- Home

- »

- Disinfectants & Preservatives

- »

-

Global Sodium Hypochlorite Market Size Report, 2020-2027GVR Report cover

![Sodium Hypochlorite Market Size, Share & Trends Report]()

Sodium Hypochlorite Market Size, Share & Trends Analysis Report By Application (Cleaning & Disinfection, Bleaching, Chemical Manufacturing), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-752-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

The global sodium hypochlorite market size was valued at USD 207.0 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2020 to 2027. Rising demand for the product from water treatment chemical manufacturing companies as well as from sanitizer producers worldwide is projected to remain key factor for the market growth.

Sodium hypochlorite, commonly called liquid bleach, is traditionally a household chemical, which is typically utilized as a bleaching agent or disinfectant worldwide. When put in solution form, the compound easily decomposes, thereby liberating chlorine, and is therefore broadly utilized as a disinfectant and bleaching agent. The product finds the majority of its application as a bleaching agent across an array of industries, including pulp and paper, detergents, and textiles.

Furthermore, in light of the recent COVID-19 global pandemic, one of the key sectors that reflected immense sales globally was the sanitizer industry. The impact of the virus spread led to the direct realization of the essence of personal hygiene, which led to the consumption of hand sanitizers and other disinfectant products. Sodium hypochlorite is one of the key feedstocks consumed in formulating these hygiene and disinfectant products by companies globally.

Furthermore, according to the Ministry of Health and Family Welfare of multiple Asian nations, office spaces, residential complexes, public toilets, and outdoor areas are required to be highly disinfected using products with specified concentrations of sodium hypochlorite. For the formulation of 1% sodium hypochlorite liquid bleach, available chlorine is 3.5%, whereas, for sodium hypochlorite liquid, 5% chlorine is available. Chlorine is one of the most essential components of the disinfectant industry due to its ability to kill pathogens, which include viruses and several bacteria. This is projected to drive demand for the product in disinfectant applications over the foreseeable future.

The product has widespread utility as a disinfectant in several other sectors as well apart from hand sanitizers, which include swimming pool sanitization, several household applications, and water treatment, which includes sewage treatment and drinking and cooling applications. It is also used as a bleaching agent in the pulp and paper and textile industries.

Application Insights

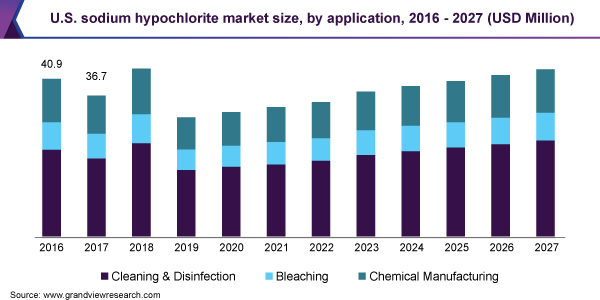

In terms of volume, the cleaning and disinfection application segment dominated the market with a share of 59.0% in 2019. This is attributed to the widespread demand for sodium hypochlorite in the formulation of household products, swimming pool sanitizing products, and water treatment products. The application of sodium hypochlorite in the formulation of water treatment chemicals has been dominant across the globe for decades.

With increasing industrialization and a globally rising number of manufacturing facilities, the discharge of industrial effluents in water bodies has been at its peak. This trend is projected to be the most likely cause of high product demand from the water treatment sector in the coming years.

Additionally, due to its immense ability to act as a disinfectant, sodium hypochlorite is commonly utilized for skin and tissue damage prevention and care, which are majorly caused by scrapes and cuts. Moreover, the product finds numerous applications in surgical operations, wherein it is used before and after surgeries to prevent infections. Chlorine works as a strong antiseptic, which aids in the prevention of skin and skin tissues against most viruses and bacteria.

In terms of bleaching, the substance finds an array of applications in the pulp and paper, detergent, and textile industries. The substance has been used as a bleach across all major industries worldwide. Furthermore, the U.S. Environmental Protection Agency (EPA) has declared the product as safe for consumption in household applications as well as for industrial purposes, which eventually led to high consumption of the product across all major end-use industries globally.

Regional Insights

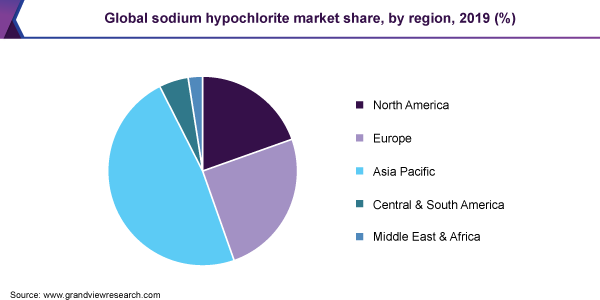

The Asia Pacific dominated the sodium hypochlorite market and accounted for 39.1% share of the global revenue in 2019. This is attributed to the fast-shifting lifestyle of the regional population with regards to the high demand for treated water, coupled with increasing requirements for hand sanitizers and other personal hygiene products across countries, such as China, Indonesia, India, Japan, and Thailand.

Additionally, countries such as Japan, India, Thailand, South Korea, and Indonesia are rapidly becoming major hubs for textile processing companies due to the availability of skilled and cheap labor, ease of regulations, and low-price land availability. It is expected that by 2030, the textiles market will bounce by more than 20% as compared to 2020 due to increasing demand for textile products from parachute manufacturers, car interior producers, tents, bags, and mattress producers across these countries, which is anticipated to fuel the demand for the product over the forecast period.

Europe is anticipated to reflect the high demand for sanitizing and disinfectant products over the next decade in light of the coronavirus outbreak. Native populations in countries, such as Italy, Germany, and the U.K., are increasingly aware of personal hygiene and the importance of using sanitizers and disinfectants in their daily lives. This is projected to boost product requirements as a disinfectant across European countries.

The market in North America is likely to be driven by increasing demand for the substance from waste treatment facilities, majorly centered in the U.S. The country has a long history of water-borne illness among the local population, which has led to the high requirement for sodium hypochlorite in water treatment operations. This trend is likely to remain constant over the foreseeable future, thereby ensuring steady consumption of the product across North America.

Key Companies & Market Share Insights

The market has been characterized by high competition with the presence of globally recognized brands by multinationals. Growing competition in the global market space has led to structural process reforms adopted by these companies, new product launches, project expansions, and product positioning strategies.

Rising demand for the substance from rapidly moving end-use industries is one of the key factors compelling industry participants to raise the standard of the product quality by investing in research & development and simultaneously reduce costs through process innovation, thereby positioning the product in the market at competitive pricing. Multinationals are also observed engaging in long-term agreements with textile manufacturers, water treatment chemical producers, and disinfectant product manufacturers globally to establish a sustainable business in the competitive market space. Some of the prominent players in the sodium hypochlorite market include:

-

Unilever

-

Chlorotec

-

Tessenderlo Group

-

Vynova

-

ICL

-

OxyChem

-

Olin Chlor Alkali

-

Hawkins Inc.

Sodium Hypochlorite Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 218.0 million

Revenue forecast in 2027

USD 302.7 million

Growth Rate

CAGR of 4.9% from 2020 to 2027

Market demand in 2020

384.82 kilotons

Volume forecast in 2027

504.79 kilotons

Growth Rate

CAGR of 4.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Spain; France; Italy; China; India; Japan; Brazil

Key companies profiled

Unilever; Chlorotec; Tessenderlo Group; Vynova; ICL; OxyChem; Olin Chlor Alkali; Hawkins Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global sodium hypochlorite market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Cleaning & Disinfection

-

Household

-

Water Treatment

-

Swimming Pool Sanitization

-

-

Bleaching

-

Textiles

-

Pulp & Paper

-

Other

-

-

Chemical Manufacturing

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."