- Home

- »

- Medical Devices

- »

-

South Korea Anti-acne Dermal Patch Market Report, 2030GVR Report cover

![South Korea Anti-acne Dermal Patch Market Size, Share & Trends Report]()

South Korea Anti-acne Dermal Patch Market Size, Share & Trends Analysis Report By Product (Chemical Based, Herbal Based), By Age Group, By Distribution Channels, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-935-1

- Number of Report Pages: 111

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

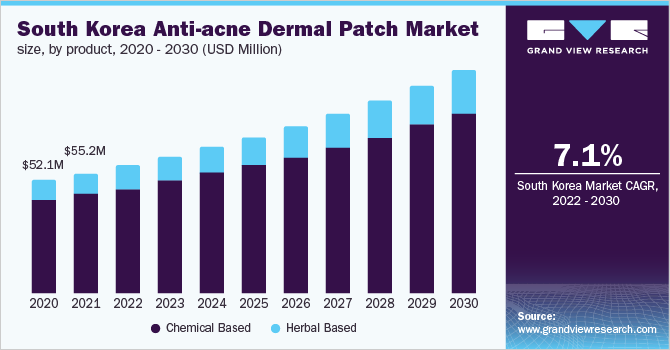

The South Korea anti-acne dermal patch market size is valued at USD 55.2 million in 2021 and is expected to register a compound annual growth rate (CAGR) of 7.1% from 2022 to 2030. The anti-acne dermal patch is a medicated pimple patch filled with active ingredients that helps to eliminate the acne-causing bacteria and reduce inflammation. These patches improve the absorption of the active ingredients into the skin thus reducing pain, bumps, and redness, and are effective in curing inflamed acne, such as papules. The rising incidence of skin conditions such as severe acne and pimples is anticipated to drive the market for anti-acne dermal patches. Increasing demand for instant acne treatment and medication is one of the major factors supporting the growth of the market. Furthermore, the growing demand for anti-acne dermal patches among the population especially among the teenage group and young adults owing to its mass marketing across the social media platforms has also boosted its adoption over the past few years.

However, the advent of the COVID-19 pandemic has hugely affected the overall market for anti-acne dermal patches. The given COVID-19 restrictions have significantly impacted the beauty and personal care industry. Owing the initial lockdown imposed across the world has led to a decline in sales of beauty products including acne patches, especially across the brick-and-mortar stores. Disruption in the supply chain and closure of cosmetic manufacturing plants across the globe are a few of the factors that have led to the significant decline in the growth rate of the anti-acne dermal patch industry in 2020. For instance, as per an article published by the Baird Investment Advisor Co., Ltd., the parent beauty, and personal care industry has witnessed a decline of 2-3% in 2020.

However, the market witnessed a revenue rebound in 2021, owing to the surge in demand for online platforms delivering acne products including patches. For instance, as per Peace Out Company; a beauty and personal care company building on the popularity of its acne dot reported a 131.0% growth in its revenue in 2021 from online sales of its products including acne patches. Hence, the growing demand for online portals has significantly mitigated the negative impact of the COVID-19 pandemic on the anti-acne dermal patch industry, thus reflecting a growth trajectory from 2021. Moreover, an increasing number of companies involved in the market are focusing on inorganic strategic partnerships to expand their target customers, thus mitigating the negative impact of the COVID-19 pandemic. The South Korea anti-acne dermal patch segment is expected to witness a growth of 7.1% during the forecast period. Other key growth factors include increasing demand for increasing focus on aesthetic appearance, rising focus on the middle-class population, and psychological burden associated with acne.

Type Insights

Chemical-based anti-acne dermal patches held a lucrative share of more than 83.1% in 2021. The herbal-based anti-acne dermal patch segment is anticipated to witness the highest growth rate of 7.8% across the forecast period as compared to chemical-based patches. Generally, acne patches in the market are composed of synthetic substances and chemicals like hydrocolloids, salicylic acid, etc. The herbal acne patch does not have any synthetic substances in its composition and is made from ingredients such as Silk and mulberries that can be easily produced. Silk consists of fibroin and sericin. Fibroin can enhance the growth rate of fibroblast which can quickly treat acne wounds.

Increasing demand for herbal-based skincare products across the globe due to their natural healing properties without any side effects is one of the major factors supporting the growth of the herbal-based anti-acne dermal patch segment. The chemical-based anti-acne dermal patch segment on the other hand is poised to hold a significant share in the market for anti-acne dermal patches across the forecast period. This is because most of the anti-acne dermal patches across the industry are chemical-based due to their instant healing properties compared to herbal patches. Moreover, an increasing number of product launches in the category will strongly support the highest shares of the segment.

Age-Group Insights

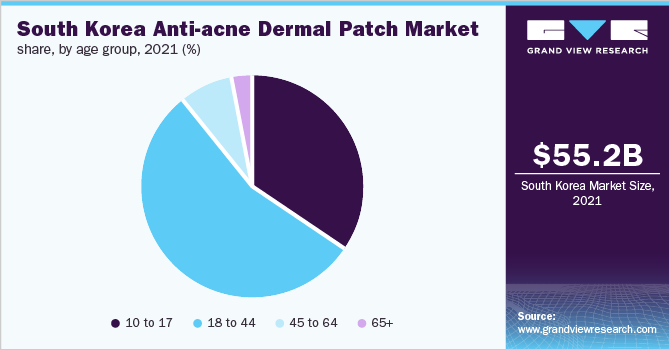

The age group 18 to 44 forms the largest user segment with a share of around 55.4% in 2021. This age group mostly struggles with acne skin conditions because of several reasons like bad dietary habits, hormonal changes, and stress. The age group 10 to 17 is the second most affected group as this group consists of teenagers who generally hit puberty at this age.

The demand for South Korea anti-acne dermal patch in-age group 18 to 44 is likely to boost as the youth is becoming more conscious about their physical appearance as it attributes to their self-confidence and self-esteem. Also, the psychological burden associated with acne can be anticipated with the market growth of Anti-Acne products. There are abundant options available in the market for acne prevention and acne treatment including laser therapy and cryotherapy. But products like Anti-Acne dermal patches being cost-effective, less time-consuming, and excellent results are likely to increase during the forecast period.

Distribution Channel Insights

Pharmacy and drug stores are the predominant distribution channel for the South Korean anti-acne dermal patch market with a share of 43.4% in 2021. Acne is a common skin condition, and it affects around 80% of the population. Owing to the rising negative social stigma associated with beauty standards and post-acne scars Anti-Acne dermal Patch market is expected to grow at a higher rate. Acne prevention products including dermal patches are sold as an over-the-counter product in the pharmacy stores making the product easily available and has helped in contributing to the market share.

Rising e-commerce platforms like Amazon are helping the products to expand globally through easy buy, sell, and quick delivery strategies. An e-commerce distribution channel is projected to become the most profitable channel during the forecast period. Moreover, With the addition of promotions, discounts, coupons, and Groupon, consumers are even more likely to shop online than go to physical stores. Advertising of products has become convenient such as social media advertisement, which will help to increase the product reach and make it available globally. Recommendations, advice, and reviews from friends, family, and followers are also easy ways to get deals online, making this mode of shopping one of the easiest and most streamlined by far.

Key Companies & Market Share Insights

New product developments, collaborations, regional expansion, and mergers are key strategic initiatives undertaken. For instance, In September 2021, COSRX leading as skincare brand and known as the best in all Anti-acne dermal patch market product launched the upgraded COSRX master patch intensive, an upgraded version of the hydrocolloid patches that form a protective, air-tight, healing seal around the blemishes.

In January 2021, Hero Cosmetics, Inc., an award-winning leader in next-generation functional skincare, announced that it received a significant minority growth investment from Aria Growth Partners, a leading consumer-focused private equity firm. The investment will enable Hero to fuel continued growth, product innovation, and expanded distribution of its innovative, highly effective, and accessibly priced skincare products. Some of the prominent players in the South Korea anti-acne dermal patch market include:

-

Hero Cosmetics

-

COSRX

-

NeoGen Dermalogy

-

CNP Laboratory

-

Innisfree

-

NICO MEDICAL CO. LTD.

-

Daewoong Pharmaceutical

South Korea Anti-Acne Dermal Patch Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 58.96 million

Revenue forecast in 2030

USD 101.8 million

Growth Rate

CAGR of 7.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, age group, distribution channels

Key companies profiled

Hero Cosmetics; COSRX; Neogen Dermalogy; CNP Laboratory; Innisfree; NICO MEDICAL CO. LTD.; Daewoong Pharmaceutical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the South Korea anti-acne dermal patch market report based on product type, age group, and distribution channel:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical based

-

Herbal based

-

-

Age Group Outlook (Revenue, USD Million, 2018-2030)

-

10 to 17

-

18 to 44

-

45 to 64

-

65+

-

-

Distribution Channels Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail stores

-

Pharmacy and Drug stores

-

E-commerce Platforms

-

Frequently Asked Questions About This Report

b. The South Korea Anti-acne Dermal Patch market size was estimated at USD 55.2 million in 2021 and is expected to reach USD 58.9 million in 2022.

b. The global South Korea Anti-acne Dermal Patch market is expected to grow at a compound annual growth rate of 7.1% from 2022 to 2030 to reach USD 101.8 billion by 2030.

b. Pharmacy and drug stores are the predominant Distribution channel for the South Korean Anti-Acne Dermal Patch market with a share of 43.4% in 2021. Acne prevention products including dermal patches are sold as an over-the-counter product in the pharmacy stores making the product easily available and has helped in contributing to the market share.

b. The key players in the market include Hero Cosmetics, COSRX, Neogen Dermalogy, CNP Laboratory, Innisfree, NICO MEDICAL CO. LTD., Daewoong Pharmaceutical

b. The growing incidence of acne across the country is one of the major factors supporting the growth of the anti-acne dermal patch market during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."