- Home

- »

- Next Generation Technologies

- »

-

Spintronics Market Size And Share, Industry Report, 2033GVR Report cover

![Spintronics Market Size, Share & Trends Report]()

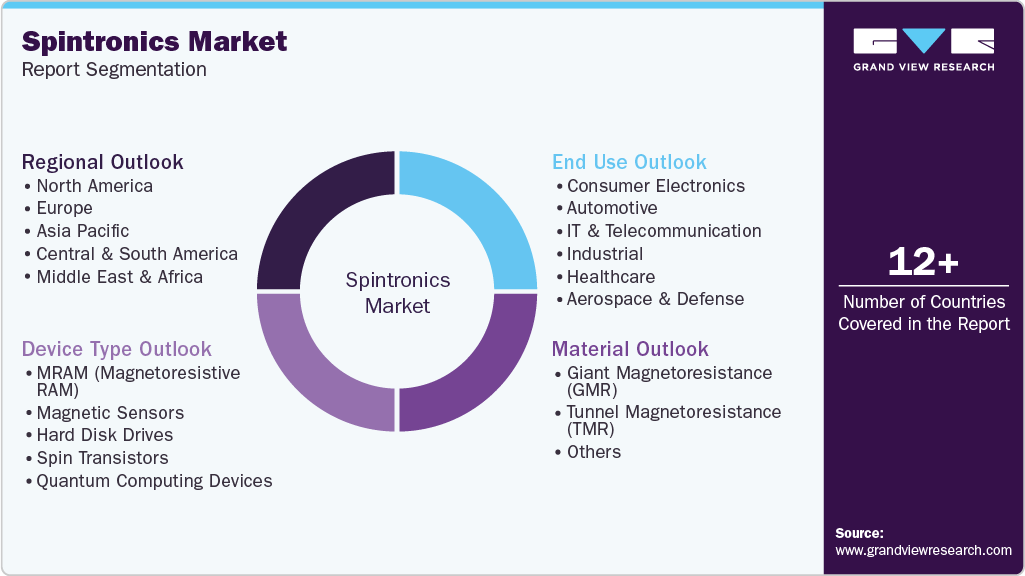

Spintronics Market (2025 - 2033) Size, Share & Trends Analysis Report By Device Type (Magnetoresistive RAM, Magnetic Sensors, Hard Disk Drives, Spin Transistors, Quantum Computing Devices), By Material, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-743-3

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Spintronics Market Summary

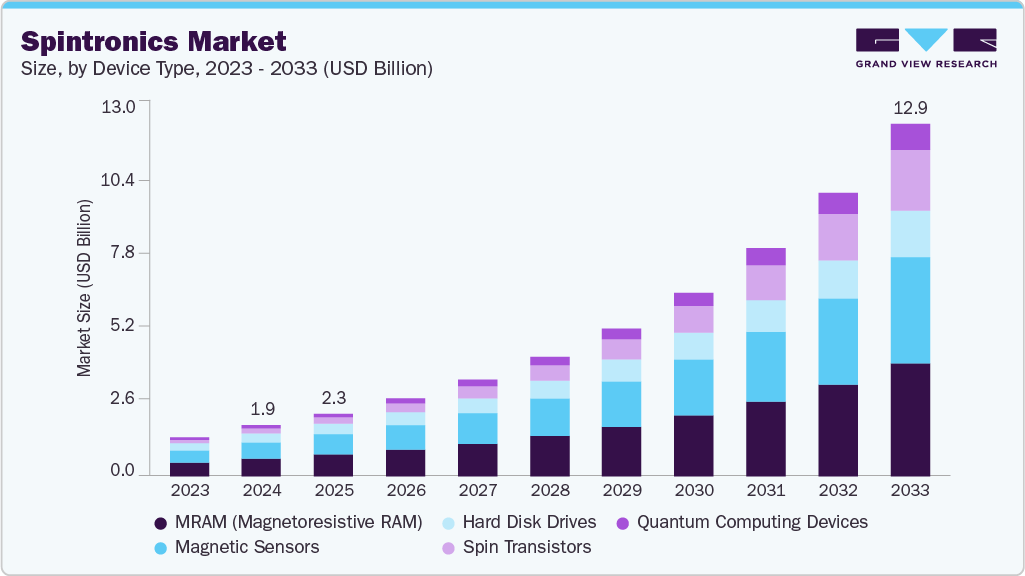

The global spintronics market size was valued at USD 1,874.8 million in 2024 and is projected to reach USD 12,918.6 million by 2033, growing at a CAGR of 24.0% from 2025 to 2033. The industry is expanding rapidly due to the rising demand for MRAM and energy-efficient memory solutions.

Key Market Trends & Insights

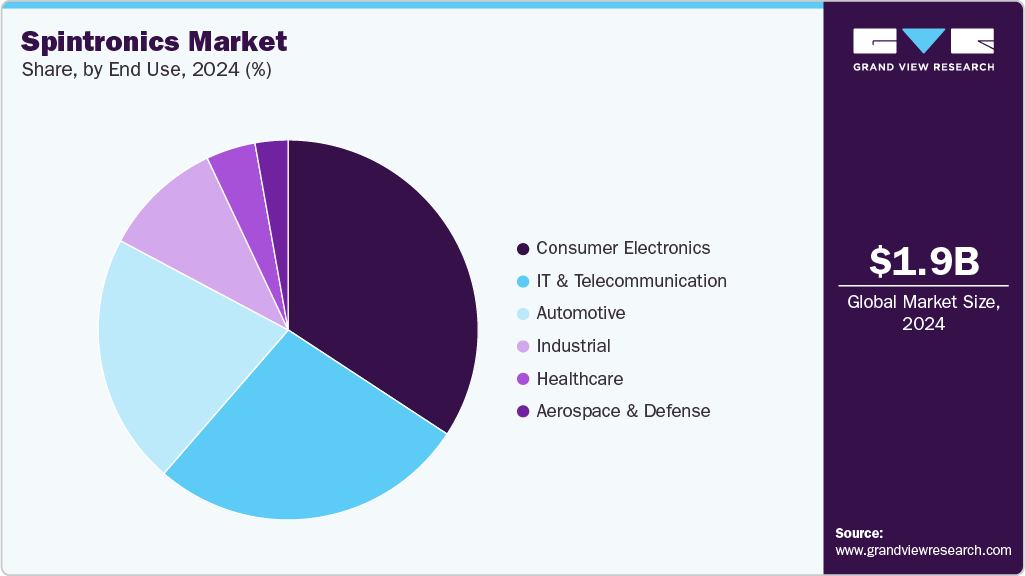

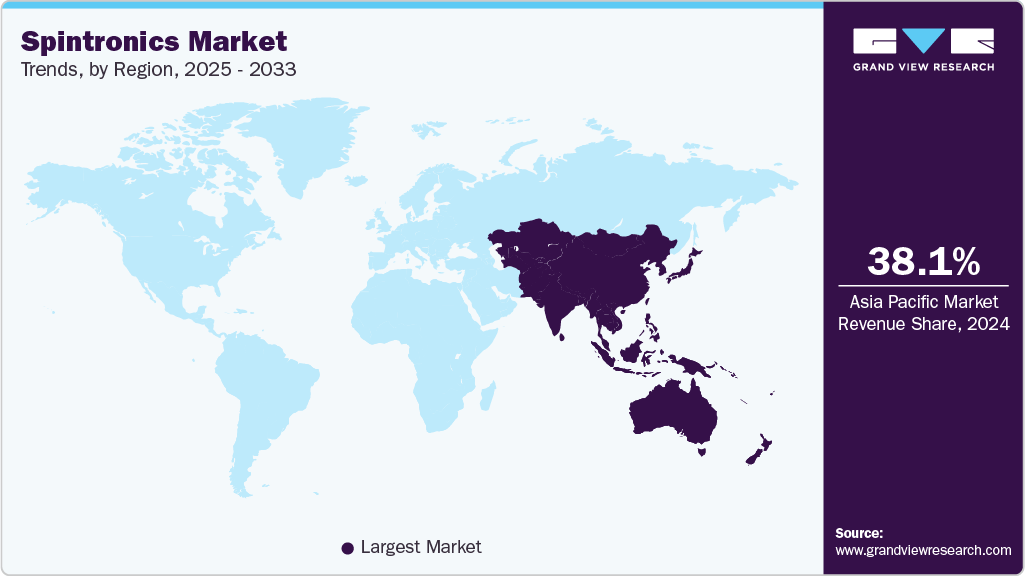

- Asia Pacific dominated the global market with the largest revenue share of 38.1% in 2024.

- The spintronics market in the U.S. led the North American market and held the largest revenue share in 2024.

- By device type, MRAM (Magnetoresistive RAM) led the market and held the largest revenue share of 35.2% in 2024.

- By material, the Tunnel Magnetoresistance (TMR) held the dominant position in the market and accounted for the largest revenue share of 40.2% in 2024.

- By end use, the automotive segment is expected to grow at the fastest CAGR of 27.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,874.8 Million

- 2033 Projected Market Size: USD 12,918.6 Million

- CAGR (2025-2033): 24.0%

- Asia Pacific: Largest market in 2024

These devices offer faster performance, non-volatile storage, and significantly lower power consumption compared to traditional memory technologies. Such advantages make them highly suitable for applications in data centers, consumer electronics, and automotive systems. As industries increasingly prioritize energy efficiency and performance, MRAM adoption is expected to accelerate, driving strong market growth.The scalability of spintronic technologies, such as MRAM and magnetic sensors, is becoming increasingly important in the market. This adaptability ensures compatibility with different system requirements and operational conditions. It also reduces the need for redesign, improving efficiency and lowering costs. As industries expand into more complex use cases, flexible spintronic solutions are increasingly in demand. For instance, in July 2024, Avalanche Technology, a U.S.-based semiconductor company, launched its enhanced Space Grade-E MRAM family in response to growing demand from the aerospace and defense sector, offering higher radiation tolerance, extended burn-in hours, and pin-compatible scalability. Built on its Gen-3 platform, the devices deliver industry-leading reliability, endurance, and non-volatile performance for mission-critical systems requiring data integrity and SWaP-optimized designs.

Integration of spintronics with advanced communication and data processing technologies is expected to drive significant growth in the spintronics market. Spintronic devices enable faster data transmission, meeting the increasing performance demands of modern computing systems. They also offer lower power consumption compared to traditional semiconductor-based solutions, which is critical for energy-efficient operations. This integration supports applications in AI, data centers, and high-performance computing, expanding the adoption of spintronic technologies. It also opens new opportunities in the commercial, industrial, and aerospace sectors. For instance, in April 2025, TDK Corporation, an electronic components manufacturer in Japan, introduced the Spin Photo Detector, a spintronic-based photonic conversion device capable of operating at ultra-high speeds of 20 picoseconds, over 10 times faster than conventional semiconductor-based photodetectors. Developed using magnetic tunnel junction (MTJ) technology, the device enables faster, low-power data transmission for applications in AI, data centers, AR/VR, and aerospace.

The integration of spintronic sensors into automotive and industrial applications is gaining momentum. These sensors provide high precision, reliability, and durability, even under harsh operating conditions. In the automotive sector, they are increasingly used in electric vehicles and advanced driver-assistance systems. Industrial applications benefit from their robustness in automation and control systems. Spintronic sensors are compact and energy-efficient, which supports the design of smart, connected devices. Their ability to operate under extreme temperatures and vibrations enhances system reliability. Adoption in aerospace and defense is also growing due to their radiation resistance and long-term stability. Advances in materials and sensor architectures are further improving performance and reducing costs.

Device Type Insights

The MRAM (Magnetoresistive RAM) segment dominated the industry in 2024, accounting for a 35.2% share, due to its fast, non-volatile memory capabilities, which provide high-speed data access while retaining information even without power. It offers low power consumption, making it highly suitable for energy-efficient applications across a variety of industries. MRAM is also highly reliable and durable, featuring long write-cycle endurance that ensures consistent performance over extended periods. Its versatility allows seamless integration into consumer electronics, automotive systems, and data centers, supporting a wide range of technological needs. Growing demand for high-performance memory in AI, IoT, and edge computing applications is further driving its adoption.

Spin transistors are experiencing growth due to their potential to combine logic and memory functions in a single device, offering faster operation and lower power consumption compared to conventional transistors. Their ability to utilize electron spin rather than charge enables more energy-efficient computing and supports the development of next-generation electronics. Increasing research in materials such as topological insulators and 2D magnetic materials is enhancing their performance and scalability. These advancements are attracting interest from AI, IoT, and high-performance computing sectors as industries seek miniaturized, low-power, and high-speed devices.

Material Insights

Tunnel Magnetoresistance (TMR) held the largest share in 2024, because of its superior efficiency and scalability. It provides high magnetoresistance ratios, which enhance performance in memory applications such as MRAM. TMR-based devices are known for their low power consumption and high reliability, making them attractive for AI and IoT applications. The technology’s compatibility with advanced CMOS processes supports its integration into next-generation computing systems. With growing investments in energy-efficient and high-speed memory solutions, TMR adoption continues to accelerate.

Giant Magnetoresistance (GMR) technology held an important position in the market in 2024, primarily due to its critical use in magnetic sensors. It enables high sensitivity in detecting magnetic fields, which makes it ideal for applications in automotive safety systems and industrial automation. The technology is also applied in hard disk drives, where it improves data reading capabilities and storage density. Continuous demand for precision sensing and efficient data storage is supporting its adoption. Advancements in miniaturization and integration into consumer devices are further expanding its relevance.

End Use Insights

Consumer electronics dominated the market in 2024, driven by the widespread adoption of MRAM and magnetic sensors in smartphones, laptops, and wearables. The demand for compact, energy-efficient, and high-performance devices has accelerated the use of spintronic components. These technologies enable faster data processing, longer battery life, and improved device reliability. Increasing integration of IoT features in consumer gadgets further amplifies the adoption of spintronics. The push for lightweight and multifunctional devices also strengthens this dominance.

The automotive sector is experiencing strong growth in the market, supported by the increasing demand for advanced driver-assistance systems (ADAS) and electric vehicles. Spintronic sensors are being deployed for precise navigation, current sensing, and safety-critical applications. Automakers are adopting MRAM for in-vehicle data storage due to its durability and low power consumption. Growing electrification and the need for high-reliability components are further fueling this expansion. The shift toward autonomous driving has increased reliance on real-time data and efficient memory solutions. Consequently, the automotive sector is becoming one of the fastest-growing application areas for spintronics.

Regional Insights

North America spintronics market held a significant share in 2024, driven by advancements in aerospace, defense, and data center applications. The presence of leading technology companies fosters early adoption of MRAM and spintronic sensors. Strong investment in R&D supports innovation in spin transistors and next-generation memory. The region also benefits from government initiatives promoting semiconductor and defense technologies. These dynamics ensure steady market growth in North America.

U.S. Spintronics Market Trends

The spintronics market in the U.S. is benefiting from strong semiconductor infrastructure and defense investments. The country is home to key innovators in MRAM, spin transistors, and advanced sensors. High demand from AI, cloud computing, and IoT sectors supports commercial adoption. Federal funding programs encourage breakthroughs in advanced memory and data storage.

Asia Pacific Spintronics Market Trends

The spintronics market in Asia Pacific held the largest share of 38.1% in 2024, supported by its strong electronics manufacturing ecosystem. The region benefits from high demand for smartphones, laptops, and consumer gadgets integrating MRAM and magnetic sensors. Rapid industrialization and expansion of automotive production further increase the adoption of spintronic technologies. Countries such as China, Japan, and South Korea are investing heavily in research and development for advanced memory and sensor solutions.

Europe Spintronics Market Trends

The spintronics market in Europe is expanding with a focus on automotive and industrial applications. The push toward electric vehicles and autonomous driving accelerates demand for spintronic sensors and MRAM. Collaborative research programs between universities and technology firms strengthen innovation. European companies are also emphasizing energy-efficient technologies to align with sustainability goals.

Key Spintronics Company Insights

Key players operating in the Spintronics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Spintronics Companies:

The following are the leading companies in the spintronics market. These companies collectively hold the largest market share and dictate industry trends.

- Avalanche Technology

- Everspin Technologies Inc.

- Hitachi, Ltd.

- IBM Corporation

- Intel Corporation

- Micron Technology, Inc.

- NVE Corporation

- Qualcomm Technologies, Inc.

- Samsung Electronics

- TDK Corporation

Recent Developments

-

In October 2024, Everspin Technologies Inc. announced an expansion of its industrial STT-MRAM product family, a high-density, persistent memory solution. These devices are designed for mission-critical applications by offering high performance, durability, and a wide temperature range.

-

In March 2024, Avalanche Technology announced the release of two new high-density STT-MRAM products designed for the high-reliability, persistent memory needs of space applications. These devices offer improved performance, reduced power consumption, and a smaller form factor for use in modern aerospace electronic systems.

Spintronics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,315.8 million

Revenue forecast in 2033

USD 12,918.6 million

Growth rate

CAGR of 24.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segments covered

Device type, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Avalanche Technology; Everspin Technologies Inc.; Hitachi, Ltd.; IBM Corporation; Intel Corporation; Micron Technology, Inc.; NVE Corporation; Qualcomm Technologies, Inc.; Samsung Electronics; TDK Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spintronics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global spintronics market report based on device type, material, end use, and region:

-

Device Type Outlook (Revenue, USD Million, 2021 - 2033)

-

MRAM (Magnetoresistive RAM)

-

Magnetic Sensors

-

Hard Disk Drives

-

Spin Transistors

-

Quantum Computing Devices

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Giant Magnetoresistance (GMR)

-

Tunnel Magnetoresistance (TMR)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Automotive

-

IT & Telecommunication

-

Industrial

-

Healthcare

-

Aerospace & Defense

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the spintronics market with a share of 31.2% in 2024. This is attributable to strong research infrastructure, significant investments in advanced electronics, and early adoption of spintronics technologies in data storage and quantum computing applications.

b. Some key players operating in the spintronics market include Avalanche Technology, Everspin Technologies Inc., Hitachi, Ltd., IBM Corporation, Intel Corporation, Micron Technology, Inc., NVE Corporation, Qualcomm Technologies, Inc., Samsung Electronics, and TDK Corporation.

b. Key factors that are driving the market growth include increasing demand for high-performance memory devices, advancements in quantum computing, rising adoption of spintronics in consumer electronics, and growing investments in R&D.

b. The global spintronics market size was estimated at USD 1,874.8 million in 2024 and is expected to reach USD 2,315.8 million in 2025.

b. The global spintronics market is expected to grow at a compound annual growth rate of 24.0% from 2025 to 2033 to reach USD 12,918.6 million by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.