- Home

- »

- Next Generation Technologies

- »

-

Space On-board Computing Platform Market Report, 2030GVR Report cover

![Space On-board Computing Platform Market Size, Share & Trends Report]()

Space On-board Computing Platform Market (2024 - 2030) Size, Share & Trends Analysis Report By Platform, By Communication Frequency, By Orbit, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-451-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Space On-board Computing Platform Market Summary

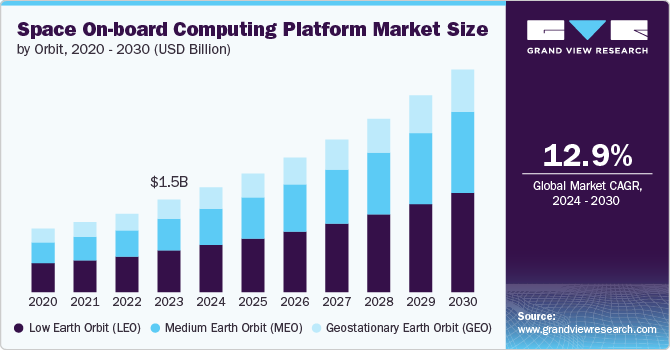

The global space on-board computing platform market size was estimated at USD 1.54 billion in 2023 and is projected to reach USD 3.59 billion by 2030, growing at a CAGR of 12.9% from 2024 to 2030. The integration of 5G technology into space on-board computing platforms is set to enhance communication capabilities significantly.

Key Market Trends & Insights

- The space on-board computing platform market in North America accounted for a revenue share of above 32% in 2023.

- The space on-board computing platform market in the U.S. is anticipated to grow at a CAGR of 10.4% from 2024 to 2030.

- The space on-board computing platform market in Asia Pacific is anticipated to grow at the highest CAGR from 2024 to 2030.

- Based on platform, the micro satellite segment dominated the market in 2023 with a market share of above 25%.

- In terms of application, the communication segment held the highest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.54 Billion

- 2030 Projected Market Size: USD 3.59 Billion

- CAGR (2024-2030): 12.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

With higher data transfer rates and lower latency, 5G enables real-time data transmission between satellites and ground stations, improving mission responsiveness. This advancement is particularly beneficial for the earth observation and remote sensing applications, where timely data is critical for decision-making. As 5G technology matures, it is expected to facilitate the development of more interconnected satellite networks, further driving the market growth.

As space missions become more complex and interconnected, there is an increasing focus on cybersecurity within the space on-board computing platform market. The rise in satellite-based services has heightened the risk of cyber threats, necessitating robust security measures to protect sensitive data and mission integrity. Companies are investing in advanced encryption techniques and secure communication protocols to safeguard their systems against potential attacks. This trend underscores the importance of cybersecurity in ensuring the reliability and safety of space operations.

The expansion of commercial space activities is significantly influencing the space on-board computing platform market. Private companies are increasingly participating in satellite launches, space tourism, and other ventures, driving demand for advanced computing platforms that can support diverse applications. This shift is fostering innovation, as commercial entities seek to develop cost-effective and efficient solutions to meet their operational needs. As the commercial space sector continues to grow, it will likely lead to increased investment in research and development, further propelling advancements in on-board computing technologies.

Software-defined technologies are gaining traction in the space sector, allowing for greater flexibility and reconfigurability of satellite systems. This approach enables satellites to be updated and reprogrammed from Earth, enhancing their operational capabilities without the need for physical modifications. As a result, missions can be adapted to changing requirements or new scientific objectives, maximizing the utility of existing assets. The ability to implement software updates in orbit is particularly valuable for long-duration missions, where adaptability can significantly extend the life and effectiveness of a spacecraft.

Platform Insights

The micro satellite segment dominated the market in 2023 with a market share of above 25%. Recent advancements in micro satellite technologies have significantly enhanced their capabilities and performance. Innovations in miniaturization have allowed for more powerful onboard computing systems and sensors, enabling complex missions previously reserved for larger satellites. Enhanced communication technologies, such as optical links and advanced antennas, improve data transmission rates and reliability. These technological improvements make micro satellites increasingly viable for a wide range of applications, from scientific research to commercial services.

The nano satellite segment is estimated to have a significant growth rate from 2024 to 2030.The ability to service and refuel nano satellites in orbit is becoming an important trend, allowing for extended mission lifetimes and enhanced operational flexibility. Innovations in on-orbit servicing technologies enable satellites to be upgraded or repaired without the need for costly and time-consuming returns to Earth. This capability is particularly valuable for nano satellites, which often operate in constellations and require coordinated maintenance. As the industry evolves, on-orbit servicing is expected to become a standard practice, further increasing the attractiveness of nano satellites for long-term missions.

Communication Frequency Insights

The S-band segment held the highest revenue share in 2023. S-band frequencies, typically ranging from 2.0 to 4.0 GHz, are widely utilized in mobile satellite services, particularly in the United States. These frequencies are essential for Earth-to-space and space-to-Earth communication, making S-band a preferred choice for many satellite operators. The ability of S-band to support telemetry and tracking functions enhances its appeal for satellite missions, ensuring reliable data transmission and command capabilities. As satellite constellations expand and the demand for robust communication systems grows, the S-band segment is expected to maintain its dominance in the market.

The K-band segment is estimated to register the highest growth rate from 2024 to 2030. K-band frequencies are well-suited for high-data-rate communication applications, such as satellite internet, direct-to-home television, and high-resolution Earth observation data transmission. The wide bandwidth available in the K-band allows for the transfer of large amounts of data at faster speeds, meeting the growing demand for real-time information and high-quality imagery from space. As the need for high-speed data links increases, particularly for satellite constellations and deep space missions, the K-band segment is poised for substantial growth.

Orbit Insights

The low earth orbit (LEO) segment held the highest revenue share in 2023. One of the primary trends in the LEO segment is the rapid expansion of satellite constellations, particularly for applications such as global internet coverage and Earth observation. Companies like SpaceX and OneWeb are leading initiatives to deploy large constellations of small satellites, which require advanced on-board computing platforms to manage data processing and communication. These constellations enhance connectivity and provide services in remote areas, driving demand for LEO-based solutions. As the number of satellites in LEO increases, the need for sophisticated computing platforms to handle the operational complexities will also rise.

The medium earth orbit (MEO) segment is estimated to have a significant growth rate from 2024 to 2030. In addition to navigation, the MEO segment is also seeing growth in the demand for communication services. MEO satellites can provide wider coverage areas compared to LEO satellites, making them suitable for applications that require regional or global connectivity. The increasing need for reliable and high-speed communication services, particularly in areas with limited terrestrial infrastructure, is driving the adoption of MEO-based communication systems. On-board computing platforms in MEO satellites play a crucial role in managing complex communication tasks, such as signal processing, routing, and network management.

Application Insights

The communication segment held the highest revenue share in 2023. As satellite communication becomes increasingly integral to critical infrastructure, the emphasis on cybersecurity is intensifying. The communication segment is witnessing a heightened focus on developing secure on-board computing platforms capable of protecting against cyber threats. This includes implementing robust encryption protocols and secure data transmission methods to safeguard sensitive information. The growing awareness of cybersecurity risks in the space industry is driving demand for fortified computing solutions that ensure the integrity and security of communication systems.

The earth observation segment is estimated to register the highest growth rate from 2024 to 2030. One of the key trends in the Earth Observation segment is the integration of advanced sensors and imaging systems on satellites. These technologies, such as hyperspectral, multispectral, and synthetic aperture radar (SAR) sensors, enable the collection of high-resolution, detailed data about the Earth's surface and atmosphere. On-board computing platforms play a crucial role in processing and analyzing this vast amount of data, allowing for more accurate and timely insights. The development of smaller, more capable sensors is making it possible to deploy them on smaller satellites, further driving the growth of the Earth Observation segment.

Regional Insights

The space on-board computing platform market in North America accounted for a revenue share of above 32% in 2023. The demand for advanced spacecraft systems is rising, fueled by the growing number of satellite missions for both commercial and military applications. This includes the deployment of small satellites and CubeSats, which require sophisticated on-board computing capabilities to manage data processing, navigation, and communication tasks effectively.

U.S. Space on-board Computing Platform Market Trends

The space on-board computing platform market in the U.S. is anticipated to grow at a CAGR of 10.4% from 2024 to 2030. The U.S. is leading the adoption of commercial space applications, such as satellite-based broadband and Earth observation. Companies are increasingly leveraging space on-board computing platforms for various commercial endeavors, enhancing connectivity and data services globally.

Europe Space on-board Computing Platform Market Trends

Space on-board Computing Platform market in Europe accounted for a notable revenue share in 2023. The European market is increasingly emphasizing sustainable space technologies. This includes the development of on-board computing systems that reduce energy consumption and enable more efficient operations in space. The push for environmentally friendly technologies aligns with broader European Union goals for sustainability and climate action.

Asia Pacific Space on-board Computing Platform Market Trends

The space on-board computing platform market in Asia Pacific is anticipated to grow at the highest CAGR from 2024 to 2030. The region is witnessing a surge in commercial space activities, with private companies entering the market to provide satellite services, launch capabilities, and space exploration technologies. This trend is driving demand for sophisticated on-board computing systems that can support various commercial applications, including Earth observation, telecommunications, and remote sensing.

Key Space on-board Computing Platform Company Insights

The market for space on-board computing platforms is highly competitive, featuring leading industry players such as Honeywell International Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, and Maxar Technologies as of 2023. These companies are actively enhancing their market positions through strategic initiatives, including partnerships, mergers, acquisitions, and the rollout of innovative products and technologies. For instance, In October 2022, Sidus Space, a provider of Space-as-a-Service solutions, secured a contract with Exo-Space to enhance its space on-board computing platforms through the integration of edge computing capabilities. This collaboration aims to implement artificial intelligence technologies, enabling the delivery of near-real-time insights derived from Earth observation data. The initiative is expected to significantly improve operational efficiency and decision-making for users relying on critical space data.

Key Space on-board Computing Platform Companies:

The following are the leading companies in the space on-board computing platform market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus

- BAE Systems

- Ball Corporation

- Blue Canyon Technologies

- Boeing

- General Dynamics Mission Systems Inc.

- Hewlett Packard Enterprise Development LP

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Maxar Technologies

- Northrop Grumman

- Redwire Corporation

- RTX

- Teledyne Technologies

Recent Developments

-

In June 2024, Ramon. Space has announced its innovative approach to revolutionizing satellite technology. By developing advanced space-resilient computing infrastructure, the company aims to equip future satellites and spacecraft with enhanced capabilities. Their cutting-edge AI/ML processors and software-empowered systems promise to deliver Earth-like computing power in space. With a proven track record of zero failures in over 50 deep space and satellite missions across the solar system, Ramon. Space is poised to redefine the possibilities of space exploration.

-

In May 2024, LEOcloud has partnered with the Center for the Advancement of Science in Space (CASIS) to bring its cutting-edge Space Edge virtualized micro data center to the International Space Station (ISS) by the end of 2025. This collaboration will enable LEOcloud to showcase its Space Edge Infrastructure as a Service, allowing customers to access cloud resources and migrate applications from terrestrial clouds to a space-based environment. By supporting research and development on commercial space stations and in-space analytics using artificial intelligence, this partnership aims to advance the field of cloud computing and unlock new possibilities for data solutions in space.

Space on-board Computing Platform Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.74 billion

Revenue forecast in 2030

USD 3.59 billion

Growth rate

CAGR of 12.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, communication frequency, orbit, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Airbus; BAE Systems; Ball Corporation; Blue Canyon Technologies; Boeing; General Dynamics Mission Systems Inc.; Hewlett Packard Enterprise Development LP; Honeywell International Inc.; L3Harris Technologies Inc.; Lockheed Martin Corporation; Maxar Technologies; Northrop Grumman; Redwire Corporation; RTX; Teledyne Technologies.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Space On-board Computing Platform Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global space on-board computing platform market report into platform, communication frequency, orbit, application, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Nano satellite

-

Micro satellite

-

Small satellite

-

Medium satellite

-

Large satellite

-

Spacecraft

-

-

Communication Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

X-band

-

S-band

-

K-band

-

UHF/VHF band

-

-

Orbit Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Earth Orbit (LEO)

-

Medium Earth Orbit (MEO)

-

Geostationary Earth Orbit (GEO)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication

-

Earth Observation

-

Navigation

-

Meteorology

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global space on-board computing platform market size was estimated at USD 1.54 billion in 2023 and is expected to reach USD 1.74 billion in 2024.

b. The global space on-board computing platform market is expected to grow at a compound annual growth rate of 12.9% from 2024 to 2030, reaching USD 3.59 billion by 2030.

b. North America dominated the space on-board computing platform market with a share of 32.6% in 2030. The deployment of large satellite constellations for communication and Earth observation is driving demand for sophisticated on-board computing systems that can manage complex data processing and operational tasks.

b. Some key players operating in the space on-board computing platform market include Airbus, BAE Systems, Ball Corporation, Blue Canyon Technologies, Boeing, General Dynamics Mission Systems Inc., Hewlett Packard Enterprise Development LP, Honeywell International Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, Maxar Technologies, Northrop Grumman, Redwire Corporation, RTX, Teledyne Technologies.

b. Key factors driving the market growth include increasing demand for autonomous and intelligent spacecraft, expanding commercial space activities, and demand for autonomous satellite operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.