- Home

- »

- Alcohol & Tobacco

- »

-

Spirits Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Spirits Market Size, Share & Trends Report]()

Spirits Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Vodka, Whiskey, Rum, Brandy, Gin), By Price Point (Economy, Mid-Premium, Supper-Premium), By Distribution Channel, By Product - Price Point - Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-825-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spirits Market Summary

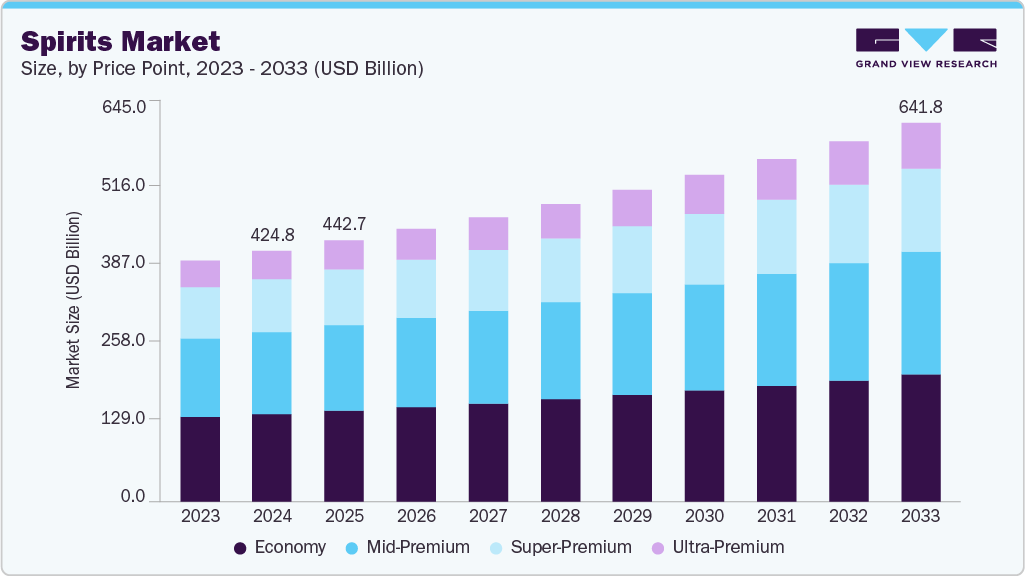

The global spirits market size was estimated at USD 424.82 billion in 2024 and is expected to reach USD 641.84 billion by 2033, growing at a CAGR of 4.8% from 2025 to 2033. The demand for spirits is expected to grow steadily over the forecast period, driven by evolving consumer preferences, premiumization trends, and the rising popularity of craft and artisanal beverages.

Key Market Trends & Insights

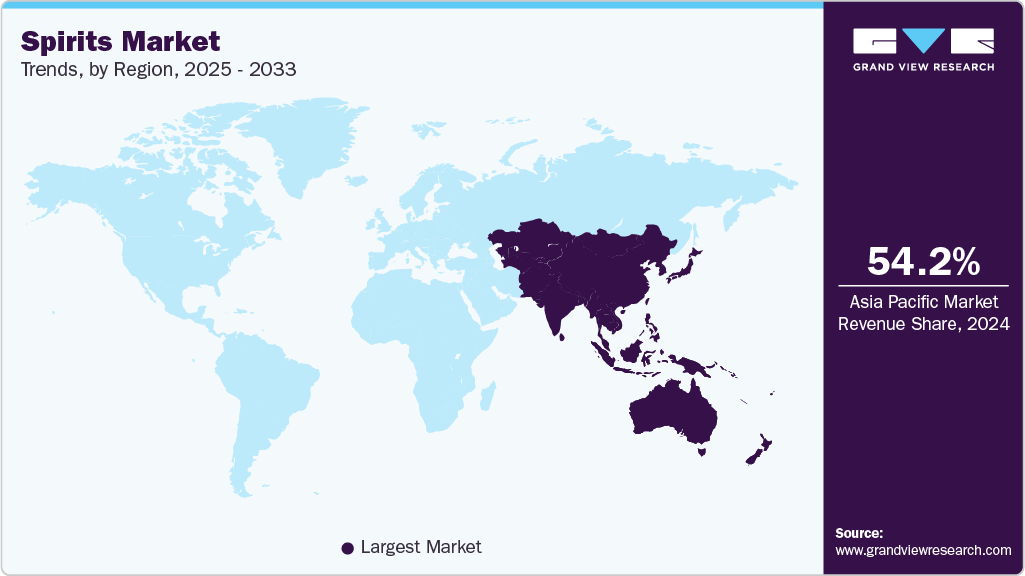

- By region, Asia Pacific led the spirits market with a share of 54.19% in 2024.

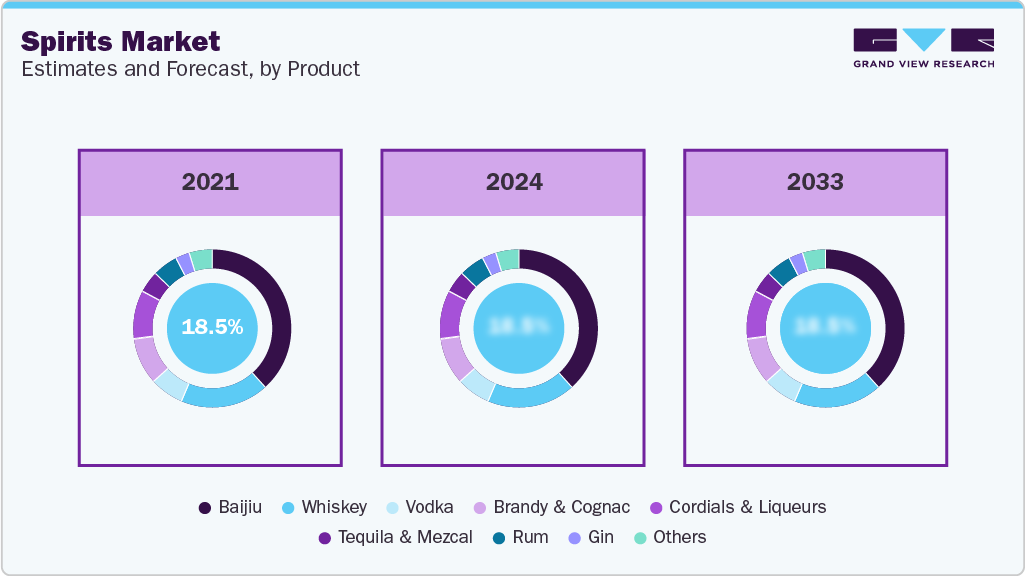

- By product, Baijiu led the spirits market and accounted for a share of 37.14% in 2024.

- By price point, the economic spirits segment led the market and accounted for a share of 35.06% in 2024.

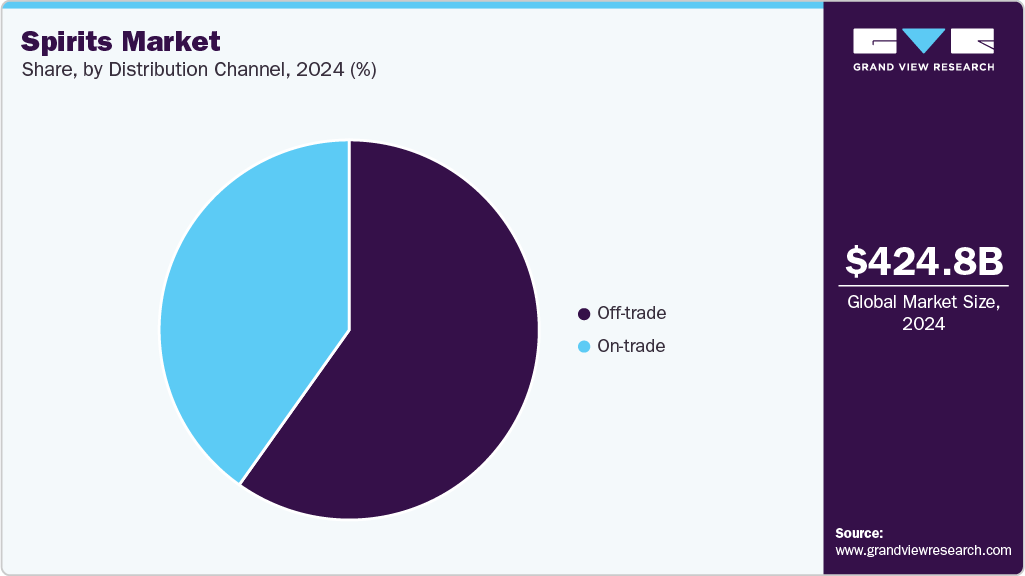

- By distribution channel, the sales of spirits through the off-trade led the spirits market and accounted for a share of 59.83% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 424.82 Billion

- 2033 Projected Market Size: USD 641.84 Billion

- CAGR (2025-2033): 4.8%

- Asia Pacific: Largest market in 2024

Increasing disposable incomes, especially in emerging economies, and the expanding young adult population are boosting the consumption of premium and flavored spirits such as whiskey, vodka, rum, and gin. Additionally, innovations in product offerings, including low-calorie, organic, and ready-to-drink (RTD) options, are attracting health-conscious consumers. The growing influence of social media, celebrity endorsements, and experiential marketing has further enhanced brand visibility and consumer engagement. Moreover, the on-trade channel recovery post-pandemic, coupled with the expansion of e-commerce platforms for alcohol sales, is contributing to the market’s strong momentum. As consumers increasingly seek unique taste experiences and higher-quality products, global spirit manufacturers are focusing on innovation, sustainability, and diversification to capture the rising demand across both developed and emerging markets.A growing trend in the market is the introduction of flavored and infused spirits, such as brandy, vodka, that are designed to attract younger and experimental drinkers. Some versions of brandy often feature fruit, spice, or honey infusions that make the spirit smoother and more approachable, especially for those new to brandy. This trend caters to evolving palates that prefer sweeter, mixable profiles ideal for cocktails or casual drinking. For instance, in June 2024, Tilaknagar Industries, a leading Indian-made foreign Liquor Manufacturer, introduced a new Green apple-flavored brandy under its premium Mansion House Flandy range, initially launched in Telangana, India. The variant blends the crisp essence of green apple with refined oaky undertones, offering a refreshing twist on traditional brandy. This launch aims to attract younger, flavor-seeking consumers and strengthen the company’s position in the premium brandy segment.

Another key trend driving the spirits market is the growing focus on premiumization through exclusive, limited-edition, and luxury product launches. Leading distillers are increasingly catering to collectors and high-end consumers with rare blends, age-statement editions, and heritage-inspired packaging that highlight craftsmanship and brand legacy. These curated releases not only enhance brand prestige but also foster a sense of exclusivity and elevated value perception among consumers. For example, in 2024, Hennessy expanded its luxury range with the Paradis Imperial and Master Blender’s Selection collections, while Rémy Martin unveiled its 300th Anniversary Coupe edition, appealing to discerning buyers who prioritize authenticity, artistry, and rarity in their spirits choices.

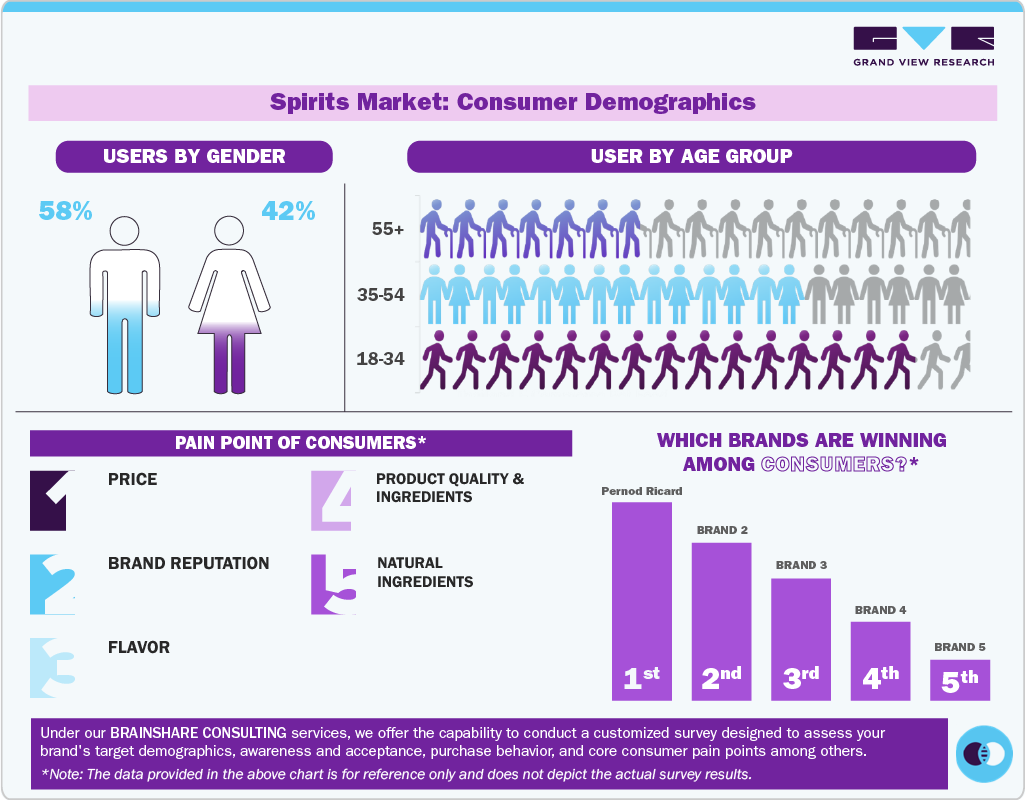

Consumer Insights

Product Insights

Based on product type, Baijiu is the largest segment, accounting for a share of 37.14% in 2024, due to its deep cultural significance, widespread consumption in China, and growing global recognition as a premium spirit. Baijiu’s dominance is supported by its strong presence in social and ceremonial occasions, where it remains an integral part of Chinese tradition and hospitality. Additionally, increasing international awareness, premium product launches, and efforts by Chinese distilleries to expand into global markets have further strengthened its position. The rising demand for authentic, heritage-rich beverages and the premiumization of traditional spirits have also contributed to Baijiu’s substantial market share.

Tequila & Mezcal is anticipated to witness a CAGR of 5.9% from 2025 to 2033, driven by rising global demand for authentic, craft-distilled spirits and the growing appreciation for agave-based beverages. Consumers, particularly in North America and Europe, are increasingly drawn to premium and ultra-premium tequila and mezcal varieties that emphasize origin, artisanal production methods, and sustainability. The expansion of cocktail culture, along with innovative flavor infusions and celebrity-backed brands, is further propelling category growth. Moreover, the shift toward sipping spirits and the popularity of experiential drinking have elevated Tequila & Mezcal from party-centric beverages to sophisticated lifestyle choices, supporting their sustained market expansion over the forecast period.

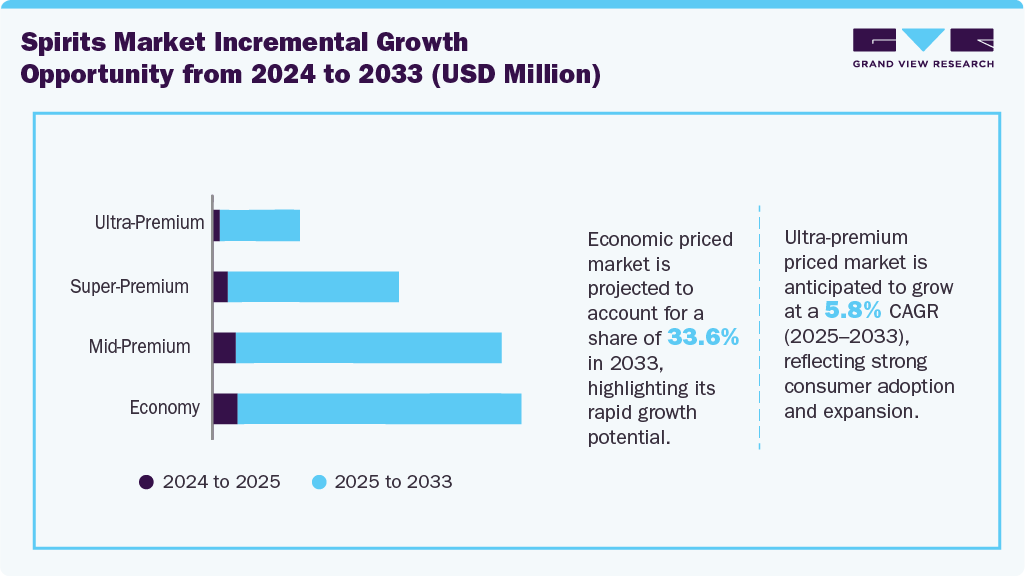

Price Point Insights

Economic spirits segment accounted for a share of 35.06% in 2024 due to their affordability, accessibility, and widespread consumption in emerging economies. These products cater to a broad consumer base that values quality and taste but remains highly price-sensitive, making them the preferred choice for everyday or social drinking occasions rather than luxury gifting or collecting. The segment also benefits from strong retail penetration across supermarkets, convenience stores, and local liquor shops, ensuring easy availability. In many developing markets, economic spirits serve as an entry point for new consumers transitioning from traditional or informal alcoholic beverages. Additionally, growing urbanization, expanding middle-income populations, and aggressive marketing by local manufacturers continue to support the steady growth of affordable spirits globally.

Ultra-premium spirits are anticipated to witness a CAGR of 5.8% from 2025 to 2033 as consumers increasingly associate these spirits with luxury, craftsmanship, and social status. Growing disposable incomes and lifestyle upgrades have fueled the trend of “drinking less but better,” with buyers seeking refined, high-quality experiences. Leading heritage brands like Hennessy and Rémy Martin drive this growth through limited editions, aged blends, and artistic collaborations emphasizing exclusivity and authenticity. This shift is particularly strong in affluent markets such as the U.S., China, and Europe, where premium spirits symbolize sophistication and success.

Distribution Channel Insights

The sales of spirits through off-trade channels held the largest shares of around 59.83% in the global spirits market in 2024, due to their wider accessibility, convenience, and cost advantages. Most consumers purchase spirits for home consumption, gifting, or social gatherings, making retail and online outlets the most practical buying options. Off-trade channels also allow customers to explore a variety of brands and price ranges at competitive rates compared to on-trade venues like bars or restaurants. Additionally, the rapid growth of e-commerce and duty-free retail has strengthened this segment, as consumers increasingly prefer purchasing premium spirits online for ease, discounts, and exclusive editions.

Spirits sales through on-trade channels are expected to grow at a CAGR of 4.4% from 2025 to 2033 due to the rising popularity of social drinking, premium experiences, and cocktail culture. Consumers, especially younger urban professionals, increasingly view spirits as sophisticated choices for socializing and celebration. The growing global trend of luxury dining, nightlife, and mixology has positioned these spirits as essential ingredients in premium cocktails, driving higher consumption through on-trade venues. Tourism growth and premium hospitality expansion have also boosted on-trade sales, as high-end establishments feature exclusive spirit selections and curated tasting experiences.

Regional Insights

The North America spirits market is expected to grow at a CAGR of 4.7% from 2025 to 2033, fueled by the premiumization trend and consumers’ evolving taste for craft and authentic experiences. Consumers are gravitating toward premium, small-batch, and aged spirits that showcase craftsmanship, provenance, and superior quality. The surge in cocktail culture has further strengthened demand across categories such as whiskey, rum, gin, and tequila, as mixology becomes a mainstream lifestyle element. Younger consumers, in particular, are exploring innovative flavor profiles and premium mixers, driving experimentation with high-end spirits in bars and at home. Leading brands are capitalizing on this trend through collaborations with renowned mixologists, limited-edition releases, and storytelling that highlights heritage and artistry. For instance, brands like Patrón and Woodford Reserve are promoting premium expressions and signature cocktail experiences, positioning themselves at the intersection of luxury and creativity in the dynamic North American spirits landscape.

U.S. Spirits Market Trends

The spirits market in the U.S. accounted for 85.43% share in the North America spirits market revenue in 2024. This leadership is driven by the country’s strong culture of premiumization, rising interest in craft distilling, and a well-developed on-trade and off-trade ecosystem. High consumer spending on premium, small-batch, and aged spirits, especially whiskey, tequila, and bourbon, continues to fuel category expansion. The U.S. also benefits from a vibrant cocktail culture, with bars, restaurants, and home mixologists driving demand for versatile, high-quality spirits. Additionally, continuous innovation, celebrity-backed brands, and a rapidly growing e-commerce channel have further strengthened market penetration. The country’s diverse consumer base, openness to experimentation, and preference for authentic, story-driven brands position the U.S. as the primary growth engine for the North American spirits industry.

Europe Spirits Market Trends

In Europe, the spirits market is being shaped by a growing emphasis on authenticity, sustainability, and craftsmanship. Consumers are increasingly drawn to spirits that celebrate regional identity, traditional production methods, and traceable ingredients, with designations such as Scotch Whisky and Cognac AOC symbolizing quality and heritage. Sustainability has become a key differentiator, as brands adopt eco-conscious practices like energy-efficient distillation, organic sourcing, and recyclable packaging to appeal to environmentally aware consumers. Meanwhile, innovation is reshaping the landscape through the introduction of flavored, lower-ABV, and cocktail-oriented variants that cater to younger, urban audiences seeking modern drinking experiences. Brands such as The Macallan and Grey Goose are expanding their portfolios with creative expressions and collaborations that bridge tradition with contemporary mixology, enhancing their relevance in both casual and premium consumption occasions across Europe.

Asia Pacific Spirits Market Trends

The Asia Pacific spirits market accounted for a revenue share of 54.19% of the global revenue in 2024, driven by rising disposable incomes, rapid urbanization, and the expanding middle-class population across major economies such as China, India, and Southeast Asian nations. Consumers in the region are increasingly shifting toward premium and flavored spirits, while maintaining strong demand for traditional categories like Baijiu, Shochu, and Soju. The growth of modern retail formats, e-commerce alcohol delivery platforms, and vibrant nightlife and on-trade channels further support market expansion.

Additionally, global brands are strengthening their presence through localized flavors, smaller pack sizes, and targeted marketing to young adults. This combination of cultural diversity, premiumization, and widening access positions the Asia Pacific as one of the fastest-growing spirits markets worldwide.

Key Spirits Company Insights

Leading players in the spirits market include Asahi Group Holdings, Ltd., Diageo plc, Pernod Ricard S.A., Campari Group, and Constellation Brands, Inc. The global spirits market remains highly competitive, with leading manufacturers strategically expanding their distribution networks across online and offline platforms to improve product accessibility and visibility. Companies strongly emphasize innovation, advanced distillation processes, and diversified flavor profiles to attract younger consumers and broaden their international presence. Market growth is further fueled by the rising demand for premium and super-premium segments, the increasing influence of Western drinking culture and global mixology trends.

Key Spirits Companies:

The following are the leading companies in the spirits market. These companies collectively hold the largest Market share and dictate industry trends.

- Asahi Group Holdings, Ltd.

- Diageo plc

- Pernod Ricard S.A.

- Campari Group

- Constellation Brands, Inc.

- Tilaknagar Industries Ltd.

- Bacardi Limited

- Suntory Holdings Limited

- Louis Royer

- Cognac Hardy

Recent Developments

-

In March 2025, Brugal Rum launched the Andrés Brugal Edition 02, the second limited edition in its ultra-premium range, with only 416 bottles available globally. Retailing at USD 3,000 per bottle, it features a blend of four single casks aged in American oak, showcasing flavors of coconut, vanilla, and gentle spice.

-

In March 2025, Wray & Nephew launched Wray’s 43, a new UK-exclusive white Jamaican rum with an ABV of 43%, designed to cater to the growing demand for flavorful, easy-to-mix spirits. This limited edition rum is a blend of unaged Jamaican white rums, featuring notes of rich fruits, charred pineapple, and molasses.

-

In November 2024, Actor and entrepreneur Idris Elba partnered with Maison Ferrand to launch a new ultra-premium Cognac under his brand, Porte Noire. This collaboration marks Maison Ferrand’s first co-branded partnership, combining Elba’s modern luxury appeal with Ferrand’s heritage and craftsmanship. The launch aims to attract a new generation of Cognac drinkers by blending celebrity influence with artisanal French distilling expertise.

-

In June 2024, Tilaknagar Industries launched a new green-apple flavor variant under its premium flavored brandy line Mansion House Flandy, debuting in Telangana, India. The green apple essence, complemented by subtle oaky undertones, is designed to appeal to rising demand for flavored spirits, especially in a market where the green apple flavor is already the largest selling in the category.

Spirits Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 442.69 billion

Revenue Forecast in 2033

USD 641.84 billion

Growth rate

CAGR of 4.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million 9-Liter Cases, and CAGR in % from 2025 to 2033

Report coverage

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Price Point, Distribution Channel, Product - Price Point - Distribution Channel, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Korea; UAE

Key companies profiled

Asahi Group Holdings, Ltd.; Diageo plc; Pernod Ricard S.A.; Campari Group; Constellation Brands, Inc.; Tilaknagar Industries Ltd.; Bacardi Limited; Suntory Holdings Limited; Louis Royer; Cognac Hardy

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Spirits Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the spirits market by product, price point, distribution channel, product - price point - distribution channel and region.

-

Product Outlook (Revenue, USD Million; Volume, Million 9-Liter Cases; 2021 - 2033)

-

Vodka

-

Whiskey

-

Rum

-

Brandy and Cognac

-

Gin

-

Cordials & Liqueurs

-

Tequila & Mezcal

-

Baijiu

-

Others

-

-

Price Point Outlook (Revenue, USD Million; Volume, Million 9-Liter Cases; 2021 - 2033)

-

Economy

-

Mid-Premium

-

Super-Premium

-

Ultra-Premium

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Million 9-Liter Cases; 2021 - 2033)

-

On-trade

-

Off-trade

-

-

Product - Price Point - Distribution Channel Outlook (Revenue, USD Million; Volume, Million 9-Liter Cases; 2021 - 2033)

-

Vodka

-

Unflavored/Regular

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Flavored

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Whiskey

-

Scotch Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Irish Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Global/American Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Japanese Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Canadian Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Other Whiskey

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Rum

-

Dark & Golden Run

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

White Rum

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Flavored & Spiced Rum

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Others

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Gin

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Brandy & Cognac

-

Unflavored/Regular

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Flavored

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Tequila Mezcal

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Baijiu

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Other Spirits

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

-

Regional Outlook (Revenue, USD Million; Volume, Million 9-Liter Cases; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sports nutrition market size was estimated at USD 424.82 billion in 2024 and is expected to reach USD 442.69 billion in 2025.

b. The global sports nutrition market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 641.84 billion in 2033.

b. Based on product type, Baijiu is the largest segment accounting for a share of 37.14% in 2024.

b. Some key players operating in the sports nutrition market include Asahi Group Holdings, Ltd.; Diageo plc; Pernod Ricard S.A.; Campari Group; Constellation Brands, Inc.; Tilaknagar Industries Ltd.; Bacardi Limited; Suntory Holdings Limited; Louis Royer; Cognac Hardy.

b. Key factors driving the spirits market growth include rising premiumization, expanding young adult population, growing tourism and hospitality sectors, wider product availability, and increasing demand for flavored and craft spirits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.