- Home

- »

- Next Generation Technologies

- »

-

Space Radar Market Size And Share, Industry Report, 2033GVR Report cover

![Space Radar Market Size, Share & Trends Report]()

Space Radar Market (2025 - 2033) Size, Share & Trends Analysis Report By Type, By Platform (Satellite-Based, Airborne Platforms), By Application (Earth Observation, Weather Forecasting, Military Surveillance), By Frequency Band, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-642-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Space Radar Market Summary

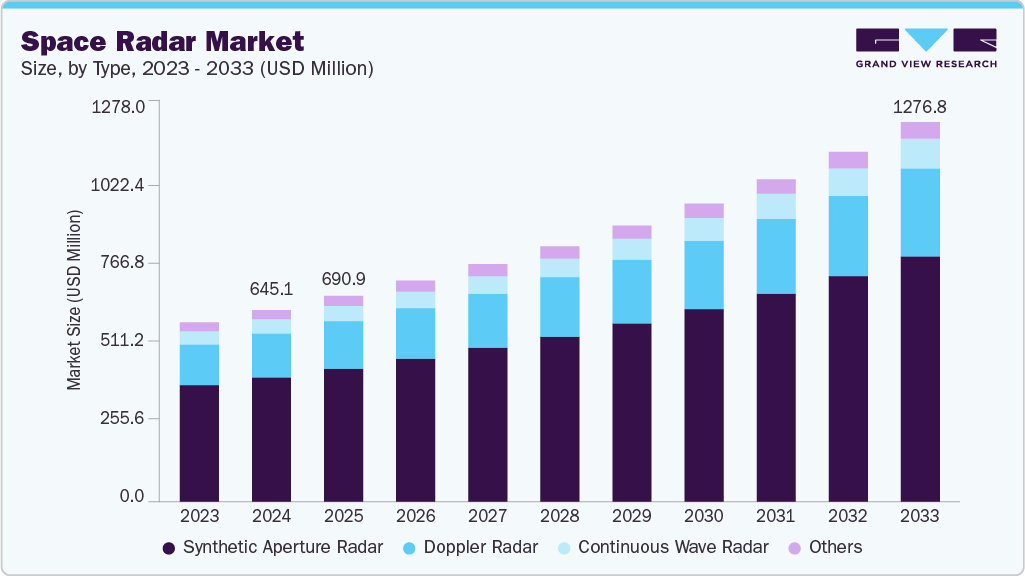

The global space radar market size was estimated at USD 645.1 million in 2024 and is projected to reach USD 1276.8 million by 2033, growing at a CAGR of 8.3% from 2025 to 2033. The market growth is primarily driven by increasing demand for high-resolution earth observation data, environmental monitoring requirements, and real-time situational awareness, which space radar systems can provide with greater accuracy and all-weather, day-night imaging capabilities.

Key Market Trends & Insights

- North America dominated the global space radar market with the largest market share of 40.9 % in 2024.

- The space radar market in the U.S. led the North America market and held the largest revenue share in 2024.

- By type, synthetic aperture radar segment led the market, holding the largest revenue share of 65.0% in 2024.

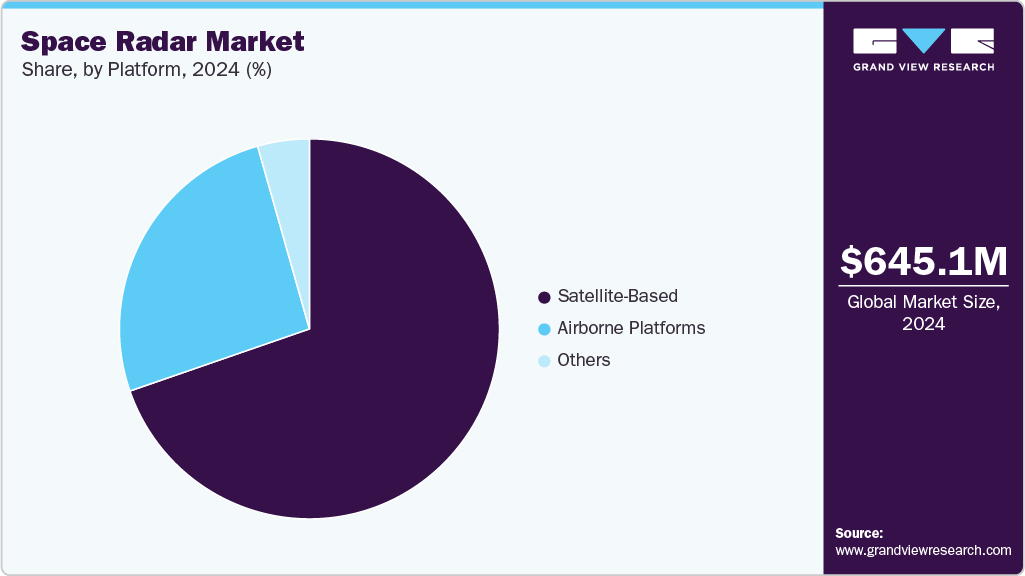

- By platform, satellite-based segment held the dominant position in the market and accounted for the leading revenue share of 69.7% in 2024.

- By application, earth observation segment is expected to grow at the largest market share of 41.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 645.1 Million

- 2033 Projected Market Size: USD 1276.8 Million

- CAGR (2025-2033): 8.3%

- North America: Largest market in 2024

The growing need for advanced Earth observation and situational awareness is driving demand in the space radar market. Traditional optical imaging systems are often limited by weather conditions and daylight availability, which has led to increased investment in radar-based satellite systems that offer all-weather, day-and-night imaging capabilities. Governments and private space agencies are increasingly adopting space radar technology to enhance national security and monitor climate change. The rising geopolitical tensions and the global emphasis on space-based reconnaissance are further accelerating funding for space radar programs, reinforcing the market’s upward trajectory.The increasing role of space radar in climate change monitoring and sustainability efforts is also propelling market growth. Space radar systems are being deployed to track deforestation, ice sheet dynamics, ocean wave patterns, and greenhouse gas levels. Synthetic aperture radar (SAR) data can capture subtle terrain deformations and vegetation density changes, which are crucial for long-term climate modeling and carbon accounting. This aligning with environmental goals establishes the space radar industry as a crucial resource for supporting global sustainability efforts, thereby unlocking new government and commercial funding opportunities.

Additionally, advancements in satellite launch technology enable the deployment of compact radar satellites, fueling a new era of cost-effective space radar networks. The evolution of small satellite platforms combined with reusable launch vehicles significantly reduces the cost of putting SAR systems into orbit. Emerging players are leveraging low-cost SAR satellites for applications such as maritime tracking, infrastructure monitoring, and urban planning. These developments are expanding the space radar customer base and diversifying use cases, thereby creating sustained momentum in the market.

Furthermore, increased defense spending and the need for advanced intelligence, surveillance, and reconnaissance (ISR) capabilities are driving adoption in the military segment. Governments are investing in space radar programs to support mission-critical operations, detect enemy movement, and monitor conflict zones. Integration of space radar with AI-powered analytics further enhances threat detection and response capabilities. Geopolitical tensions rise and defense modernization programs continue globally, demand for sophisticated radar-based ISR systems will remain a key growth pillar in the space radar market.

Type Insights

The synthetic aperture radar segment dominated the market with a share of over 65.0% in 2024, driven by its unparalleled ability to provide high-resolution imaging in all-weather and day-night conditions. The increasing use of SAR by government and defense agencies for border security, intelligence gathering, and maritime monitoring further boosts its demand. The spread of small satellite constellations equipped with SAR payloads, along with falling launch costs, has made high-frequency radar imaging more accessible and affordable. These developments, combined with the growing integration of AI and machine learning for automated SAR data analysis, are key factors driving the segment’s ongoing dominance.

The continuous wave radar segment is expected to register the highest CAGR of over 9.0 % from 2025 to 2033. This growth is primarily driven by the increasing demand for uninterrupted, real-time monitoring of spaceborne objects such as satellites, space debris, and fast-moving projectiles. Continuous wave radar systems are highly effective in detecting and measuring the velocity of moving targets with enhanced accuracy, making them crucial for orbital tracking and collision avoidance. Their ability to provide constant signal transmission and reception ensures high reliability for long-duration space surveillance missions. The adoption of continuous wave radar systems is expanding rapidly, reinforcing their role as a critical technology in the space radar market.

Platform Insights

The satellite-based segment dominated the market in 2024, driven by the increasing demand for persistent, high-resolution earth observation capabilities. Satellite-based radar systems, particularly those utilizing synthetic aperture radar (SAR), offer the unique advantage of all-weather, day-and-night imaging, making them indispensable for time-sensitive missions. Growing geopolitical tensions and climate-related risks have accelerated investments in satellite constellations for national security and environmental observation, reinforcing the segment’s dominance in the space radar market.

The airborne platforms segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by increasing demand for high-resolution, near-real-time surveillance capabilities. Advancements in lightweight SAR technology and integration with unmanned aerial vehicles (UAVs) have significantly enhanced the agility and cost-effectiveness of airborne radar systems. Defense modernization initiatives are heavily investing in manned and unmanned ISR (Intelligence, Surveillance, and Reconnaissance) aircraft equipped with advanced radar payloads. These factors are fueling the rapid growth of the airborne segment in the space radar industry.

Application Insights

The Earth observation segment dominated the market in 2024, owing to the rising demand for real-time geospatial intelligence across sectors such as defense, disaster response, and environmental monitoring. The increasing frequency of extreme weather events, natural disasters, and illegal activities such as deforestation and maritime trafficking has propelled global investment in SAR satellite constellations. Advancements in AI-powered analytics and cloud-based platforms have enabled rapid processing and interpretation of radar imagery, further driving the adoption of space radar technologies in Earth observation applications.

The weather forecasting segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by increasing climate volatility and the rising need for continuous, high-precision atmospheric monitoring. Satellites provide all-weather, day-and-night imaging, enabling accurate data collection even under cloud cover. Governments and private organizations are expanding investments in space-based radar constellations to improve storm tracking, precipitation estimation, and early warning systems. The integration of SAR data with AI and climate modeling platforms enhances predictive accuracy and disaster preparedness, making space radar an indispensable tool in modern weather forecasting.

Frequency Band Insights

The X-Band segment dominated the market in 2024, owing to its superior imaging resolution, faster data acquisition capabilities, and suitability for high-frequency, short-wavelength radar applications. X-Band SAR systems are widely adopted for both military and civilian uses due to their ability to penetrate through clouds and operate under all weather and lighting conditions. The growing demand for near real-time surveillance, particularly in defense and border security, has caused governments to invest more in X-Band satellite constellations. The ongoing miniaturization of electronics and improvements in onboard signal processing have further enhanced the efficiency and cost-effectiveness of X-Band radar payloads, making this segment the preferred choice in the evolving space radar landscape.

The L-Band segment is expected to grow at the highest CAGR from 2025 to 2033, driven by its superior performance in long-range detection and all-weather imaging capabilities. L-Band radar systems are particularly effective in penetrating foliage, clouds, and even light structures, making them highly valuable for defense and environmental monitoring. Increasing deployment of L-Band synthetic aperture radar (SAR) satellites for wide-area surveillance, change detection, and border security is fueling demand. L-Band's compatibility with low Earth orbit (LEO) platforms and its efficient bandwidth utilization supports cost-effective, large-scale satellite constellations, driving rapid growth in this frequency band segment of the space radar industry.

End Use Insights

The government agencies segment dominated the market in 2024, driven by the increasing reliance on satellite-based radar systems for national security, border surveillance, and disaster response. The growing need for real-time geospatial intelligence, coupled with rising geopolitical tensions and the urgency to mitigate the impacts of climate change, has further accelerated government-led initiatives and funding in space radar programs. These factors have reinforced the segment’s dominance in the space radar industry.

The defense organizations segment is expected to grow at a significant CAGR from 2025 to 2033, driven by rising investments in space-based intelligence, surveillance, and reconnaissance (ISR) capabilities. The growing emphasis on space domain awareness, missile launch detection, and border surveillance is prompting governments to integrate space radar assets into national defense strategies. The increasing development of counter-space technologies and the militarization of space are accelerating demand for persistent, all-weather radar imaging systems, further propelling growth in this segment of the space radar market.

Regional Insights

North America space radar market dominated the global industry with a share of over 40% in 2024, driven by substantial investments in defense modernization, space situational awareness, and Earth observation capabilities. The region has prioritized synthetic aperture radar (SAR) satellite constellations as a critical tool for military intelligence, missile tracking, and global surveillance. The increasing frequency of extreme weather events and natural disasters across the region is fueling demand for high-resolution radar imaging to enhance disaster preparedness and response. These factors, combined with growing public-private collaborations and favorable regulatory frameworks, are accelerating the adoption of the space radar industry across region.

U.S. Space Radar Market Trends

The U.S. space radar market dominated the market with a share of 83.18% in 2024. The growth is driven by sustained investments from defense and intelligence agencies. The country’s emphasis on space domain awareness and real-time intelligence has accelerated the deployment of advanced radar constellations. The rising need to monitor climate change, detect natural disasters, and track adversarial satellite activity is also propelling the integration of space radar systems into broader U.S. national security and environmental strategies.

Europe Space Radar Market Trends

The Europe space radar market is expected to grow at a CAGR of 7.1% from 2025 to 2033, driven by the strong growth in commercial satellite data services and public-private partnerships. The support of the EU Horizon Europe funding program and national space agencies is fostering collaboration between startups, research institutions, and defense contractors. This ecosystem is driving the commercialization of SAR data for a range of civil and industrial applications, from maritime domain awareness to infrastructure monitoring, expanding the addressable market for space radar solutions across the region.

The space radar market in Germany is expected to witness growth from 2025 to 2033. The market’s key drivers include substantial investment in high-resolution synthetic aperture radar (SAR) technologies for defense, Earth observation, and climate monitoring. With support from both the German Aerospace Center (DLR) and private aerospace companies, Germany is expanding its space radar capabilities to improve data accuracy, revisit times, and real-time imaging.

The UK space radar market is expected to grow in the coming years, driven by increased government investment in Earth observation and defense surveillance capabilities, as part of the UK Space Strategy, which prioritizes sovereign radar satellite infrastructure to reduce reliance on foreign data sources.

Asia Pacific Space Radar Market Trends

The Asia Pacific market is expected to grow at the fastest CAGR of 10.7% from 2025 to 2033, driven by the increasing deployment of space-based satellites for environmental monitoring and defense surveillance. Rising investments from countries such as China, India, Japan, and South Korea in indigenous satellite constellations and radar imaging capabilities are enhancing regional autonomy and situational awareness. The growing need for real-time data on climate change, urbanization, and maritime domain awareness, especially in disaster-prone and geopolitically sensitive areas, continues to drive demand for advanced space radar systems across the region.

The space radar market in China is fueled by the country’s strong investment in defense modernization, advancements in satellite manufacturing, and growing need for enhanced Earth observation capabilities. The Chinese government’s emphasis on space-based intelligence and its support for commercial satellite firms have also catalyzed domestic innovation. China aims to achieve global technological leadership in space systems, and the deployment of radar-equipped satellites continues to accelerate, significantly boosting the country’s footprint in the global space radar industry.

Japan space radar market is rapidly expanding, driven by the aging population and an increased focus on environmental law due to the country's commitment to reducing carbon emissions. Japan’s vulnerability to natural disasters like earthquakes, tsunamis, and typhoons has significantly accelerated the adoption of advanced space radar technologies for real-time disaster monitoring and early warning systems. The strong national emphasis on disaster preparedness and resilient infrastructure is a key driver boosting Japan’s space radar market growth.

Key Space Radar Company Insights

Some of the key players operating in the market include ICEYE and Capella Space among others.

-

ICEYE is a Finnish aerospace company that has rapidly established itself as a global leader in the commercial space radar sector. ICEYE specializes in developing and operating one of the world’s largest constellations of Synthetic Aperture Radar (SAR) satellites, offering persistent monitoring capabilities regardless of weather or lighting conditions. The company provides high-resolution radar imagery and analytics to clients in disaster response, national security, environmental monitoring, and insurance. ICEYE’s SAR-as-a-Service model enables near real-time tasking and delivery of radar data, making it a go-to provider for governments and commercial customers worldwide. ICEYE continues to expand its satellite fleet and global partnerships, reinforcing its dominance in the evolving space radar industry.

-

Capella Space is an Earth observation company pioneering the use of high-resolution Synthetic Aperture Radar (SAR) to deliver detailed imagery of the planet. The company’s radar satellites are capable of penetrating cloud cover and darkness, enabling uninterrupted observation of critical areas. Capella emphasizes data accessibility and transparency, offering an open API for clients to program satellite tasking and access imagery directly. With strong contracts from U.S. government agencies, including the Department of Defense and NOAA, Capella Space is positioning itself as a top-tier player in the commercial market, accelerating adoption of radar data for time-sensitive decision-making across multiple industries.

PredaSAR Corporationa and Synspective Inc. are some of the emerging market participants in the space radar market.

-

PredaSAR Corporationa is a space technology company focused on building and operating a fleet of advanced Synthetic Aperture Radar (SAR) satellites designed to support defense, intelligence, and commercial applications. The company delivers high-resolution, all-weather radar imagery for mission-critical operations, with a strong emphasis on persistent surveillance and national security. PredaSAR’s solutions leverage advanced radar payloads and AI-driven analytics to provide near real-time situational awareness, infrastructure monitoring, and battlefield intelligence. With close alignment to U.S. military priorities and partnerships with defense integrators, PredaSAR aims to become a key enabler of next-generation space-based radar capabilities.

-

Synspective Inc. is a Japanese startup that develops and operates Synthetic Aperture Radar (SAR) satellites for urban development, infrastructure monitoring, and disaster response. The company focuses on delivering satellite-driven data solutions that support sustainable city planning and resilience in the face of natural disasters. Synspective provides end-to-end services that combine radar imaging with machine learning analytics to offer actionable insights for governments and enterprises. Backed by support from JAXA and Japanese venture funds, Synspective is rapidly expanding its satellite constellation and strengthening its position in the Asia-Pacific space radar industry.

Key Space Radar Companies:

The following are the leading companies in the space radar market. These companies collectively hold the largest market share and dictate industry trends.

- Saab AB

- ICEYE

- Boeing

- Northrop Grumman

- Leonardo S.p.A.

- Lockheed Martin Corporation.

- LeoLabs

- Capella Space

- Denel Dynamics

- RTX

- PredaSAR Corporation

- Synspective Inc.

Recent Developments

-

In May 2025, ICEYE and Rheinmetall announced the formation of a joint venture, Rheinmetall ICEYE Space Solutions, to manufacture Synthetic Aperture Radar (SAR) satellites in Germany. The partnership strengthens ICEYE’s focus on space-based defense technologies. Satellite production is set to begin in the second quarter of 2026 at Rheinmetall’s Neuss site, reinforcing Germany’s role as a hub for advanced space radar industry.

-

In April 2025, LeoLabs announced the launch of Scout, a next-generation expeditionary radar designed for advanced space domain awareness missions. This new radar system emphasizes mobility, modularity, and rapid deployment, aiming to expand LeoLabs’ Global Radar Network. As space becomes increasingly congested and contested, Scout is tailored to meet the evolving needs of ground-based space surveillance, thereby enhancing global capabilities in the space radar market.

-

In April 2025, Boeing announced a major expansion of its satellite manufacturing facility in El Segundo, California, nearly doubling its production space. This move aims to scale up production capacity, driven by a growing backlog of defense contracts. The expansion marks a strategic shift toward high-rate production of advanced satellite systems, including those equipped with space radar capabilities, to meet increasing demand from U.S. defense and intelligence agencies.

Space Radar Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 690.9 million

Revenue forecast in 2033

USD 1276.8 million

Growth rate

CAGR of 8.3% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, application, frequency band, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Finland; Russia; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; Israel

Key companies profiled

Saab AB; ICEYE; Boeing; Northrop Grumman; Leonardo S.p.A.; Lockheed Martin Corporation.; LeoLabs; Capella Space; Denel Dynamics; RTX; PredaSAR Corporation; Synspective Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Space Radar Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global space radar market report based on type, platform, application, frequency band, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Synthetic Aperture Radar

-

Doppler Radar

-

Continuous Wave Radar

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Satellite-Based

-

Airborne Platforms

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Earth Observation

-

Weather Forecasting

-

Military Surveillance

-

Navigation

-

Others

-

-

Frequency Band Outlook (Revenue, USD Million, 2021 - 2033)

-

X-Band

-

C-Band

-

L-Band

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Government Agencies

-

Commercial Enterprises

-

Defense Organizations

-

Research Institutions

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Finland

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global space radar market was estimated at USD 645.1 million in 2024 and is expected to reach USD 690.9 million in 2025.

b. The global space radar market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2033 to reach USD 1276.8 million by 2033.

b. The Asia Pacific space radar is expected to grow at a CAGR of over 10% from 2025 to 2033, driven by the increasing deployment of space-based satellites for environmental monitoring and defense surveillance. The growing need for real-time data on climate change, urbanization, and maritime domain awareness, especially in disaster-prone and geopolitically sensitive areas, continues to drive demand for advanced space radar systems across the region.

b. The key players in the space radar market are Saab AB, ICEYE, Boeing, Northrop Grumman, Leonardo S.p.A., Lockheed Martin Corporation., LeoLabs, Capella Space, Denel Dynamics, RTX, PredaSAR Corporation, Synspective Inc.

b. Key drivers of space radar market include the increasing need for all-weather, day-and-night surveillance capabilities, rising investment, growing demand for persistent monitoring in defense and intelligence operations, rapid advancements in Synthetic Aperture Radar (SAR) technology, and expanding use of radar data for disaster response and environmental monitoring.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.