- Home

- »

- Next Generation Technologies

- »

-

Global Software Defined Radio Market Size Report, 2030GVR Report cover

![Software Defined Radio Market Size, Share & Trends Report]()

Software Defined Radio Market Size, Share & Trends Analysis Report By Type (General Purpose Radio, TETRA), By Component, By Frequency Band, By Platform, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-911-1

- Number of Report Pages: 213

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Technology

Software Defined Radio Market Trends

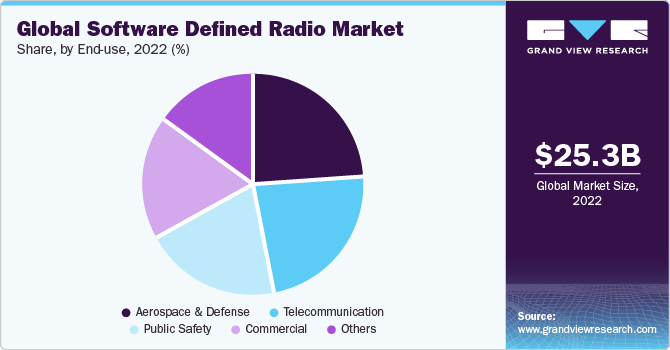

The global software defined radio market size was estimated at USD 25.29 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2023 to 2030. The defense agencies are adopting software defined radio (SDR) owing to the rising demand for advanced communication devices. In addition, governments are focusing on increasing their defense budgets, which is a key factor driving the growth of the market.

SDRs possess the ability to receive and transmit signals in various frequency bands such as S-band, L-band, and Ultra-High Frequency (UHF) bands without altering the hardware. The emphasis of various governments on supplying funding for R&D activities and the development of programs by defense agencies are expected to propel market growth.

The escalating demand for software defined radio (SDR) across diverse industries is attributed to a paradigm shift in wireless communication technologies. In defense applications, SDR plays a pivotal role in ensuring secure, dependable, and interoperable communication. The dynamic nature of modern warfare demands flexible communication systems that can quickly adapt to changing conditions. SDR's capability to reconfigure and upgrade software functionalities without requiring hardware modifications aligns perfectly with the defense sector’s need for rapid, agile communication solutions. This not only enhances operational efficiency but also provides a strategic edge in the increasingly complex and unpredictable defense.

The adoption of digital radio has ushered in a new era of advanced capabilities prominently characterized by increased efficiency and cost-effectiveness across various industries. This transformation is particularly noteworthy in comparison to traditional analog radio systems, displaying a paradigm shift in communication technology. Digital radio excels in efficiency owing to its ability to send and receive signals with greater clarity and reliability. Unlike analog signals, which are susceptible to interference and signal degradation, digital radio uses advanced modulation techniques that enhance the quality of communication. This translates into improved voice clarity, reduced noise, and an overall enhanced user experience. Moreover, digital radio systems are inherently more spectrally efficient than their analog counterparts. The use of digital modulation schemes allows for the transmission of a higher volume of information within the same bandwidth. This increased spectral efficiency is pivotal in addressing the growing demand for wireless communication, enabling more users and devices to operate without compromising performance.

The market shows promising growth prospects, driven by advancements in wireless communication technologies. Penetration into diverse industries, including telecommunications, defense, and healthcare, highlights its multifaceted applications. In the telecommunications sector, SDR enables dynamic spectrum use, enhancing network efficiency and flexibility within the defense. SDR’s adaptability proves pivotal, allowing rapid reconfiguration for various communication standards. The market’s expansion is further fueled by the increasing demand for secure and resilient communication systems, particularly in mission-critical operations. Healthcare applications, such as remote patient monitoring and medical telemetry, underscore SDR’s role in shaping the future of healthcare infrastructure. The ability to accommodate evolving protocols and standards positions SDR as a cornerstone in the integration of smart healthcare solutions.

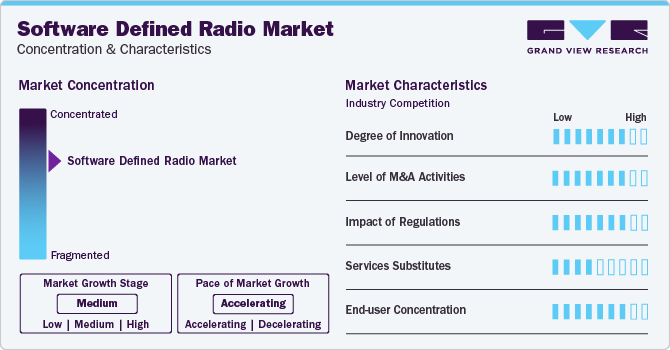

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The escalating demand for versatile communication systems, coupled with rapid advancement in wireless technology, has created a fertile environment for the market. The increasing adoption across diverse sectors such as telecommunications, defense, and public safety substantiates the accelerating pace of market growth.

The market is seeing an increasing number of merger and acquisition (M&A) activities by the leading players underlying a dynamic industry landscape. Strategic alliances and consolidations have become pivotal in fostering innovation and expanding market reach. Key players recognize the imperative need to integrate diverse technologies and enhance product portfolios to stay competitive.

The market is also subject to increasing regulatory scrutiny. Supportive regulations foster innovation ensuring a conducive environment for the technologies. Policies that promote spectrum flexibility and interoperability enhance market growth, allowing for diverse applications in communication, defense, and beyond.

End-user concentration is a significant factor in the market. Increasing demand for the defense and aerospace sectors, where SDR offers flexibility in adapting to evolving communication standards, consolidates a signification portion of the market. Moreover, the convergence of wireless communication technologies, such as 5G, further propels SDR adoption, particularly in telecommunications.

End-use Insights

The aerospace & defense segment held the largest market revenue share in 2022. The aerospace & defense segment is further categorized into military and space. Widely used in the defense industry, software-defined radio (SDR) is valued for its extensive functional scope, including high interoperability, adaptability, precision, speed, and clarity among its major characteristics. Furthermore, the aerospace & defense segment is experiencing growth owing to the continuous development in SDR technology, as well as enhanced processing power and improved software capabilities. These advancements allow aerospace & defense systems to stay updated with emerging threats and evolving communication standards, which is critical for maintaining safety and security.

The commercial segment is projected to witness growth of 9.8% over the forecast period. This growth is attributed to the increasing usage of SDR across industries, such as automotive and transportation. Another factor is the rising need for automotive radios to support both analog and digital systems. Moreover, commercial airports are focusing on the adoption of SDRs in unmanned aerial vehicles (UAVs) for remote control jamming systems. The devices are also being adopted in UAVs for providing command, control, and navigation systems. In addition, SDRs find applications in commercial premises, such as parking facilities, for communication purposes. These factors are expected to drive the demand for SDRs in commercial applications.

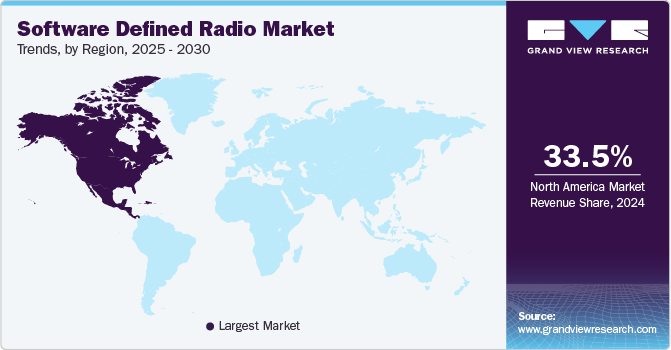

Regional Insights

The North America market held a revenue share of 34.2% in 2022. The Joint Tactical Networking Center (JTNC) program, which offers technical support for wireless communication systems to the US Department of Defense, helped North America to dominate the software defined radio industry. The defense sector in North America has incorporated software defined radio systems extensively, which is driven by research initiatives and efforts to unify communication systems within state and federal agencies. This adoption is particularly prominent owing to the versatile nature of software defined radio, helping seamless integration and interoperability across various defense applications.

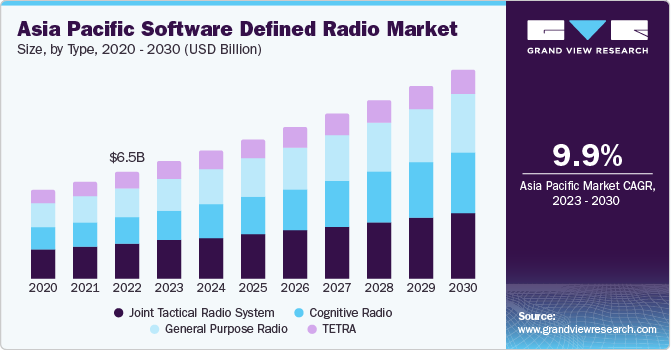

Asia Pacific is expected to witness significant growth in the market. The proliferation of the market in Asia is majorly owing to the growing number of smart phone users and the emergence of 5G in the telecommunication sector. The emergence of advanced transportation sources, such as smart railways in countries like Japan, China, and India, is expected to fuel market growth in the region. Furthermore, the emergence of 5G in the Asia Pacific region is expected to increase the adoption of software defined radios in the telecommunication sector resulting in promising growth of the market over the forecast period.

Type Insights

Joint tactical radio system held the largest market revenue share in 2022. The growth is attributed to the widespread integration of multi-band/multi-mode pre-emptive radio sets in the defense industry, providing warfighters with simultaneous speech and data communication capabilities. The joint tactical radio system (JTRS) relies heavily on an open systems architecture based on software communications architecture 4.0, a framework that is also propelling the JTRS market forward as part of the initiative by the US Department of Defense.

The cognitive radio segment is anticipated to register the fastest CAGR during the forecast period. The integration of cognitive radio with emerging technologies like 5G and the Internet of Things (IoT) is unlocking new opportunities for spectrum optimization and efficient wireless communication. In addition, the rising focus on security and privacy in cognitive radio networks, coupled with advancement in machine learning and artificial intelligence, is enhancing the technology capabilities for adaptive and secure spectrum management.

Component Insights

Based on component, the hardware segment held the largest revenue share of 41.5% in 2022. The hardware segment is further categorized as antenna, transmitter, receivers, and others. This growth is attributed owing to the convergence of analog and digital technologies on a single chip, a development that significantly influences the reduction in both weight and size. In addition, the increasing adoption of field-programmable gate arrays (FPGAs) equipped with integrated analog-to-digital converters (ADCs) and digital-to-analog converters (DACs) also contributes to the segment's growth.

The services segment is expected to register the fastest CAGR during the forecast period. Companies such as Collins Aerospace, and Raytheon Company, among others deal with the integration of software defined radios. The ongoing upgradation activities of communication systems, which involve the installation of airborne systems on the aircraft, are expected to provide growth opportunities for these players. For instance, in June 2022, Collins Aerospace introduced ARC210 Gen6, a next-generation software defined airborne communication system, to Five Eye and North Atlantic Treaty Organization (NATO). The airborne radio is equipped with satellite capability, anti-jam technology, and modernized cryptology for seamless communications in challenging environments.

Frequency Band Insights

The high frequency band segment held the largest market revenue share in 2022. High-frequency SDR systems are equipped with IP networks for tactical communication. IP systems offer advantages, including lower transaction costs and better end-use experience, which provide a significant boost in demand for next-generation IP systems with integrated software defined radio systems. Furthermore, the demand for high frequency SDR is increasing owing to its popularity in maritime operations and increasing deployments in large antennas.

The ultra-high frequency (UHF) segment is expected to register the fastest CAGR during the forecast period. The potential growth in this segment is attributed to commercial applications such as cellular systems and 5G networks using Ultra High Frequency (UHF) bands. UHF SDRs deliver uninterrupted services to customers owing to the need for extended area coverage. Furthermore, factors such as the growing number of smartphones and the widespread internet usage for IoT applications are propelling the market growth.

Platform Insights

The ground platform segment held the largest market revenue share in 2022. This growth is attributed to the wide range of tactical military communications systems in space and defense sectors. In satellite communications, software defined radio optimizes ground station designs and enhances ground station sensitivity, which helps in clear communications. The increasing number of space projects in the communication sector and the growing use of software defined radio (SDR) technology have been the driving forces behind the development of the new space communications architecture.

The airborne platform segment is anticipated to register the fastest CAGR over the forecast period. Airborne software defined radio (SDR) is a high-speed data transmission technique widely used in both military and civilian applications. Companies such as L3 Harris Technologies and Collins Aerospace have integrated SDR technology solutions with current airborne applications that have resulted in secure, cost-effective, and mission-critical systems. SDRs also include a wideband networked waveform that can be used for secure airborne telecommunications.

Key Companies & Market Share Insights

Some of the key players operating in the market include L3Harris Technologies Inc., BAE Systems plc, Northrop Grumman Corporation, Elbit Systems Ltd., among others.

-

L3Harris Technologies Inc., renowned for its commitment to advancing communication capabilities, L3Harris has consistently delivered SDR solutions that cater to diverse applications from military to commercial sectors.

-

Northrop Grumman commitment to innovation is evident in the development of advanced SDR solutions, enabling flexible and adaptable communication systems. The company’s focus on software defined capabilities allows for seamless integration with diverse communication platforms, enhancing interoperability and mission effectiveness.

-

DataSoft, Data Device Corporation, and Anaren Inc. are some of the emerging market participants in the software defined radio industry.

-

DataSoft’s emergence in the market is marked by innovative solutions and robust support. It delivers SDR solutions that reduce communication paradigms. The company’s commitment to research and development is evident in its feature rich products, providing flexibility and adaptability crucial in dynamic communication environments.

-

Data Device Corporation’s commitment to innovation is evident in their SDR solutions, providing versatile and adaptable radio communication capabilities. Their technology empowers users with the flexibility to reconfigure radio parameters in real-time, enhancing operational efficiency across diverse applications.

Key Software Defined Radio Companies:

- Analog Devices Inc.

- Anaren Inc.

- BAE Systems plc.

- Collins Aerospace Systems

- Data Device Corporation

- DataSoft

- Elbit Systems Ltd.

- Huawei Technologies Co. Ltd.

- Indra Sistemas S.A.

- L3Harris Technologies Inc.

- Microchip Technology Inc.

- Northrop Grumman Corporation

- RTX Corporation

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

Recent Developments

-

In December 2023, Microchip Technology Inc. opened a new facility center at Cambridge Research Park, UK The new facility center will significantly increase research and development space, allowing the company’s business units to develop their comprehensive offering further. Further, the new site would help Microchip focus on the needs of several key markets, including automotive, IoT, and industrial, among others.

-

In November 2023, Anaren Inc. announced the opening of a new manufacturing facility in New York State. The project reflects their support for fostering a microelectronics ecosystem in New York and throughout the U.S. defense and aerospace industry. The proposed facility is a major player in the domestic microelectronics ecosystem, which is larger than the RF microwave and microelectronics facility in Syracuse.

-

In February 2023, Analog Devices Inc. announced the partnership with Marvell Technology, Inc., a data infrastructure company, to launch MIMO, a next-generation design platform that would support Open Radio Access Network (RAN). The combination of Analog’s RadioVerse transceiver System on Chip (SoC) and Marvell’s OCTEON 10 Fusion 5G baseband processor improves the time-to-market for advanced MIMO radio units. It supports up to 40% lower energy consumption.

Software Defined Radio Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.66 billion

Revenue forecast in 2030

USD 49.13 billion

Growth rate

CAGR of 8.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2022

Forecast period

2023 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, frequency band, platform, end-use, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; China; Japan; India; Australia; Mexico; Brazil

Key companies profiled

Analog Devices Inc.; Anaren Inc.; BAE Systems plc.; Collins Aerospace Systems; Data Device Corporation; DataSoft; Elbit Systems Ltd.; Huawei Technologies Co. Ltd.; Indra Sistemas S.A.; L3Harris Technologies Inc.; Microchip Technology Inc.; Northrop Grumman Corporation; RTX Corporation; Renesas Electronics Corporation; STMicroelectronics N.V.; Texas Instruments Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Software Defined Radio Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global software defined radio market report based on type, component, frequency band, platform, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

General Purpose Radio

-

Joint Tactical Radio System

-

Cognitive Radio

-

TETRA

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Antenna

-

Transmitter

-

Receiver

-

Others

-

-

Software

-

Service

-

-

Frequency Band Outlook (Revenue, USD Million, 2018 - 2030)

-

HF Band

-

VHF Band

-

UHF Band

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Ground

-

Naval

-

Airborne

-

Space

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Space

-

Military

-

-

Telecommunication

-

Public Safety

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global software defined radio Market size was estimated at USD 25.29 billion in 2022 and is expected to reach USD 27.66 billion in 2023.

b. The global software defined radio market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2030 to reach USD 49.13 billion by 2030.

b. Based on type, the joint tactical radio system segment dominated the market in 2022 owing to the widespread integration of multi-band/multi-mode pre-emptive radio sets in the defense industry, providing warfighters with simultaneous speech and data communication capabilities.

b. The key players in this industry are Analog Devices Inc., Anaren Inc., BAE Systems plc., Collins Aerospace Systems, Data Device Corporation, DataSoft, Elbit Systems Ltd., Huawei Technologies Co. Ltd., and others.

b. Key factors driving the software defined radio market growth include an increase in defense spending to upgrade defense communication systems and the growing demand for communication equipment that is more flexible and software programmable.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."