- Home

- »

- Homecare & Decor

- »

-

Spain Pest Control Products Market, Industry Report, 2033GVR Report cover

![Spain Pest Control Products Market Size, Share & Trends Report]()

Spain Pest Control Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Sprays/Aerosols, Baits/Gels, Repellents, Predators), By Pest Type (Flying Insects, Crawling Insects, Rodents), By Control Mechanism, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-733-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spain Pest Control Products Market Trends

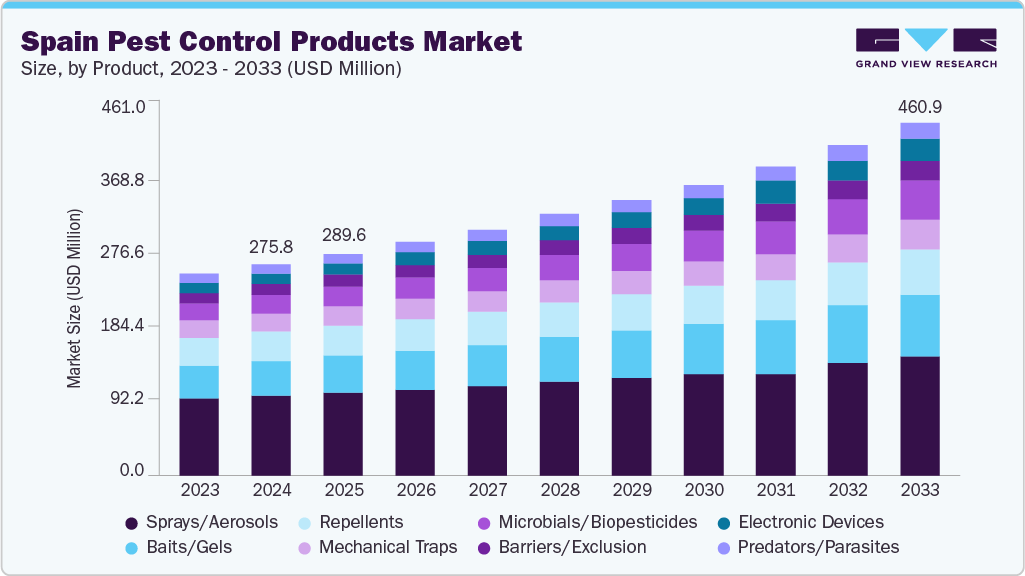

The Spain pest control products market size was estimated at USD 275.8 million in 2024 and is projected to reach USD 460.9 million by 2033, growing at a CAGR of 6.0% from 2025 to 2033. Commercial and residential demand growth constitutes a primary driver for pest control products in the European country. After pandemic recovery and ongoing tourism and hospitality activity, facilities management and accommodation operators increased procurement of integrated pest control solutions to protect assets and brand reputation. The demand is pronounced in urban centers and logistics hubs where foodservice, retail, and warehousing are concentrated; those verticals require frequent treatments for rodents, stored-product pests, and cockroaches, generating steady product turnover (sprays, baits, traps, and fumigants) and service contracts.

Large national and regional operators have expanded route density and stock investments to serve repeat-purchase customers, which in turn stimulates supplier investment in product lines and distribution. In short, the combination of a measurable market base and intensifying facility-level pest risk drives product sales and recurring service revenues for both chemical and non-chemical offerings.

The Spain pest control products industry shows a clear trend toward biopesticides, biological control, and low-toxicity formulations as customers and regulators press for sustainability. The rapid growth in the biopesticide segment has prompted manufacturers to expand their product portfolios by introducing microbial, botanical, and pheromone-based solutions designed to address both agricultural and urban pest management needs. Private operators increasingly integrate biological tools, entomopathogenic fungi, bacterial larvicides, pheromone traps, and sterile-male releases into integrated pest management (IPM) programs to reduce chemical reliance, meet environmental, social, and governance (ESG) commitments, and comply with tighter European Union (EU) regulations and standards.

Spain’s research institutions and several regional public bodies have sponsored pilot biological-control projects (for instance, municipal mosquito control pilots and university collaborations), which accelerate commercial adoption by proving operational efficacy and cost profiles. For suppliers, the trend implies reallocation of R&D and sales resources toward certified biologicals, tailored formulations for indoor use, and product lines that can be sold as “safer use” options to hospitality and consumer channels.

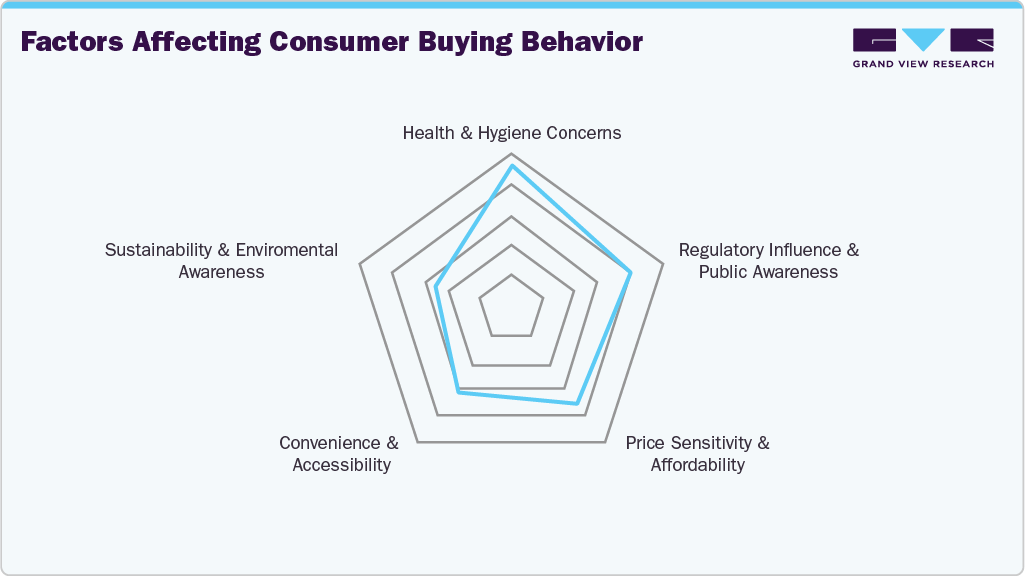

Consumer Insights

Younger consumers are sustainability-driven, middle-aged households balance safety with performance, and older demographics prioritize reliability and familiarity, together shaping the demand landscape in the Spain pest control products market. Younger consumers’ purchases are typically driven by affordability and convenience, leading to higher adoption of DIY sprays, aerosols, and plug-in repellents available through supermarkets and online platforms.

Families and working professionals exhibit a balanced preference for efficacy and safety. With children or pets at home, middle-aged consumers are increasingly cautious about toxic residues, encouraging demand for biological sprays, gels, and bait systems. Older consumers are more likely to stick to established chemical products, such as aerosols and fumigants, as they are familiar and perceived as reliable. However, health concerns, such as respiratory sensitivities, influence some to cautiously explore biological alternatives when endorsed by healthcare professionals or public health campaigns.

Consumers in Spain prioritize pest control purchases to safeguard their households and workplaces against health risks posed by insects and rodents. Outbreaks of vector-borne diseases, such as dengue and West Nile Virus in parts of Spain, have increased consumer awareness of the need for preventive pest control. Families with children and pet owners in particular favor solutions that promise safety while eliminating pests. This health-driven urgency strongly influences both the frequency and type of products purchased, with sprays and aerosols still being preferred for immediate relief.

Affordability remains a critical factor in product selection, especially in the B2C segment. While professional B2B services often operate under contracts, individual households typically weigh cost-effectiveness before purchasing. Aerosol sprays and DIY traps are popular because they offer immediate results at lower prices. However, the growing middle-class segment is also willing to pay premium rates for non-toxic and residue-free biopesticides when safety benefits justify higher costs.

Product Insights

Pest control sprays/aerosols accounted for a revenue share of 37.59% of the Spain pest control products industry in 2024, primarily due to their convenience, rapid action, and widespread adoption in both residential and commercial spaces. These products provide an immediate knockdown effect against common pests such as cockroaches, ants, and mosquitoes, which remain persistent in urban households and hospitality facilities. Their affordability and availability across retail channels, including supermarkets and hardware stores, further reinforce their high penetration rate. In Spain, where the hospitality industry is integral to the economy, hotels, restaurants, and cafés frequently rely on aerosol-based treatments for quick interventions to preserve hygiene standards and avoid reputational risks.

The microbials/biopesticides product category is expected to grow at a CAGR of 9.3% from 2025 to 2033 in the Spain market, driven by growing regulatory pressure and consumer demand for eco-friendly alternatives. Municipalities and agricultural cooperatives are increasingly piloting microbial-based mosquito control programs, while residential users show rising interest in non-toxic alternatives that minimize risks to human health and pets. Moreover, biopesticides based on bacteria, fungi, and pheromones align with integrated pest management (IPM) practices that are becoming standard in both agriculture and urban pest control.

Pest Type Insights

The flying insects segment logged a revenue share of 35.45% in the Spain pest control products industry in 2024, primarily attributed to the increasing prevalence of mosquitoes and flies linked to climatic shifts and urban density. Rising summer temperatures and prolonged breeding seasons have fueled outbreaks of Aedes albopictus (Asian tiger mosquito) and Culex species, which are known carriers of West Nile Virus and dengue. Public health authorities in regions such as Andalusia and Catalonia have intensified vector-control programs, creating high-volume demand for larvicides, repellents, fogging chemicals, and aerosol sprays.

The crawling insects segment is expected to grow at a CAGR of 6.5% from 2025 to 2033 in the Spain market, fueled by rising infestations in urban housing complexes and commercial kitchens. Bed bug resurgence has increased demand for specialized residual sprays, heat-treatment-compatible chemicals, and monitoring solutions in Spain’s hospitality and residential sectors. The growth of dense, high-rise urban living has amplified pest migration between units, accelerating consumer reliance on preventive and curative solutions.

Control Mechanism Insights

Chemical pest control contributed a revenue share of 67.94% towards the Spain pest control products industry in 2024, due to its broad-spectrum efficacy, cost efficiency, and entrenched usage across both commercial and residential sectors. These products, ranging from insecticidal sprays and fumigants to rodenticides, offer rapid results that are particularly valued in industries where hygiene compliance is non-negotiable, such as food processing, hospitality, and healthcare. Moreover, chemical formulations benefit from extensive distribution networks, established regulatory approvals, and consumer familiarity, all of which reinforce repeat purchases and high market penetration.

Biological pest control is expected to grow at a CAGR of 8.6% from 2025 to 2033 in Spain, propelled by regulatory momentum and consumer preference for eco-friendly solutions. Spanish research institutions and local governments have already piloted biocontrol projects, such as the release of sterile male mosquitoes in Valencia to suppress vector populations, showcasing the operational viability of biological methods. In addition, growing consumer awareness of the health and environmental risks associated with chemical residues has encouraged demand for microbial agents, pheromone traps, and predator-based solutions.

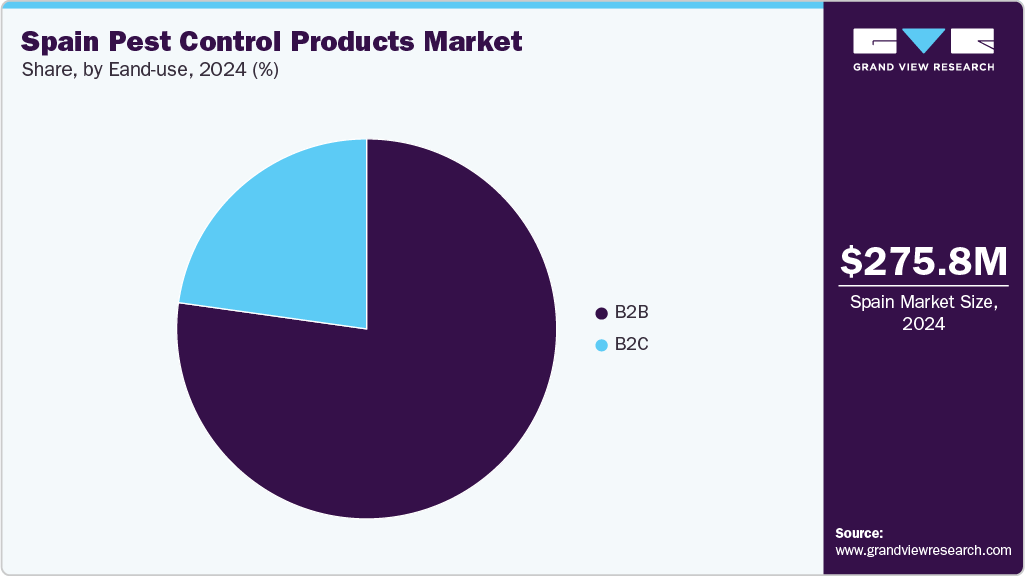

End Use Insights

The B2B segment captured a revenue share of 77.21% in the Spain pest control products industry in 2024 due to stringent regulatory frameworks and compliance obligations faced by commercial establishments. Industries such as hospitality, food service, healthcare, and logistics must adhere to Hazard Analysis and Critical Control Points (HACCP) protocols and sanitary regulations, which mandate preventive pest management to safeguard public health and brand reputation. For instance, Spain’s restaurant and hotel sector, serving millions of tourists annually, relies on professional pest control providers to ensure uninterrupted operations and compliance with health inspections.

The B2C segment is expected to grow at a CAGR of 8.3% from 2025 to 2033, driven by rising consumer awareness, urban lifestyle changes, and increased household pest challenges in Spain. Population density in metropolitan areas such as Madrid, Barcelona, and Valencia has heightened the visibility of cockroaches, mosquitoes, and bed bug infestations, prompting households to adopt ready-to-use sprays, aerosols, and eco-friendly biopesticides. The expansion of e-commerce and retail channels has made pest control products more accessible, while social media campaigns and public health advisories have educated consumers about preventive measures.

Key Spain Pest Control Products Company Insights

The Spain pest control products industry is characterized by strong international & regional companies, emerging domestic manufacturers, fast-growing bioinput segments, and active distribution and partnership strategies that shorten time-to-market for new technologies.

Service providers and distributors have professionalized operations and adopted digital tools and IPM principles, creating demand for product bundles, monitoring sensors, and data-driven treatment strategies. Larger pest management firms now sell integrated offerings, remote monitoring for rodent activity, digital reporting dashboards for HACCP compliance, and smart traps that feed alerts into mobile apps, thereby shifting buyers from one-off chemical purchases toward recurring service contracts and hardware-plus-consumables models.

Regulators and corporate customers increasingly require documented IPM programs (inspection records, threshold-based interventions), which raise the value of monitoring devices, tamper-proof bait stations, and targeted products designed for minimal non-target exposure. This evolution also allows suppliers to differentiate through service enablement (training, warranty, digital reporting) and supports premium pricing for compliance-oriented solutions.

Key Spain Pest Control Products Companies:

- BASF SE

- Syngenta Group

- Bayer AG

- FMC Corporation

- Sumitomo Corporation

- Corteva Agriscience

- Novozymes Biologicals

- Nufarm Limited

- UPL Limited

- Koppert

Recent Developments

-

In November 2024, Seipasa received an extended approval from Spain’s Ministry of Agriculture to apply its bioinsecticide Pirecris across additional crops, including stone and pome fruit trees, berries (strawberries, blueberries, raspberries, blackberries), apricot, and persimmon.

-

In July 2024, Syngenta introduced Pyrevert 5% EC, the market’s most concentrated natural pyrethrin formulation. Created for Spain, it effectively controls a wide range of pests, aphids, whiteflies, thrips, cluster moths, leafhoppers, potato beetles, and vinegar flies, offering a high-efficiency, low-toxicity alternative aligned with EU sustainability goals.

Spain Pest Control Products Market Report Scope

Report Attribute

Details

Market size in 2025

USD 289.6 million

Revenue forecast in 2033

USD 460.9 million

Growth rate (Revenue)

CAGR of 6.0% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, pest type, control mechanism, end use

Country scope

Spain

Key companies profiled

BASF SE; Syngenta Group; Bayer AG; FMC Corporation; Sumitomo Corporation; Corteva Agriscience; Novozymes Biologicals; Nufarm Limited; UPL Limited; Koppert

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Spain Pest Control Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Spain pest control products market report by product, pest type, control mechanism, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Sprays/Aerosols

-

Baits/Gels

-

Repellents

-

Predators/Parasites

-

Microbials/Biopesticides

-

Barriers/Exclusion

-

Mechanical Traps

-

Electronic Devices

-

-

Pest Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flying Insects

-

Crawling Insects

-

Rodents

-

Others (Birds)

-

-

Control Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemical

-

Physical/Mechanical

-

Biological

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

B2C

-

Supermarkets and Hypermarkets

-

Pharmacies & Drugstores

-

Home Improvement & Hardware Stores

-

E-commerce/Online

-

Others (Grocery Stores, Department Stores)

-

-

B2B

-

Direct Sales

-

Distributors & Wholesalers

-

Agricultural Supply Stores & Co-operatives

-

Commercial & Institutional E-procurement Platforms

-

Others (Government Procurement Programs)

-

-

Frequently Asked Questions About This Report

b. The Spain pest control products market was estimated at USD 275.8 million in 2024 and is expected to reach USD 289.6 million in 2025.

b. The Spain pest control products market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 460.9 million by 2033.

b. The sprays and aerosols hold the largest market share in the Spain pest control products market due to their convenience, rapid action, and widespread adoption in both residential and commercial spaces.

b. Key players in the Spain pest control products market are BASF SE, Syngenta Group, Bayer AG, FMC Corporation, Sumitomo Corporation, Corteva Agriscience, Novozymes Biologicals, Nufarm Limited, UPL Limited, Koppert, among others.

b. Key factors that are driving the Spain pest control products market growth include rising commercial/residential demand, shift toward biologicals and low-toxicity solutions, public-health risk and climate-driven vector expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.