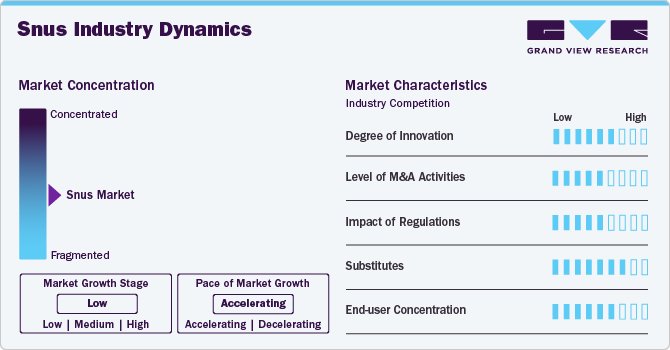

Market Concentration & Characteristics

Innovation in the snus market is marked by the introduction of new flavors and formulations, varying nicotine content, and enhanced packaging for convenience and freshness. Companies are also exploring tobacco-free nicotine pouches and adopting sustainable practices to meet evolving consumer demands and regulatory requirements.

Regulations significantly impact the snus market by dictating product composition, packaging, and marketing practices. Strict regulations in some regions limit the sale and promotion of snus, affecting market growth. Conversely, the market sees greater innovation and expansion in regions with more lenient regulations. Compliance with health warnings and ingredient disclosures is also a key regulatory influence.

Substitutes in the snus market include nicotine replacement therapies like gums, patches, and lozenges, as well as other smokeless tobacco products, such as chewing tobacco and dip. In addition, nicotine pouches, which are tobacco-free, and e-cigarettes or vaping products serve as alternatives, catering to similar consumer needs for nicotine without smoking.

End-user concentration in the snus market tends to be higher among regions with a strong cultural acceptance of smokeless tobacco, such as Sweden and Norway. These markets have a more concentrated user base with high brand loyalty. In contrast, other regions exhibit lower end-user concentration due to varying regulatory environments and differing consumer preferences for nicotine products.

Product Insights

The portioned snus segment accounted for a revenue share of 83.08% in 2023. Portioned snus offers users the convenience of pre-packaged pouches, eliminating the need for preparation associated with loose snus. This convenience factor and the perceived hygiene benefits of portioned packaging have contributed significantly to its appeal among consumers. Moreover, the availability of diverse flavors and nicotine strengths caters to a wide range of preferences, attracting both new and existing users. In light of increasing health concerns surrounding smoking, portion snus is often viewed as a potentially safer alternative, appealing to individuals seeking to quit smoking or reduce tobacco consumption.

The loose snus segment is projected to grow at a CAGR of 4.5% over the forecast period. One significant factor is users' preference for an authentic experience with the traditional method of forming their portions according to personal taste. Loose snus offers variety and customization unmatched by portioned snus, allowing consumers to mix flavors and nicotine strengths to create bespoke blends. According to data published by Statistics Norway on 'Tobacco, alcohol, and other drugs,' in 2021, 15 percent of individuals aged 16 to 74 reported using snus daily, marking a slight increase of 2 percentage points since 2020.

Flavor Insights

The flavored snus segment accounted for a revenue share of around 90.37% in 2023. The diverse array of flavors, including fruity, minty, and herbal varieties, caters to a wide range of taste preferences. Many individuals opt for flavored snus to mask the taste of traditional tobacco, finding these alternatives more palatable. The novelty and variety inherent in flavored snus also appeal to those seeking new experiences, particularly attracting younger users drawn to flavored products. According to Truth Initiative, flavored tobacco products have a significant appeal among young adults aged 18 to 24, with more than four out of five individuals who have ever used tobacco reporting that their initial product was flavored.

The original/unflavored snus segment is projected to grow at a CAGR of 4.3% over the forecast period. People often choose standard flavored snus as the traditional flavors offer a sense of familiarity and comfort. Their widespread availability makes them convenient options for many individuals. Some people prefer the taste of standard flavors over more exotic or experimental ones, appreciating their simplicity and consistency. Brand loyalty further drives the preference for standard flavored snus, as consumers trust the reputation of established brands.

Distribution Channel Insights

The tobacco stores segmentaccounted for a revenue share of around 68.65% in 2023. These establishments typically offer a diverse selection of snus products, ranging in flavors, nicotine strengths, and brands, providing customers with ample choices to suit their preferences. In addition, the staff at tobacco stores often possess extensive knowledge about snus, enabling them to offer informed recommendations and guidance to customers, particularly beneficial for those new to snus or seeking to explore different options.

The online channel segment is estimated is projected to grow at a CAGR of 10.5% over the forecast period. Many individuals opt for online purchasing of snus due to its convenience. It allows users to browse, compare, and buy snus from the comfort of their homes or any location with internet access. Moreover, online retailers typically offer various product options, including different brands, flavors, strengths, and packaging, catering to diverse preferences. In addition, the privacy afforded by online shopping appeals to users who prefer discretion in their snus purchases, especially in areas where tobacco products carry a social stigma.

Regional Insights

The snus market in North America held a share of 24.3% of the global revenue in 2023. The convenience and discretion offered by snus appeal to consumers, particularly in regions with stringent smoking restrictions. Snus can be used discreetly without the need for spitting, making it more socially acceptable in public settings. This aspect has contributed to its popularity among individuals who want to use tobacco without the social stigma or inconvenience associated with smoking.

U.S. Snus Market Trends

The U.S. snus market is expected to grow at a CAGR of 5.9% from 2024 to 2030. The availability and marketing of snus products have played a significant role in driving the marketgrowth. Major tobacco companies have invested heavily in marketing and distributing snus products, capitalizing on their appeal to adult tobacco users. Aggressive advertising campaigns, coupled with innovative product formulations and packaging, have helped expand the reach of snus and attract new consumers.

Europe Snus Market Trends

The snus market in Europe held a share of 62.1% of the global revenue in 2023.The availability of a wide range of products, including different flavors and strengths, has contributed to its popularity among consumers. Manufacturers have innovated to meet the diverse preferences of consumers, offering an array of options ranging from traditional tobacco flavors to fruit and mint varieties. This variety appeals to different demographic groups and contributes to the expansion of the snus market across Europe.

Asia Pacific Snus Market Trends

The Asia Pacific snus market accounted for a revenue share of around 9.3% in the year 2023. The growing awareness of snus as a smokeless tobacco option contributes to regional market expansion. With increased access to information through the internet and other media channels, consumers are becoming more knowledgeable about different tobacco products and their potential health effects. As a result, many are turning to snus as a perceived safer alternative, particularly those looking to quit smoking.

Key Snus Company Insights

Companies focus on strategies, such as new product development and mergers & acquisitions, to increase their global market share. Furthermore, geographic expansions, packaging redesigning, new flavor launches, and joint ventures are a few other strategic initiatives undertaken by key industry players.

Key Snus Companies:

The following are the leading companies in the snus market. These companies collectively hold the largest market share and dictate industry trends.

- Swedish Match AB

- British American Tobacco

- Imperial Brands

- US Smokeless Tobacco Co., Inc.

- Philip Morris International

- Swisher

- Mac Baren Tobacco Company A/S

- Nordic Snus

- Ministry of Snus

- Northerner Scandinavia Inc.

Recent Developments

-

In January 2023, Cannadips Europe, a brand under SpectrumLeaf known for its premium CBD offerings in the European market, collaborated with Snushus AG. Together, they introduced all-natural CBD snus pouches and made the core collection available in-store. Cannadips CBD offers a wide collection, including 5 flavors in the Core Collection, 10 in the Limited Edition, 3 in the CBG+Caffeine Line, and 4 in the Terpene Range (no CBD). All 5 flavors of the Core Collection will be available online at Snushus.ch (and Snushus.eu) and in all Snushus stores across Switzerland, with more collections to be added

-

In December 2022, Philip Morris International completed its acquisition of Swedish Match, a leading manufacturer of nicotine pouches and snus. This strategic acquisition expanded the tobacco giant's presence in the non-combustible tobacco and nicotine product sectors

-

In September 2022, Swedish Match made public its determination to cease all production of combustible tobacco products. It also unveiled intentions to separate its cigar business and distribute it among shareholders. This transition enabled the company to concentrate its efforts on smoke-free alternatives like nicotine pouches and snus

-

In March 2022, Mac Baren Tobacco Company A/S announced its plans to establish its headquarters in Sweden at Usedomstrasse 7-9 in the Wandsbek district of Hamburg. The company will occupy 1,510 m², which includes manufacturing space, warehousing, and offices. This move by Mac Baren Tobacco was a strategic decision, as Hamburg is known to be a major hub for the tobacco industry in Sweden

Snus Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.11 Billion

Revenue forecast in 2030

USD 4.10 Billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Sweden; Norway; China; India; Japan; Indonesia; Bangladesh; Brazil; Argentina; South Africa

Key companies profiled

Swedish Match AB; British American Tobacco; Imperial Brands; US Smokeless Tobacco Co., Inc.; Philip Morris International; Swisher; Mac Baren Tobacco Company A/S; Nordic Snus; Ministry of Snus; Northerner Scandinavia Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Snus Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the snus market report on the basis of product, flavor, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Loose

-

Portion

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original/Unflavored

-

Flavored

-

Mint

-

Whiskey

-

Fruit

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco Stores

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Bangladesh

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global snus market size was estimated at USD 3.01 billion in 2023 and is expected to reach USD 3.11 billion in 2024.

b. The global snus market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 4.1 billion by 2030.

b. Europe held the largest share of 62.1% in 2023. This is attributed to the strong popularity of snus among the consumers of Scandinavian countries including Sweden and Norway.

b. Some key players operating in the snus market include Swedish Match AB, British American Tobacco, Altria Group, Inc, AG Snus, Burger Söhne Sweden AB, Dacapo Silver AB, Fiedler & Lundgren, GN Tobacco, Gordito Oü, Gotlandssnus, Nordic Snus AB, and Skruf Snus.

b. Key factors that are driving the snus market growth include the product's convenience of application to its users and ease of using the product.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.