- Home

- »

- Organic Chemicals

- »

-

Specialty Pulp & Paper Chemicals Market Size Report, 2030GVR Report cover

![Specialty Pulp & Paper Chemicals Market Size, Share & Trends Report]()

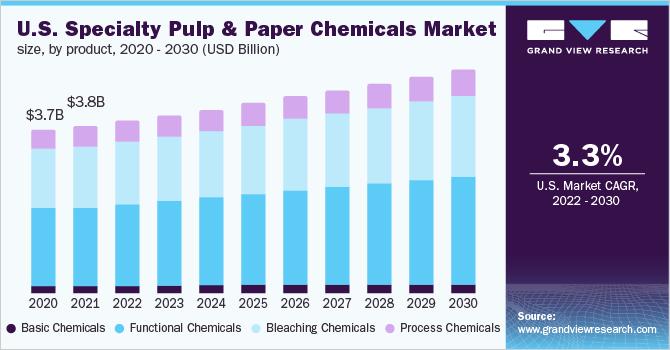

Specialty Pulp & Paper Chemicals Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Basic, Functional, Bleaching, Process), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-223-5

- Number of Report Pages: 148

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Pulp & Paper Chemicals Market Summary

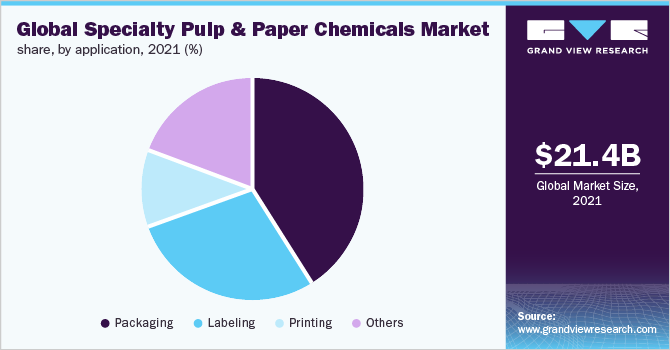

The global specialty pulp and paper chemicals market size was estimated at USD 21.4 billion in 2021 and is projected to reach USD 28.1 billion by 2030, growing at a CAGR of 3.1% from 2022 to 2030. The growing demand for bleaching and functional chemicals used in the production of specialty paper for applications such as packaging, printing, and labeling is expected to drive the market.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2021.

- Country-wise, Venezuela is expected to register the highest CAGR from 2022 to 2030.

- By product, the functional segment are anticipated to be the largest as well as the fastest-growing product segment in 2021.

- By application, the packaging emerged as the largest application segment in 2021, with a revenue-based share of 41.0%.

Market Size & Forecast

- 2021 Market Size: USD 21.4 Billion

- 2030 Projected Market Size: USD 28.1 Billion

- CAGR (2022-2030): 3.1%

- Asia Pacific: Largest market in 2021

COVID-19 had a huge impact on the global industrial supply chains. Several imposed restrictions on people and goods movements had an adverse impact on industrial production. The printing paper and copier paper demand suffered due to the closure of offices, schools, & universities. On the other hand, demand for personal hygiene paper products incased, during the pandemic.

Specialty pulp & paper chemicals are downstream derivatives of a wide range of commodity chemicals including acids, amines, alcohols, fatty alcohols, solvents, surfactants, and betaines; wherein these commodity raw materials are bulk chemicals and can be supplied directly without preprocessing treatment. Mineral acids and bases are generally used as basic chemicals in the manufacturing of specialty pulp and papers.

Various raw materials used in the manufacturing of these products include chelating agents, caustic soda, and biocide. Chelating agents provide the desired level of brightness to the paper when applied with hydrosulfite and hydrogen peroxide bleaches, thereby playing a vital role in the specialty pulp and paper industry. Biocides, however, are used to control and prevent microbial growth and to maintain efficiency in specialty pulp and paper manufacturing machines.

Over the past years, demand for specialty pulp & paper chemicals has been declining or is relatively stagnant due to the digital revolution, which has also led to consolidation in the industry. However, growing demand for packaging, household, and sanitary applications has helped bring stabilization in the market. The increasing popularity of coating as a protective material to induce smoothness and reduce ink absorbency in specialty paper will increase the usage of functional chemicals during the next few years.

Product Insights

The product segment includes basic, functional, bleaching, and process chemicals. Functional chemicals are anticipated to be the largest as well as the fastest-growing product segment in 2021 and are expected to register a volume-based CAGR of 2.4% during the forecast period. It constitutes pigment, starch, latex, binders, dye, and miscellaneous coating agents.

The functional chemicals used to improve the properties and qualities of specialty paper such as printability, color, texture, water repellency, and strength. Some of the commonly used functional chemicals are dyes, coating binders, sizing additives, dry and wet additives, and whitening agents. Non-fibrous materials including functional and coating chemicals such as fillers, rosins, brighteners, and alum are added during paper making process for imparting gloss, strength, and ink retention characteristics.

Application Insights

Packaging emerged as the largest application segment in 2021, with a revenue-based share of 41.0% in the global market. The demand for specialty pulp & paper chemicals for packaging is likely to witness a high growth on account of its ability to deliver outstanding print contrast as well as smooth finish in laminating and vacuum metalizing applications.

Wide application of specialty paper in food packaging products including corrugated clamshell, carryout boxes, paper tubes, plates, and cups is another factor augmenting the overall market demand. Commercial printing accounts for major sections in writing and printing application, which is expected to propel the demand for the printing application segment during the next few years.

Specialty chemicals are extensively used in the production of various labels including industrial bar code labels, retail labels, healthcare, and medical labels, and transportation and distribution labels. Various beneficial properties of these labels such as outstanding printability, enhanced bar code readability, and compatibility with solvents anticipated to propel the market demand during the forecast period.

Regional Insights

The Asia Pacific dominated the market accounting for around 46.0% of the total revenue share in 2021. The strong presence of specialty pulp and paper manufacturers in Japan and China in light of easy access to equipment as well as raw materials is expected to increase the use of chemicals during the forecast period.

In addition, increasing demand for specialty pulp and paper in several end-use applications such as labeling, printing, and packaging is predicted to propel the market growth throughout the forecast period. China and India are projected to exhibit remarkable growth owing to rising industrialization, supplemented by rapid economic growth and low labor cost.

In North America, factors such as environmental performance, regulatory compliance, and early adoption of sustainable production techniques play a vital role in shaping industry growth. North America reached a stagnant level in the market for specialty pulp & paper chemicals due to the saturation and growth in the digital industry in 2021. Nevertheless, the market is expected to grow due to the increasing demand for eco-friendly chemicals for recycled papers and the growing application scope of specialty papers.

Key Companies & Market Share Insights

The market is highly fragmented in nature with the presence of established industry players and characterized by mergers & acquisitions, joint ventures, capacity expansions, substantial distribution, and branding decisions to improve market share and regional presence. They are integrated through the value chain from sourcing the raw material to the finished product line. In addition, they are involved in continuous R&D activities to develop new technologies as well as focused on expanding the product portfolio. This is expected to intensify the competition and pose a potential threat to the new players entering the market.

Buck man’s advanced pitch control technology improves quality and productivity. In addition, SNF’s Dry Strength Resin (DSR) programs reduce basis weight, eliminate poor fiber quality, and get better machine speed improving the dry strength of the paper products. Some of the prominent players in the global specialty pulp & paper chemicals market include:

-

Ashland

-

BASF SE

-

Buck man

-

Dow Chemical Company

-

Ecolab

-

SNF Group

-

Evonik Industries AG

-

Nouryon

-

So lenis

Specialty Pulp & Paper Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 22.07 billion

Revenue forecast in 2030

USD 28.1 billion

Growth Rate

CAGR of 3.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, CAGR from 2017 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional Scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country scope

U.S.; Mexico; Canada; Germany; U.K.; Italy; France; Spain; Netherlands; Russia; Turkey; China; India; Japan; South Korea; Indonesia; Malaysia; Australia; New Zealand; Thailand; Vietnam; Brazil; Argentina; Venezuela; Iran; Saudi Arabia; UAE

Key companies profiled

Ashland; BASF SE; Buck man; Dow Chemical Company; Ecolab; SNF Group; Evonik Industries AG; Nouryon; So lenis

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global specialty pulp & paper chemicals market report based on the product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Basic Chemicals

-

Functional Chemicals

-

Bleaching Chemicals

-

Process Chemicals

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Printing

-

Packaging

-

Labeling

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

Netherlands

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Malaysia

-

Australia

-

New Zealand

-

Thailand

-

Vietnam

-

-

Central and South America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Iran

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global specialty pulp and paper chemicals market size was estimated at USD 21.4 billion in 2021 and is expected to reach USD 22.07 billion in 2022.

b. The global specialty pulp and paper chemicals market is expected to grow at a compound annual growth rate of 3.1% from 2022 to 2030 to reach USD 28.1 billion by 2030.

b. Asia Pacific dominated the specialty pulp and paper chemicals market with a share of 45.93% in 2021. This is attributable to the growing demand for flexible packaging due to the increase in consumption of packaged or convenience food.

b. Some key players operating in the specialty pulp and paper chemicals market include Ashland, BASF SE, Buckman, Dow Chemical Company, Ecolab, SNF Group, Evonik Industries AG, Nouryon, Solenis.

b. Key factors that are driving the specialty pulp and paper chemicals market growth include mounting consumption of masking tapes during the construction of bridges, tunnels, water supply, roofing, cladding, glazing, and air conditioning coupled with growth in the coated paper industry

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.