- Home

- »

- Renewable Energy

- »

-

Global Solar Tracker Market Size, Share & Trends Report 2030GVR Report cover

![Solar Tracker Market Size, Share & Trends Report]()

Solar Tracker Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Solar Photovoltaic (PV), Concentrator Photovoltaic), By Type (Single Axis, Dual Axis), By Application (Utility, Non-utility), By Region, And Segment Forecasts

- Report ID: 978-1-68038-267-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar Tracker Market Summary

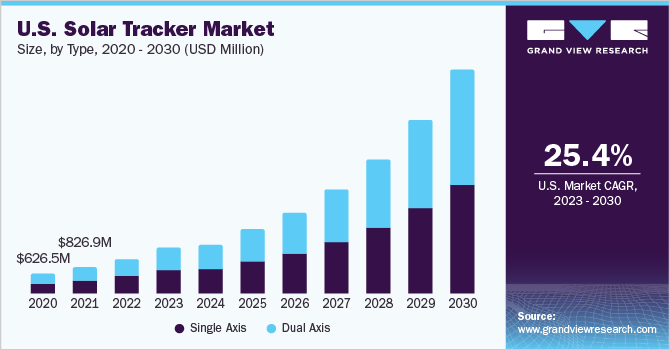

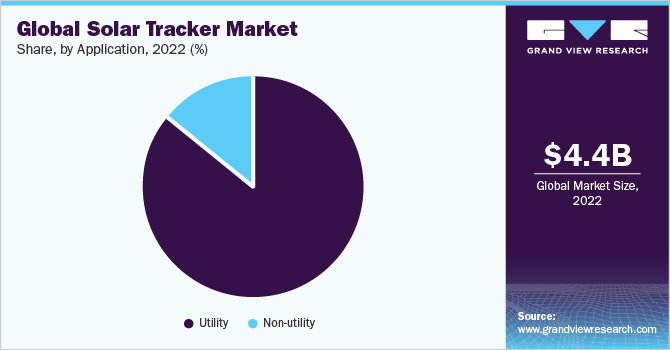

The global solar tracker market size was valued at USD 4.41 billion in 2022, and is projected to reach USD 29.31 billion by 2030, expanding at a CAGR of 26.2% from 2023 to 2030. Rising concerns over energy conservation and transition from non-renewable energy to renewable energy is expected to surge demand for solar energy and eventually solar trackers over the forecast period on a global level.

Key Market Trends & Insights

- North America dominated the market with the highest revenue in 2022.

- Middle East & Africa is anticipated to witness highest growth during the forecast period.

- By type, the dual axis tracker segment accounted for the largest market share of 50.83% in 2022.

- By technology, the photovoltaic (PV) technology accounted for the largest revenue share of 91.52% in 2022.

- By application, utility segment accounted for 85.56% of the market share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.41 Billion

- 2030 Projected Market Size: USD 29.31 Billion

- CAGR (2023-2030): 26.2%

- North America: Largest market

- Middle East & Africa: Fastest growing market

Solar tracker utilizes various electrical components including actuators, motors, and sensors to orient the solar cell for concentrating the sunlight in order to maximize the energy captured. The captured solar radiations are further converted into electricity which is utilized by various end-user segments. Rising use of solar power as a potential source of commercial energy generation has gained popularity due to decreasing solar PV panel cost which is excepted to further augment solar tracker market growth.Solar PV technology has been one of the fastest growing renewable sources of energy over the past few years in the U.S. Increasing government focus on renewable energy has resulted in the development of PV cells as a sustainable and continuous source of energy generation. Rising capacity expansions across the U.S. has led to decline the levelized cost of electricity (LCOE). This has made solar PV competitive with other conventional forms of energy in the country. Along with supporting policies by the U.S. government has been one of the significant drivers for high implementation of solar energy in the country.

Technological innovations aimed at the development of new methods in tracking systems by companies such as NEXTracker, Array Technologies, AllEarth Renewables, and Solaria are expected to drive market growth during the forecast period. The solar tracker market is price competitive, so the solar tracker manufactures have to be operationally efficient and extremely strategic to be successful.

The market in Europe is expected to witness substantial growth over the forecast period, owing to the recent increase in the Feed-in Tariff (FIT) rates especially in Germany. The presence of other government subsidies in the region is likely to have a positive impact on the European market over the next ten years. During the FIT boom in Europe, numerous projects employed dual axis trackers with poor reliability which led to high O&M costs.

Type insights

Dual axis tracker accounted for the largest market share of more than 50.83% in 2022 in terms of revenue and is projected to expand at the highest CAGR during the forecast. Dual axis trackers allow maximum absorption of the sun’s rays on account of their ability to follow the sun both horizontally and vertically. Dual axis trackers help in generating 8% to 10% more energy than single axis trackers.

Higher land requirements and more complex technology coupled with high maintain requirement for motors and control systems results in high O&M expenditure for dual-axis trackers. This factor acts as a major restraint for wider adoption for dual-axis trackers.

Single axis systems track the sun’s rays along a single axis allowing them to increase system performance by 20% or more over fixed solar PV cells in areas of high isolation. Single axis solar trackers take up more land as compared to fixed solar panels as their movement can create shadows which can affect the efficiency of neighboring panels. The use of single axis trackers maximizes potential output but also come with higher capex (capital expenditure) and opex (operating expenditure).

Technology insights

Photovoltaic (PV) technology was the largest technology segment in 2022 and accounted for a revenue share of about 91.52% in 2022. Compatibility of PV cells with standard photovoltaic modules technologies is the major reason for largest market share of PV technology. The rising cost of electricity owing to supply-demand gap will further augment the use of solar PV in utility and non-utility applications.

The use of solar trackers on PV modules requires less design regulations when compared to mirrors, lenses, and Fresnel collectors on the CSP and CPV technology trackers. These features will drive the growth of solar trackers in PV technology over the forecast period. CPV is the emerging technology in the solar industry. CPV system produces low-cost solar power owing to low manufacturing cost and fewer raw material requirements. This technology uses optics such as lenses to concentrate a large amount of sunlight on a small surface of PV materials to generate electricity.

Concentrated Solar Power (CSP) is used to harness the sun’s energy potential and has the capacity to provide consumers globally with reliable renewable energy even in the absence of the sun’s rays. Over the past few years, CSP has been increasingly competing with the less expensive PV solar power and concentrator photovoltaics (CPV), which is also a fast-growing technology.

Application insights

In terms of revenue, utility was the largest application sector while accounting for over 85.56% of the market share in 2022. Increasing electricity cost coupled with rising demand for renewable source for energy generation is expected to augment the use of solar trackers in utility applications. This trend is projected to continue during the forecast period.

The most widely used solar trackers in utility sector is the single axis tracking system as utility solar installations are ground mounted, and single axis trackers can be used to follow the sun throughout daylight hours; Trackers are being used on a large-scale in utility applications in light of increasing government subsides coupled with feed-in tariff schemes particularly in North American and European region.

The prevalence of various government subsidies in North America and Europe will augment the use of solar panels in non-utility applications over the forecast period. One of the major factors affecting the application of trackers in non-utility projects is high cost associated with them. Implementing solar trackers can be extremely costly, but it consequently helps in generating 25%-30% more solar power as compared to a fixed solar panel. However, high cost and land constraints make it infeasible in most cases for use of solar trackers in commercial and residential applications.

Non-utility sector includes both commercial and residential solar power installations. Non-utility applications comprise a lower market share as compared to utility on account of the infeasibility of applying trackers due to land constraint. Another major factor affecting the application of trackers in non-utility projects is high cost associated with them. Implementing solar trackers can be extremely costly in non-utility applications.

Regional Insights

North America accounts for the major market share in the global market and this trend is expected to continue till 2030. The growth is primarily attributed to rising emphasis on renewable energy and the Paris Agreement on Climate Change that has recommended the usage of renewable energy in the nation’s energy supply.

The government in the U.S. is also targeting to increase the usage of solar power in the economy through various initiatives. In the year 2011, DOE (U.S. Department of Energy) launched the SunShot Initiative with an aim to make the solar industry cost-competitive with conventional energy sources by reducing charges to less than 1 USD/watt by 2020. The initiative has sponsored more than 350 projects which includes companies, private, universities, and national laboratories.

Middle East & Africa is anticipated to witness highest growth during the forecast period. The region is expected to witness significant growth over the next ten years on account of high solar potential and increase in investments in the solar projects in the region, particularly in UAE, and Saudi Arabia. Among these, Saudi Arabia held the highest share in 2021, owing to large investments being made by both domestic and foreign parties. The country also witnessed significant growth in light of investments being made by U.S. solar companies, due to the country’s favorable climatic conditions.

Key Companies & Market Share Insights

Companies are focusing on developing advanced technology-based products owing to the growing industrial demands for advanced technology for tracking purpose. The manufacturing companies are adopting various organic and in-organic growth strategies for expanding their geographical reach and product portfolio. The strategy framework of major solar tracker manufacturer is centered around bagging orders for large purchases as it gives the manufacturer an opportunity to achieve economies of scale. The research and development of solar trackers is a major differentiating factor for manufacturers in this market. Some of the prominent players in the global solar tracker market are:

-

Abengoa Solar S.A.

-

AllEarth Renewables

-

Array Technologies Inc.

-

DEGERenergie GmbH & Co. KG

-

Nclave

-

Powerway Renewable Energy Co. Ltd.

-

Soltec Tracker

-

SunPower Corporation

-

Titan Tracker

-

Trina Solar Limited

Solar Tracker Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.75 billion

Revenue forecast in 2030

USD 29.31 billion

Growth rate

CAGR of 26.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in megawatt, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Spain; Italy; Germany; France; China; India; Japan; UAE; Saudi Arabia; Brazil; Chile

Key companies profiled

Abengoa Solar S.A.; AllEarth Renewables; Array Technologies Inc.; DEGERenergie GmbH & Co. KG; Nclave; Powerway Renewable Energy Co. Ltd.; Soltec Tracker; SunPower Corporation; Titan Tracker; Trina Solar Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Tracker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global solar tracker market report based on technology, type, application, and region:

-

Technology Outlook (Volume, Megawatt; Revenue, USD Million, 2018 - 2030)

-

Solar Photovoltaic (PV)

-

Concentrated Solar Power (CSP)

-

Concentrated Photovoltaic (CPV)

-

-

Type Outlook (Volume, Megawatt; Revenue, USD Million; 2018 - 2030)

-

Single Axis

-

Dual Axis

-

-

Application Outlook (Volume, Megawatt; Revenue, USD Million; 2018 - 2030)

-

Utility

-

Non-utility

-

-

Regional Outlook (Volume, Megawatt; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Chile

-

-

Middle East &Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global solar tracker market size was estimated at USD 4.41 billion in 2022 and is expected to reach USD 5.74 billion in 2023.

b. The global solar tracker market is expected to witness a compound annual growth rate of 22.6% from 2023 to 2030 to reach USD 29.31 billion by 2030.

b. Double-axis trackers held the largest share of 50.83% in 2022 because these systems track the sun’s rays along a two axes allowing them to increase system performance or more over fixed PV cells in the areas of high isolation.

b. Some key players operating in the solar tracker market include AllEarth Renewables, Inc.; NEXTracker, Inc.; Soltec; PV Hardware; Artech Solar; NClave; and Powerway Renewable Energy Co. Ltd.

b. Key factors that are driving the solar tracker market growth include rising concerns over energy conservation and transition from non-renewable energy to renewable energy is expected to surge demand for solar energy and trackers over the forecast period on a global level.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.