- Home

- »

- Advanced Interior Materials

- »

-

Solenoid Valves Market Size, Share & Growth Report, 2030GVR Report cover

![Solenoid Valves Market Size, Share & Trends Report]()

Solenoid Valves Market Size, Share & Trends Analysis Report By Material (Stainless Steel, Brass, Aluminum, Plastic), By Function (2 Way, 4 Way), By End-use (Oil & Gas, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-363-2

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Solenoid Valves Market Size & Trends

The global solenoid valves market size was estimated at USD 4.88 billion in 2023 and is forecasted to grow at a CAGR of 3.8% from 2024 to 2030. This growth is attributed to the expansion of various end-use industries such as oil & gas, chemical & petrochemical, food & beverage, power generation, and automotive, coupled with industrial automation across these sectors. Automation requires precise control over fluid flow, which solenoid valves provide efficiently, increasing their market use.

Ongoing advancements in solenoid valve technology, including the development of smart and IoT-enabled valves, offer new opportunities for product growth. These advanced valves provide real-time monitoring, predictive maintenance, and enhanced control, aligning with the latest market trends. Furthermore, the growing demand for customized and application-specific solenoid valves presents opportunities for manufacturers to develop tailored solutions. Companies can differentiate themselves in this competitive market by addressing unique customer requirements and providing specialized products.

High initial costs associated with the installation and maintenance of solenoid valves are expected to restrain growth, which can limit their adoption in cost-sensitive industries. In addition, this product may face operational limitations under certain conditions, such as high-pressure and high-temperature environments, which can restrict its usage in specific applications and industries.

The market also includes alternative flow control technologies, such as manual valves, pneumatic actuators, and electric actuators, which pose a challenge to product growth. However, the increasing focus on sustainability and energy efficiency creates opportunities for solenoid valves designed to reduce energy consumption and environmental impact over the coming years.

Material Insights

Based on material, the market is segmented into stainless steel, brass, aluminum, and plastic. Stainless steel dominated the market with a revenue share of 35.25% in 2023 and is further expected to grow significantly over the forecast period. Stainless steel is one of the most popular materials for product manufacturing owing to its exceptional durability, corrosion resistance, and ability to withstand high temperatures and pressures. It is particularly suitable for applications such as oil & gas, chemical processing, food & beverage, and pharmaceuticals on account of its ability to handle aggressive chemicals.

Demand for plastic material for solenoid valve manufacturing is anticipated to grow at the fastest rate of 4.1% over the forecast period. Plastic solenoid valves, made from materials like PVC, PTFE, and polypropylene, are used in applications where chemical resistance, lightweight, and cost efficiency are important. The material is non-reactive and suitable for applications involving aggressive chemicals.

Function Insights

2 way function solenoid valve dominated the market with a revenue share of 42.93% in 2023 and is further expected to grow significantly over the forecast period. They are typically used for on/off control in a variety of applications in water systems, HVAC, industrial automation, and medical devices. They consist of simple design and operation, offering easy installation and maintenance. Furthermore, products with this function type are reliable and efficient for on/off control.

Demand for 4 way solenoid valve is anticipated to grow at the fastest CAGR over the forecast period. These valves are designed with four or more ports and are typically used in applications requiring reversing the fluid flow direction or controlling double-acting actuators. In addition, these valves are essential in complex control systems where multiple flow paths are required to be managed simultaneously.

End-use Insights

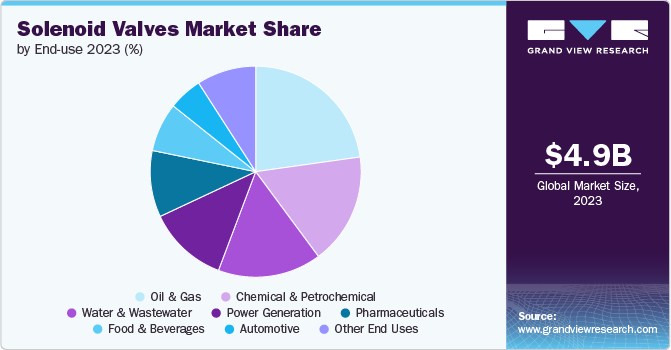

Based on end use, the market is segmented into oil & gas, chemical & petrochemical, water & wastewater, food & beverages, power generation, pharmaceuticals, and automotive. Among these, oil & gas accounted for the largest revenue share of 22.75% in 2023 and is further expected to grow at the fastest rate over the forecast period on account of their critical use in controlling the flow of various fluids and gases upstream, midstream, and downstream operations of the sector. Furthermore, in oil & gas sector, this product offers enhanced safety and control in hazardous applications.

The automotive segment is expected to grow at the fastest rate of 4.7% over the forecast period. The automotive industry utilizes solenoid valves in various systems, such as fuel systems, transmission systems, and HVAC systems, to control the flow of fluids and gases. This product contributes to the efficiency, safety, and performance of vehicles by improving fuel efficiency and engine performance.

Regional Insights

The solenoid valves market in North America is expected to grow significantly over the years. This demand is supported by a strong industrial base and ongoing advancements in automation and process control in the region. In addition, increasing focus on shale gas extraction and the expansion of pipeline infrastructure further boost demand for these valves.

U.S. Solenoid Valves Market Trends

The solenoid valves market in the U.S. is growing at a CAGR of 3.2% over the forecast period. The automotive sector, a major industry in the U.S., utilizes solenoid valves for various functions, including fuel systems, emission control, and HVAC systems, contributing to the market's expansion in the country.

Europe Solenoid Valves Market Trends

The solenoid valves market in Europe dominated in 2023 with a revenue share of 38.41% and is further expected to grow significantly over the forecast period. This growth is fueled by the region's advanced industrial capabilities, stringent environmental regulations, and emphasis on technological innovation. The key markets driving this demand are Germany, France, UK, and Italy. Furthermore, the focus on reducing carbon footprints and enhancing energy efficiency further drives the adoption of advanced solenoid valves that offer precision and reliability in the region.

Asia Pacific Solenoid Valves Market Trends

The solenoid valves market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. Expanding industrialization, urbanization, and infrastructural developments in countries like China, India, Japan, and South Korea, with significant investments in sectors such as manufacturing, automotive, oil and gas, and water treatment, are fueling product growth.

Key Solenoid Valves Company Insights

Some of the key players operating in the market are Emerson Electric Co. and IMI Process Automation:

-

Emerson Electric Co., established in 1890 in Missouri, is involved in engineering and automation technology services. The company serves many industries, such as oil and gas, power generation, water and wastewater management, and manufacturing. Its extensive portfolio includes a broad spectrum of automation products.

-

IMI Process Automation manufactures, designs, and installs flow control systems for severe and challenging environments. Its product portfolio is categorized into control, isolation, and safety Valves, actuation, trim upgrades, asset monitoring, and special solutions. Furthermore, it operates manufacturing facilities in around 12 countries and global distribution networks.

KANEKO SANGYO Co. Ltd and Anshan Solenoid Valve Co. Ltd are some of the emerging participants in the market.

-

Anshan Solenoid Valve Co. Ltd is a solenoid valve manufacturer and was formerly known as Dandong Solenoid Valve Factory. The company also produces advanced control valves, including pneumatic, marine, and electric valves.

-

KANEKO SANGYO Co. Ltd was established in 1919 and is involved in the production and supply of valves. It is also involved in designing, manufacturing, and repairing ventilation equipment. Its major products include solenoid valves, liquid level gauges, and ventilation equipment.

Key Solenoid Valves Companies:

The following are the leading companies in the solenoid valves market. These companies collectively hold the largest market share and dictate industry trends.

- Emerson Electric Co.

- IMI Process Automation

- Danfoss Industries Ltd

- Curtiss Wright Corporation

- Parker Hannifin Corporation

- AirTAC International Group

- KANEKO SANGYO Co. Ltd

- Anshan Solenoid Valve Co. Ltd

- CEME Group

- SMC Corporation

Recent Developments

- In August 2023, SMC Corporation launched its new product, stainless steel 2-port solenoid valves. This product is expected to be used in drinking water applications.

Solenoid Valves Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.10 billion

Revenue forecast in 2030

USD 6.64 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, function, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Emerson Electric Co.; IMI Process Automation; Danfoss Industries Ltd; Curtiss Wright Corporation; Parker Hannifin Corporation; AirTAC International Group; KANEKO SANGYO Co. Ltd; Anshan Solenoid Valve Co. Ltd; CEME Group; SMC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solenoid Valves Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global solenoid valves market based on material, function, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Brass

-

Aluminum

-

Plastic

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

2 Way

-

3 Way

-

4 Way

-

Other Functions

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & gas

-

Chemical & Petrochemical

-

Water & Wastewater

-

Food & Beverages

-

Power Generation

-

Pharmaceuticals

-

Automotive

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global solenoid valves market size was estimated at USD 4.88 billion in 2023 and is expected to reach USD 5.10 billion in 2024.

b. The global solenoid valves market is expected to grow at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2030 to reach USD 6.64 billion by 2030.

b. Oil & gas end use accounted for largest revenue share of 22.7% in 2023 on account of their critical use in controlling the flow of various fluids and gases in upstream, midstream, and downstream operations of sector.

b. Some key players operating in the solenoid valves market include Emerson Electric Co., IMI Process Automation, Danfoss Industries Ltd, Curtiss Wright Corporation, Parker Hannifin Corporation, AirTAC International Group, KANKEO SANGYO Co. Ltd, Anshan Solenoid Valve Co. Ltd, CEME Group, and SMC Corporation.

b. The key factors that are driving the solenoid valves market growth is the expansion of various end use industries such as oil & gas, chemical & petrochemical, food & beverage, power generation, and automotive coupled with industrial automation across these sectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."