- Home

- »

- Petrochemicals

- »

-

Sodium Sulfate Market Size & Share, Industry Report, 2030GVR Report cover

![Sodium Sulfate Market Size, Share & Trends Report]()

Sodium Sulfate Market (2025 - 2030) Size, Share & Trends Analysis Report By Nature (Natural, Synthetic), By End-use (Paper & Pulp, Detergents, Glass, Food & Beverage), By Region (North America, APAC, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-469-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sodium Sulfate Market Summary

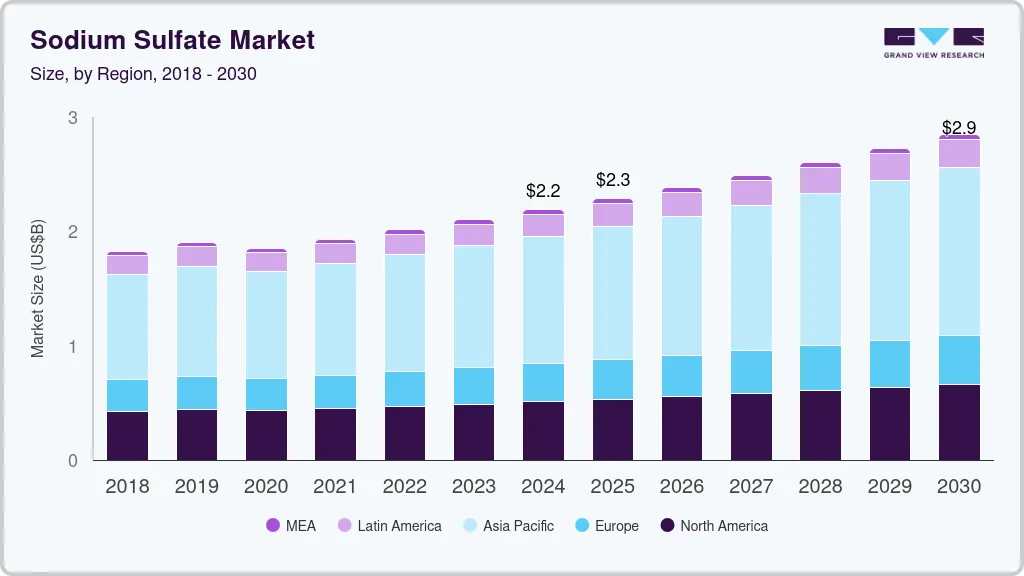

The global Sodium Sulfate Market size was estimated at USD 2,189.1 million in 2024 and is projected to reach USD 2,850.1 million by 2030, growing at a CAGR of 4.5% from 2025 to 2030. The growing demand from the detergent industry significantly drives the market.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- In terms of segment, natural accounted for a revenue of USD 2,189.1 million in 2024.

- Natural is the most lucrative nature segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2,189.1 Million

- 2030 Projected Market Size: USD 2,850.1 Million

- CAGR (2025-2030): 4.5%

- Asia Pacific: Largest market in 2024

The product is widely used as a filler in powdered detergents, enhancing their performance and improving texture. As urbanization grows and disposable incomes rise, consumers are buying more cleaning products, driving a surge in detergent consumption. This trend is especially noticeable in emerging markets, where the demand for efficient and affordable cleaning solutions continues to increase.

China's sodium sulfate market is significantly driven by the rapid growth of the detergent industry. As one of the largest consumers of household and industrial cleaning products, the demand for sodium sulfate as a filler in powdered detergents has surged. The increasing urbanization and rising disposable incomes among the Chinese population have led to higher consumption of laundry detergents, thereby boosting the need for sodium sulfate. This trend is further supported by the growing awareness of hygiene and cleanliness, especially in urban areas, which has resulted in a consistent demand for effective cleaning agents.

Another critical factor contributing to the demand for sodium sulfate in China is its use in the pulp and paper industry. As the country continues to expand its paper production capabilities to meet both domestic and international demand, sodium sulfate plays a vital role in the kraft pulping process. This process is essential for producing high-quality paper products, and sodium sulfate is used to recover chemicals, making the production process more sustainable. The growth of the packaging and printing sectors, driven by e-commerce and consumer goods, has further amplified the need for sodium sulfate in this industry.

As a food additive, it plays a crucial role in the food and beverage industry, particularly in improving the texture and extending the shelf life of products such as dairy, baked goods, and meat. Sodium sulfate's long history of safe use has contributed to its widespread acceptance in both sweet and savory food products. Additionally, the increasing global meat consumption, especially in high-income countries such as Australia, as well as significant consumption in Europe and North America, has fueled the demand for sodium sulfate. Over the past 50 years, meat production has more than tripled, with current global production surpassing 350 million tonnes annually.

Furthermore, the consumption of milk and milk products is on the rise, particularly in developing countries, where over 6 billion people consume these products. These trends are all contributing to the growing demand for sodium sulfate in the food industry. Another key factor propelling the market is its essential role in the pulp and paper industry. Sodium sulfate is utilized in the kraft process, a method for producing high-quality pulp from wood chips.

Nature Insights

Natural sodium sulfate dominated the sodium sulfate market and accounted for the largest revenue share of 69.7% in 2024. Natural sodium sulfate, often referred to as Glauber's salt, is derived from natural mineral deposits or through the evaporation of seawater. It is typically found in large quantities in regions with arid climates. Glauber's salt provides eco-friendly advantages in textile dyeing, such as lower pollution, reduced total dissolved solids (TDS), and a decreased effluent load. Serving as a catalyst, it improves dye absorption, fixation, and shade depth. In comparison to common salts, it not only minimizes environmental impact but also enhances dyeing efficiency and fabric quality.

The synthetic sodium sulfate market is estimated to grow significantly at a CAGR of 4.2% over the forecast period. Synthetic sodium sulfate is produced through chemical processes, often as a byproduct of other industrial activities, such as the production of hydrochloric acid or the neutralization of sulfuric acid. This form of sodium sulfate is typically more consistent in quality and purity compared to its natural counterpart. Synthetic sodium sulfate is used in similar applications, including detergents and industrial processes, but it may be preferred in situations where specific purity levels are required or where natural sources are not readily available.

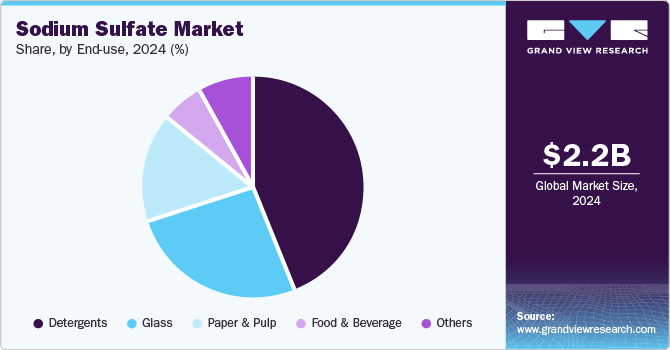

End-use Insights

Detergents led the sodium sulfate market and accounted for the largest revenue share of 43.6% in 2024, owing to the fact that sodium sulfate plays a crucial role in the detergent industry, where it is primarily used as a filler in powdered detergents. Its high solubility in water makes it an effective agent for enhancing detergents' cleaning performance. The rise of infectious diseases, including COVID-19, has increased global awareness of hygiene, driving higher demand for cleaning products, hand sanitizers, and laundry detergents. Economic growth in emerging markets has boosted disposable incomes, allowing consumers to purchase higher-quality products. Additionally, the expansion of e-commerce platforms has made detergent products more accessible, further fueling global demand and opening new opportunities for manufacturers in the market.

Glass in the sodium sulfate market is expected to grow at the fastest CAGR of 4.9% over the forecast period. Sodium sulfate anhydrous aids in eliminating small air bubbles trapped in molten glass during the melting process, ensuring that the resulting glass is smooth and free of imperfections. The rising demand for glass manufacturing with sodium sulfate is driven by global construction growth, particularly in emerging economies, and the trend toward modern, energy-efficient architecture.

In the pulp and paper industry, sodium sulfate is utilized in various processes, including paper production. It serves as a key component in the kraft process, a method of producing pulp from wood chips. Sodium sulfate helps recover chemicals used in the pulping process, making it essential for the sustainability of paper production. The increasing demand for paper products, driven by both consumer and industrial needs, is expected to boost the demand for the product in this sector.

Regional Insights

North America sodium sulfate market is expected to grow significantly at a CAGR of 4.6% over the forecast period. As urbanization increases and disposable incomes rise, consumers are purchasing more cleaning products, leading to a surge in detergent consumption. Technological advancements in the paper and pulp industry are increasing the demand for sodium sulfate, as it helps control viscosity and improve paper quality. In textile processing, sodium sulfate enhances dyeing and color brightness, driving higher demand, particularly with the growth of the textile industry in countries such as Mexico.

U.S. Sodium Sulfate Market Trends

The sodium sulfate market in the U.S. led the North American market with the largest revenue share in 2024. The growth in strategic inward investment, manufacturing, and large-scale infrastructure projects focused on de-carbonization, backed by the U.S. Inflation Reduction Act, is driving expansion in the U.S. construction market - the second largest globally. This growth is a major factor increasing the demand for sodium sulfate in glass manufacturing, a key component of the construction industry in the region. The food industry is a major contributor to the U.S. economy, driving increased demand for sodium sulfate in food processing, preservatives, and glass packaging for beverages.

Asia Pacific Sodium Sulfate Market Trends

Asia Pacific sodium sulfate market dominated the global market, with the largest revenue share of 50.9% in 2024. The growth is driven primarily by the increasing demand from various end-use industries. Rapid development in emerging economies across the Asia Pacific has significantly boosted various industries. The expanding construction and automotive sectors, with increasing demand for glass in windows, windshields, and building materials, are major contributors to the rising need for sodium sulfate in glass manufacturing. Additionally, the growing adoption of washing machines in countries such as China, India, and ASEAN has led to higher demand for detergents, further driving sodium sulfate usage in detergent production. Urbanization and population growth also contribute to this surge.

China sodium sulfate market dominated the Asia Pacific market and accounted for the largest revenue share in 2024. In 2022, Chinese consumers increasingly sought laundry care products with advanced features, such as multifunctional liquid tablet detergents or laundry sanitizers, driving demand for sodium sulfate in detergent manufacturing. Despite rising raw material and logistics costs, prices in China remained stable, with positive volume growth but declining real-value sales. The growth of e-commerce, especially budget-friendly platforms such as Pinduoduo, exerted downward pressure on prices. To compete, offline retailers, including supermarkets and hypermarkets, launched strong promotions, intensifying price competition and contributing to the rising need for sodium sulfate in detergent production.

Europe Sodium Sulfate Market Trends

Europe sodium sulfate market accounted for a substantial market share in 2024. The surge in construction activity will drive an increased demand for glass, subsequently boosting the need for sodium sulfate. In Europe, sodium sulfate is primarily used in the production of detergents, glass, paper and pulp, and textiles. The detergent industry, especially, is a major consumer, where sodium sulfate serves as a filler to modify the concentration of active ingredients and enhance the flow properties.

Key Sodium Sulfate Company Insights

Some key sodium sulfate market companies include Nippon Chemical Industrial CO., LTD; Elementis PLC.; LENZING AG; and SHIKOKU KASEI HOLDINGS CORPORATION; among others. Key companies in the global sodium sulfate market stay competitive by diversifying product applications, investing in technology, and focusing on sustainability. They expand through strategic partnerships, regional growth, and cost optimization, ensuring efficiency and reducing costs. By fostering strong customer relationships and offering customized solutions, these companies maintain their market position and adapt to growing demand across various industries.

-

Nippon Chemical Industrial CO., LTD offers products primarily used in industries such as detergents, glass manufacturing, and textiles. The company focuses on research and development to enhance production processes and improve product performance. Through strategic investments and maintaining strong customer relationships, the company continues to meet the growing demand for sodium sulfate while contributing to the evolving needs of various industries globally.

-

Elementis PLC. is a global specialty chemicals company that manufactures a wide range of products used in industries such as coatings, personal care, automotive, and consumer goods. Known for its expertise in providing innovative solutions, it offers high-performance additives, including those used in glass manufacturing and detergents. With a strong focus on sustainability and operational efficiency, it caters to diverse market needs.

Key Sodium Sulfate Companies:

The following are the leading companies in the sodium sulfate market. These companies collectively hold the largest market share and dictate industry trends.

- Nippon Chemical Industrial CO., LTD

- Elementis PLC.

- LENZING AG

- SHIKOKU KASEI HOLDINGS CORPORATION

- Bahubali Chemical Industries

- Cooper Natural Resources

- Sun European Partners, LLP

- Sigma-Aldrich Solutions

- Tokyo Chemical Industry Pvt. Ltd.

- Jiangsu Yinzhu Chemical Group Co., Ltd

Recent Developments

-

In May 2024, Grasim Industries Ltd launched EcoSodium, an eco-friendly solution sourced from extracted Sodium Sulphate during Viscose Staple Fiber production. By minimizing wastewater discharge, EcoSodium reduces environmental impact. Compliant with REACH and ZDHC MRSL standards, it ensures responsible sourcing and manufacturing.

-

In September 2023, Cinis Fertilizer announced plans to build a new sodium sulfate creation site in Hopkinsville, Kentucky. They partnered with Ascend Elements to obtain sodium sulfate for the project.

-

In November 2023, the USFDA approved Stride’s generic version of the Suprep Bowel Prep Kit. The kit contains sodium sulfate, potassium sulfate, and magnesium sulfate.

Sodium Sulfate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.28 billion

Revenue forecast in 2030

USD 2.85 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Nippon Chemical Industrial CO., LTD; Elementis PLC.; LENZING AG; SHIKOKU KASEI HOLDINGS CORPORATION; Bahubali Chemical Industries; Cooper Natural Resources; Sun European Partners, LLP; Sigma-Aldrich Solutions; Tokyo Chemical Industry Pvt. Ltd.; Jiangsu Yinzhu Chemical Group Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sodium Sulfate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sodium sulfate market report based on nature, end-use, and region.

-

Nature Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paper & Pulp

-

Detergents

-

Glass

-

Food & Beverage

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.