- Home

- »

- Beauty & Personal Care

- »

-

Spa Products Market Size & Share, Industry Report, 2030GVR Report cover

![Spa Products Market Size, Share & Trends Report]()

Spa Products Market (2025 - 2030) Size, Share & Trends Analysis Report By End-use (Women, Men), By Application (Hotel/Resort Spa, Medical Spa), By Product (Face Skin Care, Body Skin Care), By Type (Affordable, Luxury), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-498-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Spa Products Market Summary

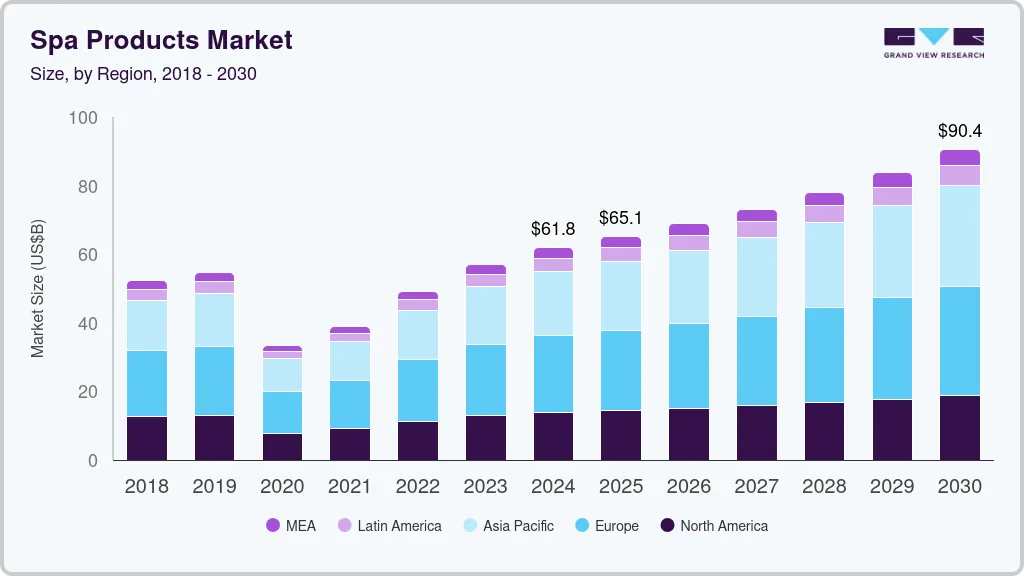

The global spa products market size was estimated at USD 61,817.8 million in 2024 and is projected to reach USD 90,408.9 million by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The spa products market encompasses a wide range of offerings, including skin care, hair care, and body care products designed for use in spas, dermatology clinics, and even at home.Key Market Trends & Insights

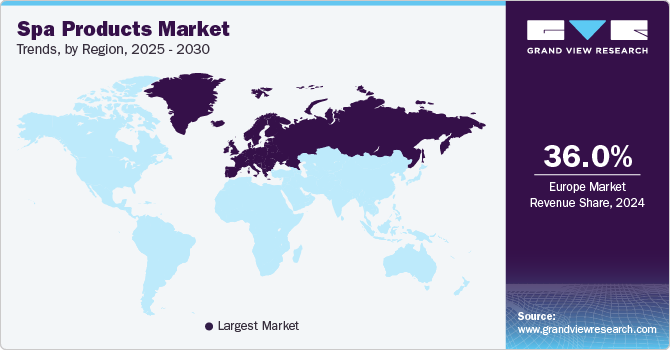

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, Qatar is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, hotel/resort spa accounted for a revenue of USD 10,871.7 million in 2024.

- Medical Spa is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 61,817.8 million

- 2030 Projected Market Size: USD 90,408.9 million

- CAGR (2025-2030): 6.5%

- Asia Pacific: Largest market in 2024

This market has grown significantly in recent years, driven by a rising preference for holistic self-care and premium personal care solutions. Unlike mass-produced options, products in the spa industry are crafted with precision, often featuring higher-quality ingredients and clinical testing. This commitment to excellence has positioned the spa products industry as a leader in delivering luxury and efficacy to consumers worldwide.

Spa products are formulated with a higher concentration of active ingredients and undergo rigorous testing to ensure safety and efficacy. They are often free from synthetic additives, such as parabens and artificial fragrances, making them suitable for sensitive skin. The spa products industry also tailors its offerings to meet diverse skin, hair, and body care needs. By penetrating deeper layers of the skin or hair, these products provide lasting results, reducing waste and ensuring value. The spa industry emphasizes professional-grade quality, which can be customized for individual needs by experts.

The increasing focus on self-care and wellness is a major driver of growth in the spa products industry. Consumers are prioritizing high-quality, natural, and eco-friendly products that deliver tangible results. Innovations in the spa industry, including the use of plant-based and sustainable ingredients, have further fueled demand. In addition, the rise of at-home spa treatments, driven by convenience and affordability, has expanded the consumer base for the spa products industry. This trend aligns with a broader shift toward holistic health, where beauty and wellness intersect.

The spa products industry leverages natural ingredients like essential oils, plant extracts, and clays to offer safe and effective solutions. These ingredients, known for their antioxidant and anti-inflammatory properties, cater to a wide range of consumer needs, from hydration to detoxification. The spa industry’s commitment to natural formulations not only appeals to environmentally conscious buyers but also enhances product efficacy. As the spa products market continues to grow, these natural components remain at the forefront of innovation, addressing evolving consumer preferences and contributing to long-term market sustainability.

As wellness becomes a priority for more individuals, the spa products market is poised for continued growth. Advancements in formulation technology, coupled with the rising popularity of personalized care, will drive innovation in the spa industry. Additionally, the integration of digital solutions, such as virtual consultations, allows the spa products industry to reach a wider audience. With increasing consumer awareness and a focus on sustainability, the spa products market will remain a cornerstone of the global beauty and wellness sectors, delivering high-performance solutions tailored to modern lifestyles.

End-use Insights

Women users accounted for a revenue share of about 66% of the spa products market in 2024. Females often seek spa experiences for identity-building, relaxation, and socialization. Many women value self-care to affirm their worth and prioritize their well-being, appreciating personalized services that offer pampering and respite. Additionally, spas serve as spaces for relationship-building, encouraging group visits with friends and family. These preferences drive targeted marketing and product offerings tailored to women’s needs and expectations.

Spa product use among men is projected to increase at a CAGR of 8.2% from 2025 to 2030. This increase is driven by growing awareness of self-care and wellness among men. Spas now offers tailored treatments addressing unique concerns like razor burn, oily skin, muscle tension, and stress, emphasizing health benefits beyond appearance. Services such as facials, massages, and grooming enhance confidence, relieve stress, and promote overall well-being, making spa experiences increasingly appealing to men.

Application Insights

Hotel and resort spas accounted for a revenue share of about 29% of the overall spa products market in 2024. Hotel and resort spas are leading users of spa products due to their focus on creating luxurious, wellness-focused experiences for guests. Partnerships with brands like Dior, La Mer, 111Skin, and La Prairie enhance these spaces, offering co-branded treatments that spotlight premium products. Hotels recognize the specialization required for wellness, akin to their collaborations with celebrity chefs for dining, and leverage these partnerships to elevate their spa services. Branded spa programs not only enhance guest experiences but also drive business opportunities for both hotels and skincare brands, making spa products an integral part of their offerings.

The sales of spa products in medical spas are expected to increase at a CAGR of 9.7% from 2025 to 2030. This is due to the growing popularity of non-invasive skincare and body care treatments. Med spas offer advanced services like laser therapies, chemical peels, and body contouring in a tranquil environment, creating a need for high-quality, targeted products to enhance and maintain results. Personalized treatment plans often include specially formulated skincare and body care products, fostering long-term client satisfaction. As med spas continue to expand globally, the demand for premium products tailored to aesthetic and wellness treatments is set to increase significantly.

Product Insights

Face skin products accounted for a revenue share of about 42% of the overall spa products market in 2024. Face skincare is more popular in the spa products market because the face is the most visible part of the body, making its care a priority for many consumers. Spa industry treatments often target facial concerns like acne, wrinkles, and dullness, which resonate with individuals seeking rejuvenation and confidence. Advanced formulations and professional-grade products in the spa products industry further enhance the appeal of facial skincare.

In May 2024, Eminence Organic Skin Care, which has its spas, announced the launch of its Charcoal & Black Seed Collection, designed to purify and balance skin. The range includes products such as a clay masque and clarifying oil, both enriched with activated charcoal and black seed oil. These ingredients help detoxify skin, control oil, and improve the appearance of pores while also providing hydration. The collection is suitable for all skin types, especially oily and combination skin, aiming to give a refreshed and balanced complexion.

The spa body skin care products market is projected to grow at a CAGR of 8.4% from 2025 to 2030. These products are poised to gain popularity as consumers increasingly seek holistic self-care solutions that go beyond facial treatments. With a growing focus on overall wellness, products targeting body concerns like dry skin, uneven texture, and cellulite are becoming more appealing. The spa products industry is also introducing luxurious body care options, such as exfoliating scrubs and hydrating masks, offering a full-body pampering experience that aligns with the wellness trend.

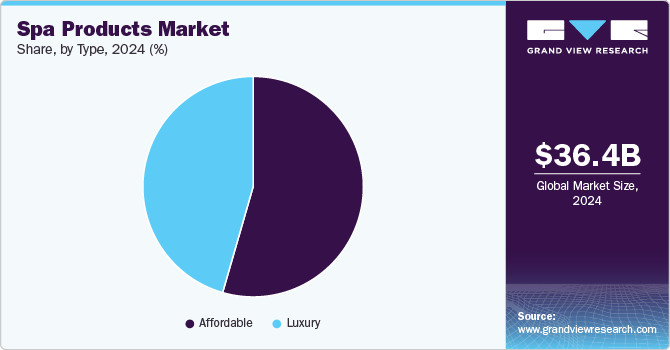

Type Insights

Affordable spa products accounted for about 54% of the overall revenue share in 2024. The market's dominance lies in its ability to deliver luxurious, effective treatments at accessible prices. Products like temporary eye tighteners, under-eye masks, aromatherapy baths, and mud masks provide high-quality results similar to luxury products, making self-care attainable for a broader audience. Their convenience, affordability, and proven effectiveness drive widespread appeal, enabling users to enjoy effective treatments at affordable price points.

Demand for luxury spa products is expected to grow at a CAGR of 8.9% from 2025 to 2030. The future of spas will see increased integration of luxury products as brands like La Prairie, La Mer, and Guerlain expand beyond high-end hotels to offer personalized boutique spa experiences. Stand-alone spas from Biologique Recherche, Augustinus Bader, and Dr. Barbara Sturm exemplify this trend, catering to the growing demand for exclusive, immersive treatments. As luxury consumers seek deeper brand connections, spas provide an ideal platform for high-touch, aspirational services that enhance loyalty and elevate brand equity. This shift aligns with the luxury beauty industry’s emphasis on experiential retail, blending professional treatments with prestige skincare to meet evolving consumer expectations.

Regional Insights

The spa products market in North America accounted for a revenue share of around 22% in 2024 in the global spa products market. The demand for spas in North America is high due to growing awareness of wellness benefits, including stress reduction and improved mental health. An increasingly diverse demographic, including men and younger consumers, is seeking tailored spa experiences, further driving growth. Technological innovations like hydrotherapy and personalized treatments have elevated the appeal of spa services, ensuring steady market expansion. This rising demand for advanced spa treatments directly fuels the spa products market, creating opportunities for high-quality, targeted solutions that cater to a wellness-focused clientele.

U.S. Spa Products Market Trends

In 2024, the U.S. spa products market held a dominant 80% share of the North American market. The demand for spas in the U.S. is steadily rising as more people recognize the wellness benefits of spa treatments, from stress relief to improved health. The spa-going demographic has expanded, with men increasingly embracing these services and seeing them as part of a wellness lifestyle. Additionally, spas are integrating advanced technologies and offering personalized experiences, which appeal to modern consumers. This growing interest creates significant opportunities for the spa products market as clients seek innovative and effective solutions to complement their treatments.

Europe Spa Products Market Trends

The spa products market in Europe accounted for a share of about 36% of the overall spa products market in 2024. The growing wellness tourism market in Europe is driving increased demand for spa products. According to a 2022 blog by the Centre for the Promotion of Imports from Developing Countries (CBI), nearly 300 million wellness trips were made in Europe before COVID-19, with more first-time and non-wellness travelers seeking spa experiences. Wellness travelers are known to spend significantly more than the average tourist, particularly at luxury destinations and yoga retreats. The UNESCO designation of the Great Spa Towns of Europe further enhances the region’s appeal, attracting tourists interested in historical wellness traditions. This booming wellness tourism, particularly post-pandemic, is expected to boost the demand for spa products in Europe.

Asia Pacific Spa Products Market

The Asia Pacific spa products market is set to grow at a CAGR of 8.7% from 2025 to 2030. The rise of wellness tourism in Asia is a significant driver of the demand for spa products in the region. As more travelers seek wellness experiences, particularly in destinations known for their healing traditions like yoga, Ayurveda, and traditional Chinese medicine, there is an increasing focus on relaxation and self-care. This growing interest fuels the need for high-quality spa products, such as skincare, aromatherapy, and wellness treatments. The demand is particularly strong among female travelers, who prioritize wellness activities during their trips, further boosting the market for spa products as part of their rejuvenation experiences.

Key Spa Products Company Insights

The spa products industry is fragmented primarily due to the presence of several globally recognized manufacturers as well as regional players. Some prominent companies in this market are L’Oréal Professional (Lancôme, Kérastase, Helena Rubinstein); The Estée Lauder Companies; Dior; La Mer; L'Occitane; Unilever plc (Murad, Dermalogica); Sisley; and Dr. Barbara Sturm among others. Market players are differentiating through innovative skin care formulations, and partnerships, and expanding their product offerings to cater to evolving consumer preferences for wellness and sustainability.

Key Spa Products Companies:

The following are the leading companies in the spa products market. These companies collectively hold the largest market share and dictate industry trends.

- L’Oréal Professional

- L'Occitane

- Eminence Organic Skin Care

- BABOR

- Comfort Zone

- La Mer

- Biologique Recherche

- Sothys

- Dior

- Valmont Group

- Guerlain

- La Prairie

- The Colgate-Palmolive Company (PCA Skin)

- Unilever plc (Murad, Dermalogica)

- Sisley

- Augustinus Bader

- Dr. Barbara Sturm

- 111SKIN

- Omorovicza

- The Estée Lauder Companies

Recent Developments

-

In September 2024, PCA SKIN announced the expansion of its professional chemical peel portfolio with the launch of two new treatments designed to target acne. The Acne Peel is formulated for mild cases and helps clear congested skin and reduce breakouts. At the same time, the Acne Peel Plus addresses moderate to severe acne, focusing on treating active blemishes and preventing future ones. Both peels are self-neutralizing and deliver noticeable results after just one session, offering skincare professionals effective solutions for a range of acne concerns.

-

In May 2024, Dior announced the launch of the world’s first Luxury Beauty Retreat at Qatar Duty at Hamad International Airport. This exclusive spa and retail space, covering over 800 square meters, combines high-end shopping with luxury wellness services. It is located within the airport’s Orchard, a lush tropical garden, and features two entrances: one through the Dior boutique and another via the Qatar Airways business lounge. The facility caters to a diverse range of travelers, including luxury seekers and business passengers.

-

In January 2023, Spa L'Occitane announced the expansion of its presence aboard Atlas Ocean Voyages’ World Traveller cruise ship with the launch of its SeaSpa wellness facility. This onboard spa offers a luxurious, holistic well-being experience, utilizing L’Occitane's signature beauty products. Guests can enjoy a variety of treatments, including those designed for anti-aging, using ingredients like Corsican Immortelle flowers. The spa’s facilities include treatment rooms, an infrared sauna, hot tubs, and even a fitness studio.

Spa Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 38.60 billion

Revenue forecast in 2030

USD 55.40 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, application, product, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Japan; South Korea; Indonesia; Thailand; Singapore; Brazil; South Africa; UAE; Qatar

Key companies profiled

L’Oréal Professional; L'Occitane; Eminence Organic Skin Care; BABOR; Comfort Zone; La Mer; Biologique Recherche; Sothys; Dior; Valmont Group; Guerlain; La Prairie; The Colgate-Palmolive Company (PCA Skin); Unilever plc (Murad, Dermalogica); Sisley; Augustinus Bader; Dr. Barbara Sturm; 111SKIN; Omorovicza; The Estée Lauder Companies Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spa Products Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global spa products market report based on the end use, application, product, type, and region.

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Women

-

Men

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hotel/Resort Spa

-

Destination Spa

-

Day/Salon Spa

-

Medical Spa

-

Thermal/Mineral Spring Spa

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Face Skin Care

-

Lotions, Face Creams, & Moisturizers

-

Cleansers & Face Wash

-

Facial Serums

-

Face Masks

-

Sunscreen/Sun Care

-

Exfoliants and Scrubs

-

Others (Eye Creams, etc.)

-

-

Body Skin Care

-

Hair Removal Products

-

Lotions, Creams, & Moisturizers

-

Body Sunscreen/Sun Care

-

Body Scrub and Exfoliators

-

Body Oils

-

Others (Serum, etc.)

-

-

Hair Care Products

-

Shampoos and Conditioners

-

Hair Masks and Treatments

-

Hair Serums and Oils

-

Others (Scalp Care Products, etc.)

-

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Affordable

-

Luxury

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Thailand

-

Singapore

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Qatar

-

UAE

-

-

Frequently Asked Questions About This Report

b. The spa products market was estimated at USD 36.44 billion in 2024 and is expected to reach USD 38.60 billion in 2025.

b. The spa products market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 55.40 billion by 2030.

b. Europe dominated the spa products market in 2024, with a share of about 36%. The growing wellness tourism market in Europe is fueling increased demand for spa products as wellness travelers spend significantly more at luxury destinations and yoga retreats.

b. Key players in the spa products market are L’Oréal Professional; L'Occitane; Eminence Organic Skin Care; BABOR; Comfort Zone; La Mer; Biologique Recherche; Sothys; Dior; Valmont Group; Guerlain; La Prairie; The Colgate-Palmolive Company (PCA Skin); Unilever plc (Murad, Dermalogica); Sisley; Augustinus Bader; Dr. Barbara Sturm; 111SKIN; Omorovicza; The Estée Lauder Companies.

b. Key factors that are driving the spa products market growth include rising demand for wellness tourism, increased consumer awareness of skincare benefits, the growing popularity of at-home spa experiences, innovations in natural and organic ingredients, and the expansion of luxury and boutique spa establishments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.