- Home

- »

- Beauty & Personal Care

- »

-

Spa Market Size, Share, Trends And Growth Report, 2030GVR Report cover

![Spa Market Size, Share & Trends Report]()

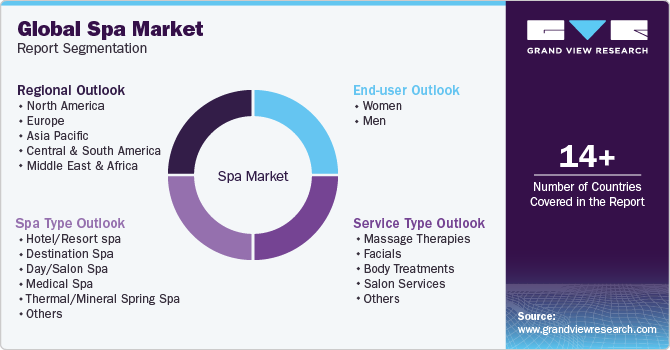

Spa Market Size, Share & Trends Analysis Report By Spa Type (Hotel/Resort Spa, Destination Spa, Day/Salon Spa, Medical Spa, Thermal/Mineral Spring Spa), By Service Type, By End-user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-373-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Spa Market Size & Trends

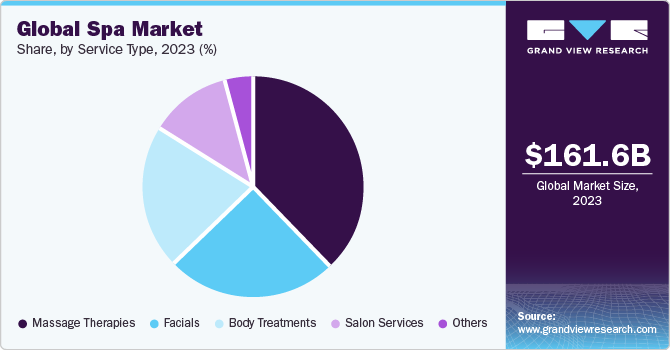

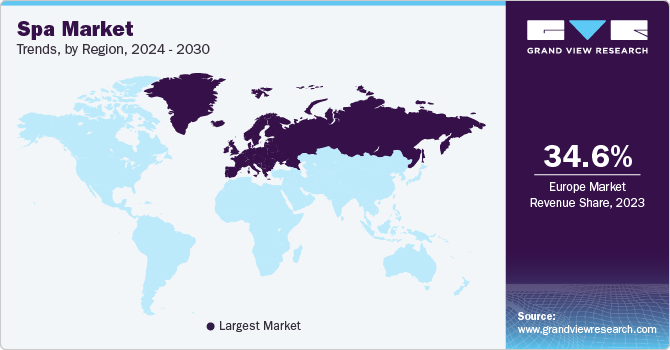

The global spa market size was estimated at USD 161.57 billion in 2023 and is expected to grow at a CAGR of 13.2% from 2024 to 2030. The growth in tourism in Europe and Asian countries such as Thailand, Indonesia, and Vietnam has led to an increase in demand for spa services. As more people travel for leisure and business, there is a growing desire for relaxation and wellness experiences. These factors have contributed to the market growth in these regions, with an increasing number of tourists seeking out spa treatments and services during their travels.

The growth in wellness tourism in Europe has led to the opening of several new luxury spas and hotels in 2023. London witnessed the debut of four prominent names, Raffles, Six Senses, The Peninsula, and Mandarin Oriental, with the latter unveiling its urban spa concept in a new hotel in Mayfair, UK, according to the europeanspamagazine.com.

In addition, Greece, Italy, Spain, Switzerland, and Austria are also poised to welcome new spa properties, further elevating the standard of health and wellbeing offerings across the continent. The rise of wellness tourism in Europe bodes well for the growth of the spa market in the region. The growing demand for high-end health and well-being experiences positions the spa industry for continued expansion.

With today's fast-paced and sedentary lifestyles, there has been a growing awareness and emphasis on wellness and self-care. More and more people, especially the younger generation, are recognizing the importance of prioritizing their physical, mental, and emotional well-being.

According to a survey of 1,000 UK men conducted by the destination spa group Champneys in 2021, over 22% expressed a desire to focus on their wellness and wellbeing, with Gen Z men being particularly keen on prioritizing self-care. Specifically, they are enthusiastic about incorporating skincare, massage, spa treatments, and nutrition into their lives. In addition, a quarter of respondents expressed interest in seeing more male-specific treatments in spas. The survey indicated millennials aged 25- 35 and 35 - 44 are leading the way in prioritizing self-care and wellbeing.

Consumers are increasingly opting for massage therapies due to a growing awareness of the benefits of wellness and self-care. According to an annual survey by the American Massage Therapy Association (AMTA) in 2022, 95% of individuals view massage as beneficial to overall health and wellness. People are also turning to these spa treatments as a natural and non-invasive way to manage and alleviate physical discomfort.

The number of spa visits and locations is growing due to increasing awareness of the importance of self-care and wellness. As people seek relaxation and stress relief, spas provide a sanctuary for rejuvenation and pampering. This trend is driving market growth as more individuals prioritize their well-being and seek out spa services for physical and mental rejuvenation. The expanding variety of spa treatments and experiences also contributes to the appeal, attracting a broader range of clientele and driving market growth.

Market Concentration & Characteristics

End-users who prioritize health, fitness, and overall well-being form a niche segment in the spa market. Individual consumers who seek spa services for personal relaxation, rejuvenation, and self-care contribute significantly to the end-user concentration in the market. These consumers may visit spas for various treatments such as massages, facials, body treatments, and wellness therapies.

Regulations often mandate that spa establishments and professionals adhere to specific licensing and certification standards. This ensures that services provided are of high quality, safe, and meet industry standards. Compliance with these requirements may increase operational costs but also instill trust among customers.

Partnerships play a vital role in the spa market, as they allow for the pooling of resources, expertise, and innovative ideas. Collaborating with other companies or organizations can help spa businesses access new markets, technologies, and customer bases. Moreover, partnerships can lead to the development of unique and compelling offerings. By partnering with others, spas can enhance their offerings, expand their reach, and ultimately provide their customers with a more comprehensive and appealing experience.

Spa Type Insights

The day/salon spa segment accounted for a revenue share of around 43.81% in 2023. Day and salon spas provide a diverse range of spa services, including massages, facials, and body treatments, administered by skilled professionals on a day-use basis. Club spas, similar to day spas, are typically housed within fitness facilities. Salon spas, on the other hand, operate within facilities primarily offering beauty services such as hair, cosmetics, and nails

The destination spa is projected to grow at a CAGR of 15.7% over the forecast period of 2024-2030. Destination spas provide a complete spa immersion where every guest partakes. Along with spa and body treatments, the all-inclusive programs encompass a wide array of choices, including fitness, mind/body practices, specialized diets, cleansing, energy work, personal coaching, nutritional guidance, weight management, sports medicine, and preventative or therapeutic medical services.

The cultural importance and widespread appeal of destination spas are evident through their frequent support by both locals and tourists. The recent surge in popularity of these spas reflects a growing interest among individuals in enhancing their overall health and wellness. Visitors are drawn to destination spas for a variety of reasons, such as seeking respite from city life, alleviating stress, or simply indulging in self-care.

End-user Insights

Spa services availed by women accounted for a market share of 73.01% in 2023. A rising proportion of women have been experiencing stress, exhaustion, and fatigue. Massage therapies and similar relaxation treatments offered by spas are a viable solution for mitigating stress levels, given their ability to induce relaxation and bolster overall well-being.

The demand for spa services among men is projected to grow at a CAGR of 14.1% over the forecast period of 2024-2030. The rising trend of men seeking relaxation and pampering experiences at spas is evident, with a remarkable 346% surge in male spa bookings from 2019 to 2023, as reported by Spabreaks.com, a prominent spa experience and booking agency. Many spas provide a wide range of treatments suitable for men, with most offerings and products being gender-neutral. This further drives the adoption of spa services among men offering service providers valuable opportunity to tailor their marketing efforts to specifically target male clientele.

Service Type Insights

The massage therapies held a market share of 38.28% in 2023. People prefer spa massage therapies for relaxation in serene environments with skilled therapists, tailored treatments, and holistic wellness approaches. These therapies offer physical benefits like tension relief and improved circulation, along with mental and emotional benefits such as stress reduction and enhanced well-being, all within a pampering spa experience. According to the annual SpaSeekers Spa Trends Report 2023, over the past year, demand surged for crystal healing massages by 91% and Turkish bath massages by 85%. Crystal healing massages incorporate crystals and minerals placed around the recipient to harness their healing properties during the massage. Consequently, the global market is anticipated to experience strong demand for massage services at spa facilities and hotels.

The demand for salon services is projected to grow at a CAGR of 15.0% from 2024 to 2030. Salon spas offer complete beauty and spa services like haircuts, hairstyles, facials, waxing, manicures, pedicures, and many other services. It also offers a range of relaxing and luxurious treatments that help brides unwind and de-stress before their big day. Brides often opt for services such as scalp treatment, facials, body scrub, microdermabrasion, and many other spa services to ensure they look their best on their wedding day.

Regional Insights

The spa market in North America held 23.18% of the global revenue in 2023. The regional spa industry is constantly evolving, offering new and innovative treatments that cater to diverse consumer needs. This includes incorporating technological advancements, organic and natural ingredients, and specialized wellness programs to stay competitive and attract customers.

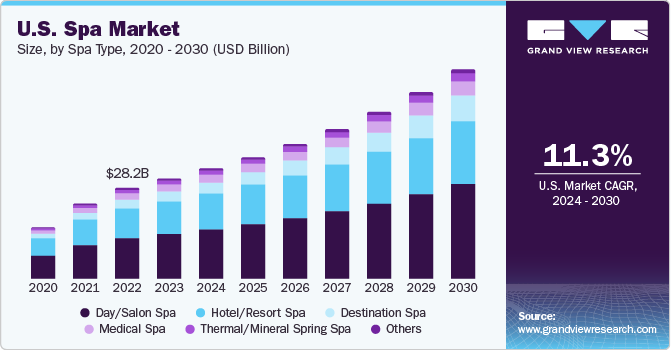

U.S. Spa Market Trends

The spa market in the U.S. is expected to grow at a CAGR of 11.3% from 2024 to 2030. The growing emphasis on holistic health and self-care in modern lifestyles across the U.S. has led more people to recognize the benefits of spa treatments for physical and mental well-being. As individuals face high levels of stress from work, personal responsibilities, and societal pressures, spa treatments offer a much-needed retreat for relaxation and rejuvenation.

Europe Spa Market Trends

The spa market in Europe held 34.62% of the global revenue in 2023. The designation of the Great Spa Towns of Europe as a UNESCO World Heritage Site emphasizes the historical significance and innovation of European spa culture. These renowned spa towns, span seven countries (Austria, Czech Republic, Austria, the UK, Belgium, France, Italy, and Germany), and offer visitors a chance to experience wellness traditions deeply rooted in history.

Key Spa Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize collaboration/partnerships, new openings, and service launches in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Spa Companies:

The following are the leading companies in the spa market. These companies collectively hold the largest market share and dictate industry trends.

- Woodhouse Spas

- Hand & Stone Franchise Corp

- Mandara Spa

- AYANA Hospitality

- Banyan Tree Hotels & Resorts

- Mandarin Oriental Hotel Group

- Four Seasons Hotels Limited

- Royal Champagne Hotel & Spa

- Miraval Group

- The Ritz-Carlton Spa

Recent Developments

-

In February 2024, Canyon Ranch announced that it would host the first edition of its beauty and wellness festival, called Enchant at Canyon Ranch, from 17 to 21 March at its Tucson resort and spa in Arizona. More than 25 brands will be showcased at the festival, where their teams will host panel discussions, provide demonstrations, and offer bespoke services to attendees.

-

In February 2024, Rocco Forte Hotels announced the launch of its new five-star hotel scheduled to open in Naples in 2027. Following its renovation, the hotel will feature a rooftop with a panoramic pool, 46 spacious suites, a bar, two restaurants, private gardens, and a spa.

-

In December 2023, Mandarin Oriental Hotel Group announced the makeover and rebranding of the Gellért Hotel in Budapest, which will reopen in 2027 as the Mandarin Oriental Gellert, Budapest. The renovation aims to transform the historic Art Nouveau property into a luxury wellness destination, building on the group's reputation for revitalizing landmark properties.

Spa Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 180.85 billion

Revenue forecast in 2030

USD 379.96 billion

Growth rate

CAGR of 13.2% from 2024 to 2030

Actuals data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Spa type, service type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Indonesia; Thailand; Brazil; South Africa

Key companies profiled in U.S.

Woodhouse Spas; Hand & Stone Franchise Corp; Mandara Spa; AYANA Hospitality; Banyan Tree Hotels & Resorts; Mandarin Oriental Hotel Group; Four Seasons Hotels Limited; Royal Champagne Hotel & Spa; Miraval Group; and The Ritz-Carlton Spa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spa Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spa market report based on spa type, service type, end-user, and region:

-

Spa Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hotel/Resort spa

-

Destination Spa

-

Day/Salon Spa

-

Medical Spa

-

Thermal/Mineral Spring Spa

-

Others

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Massage Therapies

-

Facials

-

Body Treatments

-

Salon Services

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Women

-

Men

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Europe dominated the global spa market with a share of around 34.62% in 2023. The designation of the Great Spa Towns of Europe as a UNESCO World Heritage Site emphasizes the historical significance and innovation of European spa culture.

b. The global spa market was estimated at USD 161.57 billion in 2023 and is expected to reach USD 180.85 billion in 2024.

b. The global spa market is expected to grow at a compound annual growth rate of 13.2% from 2024 to 2030 to reach USD 379.96 billion by 2030.

b. The day/salon spa segment held a market share of 43.81% in 2023 owing to the rising wellness tourism around the world.

b. Some of the key players operating in the spa market include Woodhouse Spas; Hand & Stone Franchise Corp; Mandara Spa; AYANA Hospitality; Banyan Tree Hotels & Resorts; Mandarin Oriental Hotel Group; Four Seasons Hotels Limited; Royal Champagne Hotel & Spa; Miraval Group; and The Ritz-Carlton Spa.

b. Key factors that are driving the spa market growth include growing awareness and emphasis on wellness and self-care, and an increasing number of tourists seeking out spa treatments and services during their travel.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."