- Home

- »

- Next Generation Technologies

- »

-

Sports Betting Market Size & Share Analysis Report, 2030GVR Report cover

![Sports Betting Market Size, Share & Trends Report]()

Sports Betting Market Size, Share & Trends Analysis Report By Platform, By Betting Type (Fixed Odds Wagering, Exchange Betting, Live/In-Play Betting, eSports Betting), By Sports Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-539-7

- Number of Report Pages: 131

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global sports betting market accounted for USD 83.65 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2030. The demand for sports betting is driven by factors such as the major shift in the regulatory landscape of the global gambling sector, the penetration of connected devices, and the developing digital infrastructure. The global sports sector has been greatly influenced by the COVID-19 pandemic due to restrictions on sporting activities across the globe. However, online sports betting gained popularity during the pandemic due to an upsurge in eSports and similar forms of betting. In addition, increased usage of smartphones has led to the wide availability and accessibility of sports betting, consequently propelling the global market. For instance, according to a recent survey from Uplatform, a sports betting and casino operating platform, mobile devices accounted for about 70% of online betting revenue in 2020.

Digitalization trends backed up by technological developments in terms of smartphones and betting software globally have enabled sports betting operators to simplify their platforms and provide an enjoyable betting experience to users. In addition, the incorporation of digital technologies is attracting new customers across the sports betting industry, fueling the growth of the market.

The relaxation of frameworks to regulate the l betting/gambling activities by governments across the globe is expected to offer lucrative opportunities for betting operators and consumers alike. For instance, according to the United States gambling industry association “American Gaming Association” as of January 2023, sports betting is legal in 36 states, up from 32 in 2021. In addition, during the first ten months of 2022, users have wagered about USD 73 billion, in the U.S. legally on sports.

Platform Insights

The online platform led the sports betting market in terms of the platform in 2022. The segment is expected to showcase a CAGR of more than 12.0% and maintain its dominance over the forecast period. The growth of the segment can be credited to the proliferation of smartphones and boosting internet infrastructure worldwide.

For instance, according to the data from an Indian gambling site known as Pure Win, more than 62% of all the bets made are done using a smartphone. Moreover, the global trend of digitization and technological advancements have influenced the lifestyle of the global population, contributing to the growth of the online platform segment. In addition, factors such as financial growth, improvement in the standard of living, and an increase in disposable income have driven the demand for online sports betting.

Betting Type Insights

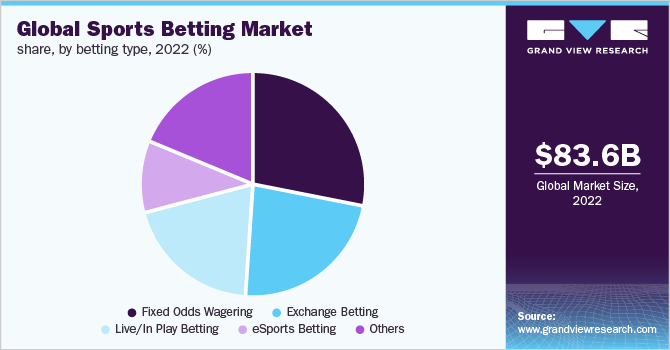

The sports betting industry by betting type was led by the fixed odds wagering segment in 2022, accounting for a revenue share of over 26%. The eSports betting segment is likely to grow at the fastest CAGR of over 14.0% during the forecast period. According to DataReportal, 60.0% of the world’s population has access to the internet.

The majority of customers with internet access are engaging in leisure activities like sports betting and actively seeking extra income in addition to entertainment. Moreover, as an increasing population is indulging in competitive eSports matches for entertainment and income, eSports is likely to offer lucrative opportunities for eSports betting operators.

Sports Type Insights

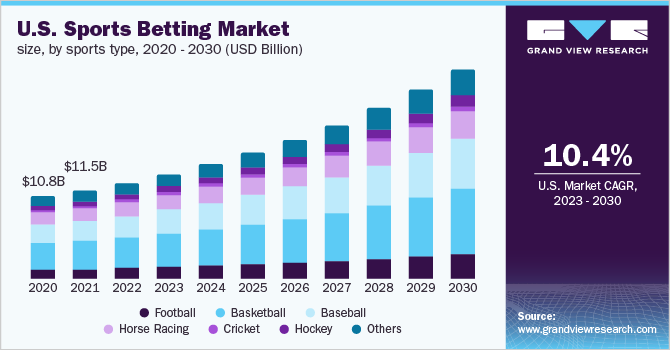

By sports type, the football segment registered a market share of more than 24.0% in 2022. Following football, the horse-racing segment accounted for the second-largest market share in 2022, growing at a CAGR of over 8.0% during the forecast period. The basketball and baseball segments are also expected to witness a CAGR of more than 10% owing to increasing trends toward betting among these sports types.

The major factor contributing to the growth of the market is the ever-increasing number of annual events by the sports leagues such as NFL, IPL, and EFL, among others. For instance, according to the Colorado Department of Revenue, NFL bets dominated sports betting in September 2022, followed by baseball and NCAA football in Colorado, U.S.

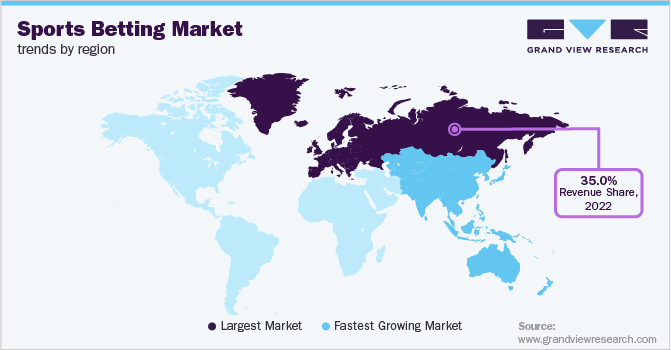

Regional Insights

Europe accounted for the largest market share of more than 35% in 2022. The region is anticipated to expand at a CAGR of almost 10.0% during the forecast period. The regulations across European countries regarding the sports betting/gambling industry are favorable for their population.

For instance, in the U.K., sports betting had been legalized since 1960, along with some of the most developed laws that allow legal sports betting. The online sports betting segment witnessed notable growth across Europe owing to restricted offline/retail betting activities, reaching a market size of over USD 40 billion by the end of the forecast period.

The Asia Pacific region is likely to register growth at the highest CAGR of over 11% during the forecast period. The significant factor contributing to the Asia Pacific sports betting market development is the increasing percentage of the regional population indulging in several forms of sports betting activities as several countries in the region are legalizing the gambling industry and attracting overseas market players.

Gambling is majorly popular among the people of China and India. For instance, according to the India Internet Player Society (IIPS), around 80% of Indians gamble once a year in the form of sports betting, lotteries, casino games, or local gambling.

Key Companies & Market Share Insights

The major players in the sports betting business focus on developing engaging websites and providing exclusive deals to have a competitive edge in the market. Companies are focusing on integrating technology like APIs to enhance functionalities and provide a simplified user interface. In addition, the market players are collaborating for product enhancements and the creation of new revenue streams.

For instance, in September 2021, Nuvei Corporation collaborated with 888 Holdings Plc to provide its Instant Bank Transfer payment solution to SI Sportsbook, the recently introduced online sports betting platform. Some prominent players in the global sports betting market include:

-

888 Holdings Plc

-

Bet365

-

Betsson AB

-

Churchill Downs Incorporated

-

Entain plc

-

Flutter Entertainment Plc

-

IGT

-

Kindred Group Plc

-

Sportech Plc

-

William Hill Plc

Sports Betting Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 83.65 billion

Revenue forecast in 2030

USD 182.12 billion

Growth rate

CAGR of 10.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, betting type, sports type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S; Canada; U.K.; Germany; France; Italy; Rest of Europe; China; India; Japan; Rest of Asia Pacific; Brazil; Mexico; Rest of Latin America

Key companies profiled

888 Holdings Plc; Bet365; Betsson AB; Churchill Downs Incorporated; Entain plc; Flutter Entertainment Plc; IGT, Kindred Group Plc; Sportech Plc; William Hill Plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Sports Betting Market Segmentation

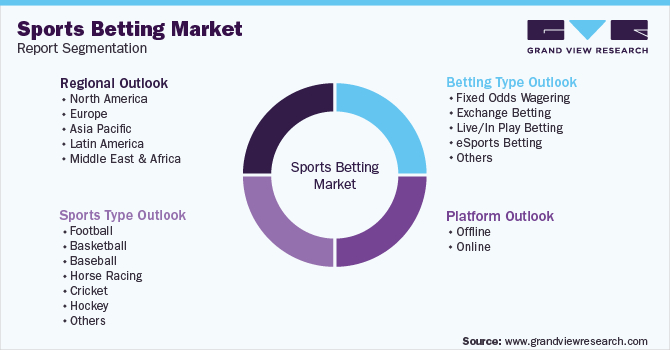

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sports betting market report based on platform, betting type, sports type, and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Betting Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed Odds Wagering

-

Exchange Betting

-

Live/In-Play Betting

-

eSports Betting

-

Others

-

-

Sports Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Football

-

Basketball

-

Baseball

-

Horse Racing

-

Cricket

-

Hockey

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S

- Canada

-

-

Europe

-

U.K

-

Germany

-

France

-

Italy

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The sports betting market was valued at USD 83.65 billion in 2022 and is estimated to reach USD 91.43 billion by 2022.

b. The global sports betting market is expected to grow at a compound annual growth rate of 10.3% from 2023 to 2030 to reach USD 182.12 billion by 2030.

b. Europe region dominated the global sports betting market with a share of 37% in 2022. This is attributable to the safety laws and regulations for offline as well as online betting across most of the countries in the region.

b. Some key players operating in the sports betting market include 888 Holdings Plc; Bet365; Flutter Entertainment Plc; Sportech Plc; and William Hill Plc.

b. Key factor that are driving the sports betting market growth include the increase in a number of sports events and leagues and the growing digital infrastructure and penetration of connected devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."