- Home

- »

- Consumer F&B

- »

-

Sourdough Market Size, Share, Growth Analysis Report 2030GVR Report cover

![Sourdough Market Size, Share & Trends Report]()

Sourdough Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Type I, Type II, Type III), By Application (Breads, Cookies, Cakes, Waffles, Pizza), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-510-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sourdough Market Summary

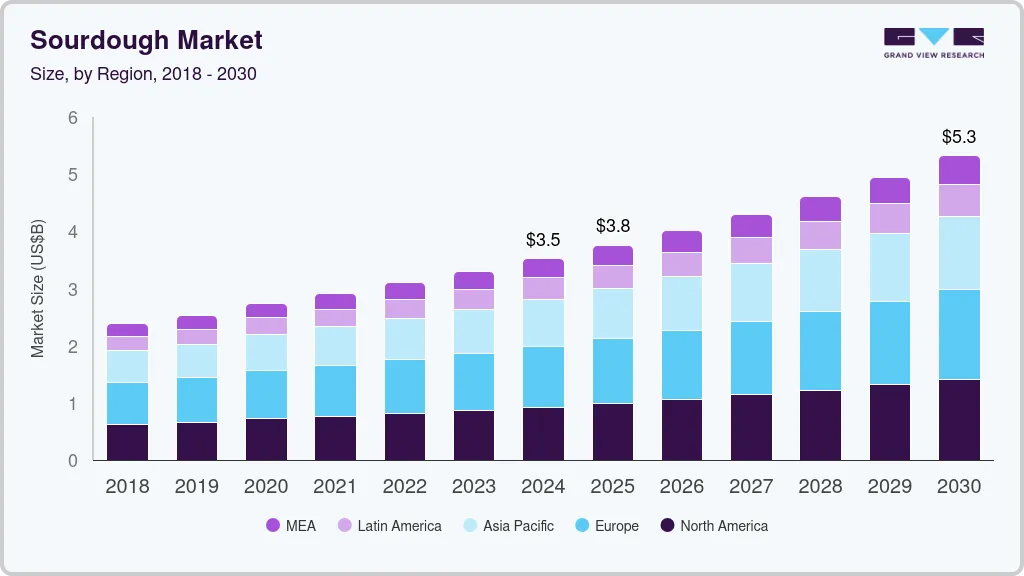

The global sourdough market size was valued at USD 3.30 billion in 2023 and is projected to reach USD 5.32 billion by 2030, growing at a CAGR of 7.2% from 2024 to 2030. Consumer preference for healthy and artisanal baked goods has triggered the need for sourdough.

Key Market Trends & Insights

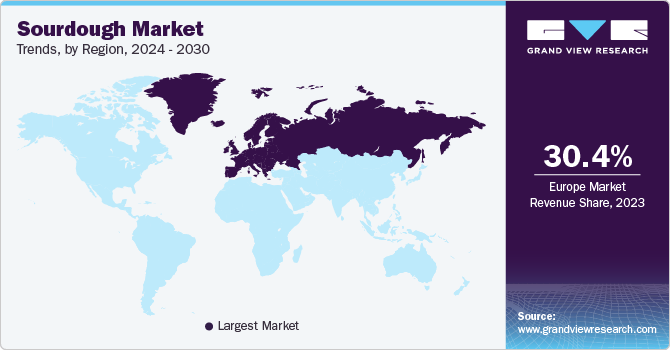

- The sourdough market in Europe dominated globally in 2023 with a revenue share of 30.4%.

- Asia Pacific sourdough market is anticipated to witness significant growth in 2023.

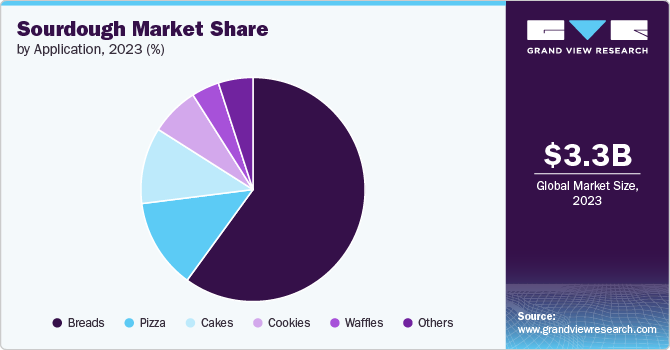

- Based on application, the bread segment dominated in 2023 with a market share of 60.1%.

- Based on type, the type III segment dominated with a market share of 42.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.30 Billion

- 2030 Projected Market Size: USD 5.32 Billion

- CAGR (2024-2030): 7.2%

- Europe: Largest market in 2023

The rise in artisanal bread, growing consumer awareness about the health benefits, and increasing popularity of clean-labeled organic products are expected to drive market growth. In addition, the surge in home-baking activities, especially in post-pandemic times has significantly boosted the demand. The abundant availability of sourdough products in retail and online channels further contributes to market growth.

The sourdough industry is fuelled by product innovation specifically the diversification in various food segments. Manufacturers of bakery food products follow new formulations to create products that incorporate sourdough for items such as pizza, crackers, and snacks. This diversification helps in profiling customer needs. In addition, some trends related to the ongoing developments of the nutrient mix and the improvement of the fermentation process improve the stability of production and quality of sourdough making them more popular among consumers and industrial bakers.

Consumer awareness of sustainable living standards and environmental protection has also increased in the past few years. Sourdough production involves a longer fermentation time, which minimizes the use of artificial ingredients and preservatives. This aligns with the latest trends in the use of organic ingredients and clean labeling. Furthermore, the consumption of sourdough bread is on the rise as most producers of sourdough bread have adopted eco-friendly practices.

Type Insights

The type III segment dominated with a market share of 42.8% in 2023 owing to its versatility and convenience in large-scale commercial baking. Type III profiles the controlled fermentation process and defines the standard taste, followed by industrial bakers ensuring consistency and stable quality. The segment has become highly popular and is known for its nutritional value and the longevity of the baked products.

Type II is expected to register a CAGR of 7.4% during the forecast period due to its unique balance of traditional sourdough flavors and modern convenience. The duration of the fermentation process is relatively short compared to other types, resulting in a customized taste and texture. In addition, the increasing consumer preference for clean-label and naturally fermented products supports type II sourdough segment growth.

Application Insights

The bread segment dominated in 2023 with a market share of 60.1% as bread is an essential commodity to the population. In addition, the increased preference for bread products is contributing to the segment growth. In addition, sourdough breads are easily digested and have high nutrient value which is anticipated to drive the market growth. Furthermore, the artisanal appeal and quality of sourdough bread drives its adoption in home baking and commercial bakery, further boosting its growth.

The pizza segment is projected to grow at a CAGR of 8.1% over the forecast period as the customers are looking forward to premium and artisanal products. Sourdough pizza crusts end up tasting better than regular doughs. It is also becoming the focus of attention among customers who desire taste without compromising their health. In addition, there is an increasing use of gourmet and customization options offered in restaurants that use sourdough bases for pizza crusts. Furthermore, the natural fermentation processes are trending in the food industry enhancing food digestibility and promoting probiotics development. Therefore, these factors are anticipated to drive the use of sourdough bases in the pizza segment in the forthcoming years.

Regional Insights

North America sourdough market was identified as a lucrative region in 2023 owing to the high consumption and the increase in demand for healthy food and the availability of on-the-go products. In addition, the demand for artisanal and premium bakery goods is growing tremendously which is anticipated to drive the market growth. Furthermore, the increasing availability of sourdough in supermarkets and specialty stores is expected to further propel the market growth in this region.

Europe Sourdough Market Trends

The sourdough market in Europe dominated globally in 2023 with a revenue share of 30.4%. This is driven by the traditional practices of artisanal baking and a strong cultural preference for naturally fermented bread products. In addition, there is an increased awareness among European consumers of the health benefits associated with sourdough, such as improved digestibility and nutritional value, which has significantly boosted demand. Furthermore, the expanding availability of a diverse range of sourdough products in artisanal bakeries and mainstream retail channels is anticipated to drive market growth in this region.

The UK sourdough market is expected to grow at a significant rate in the coming years as the population is becoming health-conscious. Thus, sourdough is perceived as a healthy product for its digestive health benefits. Furthermore, the increase in specialty bakeries cafes and emerging trends of home baking are further anticipated to propel the market growth.

Asia Pacific Sourdough Market Trends

Asia Pacific sourdough market is anticipated to witness significant growth in 2023. The population in this region is becoming more health-conscious and is selective about the nutrients in the foods they consume. In addition, the population is gradually receptive to sourdough and its benefits and has begun to realize its distinct flavor, which is anticipated to drive market growth. Furthermore, the changing demographics of the market and the rise of artisanal and specialty stores along with the rising disposable income across Asia Pacific are further expected to propel the market growth.

China sourdough market held a substantial share in 2023 pertaining to the growing interest among Chinese consumers for healthy and natural food options. The fermented dough method fits well with this trend, as it offers high dietary and nutritional values compared with commercial bread. In addition, China has witnessed a rise in upper-middle-income groups, with increased spending.

Key Sourdough Company Insights

Some key companies in the global sourdough market include Puratos, Boudin Bakery, Alpha Baking Company, Inc., Josey Baker Bread, and others. Organizations focus on increasing customer base to gain a competitive edge in the industry.

-

Puratos is a global company specializing in bakery, pastries, and other chocolate products, focusing on sourdough solutions. Their wide range of sourdough products includes ready-to-use sourdoughs, sourdough starters, and flavor enhancers, catering to various regional tastes and preferences.

Key Sourdough Companies:

The following are the leading companies in the sourdough market. These companies collectively hold the largest market share and dictate industry trends.

- Puratos

- Boudin Bakery

- Riverside Sourdough

- Lallemand

- Truckee Sourdough Company

- Gold Coast Bakeries (Queensland) Pty Ltd

- Alpha Baking Company, Inc.

- Josey Baker Bread

- Bread SRSLY

- Morabito Baking Co. Inc.

View a comprehensive list of companies in the Sourdough Market

Recent Developments

-

In December 2023, Lallemand acquired Evolva, a Swiss biotechnology company that specializes in the production of high-value ingredients. This acquisition enhances Lallemand's capabilities in biotechnology and fermentation, allowing the development of innovative products across various industries. The move aligns with Lallemand's strategic goals to expand its product portfolio and strengthen its position in the biotechnology market.

-

In July 2023, Puratos scaled up in the Kosovo market in collaboration with Korabi Corporation, aiming to strengthen its position and support local bakers and patissiers. This strategic move allows Puratos to bring its innovative products and services closer to the Kosovo market, enhancing the local baking industry. The collaboration reflects Puratos' commitment to growth and supporting local markets with high-quality baking solutions.

Sourdough Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.52 billion

Revenue forecast in 2030

USD 5.32 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil, South Africa

Key companies profiled

Puratos; Boudin Bakery; Riverside Sourdough; Lallemand; Truckee Sourdough Company; Gold Coast Bakeries (Queensland) Pty Ltd; Alpha Baking Company; Inc.; Josey Baker Bread; Bread SRSLY; Morabito Baking Co. Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sourdough Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sourdough market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Type I

-

Type II

-

Type III

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Breads

-

Cookies

-

Cakes

-

Waffles

-

Pizza

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.