- Home

- »

- Healthcare IT

- »

-

Specialty PACS Market Size & Share, Industry Report, 2033GVR Report cover

![Specialty Picture Archiving And Communication System Market Size, Share & Trends Report]()

Specialty Picture Archiving And Communication System Market (2025 - 2033) Size, Share & Trends Analysis Report By Specialty (Radiology PACS, Pathology PACS), By Deployment Mode (Cloud-based/Web-based, Hybrid), By End Use (Hospitals, Diagnostic Imaging Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-762-9

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty PACS Market Summary

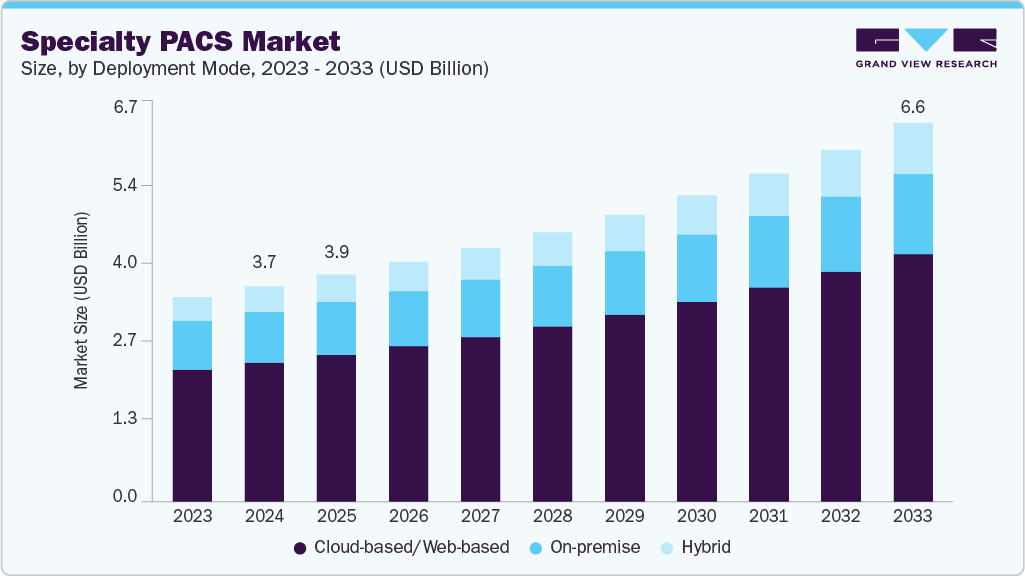

The global specialty picture archiving and communication system market size was estimated at USD 3.74 billion in 2024 and is projected to reach USD 6.57 billion by 2033, growing at a CAGR of 6.6% from 2025 to 2033. This growth is attributed to rising adoption of digital imaging solutions, the increasing volume of medical imaging procedures, growing demand for tele radiology and remote diagnostics, Government initiatives and regulatory support for healthcare IT adoption, and Technological advancements in cloud-based PACS solutions.

Key Market Trends & Insights

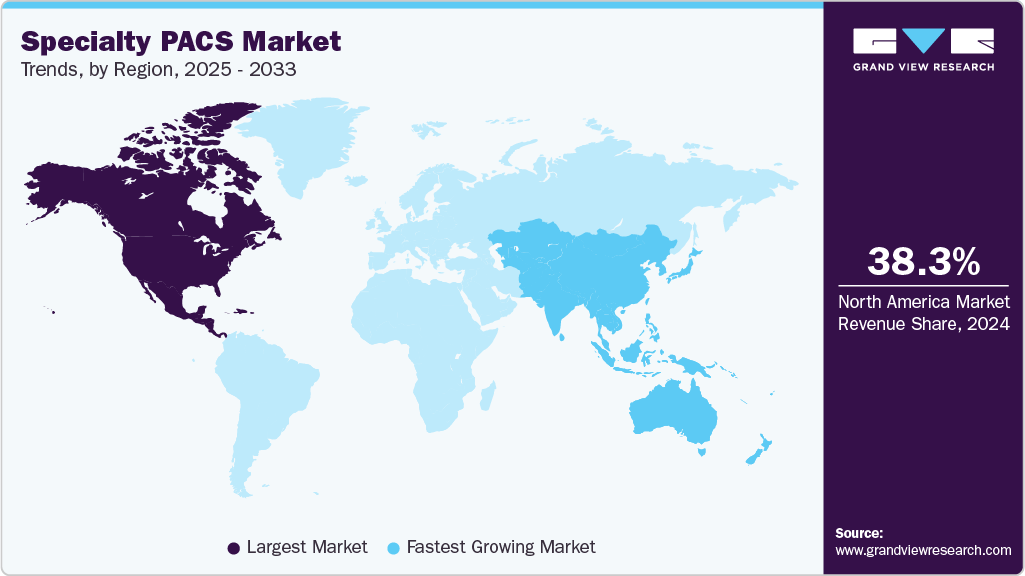

- North America dominated the specialty PACS market with a revenue share of 38.29% in 2024.

- The Asia Pacific specialty PACS is estimated to grow at the fastest CAGR from 2025 to 2033.

- By deployment mode, the cloud-based/web-based segment held the dominant market share in 2024.

- By specialty, the radiology PACS segment held the largest revenue share in 2024.

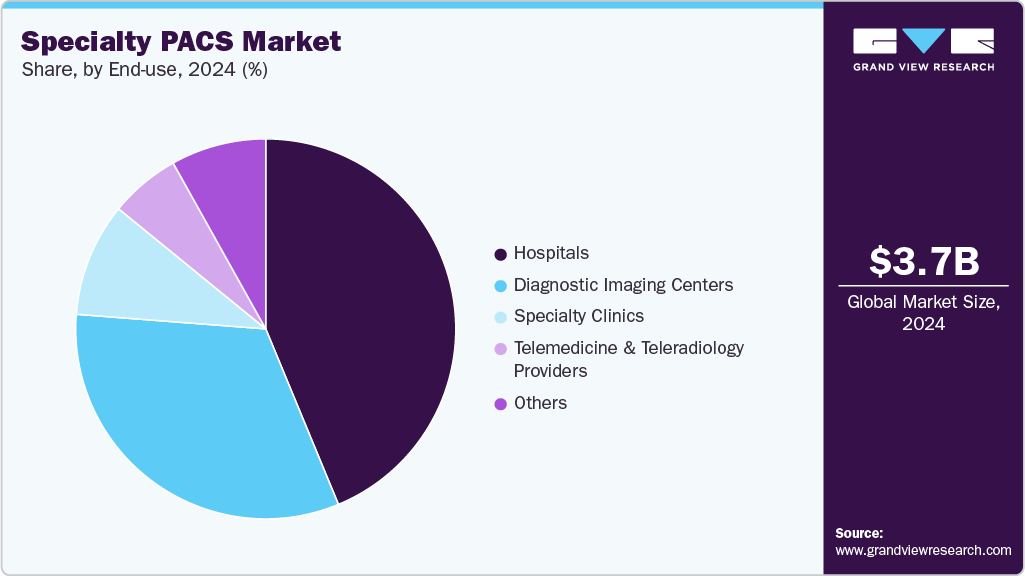

- By end use, the hospitals segment held the dominant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.74 Billion

- 2033 Projected Market Size: USD 6.57 Billion

- CAGR (2025-2033): 6.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the growing integration of artificial intelligence (AI) into specialty PACS is an emerging trend shaping the market. The increasing volume of medical imaging procedures is a major driver for the specialty (Picture Archiving And Communication System) PACS industry. The growth is fueled by the rising prevalence of chronic diseases, an aging population, and advances in imaging modalities that expand diagnostic capabilities. As more scans are performed across specialties such as cardiology, mammography, orthopedics, and dentistry, healthcare providers face growing challenges in storing, retrieving, and managing large volumes of complex image data. According to the Journal of the American College of Radiology, imaging utilization is projected to rise from 16.9% in 2023 to 26.9% by 2055, highlighting the accelerating demand for efficient imaging management systems which further emphasizes the need for specialty PACS solutions that offer tailored workflows, advanced visualization, and streamlined data management to enable faster interpretation, improved collaboration, and better patient outcomes.

Rising adoption of tele radiology is driving growth in the specialty PACS market, as healthcare providers increasingly rely on remote diagnostic services to address radiologist shortages, expand access to expertise, and enable around-the-clock reporting. According to Merative, by 2033, the U.S. could face a shortage of up to 42,000 radiologists. Tele radiology allows medical images from modalities such as CT, MRI, mammography, and ultrasound to be shared instantly across locations, supporting faster diagnoses and continuity of care, particularly in rural or underserved regions. Specialty PACS solutions complement this demand by offering cloud-based access, secure image sharing, and specialty-specific workflows that ensure seamless collaboration between radiologists and referring physicians across geographies, improving efficiency, turnaround times, and diagnostic accuracy.

Integration of AI in Specialty PACS

AI is increasingly transforming specialty PACS by automating critical imaging workflows such as image sorting, detection of abnormalities, reporting, and study prioritization. These technologies accelerate diagnosis, reduce interpretation errors, and enhance overall radiology efficiency by minimizing manual effort and enabling faster, data-driven clinical decision-making.

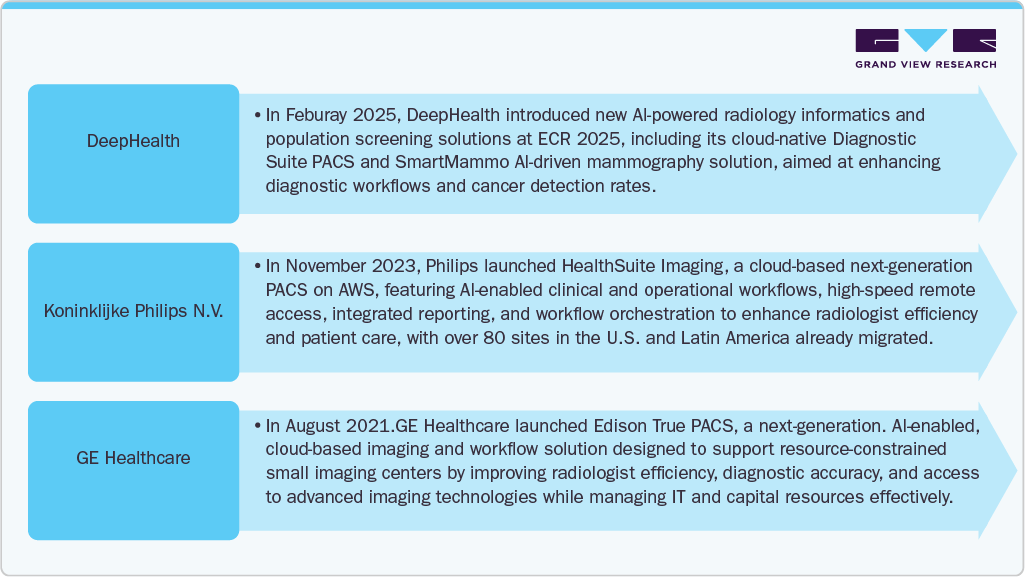

Several leading specialty (Picture Archiving And Communication System) PACS providers are leveraging AI and advanced analytics to improve diagnostic efficiency, streamline radiology workflows, and enhance clinical decision-making. The table below highlights key AI-driven capabilities offered by major market players in the specialty PACS space.

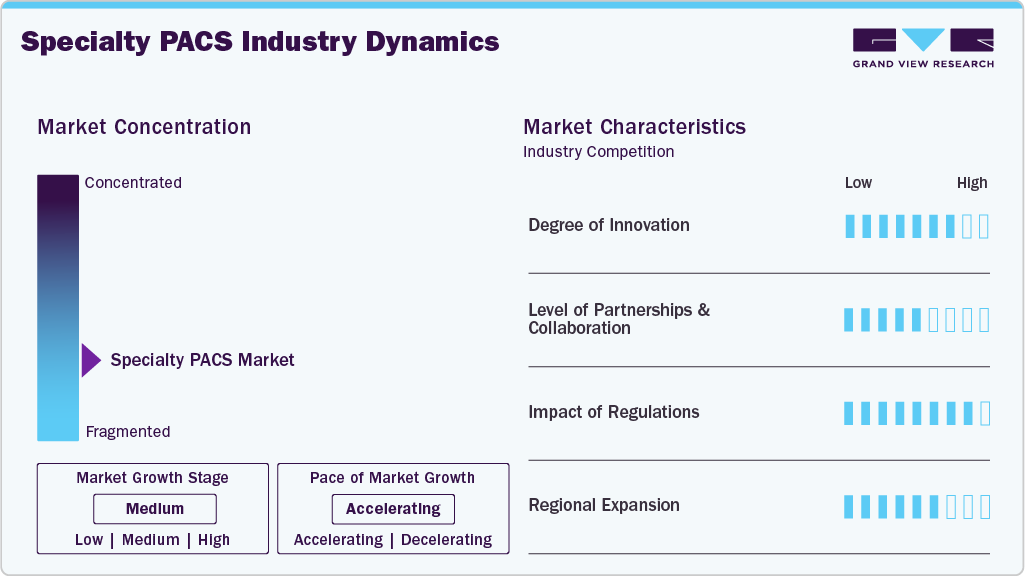

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the specialty PACS market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation is high, driven by the integration of AI, cloud computing, and advanced analytics into imaging workflows. Vendors are developing solutions with specialty-specific features, including automated detection of abnormalities, 3D visualization, enhanced reporting tools, and seamless interoperability with EMRs and RIS. Innovations in cloud-based access, tele radiology support, and AI-enabled decision support are enabling faster diagnoses, improved collaboration, and better patient outcomes.

The level of partnerships and collaborations in the specialty PACS industry is moderate, focusing on enhancing diagnostic efficiency and clinical workflows. Market players collaborate with healthcare providers, imaging device manufacturers, and technology partners to expand interoperability, integrate AI-driven tools, and offer specialty-specific imaging solutions. For instance, in March 2025, NewVue.ai partnered with RamSoft to integrate NewVue.ai’s EmpowerSuite, featuring AI-driven Intelligent Worklist and Radiologist Cockpit, into RamSoft’s PowerServer and OmegaAI RIS/PACS platforms, aiming to streamline radiology workflows, improve efficiency, and support modernization of radiology operations.

“This partnership is a game-changer for RamSoft customers,We've seen firsthand how radiology groups struggle with fragmented workflows and legacy worklist systems. By integrating NewVue.ai's EmpowerSuite with RamSoft's PowerServer and OmegaAI platforms, RamSoft is providing a next-generation workflow that dramatically improves efficiency, reduces IT complexity, and empowers radiologists to focus on clinical excellence.”

- Kyle Lawton, CEO of NewVue.ai

Regulations have a high impact on shaping the market, ensuring patient data security, compliance with standards like HIPAA, and adherence to medical imaging guidelines. Regulatory requirements drive vendors to implement secure data storage, encrypted image transfer, audit trails, and standardized reporting, which enhances trust, interoperability, and overall adoption of specialty PACS solutions across healthcare providers.

The specialty PACS market is expanding across regions, driven by the growing demand for efficient imaging management, faster diagnoses, and improved clinical workflows. The adoption of cloud-based PACS, AI-enabled image analysis, automated reporting tools, and increasing investments in healthcare IT infrastructure support growth

Specialty Insights

The radiology PACS segment held the largest market share of 47.70% in 2024, driven by high demand for advanced imaging, growing adoption of AI-enabled solutions, increasing imaging volumes, and the need for efficient, interoperable workflows across hospitals and diagnostic centers. Moreover, key market players such as Sectra AB, Intelerad, Koninklijke Philips N.V., and GE Healthcare are continuously focusing on developing AI-integrated radiology PACS solutions to enhance diagnostic accuracy, streamline workflows, and improve clinical efficiency, contributing to the segment's large share.

The pathology (Picture Archiving And Communication System) PACS segment is expected to grow significantly over the forecast period. This growth is attributed to the increase in imaging and pathology workloads, making high‐performance PACS essential. Regulatory support, healthcare IT infrastructure investment, and government initiatives toward digital health and interoperability further bolster growth. In contrast, integration with electronic health records (EHRs) ensures that pathology images are more useful in wider clinical contexts.

Deployment Mode Insights

The cloud-based/web-based segment led the specialty PAC market with the largest revenue share of 64.64% in 2024, due to its ability to reduce IT infrastructure costs, minimize the need for on-premises hardware, and provide easy access and sharing of imaging data across multiple sites. In addition, the focus of market players on offering integrated imaging solutions to enhance workflow efficiency and interoperability further contributes to the large market share. For instance, in November 2024, Konica Minolta Healthcare launched Exa Enterprise, a cloud-based enterprise imaging solution powered by AWS, providing integrated PACS/RIS, advanced visualization, and seamless third-party integrations, exemplifying the trend of vendors developing advanced cloud-based solutions.

The hybrid segment is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to its ability to balance on-premise data control with cloud-based scalability and remote access. Rising demand for secure yet flexible imaging workflows, cost-effective storage solutions, and seamless integration with AI and analytics platforms is driving adoption, especially among healthcare providers managing large, multi-site networks.

End Use Insights

The hospitals segment held the dominant share of the specialty (Picture Archiving And Communication System) PACS market in 2024, driven by the high volume of diagnostic imaging procedures and the need to manage imaging workflows across multiple departments and specialties. Hospitals implementing PACS to enable efficient data storage, retrieval, and sharing, ensure seamless integration with EMR and RIS systems, and support tele radiology and remote consultations across their networks, enhancing overall clinical efficiency and patient care. For instance, in January 2023, Manipal Hospitals partnered with FUJIFILM to implement the large-scale PACS by FUJIFILM in India. The rollout extended across 23 hospitals and 45 teleradiology centers operated by Manipal Health Enterprises nationwide.

The diagnostic imaging centers segment is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to the volume of outpatient imaging increases-driven by broader access, preventive care programs, and referrals from primary care, these centers need dedicated, efficient systems that can handle large imaging workloads without the complexity of hospital infrastructure.

Regional Insights

North America dominated the specialty PACS market in 2024, with a revenue share of 38.29%. This can be attributed to the high healthcare infrastructure investments, increasing demand for efficient radiology workflows, high adoption of advanced imaging technologies, and early integration of cloud-based and tele radiology solutions. The presence of leading market players and supportive regulatory frameworks further reinforces the region’s dominance in specialty PACS adoption.

U.S. Specialty PACS Market Trends

The U.S. specialty PACS industry is growing due to the high adoption of advanced imaging technologies, increasing focus on specialty-specific imaging solutions, and the need to efficiently manage growing patient volumes. In addition, the increasing investments in AI-driven healthcare solutions by leading health systems are also supporting the growth. For instance, in May 2025, Rad AI received strategic investments from four prominent health systems: Advocate Health, Memorial Hermann Health System, Corewell Health, and Atlantic Health System to advance enterprise AI in healthcare. Such investments are expected to accelerate the adoption of AI-enabled imaging solutions, enhance operational efficiency, and support the overall market growth.

Europe Specialty PACS Market Trends

The specialty PACS industry in Europe is expanding due to the growing adoption of tele radiology, increasing demand for cross-border data sharing, and strong healthcare infrastructure across the region. For instance, according to the WHO, around 84% of countries in Europe report the use of tele radiology, alongside rising uptake of tele psychiatry (51%) and telemedicine or remote monitoring services (77%). This widespread adoption of tele radiology is expected to accelerate the deployment of specialty PACS platforms, supporting secure image exchange, seamless collaboration, and improved diagnostic efficiency across European healthcare systems.

The specialty PACS market in the UK is witnessing steady growth driven by the NHS’s digital transformation initiatives, the need for centralized imaging repositories, and the rising adoption of cloud-hosted solutions to support regional diagnostic networks. For instance, in January 2021, Medica Group PLC, the largest tele radiology provider for NHS hospitals, acquired Sectra’s enterprise imaging PACS solution to automate workflows, enhance efficiency, and provide advanced tools for over 450 radiologists serving more than 100 hospitals. Such deployments underscore how leading providers are modernizing infrastructure to strengthen tele radiology services and improve patient care, thereby fueling PACS adoption across the UK.

The Germany specialty PACS market is witnessing steady growth, driven by the country’s advanced healthcare infrastructure, rising adoption of digital health technologies, and strong emphasis on data protection and compliance with stringent regulations such as GDPR. Hospitals and imaging centers increasingly invest in secure and interoperable PACS solutions to streamline workflows and enable seamless data sharing across facilities.

Asia Pacific Specialty PACS Market Trends

The Asia Pacific specialty PACS industry is experiencing rapid growth, fueled by the rising prevalence of chronic diseases, growing demand for advanced diagnostic imaging, and government initiatives to strengthen healthcare IT infrastructure. Countries such as China, India, and Japan are witnessing increased adoption of specialty PACS due to expanding hospital networks, rising medical imaging volumes, and the need for efficient image management.

The specialty PACS market in Japan is driven by increasing adoption of cloud-based healthcare solutions, rising demand for standardized and interoperable medical data, and the need for efficient management of growing imaging volumes. For instance, in March 2023, Fujitsu launched a new cloud-based healthcare platform in Japan that securely collects and converts medical data into HL7 FHIR standards, enabling personalized healthcare, drug development, and AI-driven preventive care in collaboration with Microsoft Azure. Such initiatives are expected to accelerate the deployment of specialty PACS solutions, enhance data interoperability across hospitals, and improve workflow efficiency, supporting overall market growth in Japan.

The China specialty PACS market is expanding rapidly due to growing investments in healthcare IT infrastructure, increasing adoption of digital imaging solutions in hospitals, rising demand for cloud-based and interoperable PACS platforms, and the need to efficiently manage growing volumes of medical imaging data.

Latin America Specialty PACS Market Trends

The specialty PACS industry in Latin America is growing due to the rapid adoption of tele radiology services to address radiologist shortages in remote and underserved areas, the expansion of hospital networks and diagnostic imaging centers, and government initiatives to modernize healthcare IT infrastructure, including telemedicine and digital imaging programs.

Middle East & Africa Specialty PACS Market Trends

The Middle East specialty PACS industry is experiencing steady growth driven by increased healthcare digitization efforts, particularly in countries like Saudi Arabia and the UAE. The focus is on improving interoperability across hospital networks, integrating PACS with EHR systems, and enabling efficient teleradiology and telemedicine services, which together are fueling the adoption of specialty PACS across the region.

Key Specialty PACS Company Insights

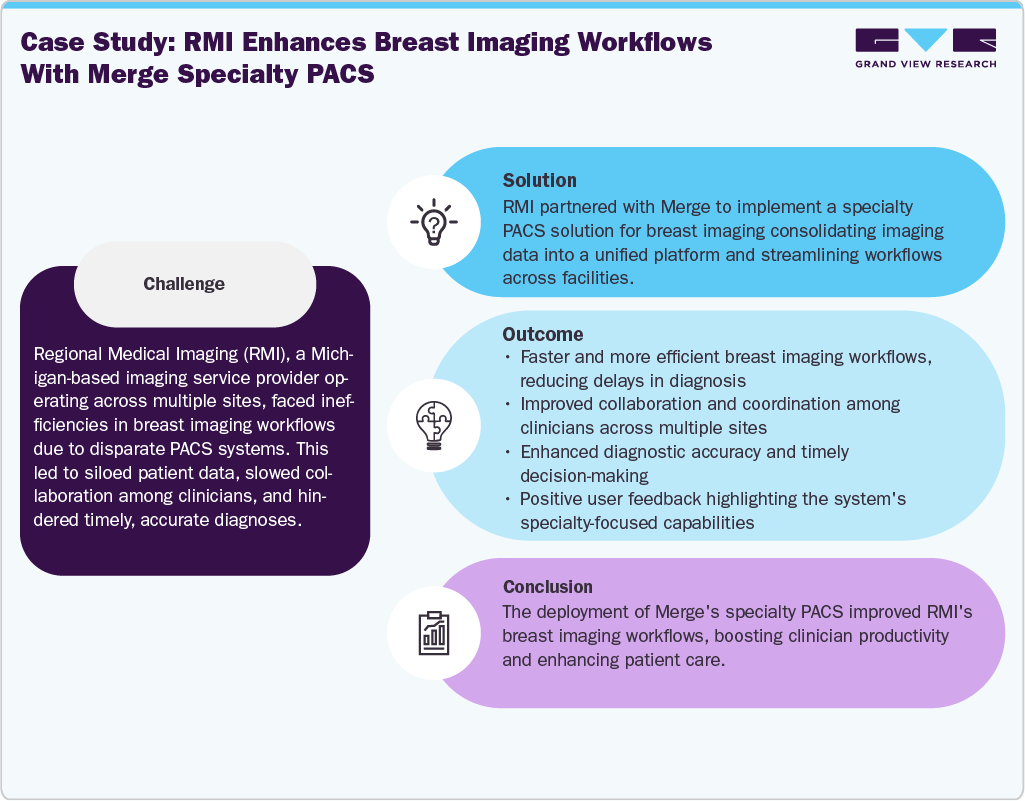

The market is fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Specialty PACS Companies:

The following are the leading companies in the specialty PACS market. These companies collectively hold the largest market share and dictate industry trends.

- Novarad

- INFINITT North America Inc.

- Sectra AB

- Intelerad

- Koninklijke Philips N.V.

- GE HealthCare

- FUJIFILM Corporation

- Canon Medical Systems, USA.

- Agfa HealthCare

- Merative

- Ramsoft

- Optum, Inc.

- Siemens Healthineers AG

- Medstrat

- Candelis Corporation

- Phoenix Ortho

Recent Developments

-

In September 2024, Medsynaptic launched an AI-enabled PACS imaging solution aimed at improving workflow efficiency and accelerating image interpretation in radiology. The platform assists radiologists by streamlining diagnostic processes and enhancing the accuracy and speed of image review within PACS environments.

-

In November 2022, Change Healthcare launched Stratus Imaging PACS, a fully managed, cloud-native Software-as-a-Service (SaaS) solution designed to centralize imaging data and enhance accessibility. This platform offers scalable storage, automatic updates, and robust cybersecurity features, aiming to streamline radiology workflows and reduce operational costs.

“Cloud native is the key differentiator in comparison to lift-and-shift or cloud-enabled options. It offers increased security for patient information and data, and it gives you more speed to improve patient care because you can do it faster and more efficiently.”

-Sonia Gupta, MD, Chief Medical Officer of Change Healthcare.

- In November 2021, AbbaDox launched a PACS-as-a-Service solution powered by Zadara's edge cloud infrastructure. This HIPAA-compliant platform offers imaging centers scalable, low-latency storage and compute resources, enhancing data access and reducing IT complexity. It supports various use cases, including teleradiology and disaster recovery, seamlessly integrating with AbbaDox's cloud-based Radiology Information System (RIS).

“With the growing success of AbbaDox cloud RIS-as-a-Service, Zadara Edge compute and Storage-as-a-Service is a natural fit with our suite of mission-critical applications. It allows radiology organizations to transform their traditional on-premise IT infrastructure into a modern, scalable, and secure radiology information system”.

-Yaniv Dagan, CEO of AbbaDox.

- In December 2021, Synapsica partnered with GenWorks Health to distribute its AI-powered PACS solution, Radiolens, across over 300 tier 2 and 3 cities in India. This collaboration aims to address the radiologist shortage by automating diagnostic workflows, enabling 24/7 reporting, and improving access to quality radiology services in underserved regions.

We forge partnerships that enable access to quality healthcare infrastructure for everyone. Synapsica’s Radiolens is a fantastic innovation and fits very well with our mission. The partnership will allow hospitals and diagnostic centres to have access to healthcare specialists available on Synapsica’s platform efficiently and support with diagnostics reporting 24X7 which plays an important role in improving patient care.

-Ganesh Prasad, MD & CEO

Specialty PACS Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.94 billion

Revenue forecast in 2033

USD 6.57 billion

Growth rate

CAGR of 6.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Market value in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery mode, specialty, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Novarad; INFINITT North America Inc.; Sectra AB; Intelerad; Koninklijke Philips N.V.; GE HealthCare; FUJIFILM Corporation; Canon Medical Systems, USA; Agfa HealthCare; Merative; Ramsoft; Optum, Inc.; Siemens Healthineers AG; Medstrat; Candelis Corporation; Phoenix Ortho

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty PACS Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global specialty PACS market report based on specialty, deployment mode, end use, and region:

-

Specialty Outlook (Revenue, USD Million, 2021 - 2033)

-

Radiology PACS

-

Cardiology PACS

-

Mammography PACS

-

Orthopedic PACS

-

Ophthalmology PACS

-

Pathology PACS

-

Oncology / Radiation Therapy PACS

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-Based/ Web-Based

-

On-premise

-

Hybrid

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Diagnostic Imaging Centers

-

Telemedicine & Tele radiology Providers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.