- Home

- »

- Pharmaceuticals

- »

-

Sodium Hyaluronate-based Products Market Report, 2030GVR Report cover

![Sodium Hyaluronate-based Products Market Size, Share & Trends Report]()

Sodium Hyaluronate-based Products Market Size, Share & Trends Analysis Report By Type (Injectable, Topical), By Application {Pharmaceuticals (Orthopedic, Ophthalmology, Urology), Cosmetics}, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-345-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

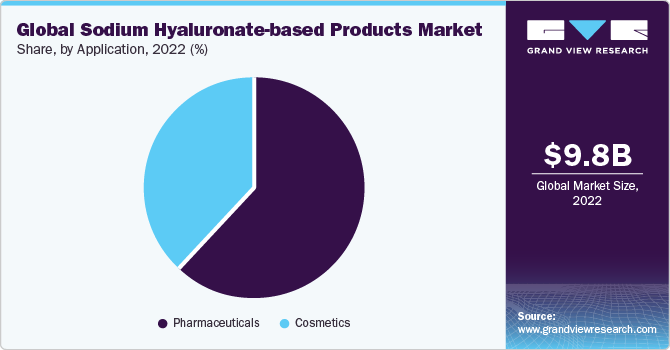

The global sodium hyaluronate-based products market size was valued at USD 9.83 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. The growth of the market can be attributed to an increase in the geriatric population, a demographic that is prone to diseases such as osteoarthritis and cataracts. Growing awareness and a rising number of dermal filler procedures are likely to further propel the market growth. As per the American Society of Plastic Surgeons report, in 2020, in the U.S., there were around 13.2 million cosmetic procedures performed, of which 3.4 million used soft tissue fillers.

According to the U.S. Census Bureau, as of June 2023, the U.S. population aged 65 and over increased approximately five times more quickly than the total population from 1920 to 2020. In 2020, the elderly population in the U.S. accounted for 16.8% of the total population, and around 1 in 6 Americans were 65 or older. An associated consequence of this will be an increase in the incidence of vision impairment and blindness, obesity, and osteoarthritis. Therefore, the rising global geriatric population is expected to be a high-impact rendering driver for this market.

Moreover, sodium hyaluronate (NaHA) dermal fillers are increasingly being preferred over procedures such as Botox as they help bring more natural results, resulting in the patient feeling more comfortable and natural. In addition, dermal filler injections are minimally invasive with minimal downtime. Some of the FDA-approved sodium hyaluronate dermal fillers available in the market are Restylane Defyne, Refyne, and Restylane. Thus, it is anticipated that the need for such products will act as a high-impact rendering driver for sodium hyaluronate products over the forecast period.

However, there are certain adverse effects associated with the application of sodium hyaluronate, such as swelling of eyelids, pain in the face, pain, redness, and itching or swelling at the injection site. Moreover, patients may report stomach pain, difficulty in swallowing after treatment, shortness of breath, diarrhea, neck or back pain, muscle stiffness, fever and flu symptoms, anxiety, and other symptoms. These effects could slow down the market.

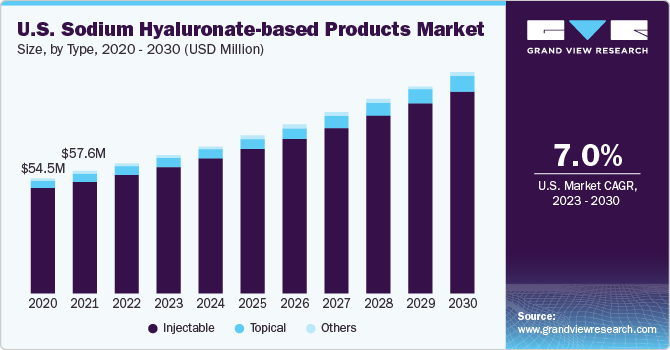

Type Insights

The injectable segment accounted for the largest revenue share of over 90% in 2022. The major products such as dermal fillers, visco supplement injections for arthritis, and ophthalmic viscosurgical devices are available in injectable form. Sodium hyaluronate (NaHA) based injections are widely used in the treatment of knee pain caused due to osteoarthritis and are often administered when other medications used for osteoarthritis treatment have not been effective. For instance, as per the Centers for Disease Control and Prevention,osteoarthritis (OA), is the most prevalent form of arthritis.OA symptoms include pain, stiffness, and edema.Usually, these changes take time to develop and deteriorate.In the U.S., OA affects more than 32.5 million people. This is one of the major factors driving this segment. Key injectable sodium hyaluronate-based products include Euflexxa, Hyalgan, Hyacyst, Protescal, and Restylane Kysse

As per a study published in the U.S. National Library of Medicine, the global prevalence of dry eye diseases ranges from 5% to 35% and is much influenced by lifestyle, climatic conditions, and geographical locations. Conditions such as dry eyes are notably common in the elderly population and with the rise in the geriatric population, both in the developed and the developing countries, the prevalence of dry eye diseases is expected to significantly rise over the forecast period, thereby driving the market for sodium hyaluronate-based products for the treatment of dry eye conditions.

The topical segment is expected to grow at the fastest CAGR during the forecast period. The topical sodium hyaluronate market is expected to be driven by factors such as increasing demand for skincare products, rising prevalence of skin-related conditions, and the aging population. Consumers are seeking efficient ways to deal with their skincare concerns,owing to increasing awareness regarding the significance of maintaining healthy skin and prevention of premature aging. Since sodium hyaluronate can hold up to 1,000 times its weight in water, it is well known for its moisturizing effects when applied topically. This makes it a perfect component for moisturizing creams, serums, and masks that serve to enhance the appearance of the skin, improve skin texture, and lessen fine lines and wrinkles.

Topical sodium hyaluronate medications are used for various medical applications such as the treatment of dry eyes, skin ulcers like diabetic foot ulcers or bedsores, burn wounds, cuts, abrasions, and surgical incisions, and providing relief from gynecological problems.

Application Insights

The pharmaceutical segment held the largest revenue share of over 60% in 2022 and is anticipated to grow at the fastest CAGR of 7.9% over the forecast period. The pharmaceutical segment is sub-segmented into orthopedic, ophthalmic, urology, and others. The increasing prevalence of arthritis and cataracts is a major factor driving this segment. Sodium hyaluronate-based injections are often used in cataract and refractive surgeries. As per the Lancet Global Health, cataracts and uncorrected refractive error were the leading causes of blindness, with 17.8 million and 3.7 million cases globally in 2020, respectively. Due to the aforementioned factors and the effectiveness of sodium hyaluronate-based products in treating eye conditions, the pharmaceuticals segment is expected to grow over the forecast period.

The cosmetics segment is also expected to grow at a lucrative rate. The cosmetics segment includes dermal fillers that are used for the treatment of wrinkles, acne, and scars and augmentation of the lip, cheek, and chin. The increasing demand for anti-aging treatments and rising awareness regarding them are expected to drive the segment. These fillers volumize, hydrate, stimulate new collagen, and help in softening fine lines. Additionally, sodium hyaluronate has a greater hydrating effect compared to hyaluronic acid due to the lower molecular weight, which enables it to improve hydration from the underlying skin layers, by penetrating the epidermis or top layer of the skin. According to the report published by the International Society of Aesthetic Plastic Surgery, around 4.3 million HA-based dermal fillers procedures were performed in 2019. This number is expected to increase during the forecast period, thus driving the cosmetics segment.

Regional Insights

North America dominated the market and accounted for the largest revenue share of over 35% in 2022. The high healthcare expenditure and comparatively high number of dermal filler procedures performed in the U.S. are major factors driving the regional market. HA-based dermal fillers procedures were ranked second among the non-invasive injectable procedures in the U.S.

Asia Pacific is expected to grow at the fastest CAGR of 8.4% during the forecast period. Some of the developed countries in the region also have reimbursement schemes for sodium hyaluronate-based treatments, making it more affordable for the public. The rising geriatric population in this region is one of the major driving factors.

Key Companies & Market Share Insights

Key players are launching new products in the sodium hyaluronate-based products market to strengthen their product portfolios. For instance, in April 2022, Bobbi Brown & Jones Road unveiled "WTF" foundation formulated a Jojoba oil, vitamin E, and sodium hyaluronate—a humectant that draws moisture to the skin. Another instance, in February 2022, a joint painkiller called Kukje Hyal injection was introduced by Kukje Pharma. The medication is given in a pre-filled syringe and is injected into the shoulder or knee joint over the course of five weeks.

Key Sodium Hyaluronate-based Products Companies:

- Allergan, Inc. (a part of AbbVie, Inc.)

- Galderma S.A.

- Bohus BioTech AB

- LG Chem Ltd.

- Syner-Med (Pharmaceutical Products) Ltd.

- Anika Therpeutics Inc.

- Cadila Pharmaceuticals Ltd.

- Ferring Pharmaceuticals B.V.

- Fidia Farmaceutici S.p.A.

Sodium Hyaluronate-based Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.53 billion

Revenue forecast in 2030

USD 17.73 billion

Growth Rate

CAGR of 7.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Allergan, Inc.(a part of AbbVie, Inc.); Galderma S.A.; Bohus BioTech AB; LG Chem Ltd.; Syner-Med (Pharmaceutical Products) Ltd.; Anika Therpeutics Inc.; Cadila Pharmaceuticals Ltd.; Ferring Pharmaceuticals B.V.; Fidia Farmaceutici S.p.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

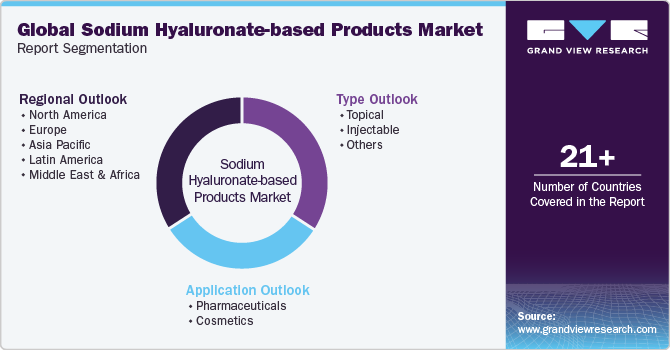

Global Sodium Hyaluronate-based Products Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sodium hyaluronate-based products market based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Injectable

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Ophthalmology

-

Orthopedic

-

Urology

-

Others

-

-

Cosmetics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Based on application, the pharmaceutical segment dominated the sodium hyaluronate-based products market in 2022 with a revenue share of 61.56%, owing to the high prevalence of osteoarthritis and cataracts coupled with the availability of a higher number of products for clinical use.

b. Some key players operating in the sodium hyaluronate-based products market include Allergan, Inc. (a part of AbbVie, Inc.); Galderma S.A.; LG Chem Ltd; Anika Therapeutics Inc., Inc.; and Ferring Pharmaceuticals B.V. amongst others.

b. The major factors driving the sodium hyaluronate-based products market growth are the increasing geriatric population, increasing prevalence of osteoarthritis and cataract, and rising awareness regarding cosmetic procedures.

b. The global sodium hyaluronate-based products market is expected to witness a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 17.73 billion in 2030.

b. The global sodium hyaluronate-based products market size was estimated at USD 9.83 billion in 2022 and is expected to reach USD 10.53 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."