- Home

- »

- Medical Devices

- »

-

Sperm Count Test Market Size, Share, Industry Report, 2033GVR Report cover

![Sperm Count Test Market Size, Share & Trends Report]()

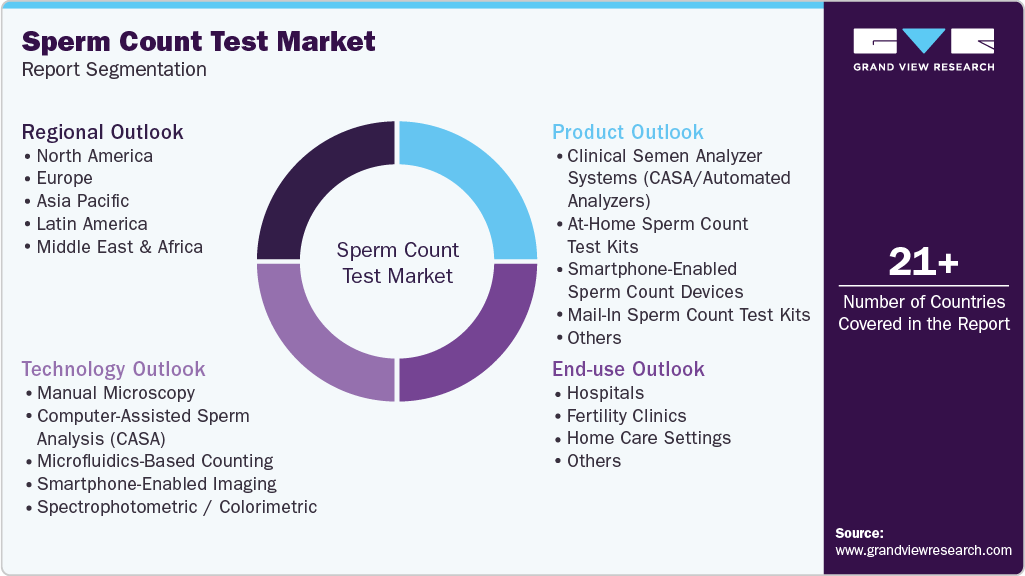

Sperm Count Test Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Manual Microscopy, CASA, Microfluidics-Based Counting, Smartphone-Enabled Imaging), By End Use (Hospitals, Fertility Clinics, Home Care Settings), By Product, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-842-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sperm Count Test Market Summary

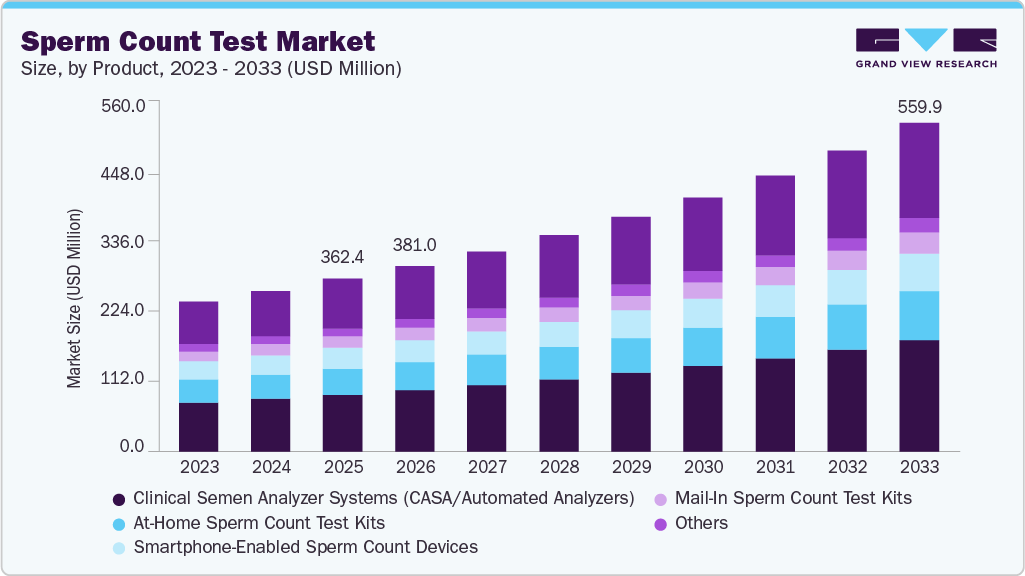

The global sperm count test market size was estimated at USD 362.39 million in 2025 and is projected to reach USD 559.89 million by 2033, growing at a CAGR of 5.65% from 2026 to 2033. This growth is attributed to the rising prevalence of male infertility, growing awareness about reproductive health, and the importance of early fertility assessment among men.

Key Market Trends & Insights

- North America market dominated the global market in 2025 and accounted for the largest revenue share of 36.14%

- U.S. market is anticipated to register the fastest growth rate during the forecast period.

- In terms of product segment, the clinical semen analyzer systems (CASA / automated analyzers) segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 362.39 Million

- 2033 Projected Market Size: USD 559.89 Million

- CAGR (2026-2033): 5.65%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In addition, delayed parenthood and changing social trends have increased the demand for fertility evaluations as couples seek medical assistance to conceive. Moreover, increased availability of fertility clinics, supportive government initiatives for reproductive health, and higher healthcare spending in both developed and emerging economies continue to propel demand for sperm count tests.

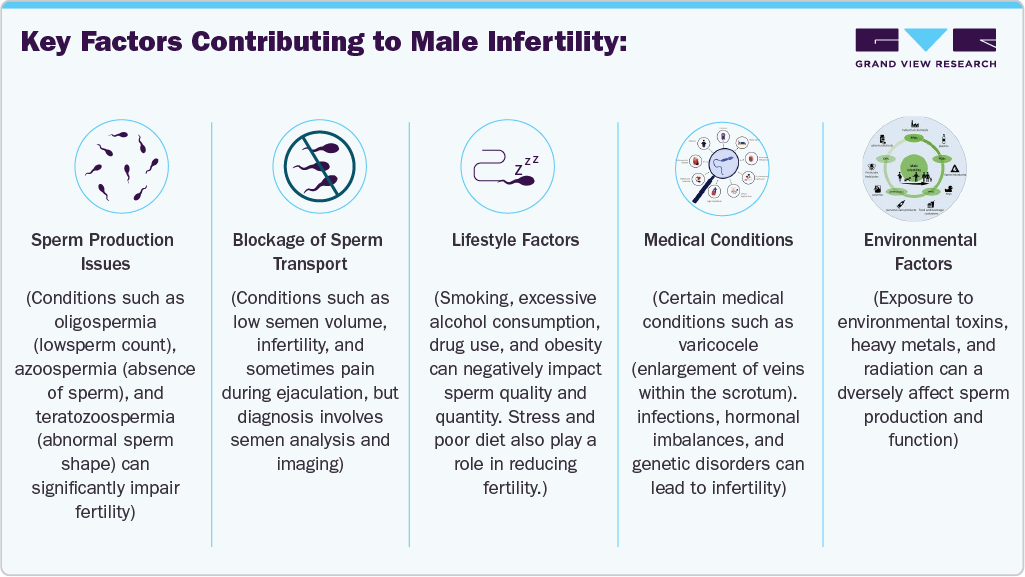

Rising prevalence of male infertility:

The increasing incidence of male infertility, largely due to lifestyle changes, stress, obesity, smoking, alcohol use, and environmental pollution, is significantly boosting the market. As per the Fertility Centers of New England, Inc. article published in June 2024, infertility impacts roughly 15% of couples globally, with male factors playing a role in about half of these cases. In the U.S., around 9% of men of reproductive age encounter difficulties with fertility, underscoring that this is not a rare problem.

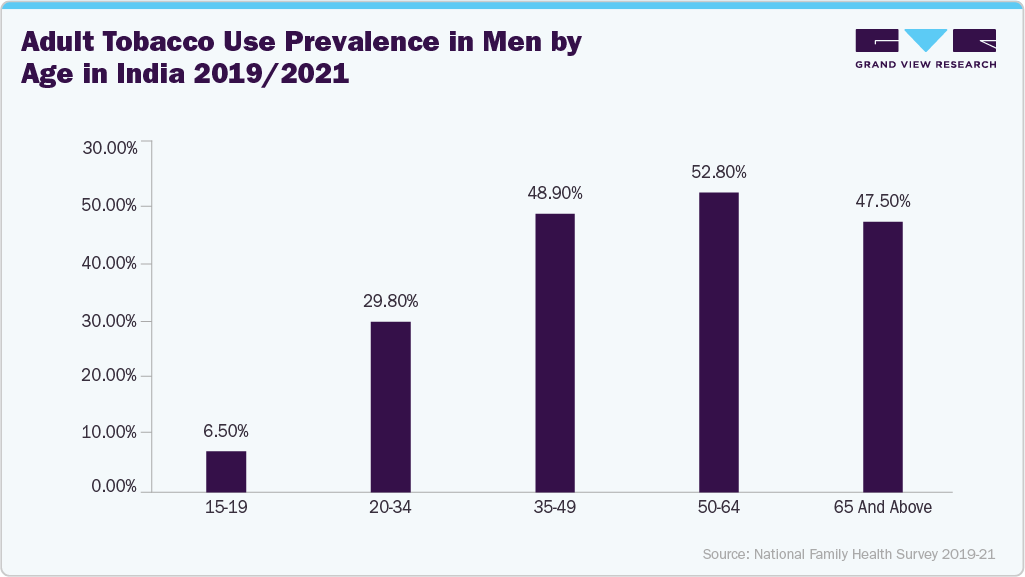

Sedentary habits, unhealthy diets, and elevated stress levels common in modern life disrupt hormonal balance and hinder sperm production. Obesity often leads to lower testosterone and poorer sperm quality, while smoking and heavy alcohol consumption are linked to DNA damage in sperm and decreased sperm count and motility. For instance, as per the Global Action to End Smoking, in 2022, approximately 200.2 million men aged 15 and above were users of tobacco products in India. These lifestyle challenges have led many individuals to actively monitor their reproductive health through home-based and non-invasive fertility testing devices.

In addition, greater exposure to environmental pollutants such as pesticides, industrial chemicals, and heavy metals correlates with declining male reproductive health. As these risk factors become more prevalent, more men face fertility issues, increasing the demand for early diagnosis and routine fertility assessments. This trend has driven the wider use of sperm count tests in both clinical environments and at-home test kits, fueling market growth.

Key Factors Contributing to Male Infertility:

Growing awareness of male reproductive health:

Increasing awareness of male reproductive health and greater acceptance of fertility testing among men are important factors driving the market. The Male Reproductive Health Initiative (MRHI) is an international effort focused on improving understanding and treatment of male reproductive health issues. It works to advance both basic and clinical research, ensuring high-quality scientific contributions in the field. MRHI also collaborates with professional societies to support education and training in male reproductive medicine. In addition, the initiative engages in advocacy, reaching out to patient groups, funding bodies, non-profit organizations, industry, and the public to raise awareness and promote better care for men’s reproductive health. Through research, education, and advocacy, MRHI aims to strengthen global efforts to address male fertility and reproductive challenges.

Earlier, infertility assessments primarily targeted women; however, awareness campaigns, media coverage, and guidance from healthcare professionals shifted attention toward the role of male factors in infertility. Improved understanding that male infertility accounts for a substantial proportion of conception difficulties has reduced social stigma and encouraged men to take a proactive approach to reproductive health. Therefore, more men are opting for fertility screenings, including sperm count tests, whether during routine checkups or family planning. This shift, along with improved access to diagnostic services and discreet at-home testing options, is boosting testing rates and supporting sustained market growth.

Delayed parenthood and changing social trends:

Delayed parenthood and evolving social trends represent significant drivers of the market, as an increasing number of individuals and couples choose to start families later in life due to career advancement, financial considerations, and shifting personal priorities. Advancing male age is associated with a gradual decline in sperm quality, concentration, and motility, thereby elevating the risk of fertility-related complications. Growing awareness of age-associated reproductive decline has prompted couples planning conception at a later stage to pursue early and comprehensive fertility evaluations. This proactive approach to reproductive planning has led to increased utilization of diagnostic solutions, including sperm count tests, across both clinical environments and home-based settings.

Expansion of fertility clinics and assisted reproductive technology (ART) services:

The expansion of fertility clinics and ART services is a significant market driver, as sperm diagnostics are integral to infertility assessment and treatment decision-making. Sapyen’s launch of the UK’s first at-home male fertility test in October 2025 helps drive the broader market by expanding accessibility, convenience, and early engagement in male reproductive health. By enabling men to collect samples at home and send them to labs with reliable preservation technology, the product reduces reliance on traditional clinical pathways with long waiting times, making sperm count and semen analysis more user-friendly and private.

Moreover, in November 2024, Basecare Medical launched an AI-driven live sperm analyzer marks, a significant technological leap in male fertility testing and IVF support by addressing core limitations of traditional computer-aided sperm analysis (CASA). This innovation was developed through extensive clinical research involving over 500,000 sperm samples and in collaboration with leading IVF centers in China, helping to overcome longstanding challenges with reproducibility and efficiency in sperm testing.

Moreover, the increasing number of specialized fertility centers, along with the growing adoption of ART procedures such as in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI), has resulted in the routine and repeated use of sperm count tests to evaluate male fertility status, guide therapeutic strategies, and monitor clinical outcomes. In October 2025, the American Hospital of Paris is transforming assisted reproductive technology (ART) by adopting AI-powered in-vitro fertilization (AIVF), a cutting-edge approach that significantly improves outcomes for patients undergoing fertility treatment. As access to professional fertility care expands across both developed and emerging markets, the demand for reliable and standardized sperm diagnostic solutions continues to increase.

Supportive government and healthcare initiatives:

Many governments and public health organizations are increasingly prioritizing reproductive health through awareness campaigns, fertility education programs, and early screening initiatives aimed at addressing infertility issues. Policies that support fertility assessments, subsidize diagnostic testing, or provide insurance coverage for infertility evaluation and treatment encourage more individuals and couples to seek timely medical consultation. For instance, the MOBY.US (Male Organ Biology Yielding United Science) consortium represents a significant step forward in advancing male infertility research by addressing one of the field’s longstanding challenges: fragmented and underpowered data. By bringing together 14 institutions, more than 50 physicians, and clinical data from over 5,000 patients, the consortium enables large-scale, standardized data sharing that improves the statistical robustness and clinical relevance of research findings. This collaborative model accelerates the discovery of novel biomarkers, improves understanding of the biological mechanisms underlying male infertility, and supports the development of more precise diagnostic and treatment approaches.

In addition, investments in healthcare infrastructure and public-private partnerships have improved access to diagnostic services, including sperm count testing, particularly in emerging economies. These initiatives help reduce social stigma, promote preventive care, and increase utilization of fertility diagnostics, thereby contributing to the sustained market growth.

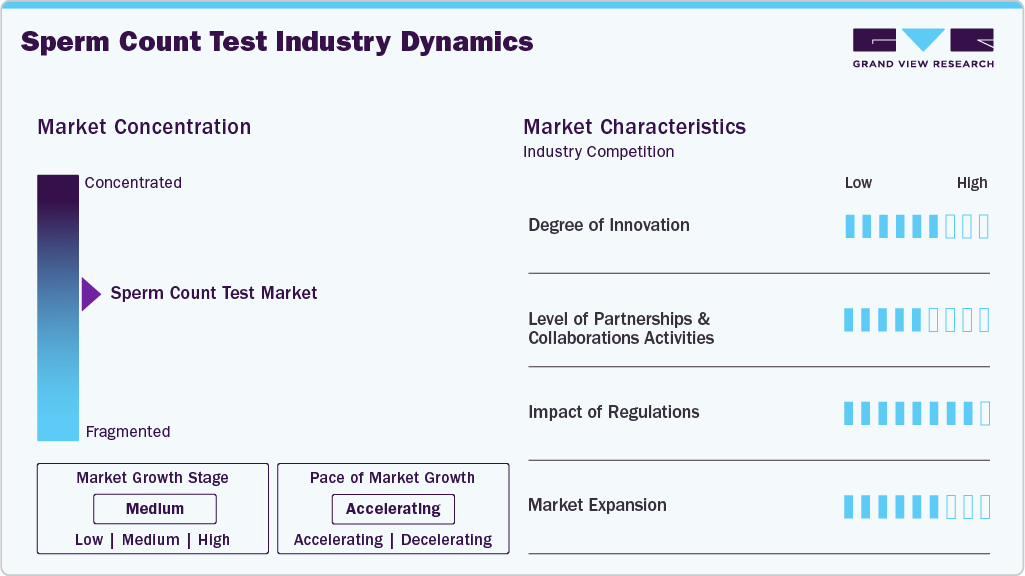

Market Characteristics & Concentration

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. There is a high degree of innovation, a moderate level of partnership & collaboration activities, a high impact of regulations, and moderate expansion of the industry.

The industry is experiencing a high degree of innovation. For instance, HagoBogo launched new test kits in January 2025, making male fertility diagnostics far more accessible and user-friendly by bringing sperm analysis out of clinics and into people’s homes. At the Consumer Electronics Show (CES) 2025 in Las Vegas, the South Korean company introduced a low-cost, discreet home test kit that lets men check their sperm condition easily and privately without medical appointments or lab visits, currently selling in China for about USD 10 and soon expanding into the U.S. market.

Several key players are actively engaging in mergers & acquisitions to promote growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in November 2024, Basecare Medical, in collaboration with 18 leading IVF centers, launched the world’s first intelligent live sperm analyzer (model BKA210), a breakthrough device designed to overcome the key limitations of traditional Computer-Aided Sperm Analysis (CASA) used in fertility clinics for decades. The device has received regulatory approval in China (NMPA 20242222101), has been recognized with a national innovation award, and is being prepared for international certification.

In Europe, sperm count tests fall under the regulatory framework for in vitro diagnostic (IVD) medical devices as they analyze human biological samples to provide information on physiological conditions. Since May 2022, the EU’s In Vitro Diagnostic Medical Devices Regulation (IVDR, Regulation (EU) 2017/746) has replaced the older directive, imposing stricter requirements on all diagnostics placed on the market. Under IVDR, manufacturers must classify their device based on risk, undergo conformity assessment by a notified body when required, demonstrate analytical and clinical performance, and obtain CE-IVD marking before marketing in any EU member state.

In October 2024, ARC Fertility and Sapyen announced a strategic partnership that aims to transform male fertility testing by integrating at-home, clinical-grade semen analysis into employer-sponsored reproductive health benefits. Under this collaboration, employers can offer male employees a convenient, private option to assess fertility from home using the Sapyen Test Kit, which preserves samples for up to 72 hours and delivers lab-quality results without the need for clinic visits, a major barrier in traditional testing.

Ashwin Ramachandran, founder and CEO of Sapyen, said:

“Our advanced at-home male fertility Test Kit offers an unprecedented level of convenience and accuracy, empowering more men to take the crucial first step in understanding their fertility health. Together with ARC, we are providing detailed fertility insights and personalized recommendations that address a critical need in reproductive health, empowering employees to make well-informed choices for any potential treatments required.”

Product Insights

Based on product, the clinical semen analyzer systems (CASA/automated analyzers) segment held a significant share of 29.11% in 2025, driven primarily by the need for greater accuracy, standardization, and efficiency in male fertility diagnostics. Automated analyzers enable precise assessment of sperm concentration, motility, morphology, and velocity parameters, supporting evidence-based diagnosis and treatment planning, especially in assisted reproductive technologies (ART) such as IVF and ICSI. In addition, increasing test volumes, shortages of skilled laboratory personnel, and stricter regulatory and quality-control requirements favor CASA systems for their reproducibility, digital data storage, and compliance with WHO guidelines.

The smartphone-enabled sperm count devices segment is expected to grow at the fastest CAGR during the forecast period due to convenience and accessibility, as these devices allow men to perform fertility screening in the privacy of their homes without scheduling clinic visits, reducing barriers related to time, stigma, or embarrassment. Moreover, cost-effectiveness compared with traditional lab-based semen analysis encourages wider adoption among individuals and employers offering fertility benefits.

Technology Insights

Based on technology, the computer-assisted sperm analysis (CASA) segment held a significant share of 39.56% in 2025, driven primarily by the increasing demand for high-precision, standardized, and objective semen analysis amid rising male infertility rates worldwide. Traditional manual microscopy is time-consuming, operator-dependent, and prone to variability, whereas CASA systems use advanced imaging, algorithms, and AI to deliver accurate, reproducible measurements of sperm concentration, motility, morphology, and velocity in real time. The expanding adoption of assisted reproductive technologies (ART), such as IVF and ICSI, further accelerates CASA uptake, as fertility clinics require detailed and reliable sperm quality metrics to optimize treatment outcomes.

The smartphone-enabled imaging segment is expected to grow at the fastest CAGR during the forecast period, driven by the growing demand for accessible, convenient, and cost-effective male fertility diagnostics, alongside rapid advances in mobile optics, sensors, and AI-based image analysis. Moreover, improvements in smartphone camera resolution, computing power, and cloud connectivity now allow accurate visualization, counting, and motility assessment of sperm using compact attachments and AI algorithms, delivering near-clinical accuracy without laboratory infrastructure. In addition, the expansion of telehealth, digital fertility platforms, and employer-sponsored reproductive health benefits is boosting demand for connected diagnostic tools that enable remote data sharing with clinicians.

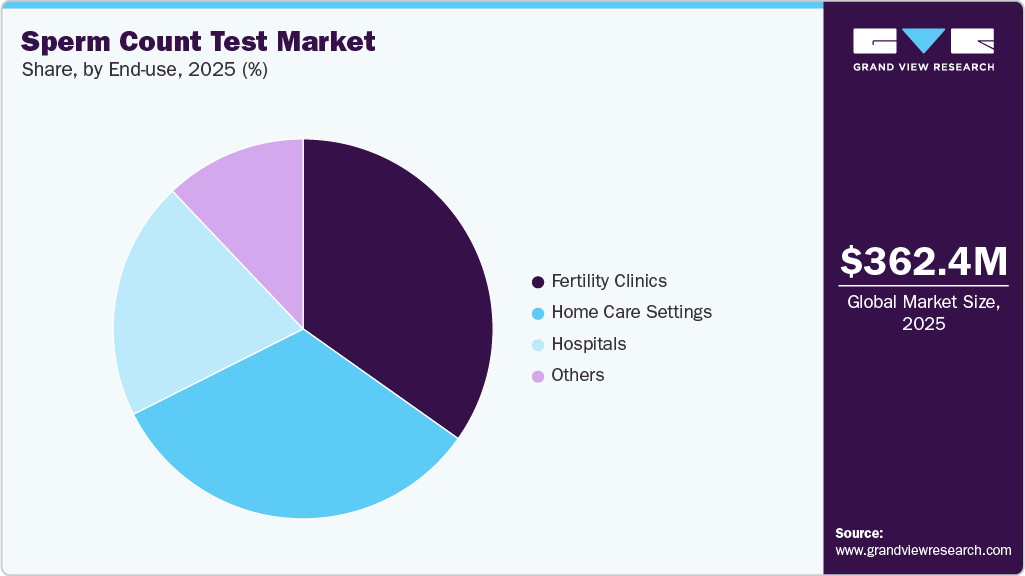

End Use Insights

Based on end use, the fertility clinics segment held a significant share of 34.80% in 2025. This growth is primarily driven by the rising prevalence of male infertility, increasing reliance on assisted reproductive technologies (ART), and the shift toward precision-based fertility care. As male factor infertility contributes to nearly half of all infertility cases, clinics routinely require sperm count and semen analysis as a first-line diagnostic before initiating treatments such as In Vitro Fertilization (IVF), Intracytoplasmic Sperm Injection (ICSI), or Intrauterine Insemination (IUI). The growing adoption of advanced diagnostic technologies, including AI-enabled semen analysis, automated imaging systems, and standardized digital reporting, further increases test volumes by improving accuracy, reducing turnaround time, and supporting personalized treatment planning.

The home care settings segment is expected to grow at the fastest CAGR during the forecast period. This is due to rising demand for privacy, convenience, and early fertility awareness among men. Many individuals prefer at-home sperm testing to avoid the stigma, discomfort, and scheduling challenges associated with clinic-based semen analysis, leading to higher testing adoption rates. Technological advancements such as mail-in sample stabilization, AI-enabled analysis, and digital result delivery have significantly improved the accuracy and reliability of home sperm count tests, making them comparable to laboratory diagnostics. In addition, increasing employer-sponsored fertility benefits, direct-to-consumer health platforms, and telehealth integration are expanding access to home testing solutions.

Regional Insights

North America held the largest revenue share of 36.14% in 2025, owing to the high awareness of reproductive health and the widespread availability of advanced assisted reproductive technologies (ART). Moreover, supportive insurance coverage in certain states and growing telehealth adoption for reproductive health consultations have further enhanced accessibility to fertility testing devices.

U.S. Sperm Count Test Market Trends

The sperm count test market in the U.S. is experiencing significant growth, driven by the increasing use of personalized fertility care and demand for early detection tools. Fertility testing devices that provide rapid hormone or sperm analysis at home are becoming popular, especially among 29- and 44-year-olds seeking convenience and privacy. Moreover, partnerships between device manufacturers and telehealth platforms are facilitating remote consultations and continuous monitoring, further driving adoption. For instance, in August 2023, Reproductive Medicine Associates of New York (RMA NY) announced a partnership with US Fertility. This strategic move expanded US Fertility's network to over 100 clinic locations and 32 IVF laboratories across the U.S., enhancing its capacity to provide advanced reproductive care. This partnership reflects a broader trend in the industry towards consolidation, aiming to enhance service delivery and patient outcomes through expanded networks and shared resources.

Asia Pacific Sperm Count Test Market Trends

The sperm count test market in the Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This is due to growth in ART clinics, particularly in countries such as China, India, Japan, South Korea, and Australia, which further supports market expansion, as semen analysis is a foundational diagnostic step before IVF and Intracytoplasmic Sperm Injection (ICSI) procedures. Moreover, improving healthcare infrastructure, expanding medical tourism, supportive government initiatives for fertility treatment, and the increasing availability of advanced and AI-enabled diagnostic technologies, including automated semen analysis systems and home-based testing kits, are accelerating adoption across both clinical and consumer settings in the Asia Pacific region.

Japan sperm count test market held a significant revenue share in 2025. Fertility startups in Japan are emerging as key players in addressing the nation's escalating infertility challenges, driven by a combination of demographic shifts and systemic healthcare inefficiencies. With Japan experiencing one of the world's lowest birth rates, the demand for assisted reproductive technologies (ART) has surged. However, patients often face prolonged waiting times and limited access to treatments, exacerbating the emotional and financial burdens associated with infertility.

The sperm count test market in Indiais driven by the rising infertility rates, influenced by lifestyle changes such as delayed marriage and parenthood, obesity, diabetes, and thyroid disorders, which are increasing the demand for fertility diagnostics, including sperm count analysis as part of infertility workups. As per GarbhaGudi IVF Centre, Inc., approximately 27.5 million couples in India are grappling with infertility, and the numbers are expected to rise further. Moreover, greater awareness of male reproductive health, supported by education initiatives and growing acceptance of fertility testing, encourages more men to seek early assessment, helping reduce stigma around male infertility and bringing sperm count tests into routine reproductive health conversations.

Europe Sperm Count Test Market Trends

The sperm count test market in Europe is expected to witness high growth owing to the rising investments in reproductive healthcare infrastructure and public awareness campaigns about fertility preservation. Furthermore, growing government support, coupled with increasing lifestyle-related issues, is driving market growth.

Germany sperm count test market held a significant share in the Europe industry, owing to the rising awareness of reproductive health and increasing infertility rates, which have led more individuals and couples to seek early and accurate fertility assessments, including sperm count tests, as part of standard clinical practice. Germany’s advanced healthcare infrastructure and strong clinical research environment support the adoption of precise diagnostic tools, including automated semen analysis systems that improve reliability and reproducibility. This technological strength, coupled with ongoing innovation such as AI-enhanced diagnostic platforms and automated microscopy, enhances the accuracy and appeal of sperm testing in both clinical and laboratory settings.

Latin America Sperm Count Test Market Trends

The sperm count test market in Latin America is expected to register considerable growth over the forecast period owing to the increasing investment in reproductive health, expanding private healthcare facilities, and rising awareness about infertility. In countries such as Brazil and Mexico, cultural stigma around fertility is gradually declining, prompting more individuals to seek testing and treatment.

Brazil sperm count test marketheld the largest market share in 2025, driven by the availability and gradual acceptance of convenient testing options-such as at-home sperm count kits approved by Brazil’s health authorities-which are lowering barriers to initial screening by offering privacy, ease of use, and quicker insights without immediate clinical visits.

Middle East and Africa Sperm Count Test Market Trends

The sperm count test market in the Middle East & Africa (MEA) is driven by rising awareness of fertility health, adoption of advanced reproductive technologies, and high-income urban populations seeking personalized healthcare solutions. In countries such as the UAE and Saudi Arabia, government initiatives to improve maternal and reproductive health, alongside rising investment in private fertility clinics, have driven device adoption.

UAE sperm count test market is being driven by the expanding fertility services ecosystem, with numerous specialized clinics and advanced diagnostic labs adopting modern technologies, facilitating greater uptake of sperm analysis as a routine part of fertility evaluations. Government support for healthcare infrastructure and rising disposable incomes further make fertility testing more affordable and appeal to a wider population.

Key Sperm Count Test Company Insights

The market is fragmented, with the presence of many region & country-level sperm count test providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Sperm Count Test Companies:

The following key companies have been profiled for this study on the sperm count test market.

- Medical Electronic Systems

- Hamilton Thorne

- Merck KGaA

- MICROPTIC

- ExSeed Health.

- Proiser R+D (ARQUIMEA Agrotech)

- DNA Diagnostics Center (DDC)

- Sperm Processor

- Genea BIOMEDX

- LogixX Pharma Limited UK

Recent Developments

-

In October 2025, Sapyen expanded its presence into the UK with the launch of an at-home male fertility testing kit, offering men a convenient, private alternative to traditional clinic-based semen analysis. The kit allows users to collect a sample at home and send it to CLIA-certified partner laboratories, where it is analyzed for key fertility indicators such as sperm count, motility, morphology, and advanced assays such as DNA fragmentation and methylation, with results delivered within a few days.

-

In September 2025, Femasys Inc. partnered with Medical Electronic Systems LLC (MES) to launch the FemSperm Analysis Kit, a new product that completes its FemSperm family of fertility solutions and significantly expands its infertility care portfolio.

“The launch of the FemSperm Analysis Kit advances our mission to deliver innovative reproductive care that is more accessible and affordable for the millions of women facing infertility,” said Kathy Lee-Sepsick, Chief Executive Officer and Founder of Femasys Inc. “By partnering with MES, a recognized leader in sperm analysis technology, and branding their advanced solution under our FemSperm product line, we have created a complete, turnkey offering that empowers gynecologists to provide FemaSeed in-office infertility treatment previously available only in fertility clinics.”

- In July 2024, Legacy secured USD 7.5 million in new financing to expand access to sperm testing and long-term storage services, with a particular focus on reaching military personnel and veterans. The funding will support newly signed contracts to serve over nine million veterans, reflecting a strategic effort to make male fertility care more widely available through at-home testing kits that can be shipped directly to users and processed in Legacy’s advanced andrology labs.

Sperm Count Test Market Report Scope

Report Attribute

Details

Market size in 2026

USD 381.06 million

Revenue forecast in 2033

USD 559.89 million

Growth rate

CAGR of 5.65% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Medical Electronic Systems; Hamilton Thorne; Merck KGaA; MICROPTIC; ExSeed Health; Proiser R+D (ARQUIMEA Agrotech); DNA Diagnostics Center (DDC); Sperm Processor; Genea BIOMEDX; LogixX Pharma Limited UK

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sperm Count Test Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sperm count test market report based on product, technology, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Semen Analyzer Systems (CASA / Automated Analyzers)

-

At-Home Sperm Count Test Kits

-

Smartphone-Enabled Sperm Count Devices

-

Mail-In Sperm Count Test Kits

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual Microscopy

-

Computer-Assisted Sperm Analysis (CASA)

-

Microfluidics-Based Counting

-

Smartphone-Enabled Imaging

-

Spectrophotometric / Colorimetric

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Fertility Clinics

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sperm count test market size was estimated at USD 362.39 million in 2025 and is expected to reach USD 381.06 million in 2026

b. The global sperm count test market is expected to grow at a CAGR of 5.65% during the forecast period and is expected to reach USD 559.89 million in 2033

b. Clinical semen analyzer systems (CASA / automated analyzers) segment held a significant share of 29.11% in 2025 driven primarily by the need for greater accuracy, standardization, and efficiency in male fertility diagnostics

b. Key players in the market include Medical Electronic Systems, Hamilton Thorne, Merck KGaA, MICROPTIC, ExSeed Health, Proiser R+D (ARQUIMEA Agrotech), DNA Diagnostics Center (DDC), Sperm Processor, Genea BIOMEDX, LogixX Pharma Limited UK

b. Key factors driving the sperm count test market include the rising prevalence of male infertility, growing awareness about reproductive health, and the importance of early fertility assessment among men. In addition, delayed parenthood and changing social trends have increased the demand for fertility evaluations as couples seek medical assistance to conceive.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.