- Home

- »

- Food Additives & Nutricosmetics

- »

-

Specialty Food Ingredients Market Size & Share Report, 2033GVR Report cover

![Specialty Food Ingredients Market Size, Share & Trend Report]()

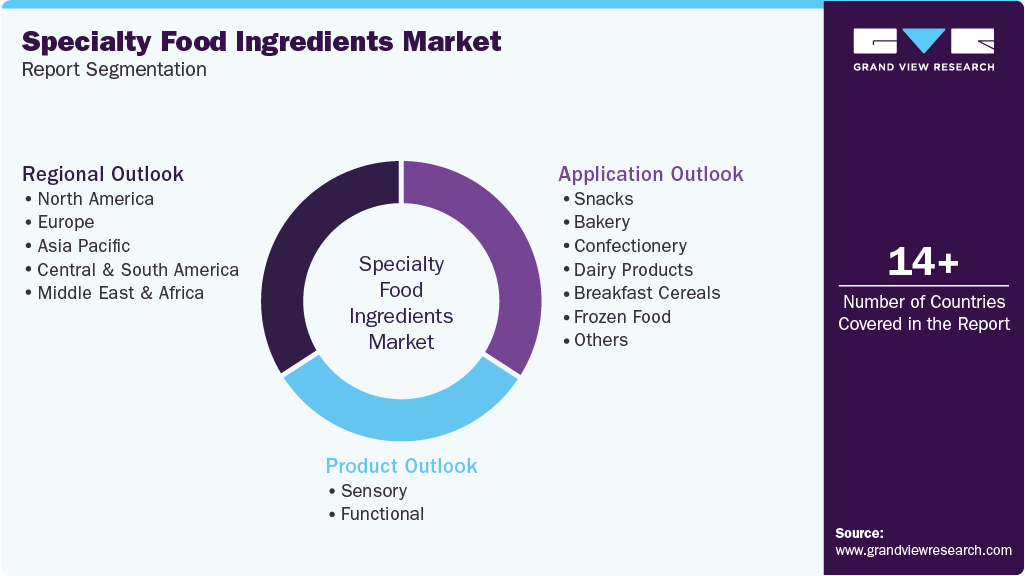

Specialty Food Ingredients Market (2026 - 2033) Size, Share & Trend Analysis Report By Product (Sensory, Functional), By Application (Snacks, Bakery, Confectionery, Dairy Products, Alcoholic, Non Alcoholic, Baby Food), By Region, Segment Forecasts

- Report ID: GVR-1-68038-591-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Food Ingredients Market Summary

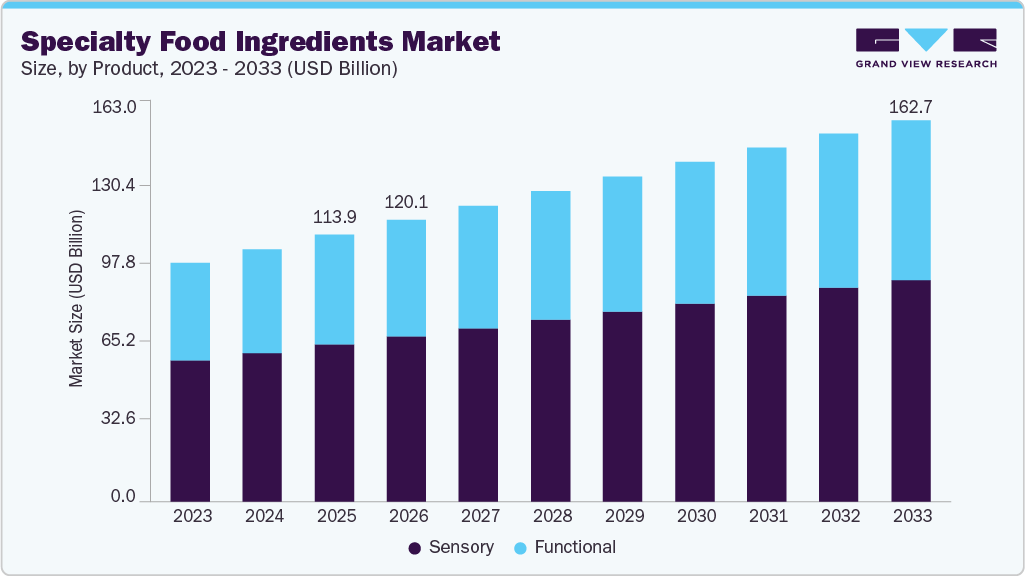

The global specialty food ingredients market size was valued at USD 113.87 billion in 2025 and is expected to reach USD 162.73 billion by 2033, growing at a CAGR of 4.4% from 2026 to 2033. The industry has been witnessing an upsurge in the past few years, mainly due to the rising health awareness among consumers.

Key Market Trends & Insights

- Asia Pacific dominated the global specialty food ingredients market in 2025 with a share of 34.30%.

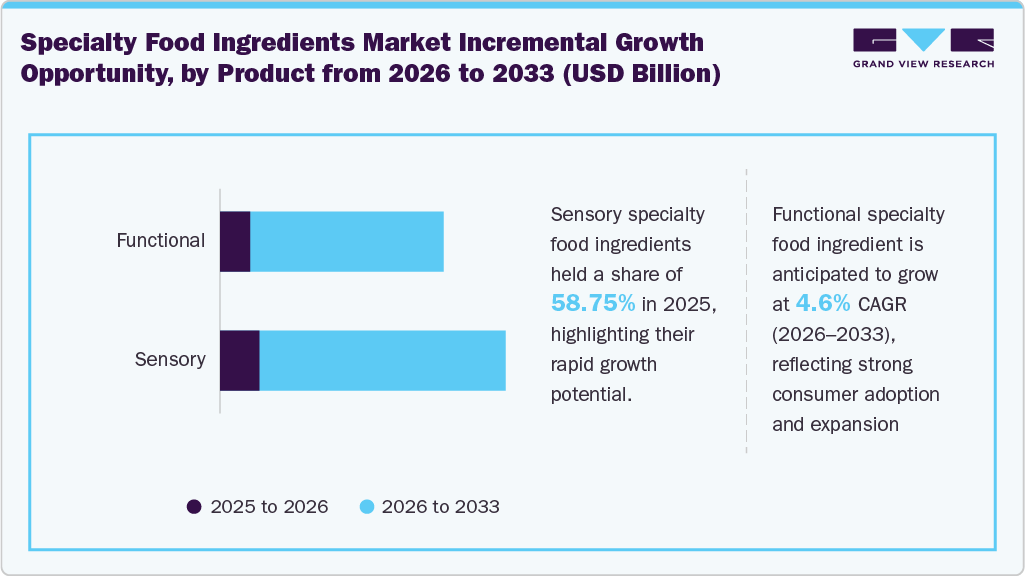

- By product, the sensory specialty food ingredients accounted for a share of 58.75% in 2025.

- The functional specialty food ingredients are expected to witness a CAGR of 4.6% from 2026 to 2033.

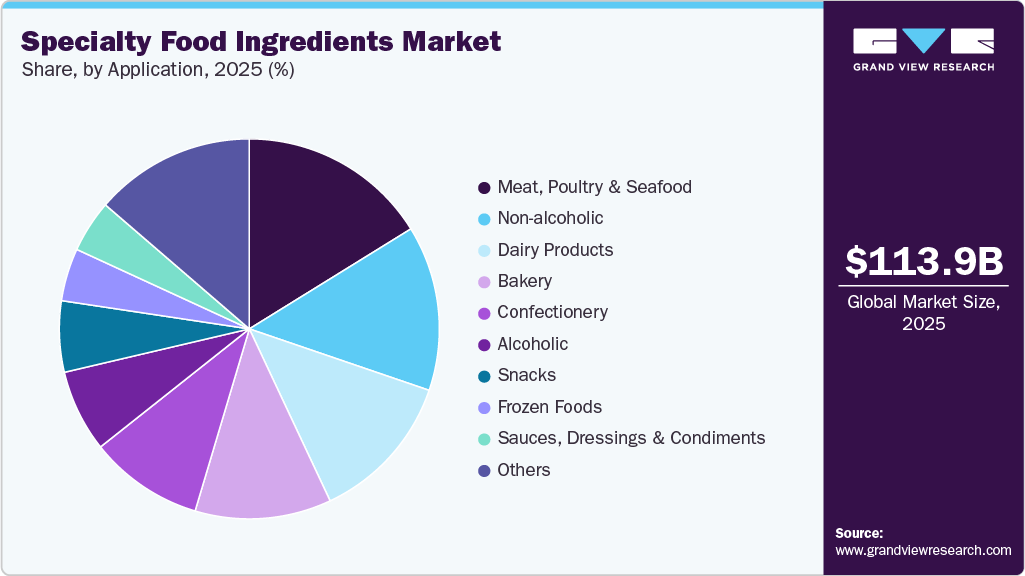

- By application, the meat, poultry, and seafood segment accounted for a share of 16.18% in 2025.

- The specialty food ingredients market for alcoholic beverages application is expected to witness a CAGR of 5.3% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 113.87 Billion

- 2033 Projected Market Size: USD 162.73 Billion

- CAGR (2026-2033): 4.4%

- Asia Pacific: Largest market in 2025

The increasing prevalence of chronic diseases such as obesity across the world has emerged as the primary driver towards the switch to healthy food alternatives. Due to this, food manufacturers have been increasingly incorporating functional ingredients such as probiotics, emulsifiers, hydrocolloids, and others into processed food.Various types of specialty food ingredients are added into food products, including functional food ingredients, specialty starch and texturants, sweeteners, flavors, preservatives, emulsifiers, colorants, enzymes, cultures, proteins, specialty oils, yeast, and others. These ingredients are usually added to packaged food products such as beverages, bakery, dairy, confectionery, dried processed food, frozen food, and others. The growing trend of incorporating sugar substitutes such as stevia and coconut sugar into beverages and bakery and confectionery products is likely to support the growth of the specialty ingredients market in the coming years.

A large number of consumers are placing a high focus on personal health, preferring products that include minimal synthetic ingredients. Increasing preference towards healthy food, coupled with the willingness to pay a premium price for such products with better nutritional value, are also important factors that are likely to propel the demand for protein supplements over the forecast period. Brand name, nutritional value, and safety of the products are some of the factors that influence the consumer's buying pattern. Awareness of high-quality products through advertisement across various forms of media, including electronic and social media, about the benefits offered by protein supplements, is further likely to influence consumer buying behavior.

The rapid socioeconomic development that has taken place over the decades has also resulted in increased cases of heart diseases, cancer, and diabetes across various segments of the population. Growing health consciousness has resulted in consumers preferring protein-based food products with added health benefits. Furthermore, factors such as a busy lifestyle that encourages on-the-go eating and the rising trend of replacing meals with smaller nutritional snacks have led to increased consumption of protein bars, cookies, and RTDs as part of a daily diet.

The trend of being proactive toward chronic health problems has spurred the demand for protein supplements in North America, as they contain essential ingredients that improve the overall health of consumers. Moreover, the growing trend of personalized nutrition in North America is expected to have a positive impact on the product demand.

Product Insights

Sensory specialty food ingredients accounted for the largest share of 58.75% of the global revenues in 2025, reflecting their critical role in enhancing taste, aroma, texture, and overall consumer experience across processed and packaged foods. These ingredients, including flavors, colors, sweeteners, texturants, and taste modulators, are widely used to differentiate products in highly competitive food and beverage markets. Rising demand for premium, indulgent, and convenience foods has accelerated the adoption of advanced sensory solutions that deliver consistent quality and sensory appeal. Additionally, growing reformulation efforts to reduce sugar, salt, and fat levels have increased reliance on sensory ingredients to maintain palatability without compromising taste. Clean-label trends and consumer preference for natural and plant-based sensory solutions have further shaped product innovation, encouraging manufacturers to develop natural flavors, extracts, and colorants that align with health, transparency, and sustainability expectations.

The functional specialty food ingredients are expected to grow at a CAGR of 4.6% from 2026 to 2033, supported by sustained consumer interest in health-oriented and value-added food products. Increasing emphasis on preventive healthcare is driving the incorporation of functional ingredients such as probiotics, prebiotics, dietary fibers, plant proteins, omega-3 fatty acids, and antioxidants into daily diets. Food and beverage manufacturers are actively reformulating products to offer targeted benefits related to digestive health, immunity support, energy, and metabolic wellness. Growth is further reinforced by rising adoption of functional beverages, sports and active nutrition products, and fortified staples. In addition, clean-label trends and demand for natural, minimally processed ingredients are shaping innovation strategies across the industry. Technological advancements that enhance ingredient stability and bioavailability are enabling wider application across bakery, dairy, snacks, and beverages, ensuring steady long-term growth of the functional specialty food ingredients market.

Application Insights

Specialty food ingredients for meat, poultry, and seafood applications accounted for the largest share of 16.18% of the global specialty food ingredients industry in 2025. Specialty ingredients are widely used in the meat processing industry in order to improve the shelf life, texture, taste, and nutritional profile of the products. As a result, the growth of the meat processing industry is expected to have a positive impact on the demand for specialty food ingredients for application in meat, poultry, and seafood. Growing adoption of frozen meat is also expected to boost the market growth over the forecast period. To fulfill the demand for certain seasonally available meat products, manufacturers are gradually shifting towards the frozen meat segment. Changing lifestyles across the globe and an increase in demand for ready-to-eat food are expected to drive the demand for frozen meat products.

The alcoholic beverages applications are projected to grow at a CAGR of 5.3% from 2026 to 2033, driven by premiumization trends and evolving consumer preferences for differentiated taste profiles and improved drinking experiences. Brewers, distillers, and winemakers are increasingly using specialty ingredients such as natural flavors, yeast extracts, enzymes, colorants, and functional additives to enhance aroma, mouthfeel, clarity, and stability. Rising demand for craft beer, flavored spirits, and ready-to-drink (RTD) alcoholic beverages is further supporting ingredient innovation. In addition, growing interest in low-alcohol, no-alcohol, and better-for-you alcoholic options is encouraging the use of specialty ingredients to maintain flavor complexity while reducing alcohol content. Sustainability and clean-label considerations are also influencing ingredient selection, with manufacturers favoring natural and fermentation-based solutions to meet regulatory requirements and shifting consumer expectations.

Regional Insights

North America accounted for a share of 23.13% of the global specialty food ingredients industry in 2025, supported by a well-developed food processing sector, high consumption of packaged and convenience foods, and strong demand for value-added ingredients. The U.S. leads the regional market due to continuous product innovation, advanced manufacturing capabilities, and early adoption of clean-label and functional ingredients. Canada contributes through the growing demand for natural and plant-based formulations across bakery, dairy, and beverages. Additionally, the Mexico specialty food ingredients market is gaining traction, driven by expanding food and beverage manufacturing, rising urbanization, and increasing incorporation of flavors, colors, and functional ingredients in processed foods tailored to local taste preferences and export-oriented production.

U.S. Specialty Food Ingredients Market Trends

The specialty food ingredients market in the U.S. is projected to grow at a CAGR of 4.2% from 2026 to 2033. The demand for specialty food ingredients in the U.S. is highly influenced by its growing vegan population, high focus on the use of natural & organic food ingredients, and the presence of key manufacturers with wide distribution networks. Moreover, extensive consumption of resistant starch in the food & beverage industry to reduce weight fuels the demand for low-fat food products such as cereals, which, in turn, is projected to drive the overall market growth over the forecast period.

Europe Specialty Food Ingredients Market Trends

The specialty food ingredients market in Europe is projected to grow at a CAGR of 4.7% from 2026 to 2033. European consumers are more inclined toward probiotic foods and probiotic beverages, as awareness about the health benefits of these probiotic food products is increasing in the region. Furthermore, probiotic yogurt is one of the emerging probiotic food products in Europe, which, in turn, is boosting the growth of the food & beverages segment in the European specialty food ingredients market. Increasing use of probiotics to maintain gut health is the key factor for the growth of the dietary supplements segment in the market. Gut health is directly related to immune health; thus, since the outbreak of the COVID-19 pandemic globally, European consumers are actively considering gut health as one of the important health issues. Thus, the use of probiotic ingredients in dietary supplements is expected to increase substantially in Europe over the forecast period.

The UK specialty food ingredients market is projected to grow at a CAGR of 5.8% from 2026 to 2033. Consumers in the UK are becoming increasingly aware of healthy lifestyles and are taking more responsibility to ensure the well-being of both their mental and physical health. The perception of being healthy has also changed significantly among UK consumers. The consumers in the country now perceive health in terms of preventing illness rather than treating it. As a result, the country has been experiencing a high demand for dietary supplements over the years. Increasing stress levels and the presence of an aging population are some of the other factors fueling the demand for dietary supplements and specialty food ingredients in the country.

Asia Pacific Specialty Food Ingredients Market Trends

The specialty food ingredients market in the Asia Pacific is projected to grow at a CAGR of 5.1% from 2026 to 2033. Rising demand for natural nutritional products, on account of the increasing number of consumers adopting a healthy lifestyle, is projected to propel the market in the Asia Pacific over the forecast period. The Food Safety and Standards Authority of India, the Japan Health and Nutrition Food Association, and the China Food and Drug Administration regulate the use of various ingredients in food & beverage products in their respective countries to ensure quality and consumer safety. Thus, the manufacturers of these countries are required to adhere to the regulations imposed by their respective governing authorities in the market.

Central & South America Specialty Food Ingredients Market Trends

The specialty food ingredients market in Central & South America is projected to grow at a CAGR of 2.6% from 2026 to 2033. Factors such as rapid urbanization and increased spending capacities in countries such as Argentina, Brazil, and Chile contribute significantly to the food & beverage industry growth. The growing consumer incomes after the economic recession and subsequent recovery are expected to result in a demand surge for beverages, dairy, and confectionery products, thereby driving the specialty food ingredients market growth. The rising demand for new flavors and cuisines in the food & beverage industry is expected to have a positive impact on market growth.

Middle East & Africa Specialty Food Ingredients Market Trends

The specialty food ingredients market in the Middle East & Africa is projected to grow at a CAGR of 3.1% from 2026 to 2033, driven by rising demand for packaged and convenience foods, urbanization, and changing dietary habits. Growth is supported by increasing investments in food processing, especially in GCC countries, and growing use of flavors, emulsifiers, and functional ingredients to enhance shelf life, taste, and product differentiation. Expanding hospitality and foodservice sectors further contribute to steady regional demand.

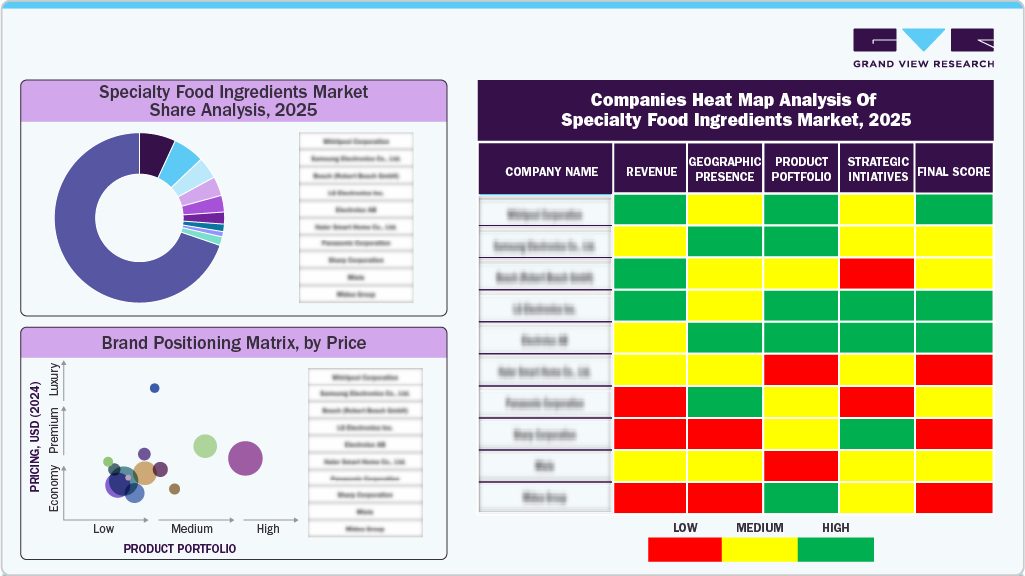

Key Specialty Food Ingredients Company Insights

Established companies and emerging players in the specialty food ingredients market are fostering a highly competitive landscape by focusing on product innovation, quality enhancement, and strategic pricing strategies. This competition is fueled by continuous investments in advanced processing technologies, automation, and a skilled workforce to maintain operational efficiency and comply with stringent regulatory standards. Additionally, increasing consumer demand for clean-label, sustainable, and functional protein sources is reshaping market dynamics. These factors collectively drive market share shifts and encourage the development of diverse, value-added specialty food ingredients.

Key Specialty Food Ingredients Companies:

The following are the leading companies in the specialty food ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Kerry Inc.

- Chr. Hansen Holding AS

- DSM

- DuPont de Nemours Inc. (IFF)

- Associated British Foods plc

- Lallemand Inc.

- Archer Daniels Midland (ADM)

- Advanced Enzyme Technologies

- Cargill Inc.

- Adisseo

Recent Developments

-

In November 2025, Probi broadened its offerings with two new probiotic lines: Sports & Active Nutrition, focused on physical performance, and Pet Health probiotics targeting digestive and oral health in companion animals, highlighting diversification beyond traditional human supplements.

-

In November 2025, Ingredion launches new clean-label ingredients: Ingredion introduced FIBERTEX CF 500 and CF 100 citrus fibre ingredients made from upcycled citrus peels that enhance texture, gelling, and viscosity for meat alternatives, baked goods, and savory foods. It also launched VITESSENCE Pea 100 HD protein to improve texture and softness in plant-based protein bars, showcased at IFT FIRST 2024

-

In July 2025, ClostraBio, Inc. announced that its next-generation probiotic strain CLB101 received self-affirmed GRAS status, positioning it for commercial launch in the U.S. market.

Specialty Food Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 120.09 billion

Revenue Forecast in 2033

USD 162.73 billion

Growth rate

CAGR of 4.4% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; France; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

Kerry Inc.; Chr. Hansen Holding AS; DSM; DuPont de Nemours Inc. (IFF Nutrition & Bio-Science); Associated British Foods plc; Lallemand Inc.; Archer Daniels Midland; Advanced Enzyme Technologies; Cargill Inc.; Adisseo

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Specialty Food Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global specialty food ingredients market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Sensory

-

Enzymes

-

Emulsifiers

-

Flavors

-

Colorants

-

Others

-

-

Functional

-

Vitamins

-

Minerals

-

Antioxidants

-

Preservatives

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Snacks

-

Bakery

-

Confectionery

-

Dairy Products

-

Breakfast Cereals

-

Frozen Food

-

Meat, Poultry, and Seafood

-

Baby Food

-

Sauces, Dressings, and Condiments

-

Alcoholic

-

Non Alcoholic

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global specialty food ingredients market size was estimated at USD 101.9 billion in 2023 and is expected to reach USD 114.9 billion in 2024.

b. The global specialty food ingredients market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 144.98 billion by 2030.

b. Asia Pacific dominated the specialty food ingredients market with a share of 33.9% in 2023. This is attributable to popularity of convenience food and expansion of end-use industries in the economies of China.

b. Some key players operating in the specialty food ingredients market include Naturex, Givaudan, Eli Fried Inc., KF Specialty Ingredients, Ingredion, Associated British Foods Plc, Kerry Group, Agropur Cooperative, Ashland Inc, Archer Daniels Midland Company, Cargill Inc., Wild Flavors GmbH, and DSM, to name a few.

b. Key factors that are driving the specialty food ingredients market growth include shift in consumer focus towards organic products coupled with growing demand for anti-ageing and environmental defense skin care products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.