- Home

- »

- Plastics, Polymers & Resins

- »

-

Starch Polymers Market Size & Share, Industry Report, 2030GVR Report cover

![Starch Polymers Market Size, Share & Trends Report]()

Starch Polymers Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Corn Starch, Potato Starch), By Application (Packaging, Agriculture), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-524-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Starch Polymers Market Summary

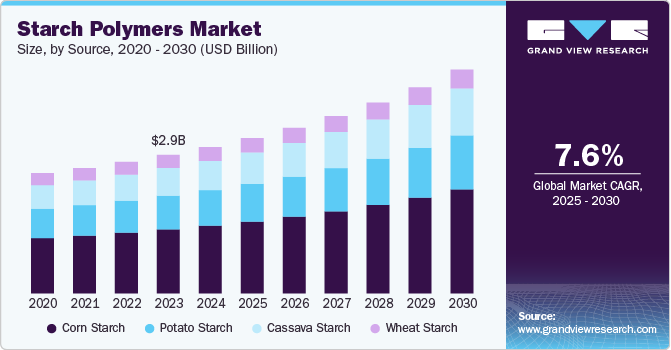

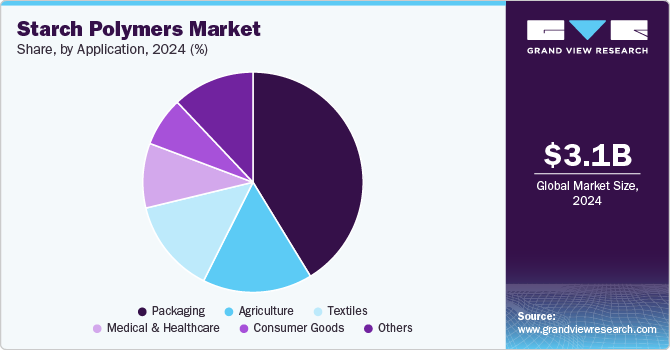

The global starch polymers market size was estimated at USD 3.10 billion in 2024 and is anticipated to reach USD 4.74 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. Growing consumer awareness about plastic pollution is increasing the demand for biodegradable and compostable alternatives, driving the adoption of starch polymers in packaging, disposable tableware, and personal care products.

Key Market Trends & Insights

- Asia Pacific dominated the global market and accounted for the largest revenue share of 40.40% in 2024.

- China was captured over 50% of the revenue share in the Asia Pacific region in 2024.

- By source, the corn starch segment dominated the market with a revenue share of 46.23% in 2024.

- By application, the packaging segment dominated the market with a revenue share of 41.27% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.10 Billion

- 2030 Projected Market Size: USD 4.74 Billion

- CAGR (2025-2030): 7.6%

- Asia Pacific: Largest market in 2024

The starch polymers industry is witnessing a strong shift towards biodegradable packaging, driven by increasing environmental awareness and regulatory support. Food, retail, and e-commerce companies are replacing conventional plastics with starch-based alternatives to reduce plastic waste. This trend is further amplified by global sustainability commitments and corporate ESG initiatives, pushing manufacturers to innovate high-performance starch polymer formulations. As a result, industry players focus on enhanced barrier properties, improved mechanical strength, and hybrid blends with other biopolymers like polylactic acid (PLA) to expand application feasibility. Major brands' rapid adoption of sustainable packaging positions starch polymers as a competitive solution within the global bioplastics market.

Drivers, Opportunities & Restraints

Stringent government policies aimed at curbing plastic pollution are accelerating the growth of the starch polymers industry. Countries across Europe, North America, and Asia Pacific are enforcing strict bans on single-use plastics, mandating the adoption of biodegradable alternatives. For instance, the European Union’s Single-Use Plastics Directive and China’s phased plastic restrictions have created a strong demand for starch-based materials in disposable cutlery, food packaging, and agricultural films. In addition, financial incentives, including tax benefits and R&D grants, are encouraging manufacturers to scale up production and enhance product quality. These policy-driven shifts strengthen market confidence, attract investments, and foster advancements in starch polymer processing technologies.

Beyond traditional biodegradable packaging, starch polymers are unlocking new opportunities in high-performance industrial applications. Advances in polymer modification techniques, such as plasticization, cross-linking, and nanocomposite reinforcement, enhance starch-based materials' mechanical and thermal properties. This enables their integration into sectors like automotive, electronics, and construction, where lightweight, eco-friendly alternatives to synthetic plastics are in demand. Furthermore, the rising interest in sustainable coatings, adhesives, and films presents a lucrative growth avenue. Companies investing in R&D to develop starch-polymer blends with improved durability and functional properties will be well-positioned to capitalize on this expanding market potential.

Despite growing interest, starch polymers face performance constraints that limit their large-scale industrial adoption. Issues such as low moisture resistance, limited mechanical strength, and faster degradation in humid conditions create challenges in applications requiring high durability. Unlike petroleum-based polymers, starch-derived materials often require additional chemical modifications or blending with other biopolymers to enhance their stability, which can increase production costs. Furthermore, the availability of cost-effective conventional plastics with superior performance properties continues to challenge the market’s competitiveness. Overcoming these material limitations through advanced formulation techniques and process optimization remains critical for sustained market growth.

Source Insights

Corn starch dominated the market across the product segmentation in terms of revenue, accounting for a market share of 46.23% in 2024 due to its high availability, cost-effectiveness, and well-established production infrastructure. Advances in agricultural biotechnology, including high-yield corn varieties and precision farming, have significantly improved corn production efficiency, ensuring a stable and scalable supply for polymer manufacturing. In addition, corn starch benefits from a mature processing ecosystem, allowing manufacturers to optimize costs through economies of scale. With increasing demand for biodegradable plastics, companies are leveraging corn starch as a primary feedstock due to its consistent quality, competitive pricing, and compatibility with existing polymer processing technologies.

Cassava starch is gaining traction in the market, particularly in regions like Southeast Asia, Africa, and Latin America, where cassava is a staple crop. Governments in these regions are promoting cassava-based bioplastics to reduce dependence on imported petroleum-based polymers and support local agriculture. Moreover, cassava starch polymers exhibit superior biodegradability and flexibility, making them suitable for applications requiring rapid decomposition. As sustainability regulations tighten, emerging-market industries increasingly invest in cassava-derived materials to develop cost-effective, locally sourced biodegradable solutions, strengthening regional supply chains and reducing import dependency.

Application Insights

Packaging dominated the market across the technology segmentation in terms of revenue, accounting for a market share of 41.27% in 2024. The growing e-commerce and food delivery industries fuel demand for starch-based biodegradable packaging as companies seek sustainable alternatives to conventional plastics. With regulatory bans on single-use plastics and rising consumer expectations for eco-friendly packaging, brands are actively integrating starch polymers into their supply chains. Fast-moving consumer goods (FMCG) companies and food service providers are particularly driving adoption, as starch-based films, trays, and pouches offer compostable and food-safe solutions. Furthermore, large-scale retailers are investing in starch polymer packaging to enhance their sustainability commitments, further accelerating market expansion in this segment.

In agriculture, starch polymers are increasingly used in biodegradable mulch films, seed coatings, and controlled-release fertilizers to support sustainable farming practices. Governments worldwide are implementing policies and subsidies to promote eco-friendly alternatives that reduce plastic waste in farmlands. Starch-based agricultural films help improve soil health by preventing plastic contamination while maintaining moisture retention and weed control. With the push for circular economy practices in agriculture, research institutions and agribusinesses are collaborating to develop high-performance starch-based solutions that enhance productivity while aligning with environmental regulations.

Regional Insights

Asia Pacific dominated the global starch polymers market and accounted for the largest revenue share of 40.40% in 2024 due to rapid industrialization, rising waste management concerns, and proactive government initiatives promoting bio-based alternatives. Countries such as India, Japan, and South Korea are implementing policies to curb plastic pollution, leading to increased investment in biodegradable materials. In addition, the region’s growing middle class and e-commerce boom are driving demand for sustainable packaging solutions. Local manufacturers are scaling up starch polymer production to meet both domestic and export demand, while government-backed R&D programs are fostering technological advancements to improve starch polymer performance and cost competitiveness.

China Starch Polymers Market Trends

The starch polymers market in China is driving significant growth due to its strict plastic reduction policies and increasing focus on self-sufficiency in bioplastic production. The government’s nationwide ban on non-biodegradable plastic bags and cutlery, along with its push for green alternatives in agriculture and packaging, is creating a strong demand for starch-based materials. In addition, China’s extensive domestic supply chain for corn and cassava starch ensures a steady raw material base, reducing dependency on imports. As a result, domestic manufacturers are expanding production capacity, integrating starch polymer solutions into mainstream industries, and positioning China as a global leader in biodegradable polymer innovation.

North America Starch Polymers Market Trends

The starch polymers market in North America is expanding due to growing corporate commitments to sustainability and circular economy principles. Large multinational corporations, including major retailers, food service providers, and packaging companies, are setting ambitious targets to reduce plastic waste and transition toward biodegradable materials. This shift is reinforced by voluntary initiatives such as the U.S. Plastics Pact and Canada’s Zero Plastic Waste Strategy, which encourage businesses to adopt compostable alternatives like starch-based bioplastics. As a result, starch polymer manufacturers in the region are witnessing increasing demand from industries seeking scalable, commercially viable solutions to meet their long-term sustainability goals.

The U.S. starch polymers market is being driven by stringent federal and state-level regulations targeting single-use plastics. States such as California, New York, and New Jersey have enacted laws banning plastic bags, cutlery, and food containers, creating significant demand for biodegradable alternatives. Moreover, extended producer responsibility (EPR) programs are pressuring businesses to adopt compostable materials in packaging and consumer goods. With regulatory enforcement increasing and public sentiment shifting against petroleum-based plastics, U.S. companies are accelerating investments in starch polymer research, scaling production capacity, and forming strategic partnerships with biopolymer manufacturers to ensure compliance and gain a competitive edge.

Europe Starch Polymers Market Trends

The starch polymers market in Europe remains a key driver due to its aggressive regulatory framework under the European Green Deal and the Single-Use Plastics Directive. The EU has imposed strict mandates requiring biodegradable and compostable packaging solutions, particularly in food service, retail, and agriculture. Furthermore, financial incentives such as research grants and tax breaks for sustainable materials encourage starch polymer innovations. Countries like Germany, France, and Italy are leading adoption, with businesses proactively investing in starch-based solutions to align with the region’s net-zero emissions and circular economy targets. This policy-driven momentum is making Europe a lucrative market for starch polymer manufacturers.

Key Starch Polymers Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Novamont S.p.A, Rodenburg Biopolymers, JAPAN CORN STARCH CO., LTD, United Biopolymers, S.A, Plantic, Balson Industries, BASF SE, BIOTEC, Biome Bioplastics, and Eco-Products Inc. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance their types' performance, cost-effectiveness, and sustainability.

Key Starch Polymers Companies:

The following are the leading companies in the starch polymers market. These companies collectively hold the largest market share and dictate industry trends.

- Novamont S.p.A

- Rodenburg Biopolymers

- JAPAN CORN STARCH CO., LTD

- United Biopolymers, S.A

- Plantic

- Balson Industries

- BASF SE

- BIOTEC

- Biome Bioplastics

- Eco-Products Inc

Recent Developments

-

In September 2024, Nouryon launched Structure Silk starch, a new rheology modifier and texturizer for personal care products. This naturally derived ingredient is designed to create luxurious, cushioned textures and add brightness to skin, hair, and styling formulations, catering to the increasing demand for innovative and unique sensory experiences in the personal care market.

-

In February 2024, Ingredion Incorporated launched NOVATION Indulge 2940, a functional native corn starch designed as a clean-label texturizer for the food and beverage industry. This non-GMO starch caters to health-conscious consumers seeking plant-based textures in products like yogurts, puddings, and desserts. Ingredion highlighted that it provides a consumer-friendly "corn starch" label and offers cost benefits, potentially improving cost-in-use due to reliable supply. With 79% of global consumers wanting to recognize product ingredients, this starch allows brands to meet the demand for recognizable ingredients without sacrificing texture or taste.

Starch Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.29 billion

Revenue forecast in 2030

USD 4.74 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Novamont S.p.A; Rodenburg Biopolymers; JAPAN CORN STARCH CO., LTD; United Biopolymers, S.A; Plantic; Balson Industries; BASF SE; BIOTEC; Biome Bioplastics; Eco-Products Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

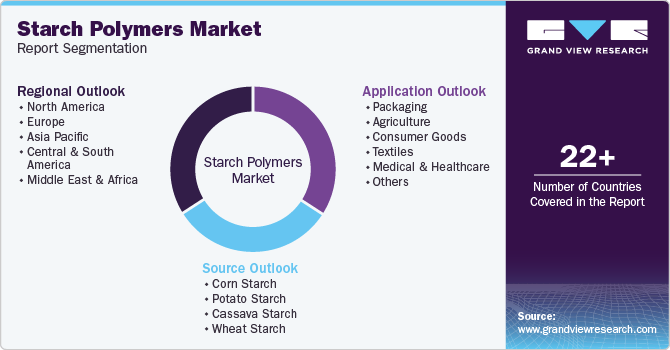

Global Starch Polymers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global starch polymers market report based on source, application, and region:

-

Source Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

Corn Starch

-

Potato Starch

-

Cassava Starch

-

Wheat Starch

-

-

Application Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Agriculture

-

Consumer Goods

-

Textiles

-

Medical & Healthcare

-

Others

-

-

Regional Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global starch polymers market size was estimated at USD 3.10 billion in 2024 and is expected to reach USD 3.29 billion in 2025.

b. The global starch polymers market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 4.74 billion by 2030.

b. Corn starch dominated the starch polymers market across the product segmentation in terms of revenue, accounting for a market share of 46.23% in 2024 due to its high availability, cost-effectiveness, and well-established production infrastructure.

b. Some key players operating in the Starch Polymers market include Novamont S.p.A, Rodenburg Biopolymers, JAPAN CORN STARCH CO., LTD, United Biopolymers, S.A, Plantic, Balson Industries, BASF SE, BIOTEC, Biome Bioplastics, and Eco-Products Inc.

b. Growing consumer awareness about plastic pollution is increasing the demand for biodegradable and compostable alternatives, driving the adoption of starch polymers in packaging, disposable tableware, and personal care products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.