- Home

- »

- Medical Imaging

- »

-

Spinal Imaging Market Size & Share, Industry Report, 2030GVR Report cover

![Spinal Imaging Market Size, Share & Trends Report]()

Spinal Imaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (X-ray, CT, MRI, Ultrasound), By Application (Spinal Infection, Spinal Cancer, Spinal Cord & Nerve Compressions), By End-use, And Segment Forecasts

- Report ID: GVR-4-68038-794-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Spinal Imaging Market Size & Trends

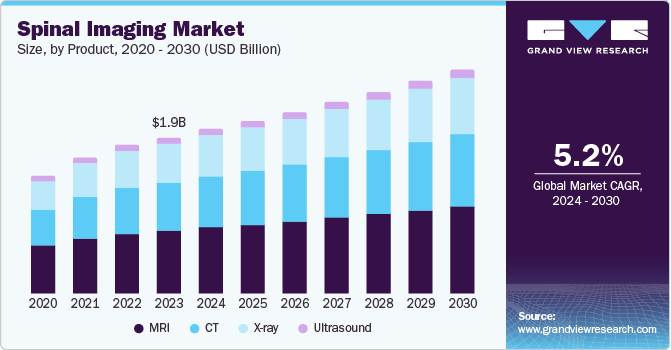

The global spinal imaging market size was valued at USD 1.97 billion in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. The rising global burden of spinal disorders, improving patient’s accessibility to medical imaging services, and the growing procedural volume of spinal surgeries are anticipated to drive the product demand over the forecast period. According to the WHO, lower back pain is the second leading reason for medical consultation, only outnumbered by upper respiratory infections. Moreover, it is estimated that 80% of the world’s population is subjected to back pain at least once in their lifetime. Thus, a rising target population is expected to grow the market.

A sedentary lifestyle, a rising geriatric population, and an increasing prevalence of obesity, anxiety, and depression are also projected to boost the demand for spinal imaging tools. The intervertebral discs deteriorate over time, increasing susceptibility towards developing spinal disorders. Moreover, these spinal discs are complex structures and lack visibility through conventional imaging modalities, due to which the procedural volume of spinal CT & MRI has increased.

Recent advancements in hardware and software technology and the utilization of machine learning concepts in spinal imaging are anticipated to propel the market growth over the forecast period. The advent of multidetector CT with faster gantry speeds has enabled a better examination experience with improved image quality. For instance, Toshiba introduced a novel automatic alignment tool called "EasyTech" in its MRI units to help reduce the examination duration with its machine-learning feature.

The increasing number of healthcare projects, the rising need for imaging equipment replacement in developed countries, and the rapidly expanding private healthcare sector are other key factors anticipated to play a significant role in the market's growth. For instance, according to the Clinical Imaging Board, around 30% of the total MRI scanners in the United Kingdom need replacement due to aging or technical issues.

Product Insights

MRI accounted for the largest revenue share of 40.4% in 2023 due to its capability to provide high-resolution images without ionizing radiation, making it a safer alternative to CT scans, particularly for patients requiring frequent imaging procedures. MRI's excellent soft tissue contrast permits detailed imaging of spinal structures, intervertebral discs, and surrounding tissues, facilitating precise identification of issues such ass herniated discs, spinal stenosis, and infections. Furthermore, upgrades in MRI technology such as diffusion tensor imaging (DTI) and functional MRI (fMRI) have broadened its abilities to evaluate nerve function and pinpoint areas of pain or inflammation. These benefits have established MRI as the preferred imaging modality for various spinal disorders.

Computed tomography (CT) is expected to register the fastest CAGR of 5.8% during the forecast period. CT excels in visualizing bony structures and calcifications, making it valuable for detecting fractures, spinal deformities, and certain infections. CT scans typically provide quicker results and are more cost-effective than MRI, which can be advantageous in emergencies or when cost is a significant concern. In addition, advancements in CT technology, such as multi-detector CT (MDCT) and low-dose CT protocols, improve image quality while reducing radiation exposure, making CT a more attractive option for a wider range of patients. These factors, combined with the increasing prevalence of spinal disorders and the need for rapid and accurate diagnosis, drive the growth of the CT segment in the spinal imaging market.

Application Insights

The spinal cord and nerve compression segment accounted for the largest revenue share in 2023. The rising prevalence of spinal disorders, such as herniated disc, spinal stenosis, cauda equina syndrome, and radiculopathy, is expected to drive the growth of the segment. MRI is the preferred imaging tool in the diagnosis of spinal nerve compression owing to its ability to produce superior soft-tissue images. In addition, spinal cord compression is one of the main reasons leading to spinal surgery, increasing the demand for spinal imaging tools.

The spinal infection is expected to register the fastest CAGR during the forecast period. This is attributable to the increasing prevalence of risk factors such as intravenous drug abuse, cancer, and diabetes. According to the NCBI report, the number of intravenous drug users in the U.S. is estimated to be over 2 million. MRI is the primary imaging modality in accessing spinal infections. Whereas, the demand for spinal CT is increasing in post-operative care owing to advantages such as low cost and metallic bodies compatibility.

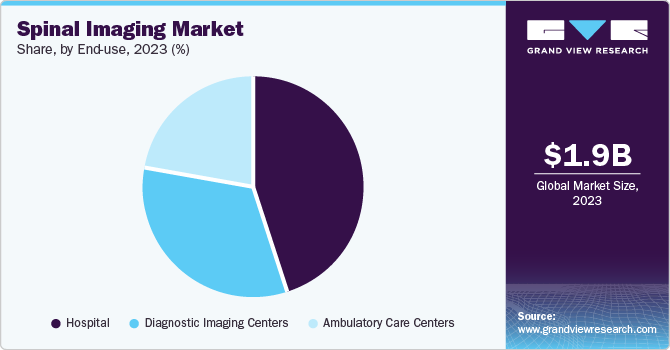

End-use Insights

The hospital segment dominated the market in 2023 as the hospitals are well-equipped to handle a variety of medical procedures, such as spinal imaging, due to their extensive infrastructure, equipment, and expertise. Their capacity to offer comprehensive care, such as diagnosis, treatment, and rehabilitation, makes them the preferred option for patients with spinal disorders. Moreover, the increasing complexity of spinal disorders and the need for advanced imaging techniques often require the resources and capabilities of hospitals to ensure accurate diagnosis and effective treatment. In addition, the increasing number of public-private participation (PPP) programs in developing healthcare infrastructure, especially in countries such as Chile, Dubai, and Saudi Arabia, will boost the segment's growth.

Diagnostic imaging centers are projected to grow with the fastest CAGR over the forecast period. This anticipated growth is attributed to the increasing prevalence of spinal disorders, rising healthcare expenditures, and advancements in imaging technology. Furthermore, diagnostic imaging centers provide comprehensive facilities and expertise, allowing for accurate and effective diagnosis of spinal disorders. In addition, the growing trend of outsourcing imaging services to specialized centers can contribute to their rapid growth, as healthcare providers seek to improve patient outcomes and optimize resource allocation.

Regional Insights

North America spinal imaging market held the largest market share of 31.7% in 2023, attributed to a well-established healthcare system, advanced imaging technology, supportive reimbursement policies, and a significant focus on patient well-being. The region's high rate of spinal disorders, due to factors such as an aging population and inactive lifestyles, creates a constant demand for spinal imaging services. Moreover, continuous advancements in imaging technologies strengthens North America's status as a prominent region in the spinal imaging market.

U.S. Spinal Imaging Market Trends

The U.S. spinal imaging market dominated North America in 2023 due to its larger population size, which requires more medical devices. Moreover, the well-developed healthcare infrastructure with advanced imaging technologies, favorable government policies, and a strong focus on patient care have contributed to its leading position.

Europe Spinal Imaging Market Trends

Europe is expected to register a significant growth rate during the forecast period. The increasing geriatric population with a high prevalence of spinal conditions such as disc herniation and stenosis requires constant need for accurate diagnostic procedures. Additionally, reliable healthcare systems that offer beneficial reimbursement policies guarantee patients can receive these imaging procedures. Ultimately, ongoing technological improvements, particularly in advanced MRI and CT scanners, continue to encourage healthcare providers to embrace them to enhance patient results.

The UK spinal imaging market is expected to grow rapidly in the coming years due to the increasing prevalence of spinal disorders, growing awareness, and earlier detection, leading to a higher need for these services. The UK's well-established healthcare system and favorable reimbursement policies make it an optimistic market for spinal imaging solutions.

Asia Pacific Spinal Imaging Market Trends

Asia Pacific spinal imaging market is anticipated to grow with the fastest CAGR of 6.1% over the forecast period. The demand for advanced imaging technologies is increasing due to a growing population, rising healthcare expenditures, and greater awareness of spinal health issues. Moreover, the ever-increasing middle class in the region is also resulting in improved availability of top-notch healthcare, such as specialized spinal imaging services. Additionally, positive government actions such as funding healthcare infrastructure and advocating for preventive healthcare measures aid the market expansion.

China spinal imaging market held a substantial market share in 2023. The growing middle class and individuals with higher disposable income in the country have led to a rise in the availability of good-quality healthcare, including specialized spinal imaging services. Moreover, government efforts to enhance healthcare infrastructure and encourage preventive care are also contributing to the market's expansion.

Key Spinal Imaging Company Insights

Some key companies in the spinal imaging market are GE HealthCare, Koninklijke Philips N.V., Siemens Healthineers AG, Canon Medical Systems Corporation, and others. Most companies focus on R&D activities to develop technologically advanced products to gain a competitive edge. Companies are also adopting various strategies, such as mergers and acquisitions, joint ventures, and developing low-cost equipment, especially for developing economies.

-

GE Healthcare is a global technology company focusing on medical imaging, patient monitoring, and IT solutions. It provides extensive products and services for various medical fields, such as spinal imaging. Its spinal imaging solutions, including advanced MRI and CT systems, are designed to provide high-quality images and accurate diagnoses for conditions such as herniated discs, spinal stenosis, and fractures.

-

Koninklijke Philips N.V. is a multinational healthcare technology company that provides various medical imaging solutions, including spinal imaging. Philips is recognized for its innovation and dedication to patient care, offering advanced MRI and CT systems tailored for spinal imaging.

Key Spinal Imaging Companies:

The following are the leading companies in the spinal imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Canon Medical Systems Corporation

- Bruker

- Mediso Ltd.

- Shimadzu Corporation

- FUJIFILM

- Hitachi, Ltd.

- Toshiba Medical Systems, Inc.

View a comprehensive list of companies in the Spinal Imaging Market

Recent Developments

-

In March 2024, Siemens Healthineers introduced an automated, self-driving C-arm system for intraoperative imaging in surgery. This alleviates the pressure on technologists, who used to configure these settings by hand. Moreover, the automated procedure helps save time by making accurate adjustments, ultimately cutting down imaging durations.

-

In March 2023, Philips announced the launch of the vendor-neutral integrated radiology workflow solutions and radiology portfolio of smart connected imaging systems. The smart imaging systems and informatics solutions that are fully interoperable connect teams in oncology, radiology, pathology, and cardiology to improve clinical certainty and progress accuracy in treatment and diagnosis.

Spinal Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.07 billion

Revenue forecast in 2030

USD 2.82 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, UAE, South Africa, South Arabia, Kuwait.

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; Canon Medical Systems Corporation; Bruker; Mediso Ltd.; Shimadzu Corporation; FUJIFILM; Hitachi Ltd.; Toshiba Medical Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spinal Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spinal imaging market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray

-

Myelogram

-

Discogram

-

X-ray (Without Contrast Media)

-

-

CT

-

Myelogram

-

Discogram

-

X-ray (Without Contrast Media)

-

-

MRI

-

Ultrasound

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Spinal Infection

-

Vertebral Fractures

-

Spinal Cancer

-

Spinal Cord and Nerve Compressions

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Diagnostic Imaging Centers

-

Ambulatory Care Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.