- Home

- »

- Clinical Diagnostics

- »

-

STD Self-Testing Market Size & Share, Industry Report, 2030GVR Report cover

![STD Self-Testing Market Size, Share & Trends Report]()

STD Self-Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (CT/NG Testing, Syphilis Testing, HIV Testing), By Region (North America, Asia Pacific, Europe, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-521-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

STD Self-Testing Market Summary

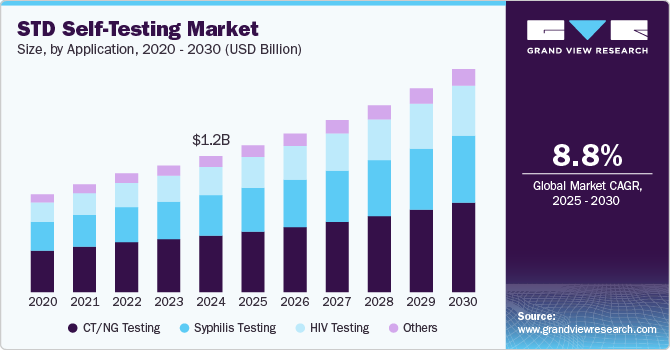

The global STD self-testing market size was estimated at USD 1.21 billion in 2024 and is projected to reach USD 1.98 billion by 2030, growing at a CAGR of 8.75% from 2025 to 2030. The market is witnessing growth due to factors such as the rising incidence sexually transmitted diseases, diseases, growing demand for privacy and convenience, and technological advancements in rapid diagnostics.

Key Market Trends & Insights

- North America accounted for the largest revenue share of 33.40% in 2024.

- The U.S market is significantly driven by large-scale public health initiatives aimed at expanding access to at-home diagnostic tools.

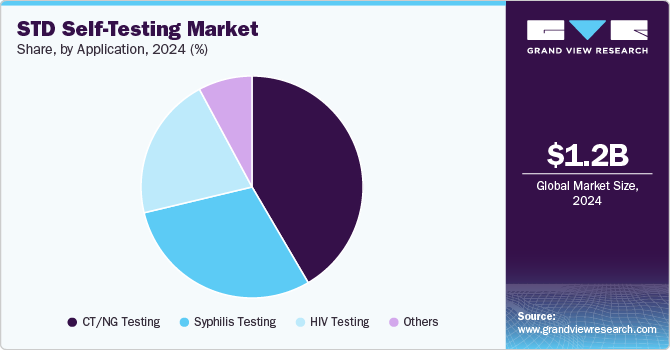

- In terms of application, CT/NG testing segment accounted for a revenue share of 41.55% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.21 Billion

- 2030 Projected Market Size: USD 1.98 Billion

- CAGR (2025-2030): 8.75%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

One of the key market drivers is government-backed initiatives and public health funding, as seen in the growing demand for home STI testing services in Ireland. The report published in January 2025, highlights a steady increase in the uptake of free STI home test kits, with orders rising from 91,000 in 2022 to 126,090 in 2024. This surge reflects a broader trend where governments and health organizations recognize the importance of accessible tests in controlling STI spread. By allocating additional funding of USD 6,18,723 in 2025, bringing the total to USD 4.9 million, the government is actively supporting the expansion of home testing. This financial backing not only improves availability but also builds public trust in these kits as a reliable diagnostic option. Moreover, the increase in kit return rates, from 62% in 2022 to 72.5% in 2024, suggests that awareness campaigns and ease of use are encouraging people to complete testing, leading to earlier detection and treatment. Such initiatives reduce the burden on healthcare facilities while making STI testing more discreet and convenient, ultimately fueling market growth.

In addition, the expansion of FDA-approved, over-the-counter diagnostic options by major healthcare companies contribute to the growth of the market. For instance, in October 2024, Labcorp introduced the First to Know Syphilis Test. The FDA’s authorization of this blood test as an at-home and provider-administered diagnostic marks a significant advancement in the accessibility of STI testing. Labcorp’s exclusive distribution agreement with NOWDiagnostics (NOWDx) ensures that the test reaches a broad range of healthcare providers and consumers nationwide, reinforcing the shift toward decentralized, patient-driven test solutions. Such developments not only make syphilis screening more convenient but also align with public health efforts to curb the rising incidence of syphilis. By offering a rapid, reliable alternative to traditional lab-based testing, such innovations help reduce barriers related to clinic visits, long wait times, and stigma, all of which have historically deterred people from getting tested. As more diagnostic companies follow, the market for STD self-test kits is expected to grow significantly, driven by increasing consumer trust and regulatory support for high-quality at-home test solutions.

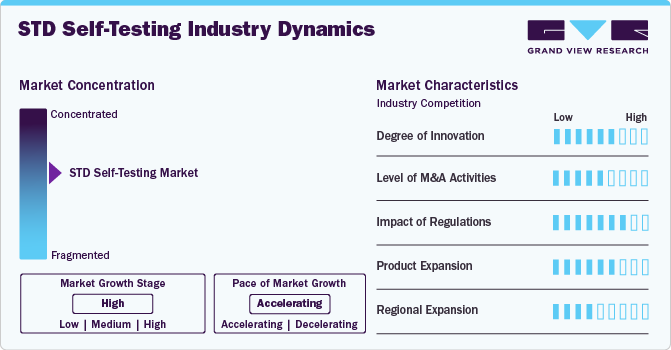

Market Concentration & Characteristics

The degree of innovation in the market is high, driven by advancements in rapid diagnostics for syphilis, HIV and other sexually transmitted diseases. Companies such as Daye have introduced diagnostic tampons capable of detecting STIs and vaginal infections, while smartphone-connected self-testing devices are emerging to enhance user experience and accessibility. These advancements mark a shift towards faster, more private, and highly accurate self-testing solutions, expanding access to STI screening and empowering individuals to take charge of their sexual health.

The STD self testing market has witnessed a moderate level of merger and acquisition (M&A) activity. Key players in the market have actively pursued acquisitions to integrate advanced diagnostic technologies into their portfolios and enhance distribution channels. For instance, Labcorp’s agreement with NOWDiagnostics expanded its distribution of its at-home syphilis test and strengthened its position in the fast growing market.

Regulation plays a crucial role in shaping the STD self-testing market by ensuring that diagnostic kits meet safety, accuracy, and effectiveness standards. Regulatory bodies such as the FDA, CE, and TGA grant approvals for at-home test kits, which helps build consumer trust and accelerates market growth. For instance, the FDA’s approval of over-the-counter syphilis and chlamydia tests has paved the way for increased accessibility to these essential health tools. However, stringent regulations can also create barriers, as companies must meet complex requirements before launching new products, which can delay market entry.

The STD self-testing market faces competition from traditional in-clinic test, where samples are collected by healthcare professionals and sent to labs for analysis. Such methods, while accurate, are often more time-consuming, require appointments, and may involve stigma. However, traditional tests are popular due to their perceived reliability and comprehensive diagnostic capabilities, especially for more complex cases. Despite substitutes, the increasing demand for more accessible and discreet options drives growth in the STD self-testing segment.

End-user concentration is largely focused on individual consumers, especially those seeking privacy, convenience, and quick results. This segment includes sexually active individuals, young adults, and those in high-risk groups who prioritize accessibility to affordable testing solutions. .

Application Insights

The CT/NG testing segment dominated the market and accounted for a revenue share of 41.55% in 2024, majorly driven by the high prevalence of these two infections, which are among the most common STIs worldwide. In 2023, over 1.5 million cases of chlamydia and gonorrhea were reported in the United States alone, making these infections a key focus of public health initiatives. The high demand for convenient, accessible testing solutions for these STIs has fueled the development of self-test kits specifically for CT/NG. For instance, FDA-approved self-test kits for chlamydia and gonorrhea have become increasingly popular due to their ease of use, offering results within minutes from home using urine or swab samples. These kits cater to a growing desire for privacy, with many people avoiding in-clinic testing due to stigma or time constraints. As a result, CT/NG test are dominating sales due to their widespread need and the ability of self-test kits to deliver quick and accurate results.

On the other hand, the HIV test segment is expected to expand at the fastest CAGR during the forecast period. This growth is driven by increasing awareness, improved diagnostic technology, and the push for early detection. In 2023, the World Health Organization (WHO) reported that approximately 39.9 million people were living with HIV globally, highlighting the urgent need for accessible testing. HIV self-test kits, such as the OraQuick In-Home HIV Test, which provides results in 20-40 minutes, have become a crucial tool in promoting early diagnosis and reducing transmission rates. The convenience and privacy of these at-home tests are key factors driving their popularity, especially in regions with high HIV prevalence but limited healthcare infrastructure. With regulatory support and growing public health initiatives, HIV self-testing is expanding rapidly, offering individuals a discreet and reliable way to monitor their health and seek timely treatment.

Regional Insights

North America STD self-testing market dominated the global market and accounted for the largest revenue share of 33.40% in 2024. The market is driven by increasing regulatory approvals that expand consumer access to at-home diagnostic solutions. A key milestone was the U.S. FDA’s marketing authorization in August 2024 for NOWDiagnostics’ First To Know Syphilis Test, the first over-the-counter, at-home test for detecting Treponema pallidum (syphilis) antibodies in human blood. This approval marks a significant advancement in making STD testing more accessible, private, and convenient. With syphilis cases rising in the U.S. and Canada, the availability of FDA-authorized home tests is expected to increase early detection and treatment rates, driving demand for self-test kits. Such regulatory developments highlight a growing market shift towards consumer-driven, at-home diagnostics, boosting North America's leadership in the global STD self-testing industry.

U.S. STD Self-Testing Market Trends

The STD self-testing market in the U.S is significantly driven by large-scale public health initiatives aimed at expanding access to at-home diagnostic tools. For instance, the CDC in March 2023 announced the launch of a project, Together TakeMeHome (TTMH), to distribute up to 1 million HIV self-tests over 5 years. This initiative, developed in collaboration with OraSure Technologies, Emory University, and other health organizations, enables individuals aged 17 and older across the U.S. and Puerto Rico to order self-test kits online, reducing barriers related to stigma, cost, and healthcare access. By making HIV self-tests widely available, the program encourages early detection, increases testing rates, and promotes public health awareness, which in turn fuels overall market growth for STD self-test kits. Such initiatives, combined with rising consumer preference for private, at-home testing solutions, are major drivers of the market’s expansion in the U.S.

Europe STD Self-Testing Market Trends

Europe STD self-testing market accounted for a significant share of the market especially due to strong government support and technological innovation. Increasing investments in rapid diagnostic technologies and government-backed research initiatives fuel the market growth. In June 2023, UK-based Linear Diagnostics secured funding from the National Institute for Health and Care Research (NIHR) to develop a 20-minute rapid test for gonorrhea and chlamydia, addressing the need for faster, more accessible STI diagnostics. Such advancements highlight Europe’s focus on enhancing self-testing accuracy and convenience, reducing reliance on clinical visits, and expanding access to early detection solutions.

The STD self-testing market in the UK is driven by strong public health initiatives that promote free and accessible testing. National HIV Testing Week (February 10-16, 2025), led by HIV Prevention England and funded by the Department of Health and Social Care (DHSC), plays a crucial role in encouraging regular HIV and syphilis testing, particularly among high-risk groups. During this campaign, individuals can order free self-test kits online, either for immediate at-home use or for lab-based analysis with results sent via text. The backing of organizations like the Terrence Higgins Trust and the ease of online ordering reduce barriers related to stigma, cost, and clinic access, driving greater adoption of self-test kits. Such government-supported initiatives significantly boost public awareness and testing rates, making them a key market driver for the STD self-testing industry in the UK.

Asia Pacific STD Self-Testing Market Trends

The Asia Pacific STD self-testing market is expected to witness the fastest CAGR of 9.72% over the projected period, driven by the rising prevalence of STDs, increased awareness about early detection, and growing government initiatives promoting self-test solutions. Countries such as China and Japan are witnessing surges in HIV and syphilis cases, leading to greater demand for at-home testing kits. In addition, technological advancements and the expansion of e-commerce and telehealth services have improved the accessibility of self-test kits, making them more convenient for consumers.

The STD self-testing market in China is being driven by the urgent need for early HIV detection, particularly among high-risk populations such as out-of-school men who have sex with men (MSM) aged 16-24 years. A survey conducted between October 2022 and May 2023 across seven major cities found that 80% of newly diagnosed HIV cases in individuals aged 15-24 were attributed to out-of-school youth, with only 51.6% of cases previously diagnosed. This highlights the gap in testing accessibility and awareness, emphasizing the importance of self-test kits as a discreet and convenient alternative to traditional testing. The rising HIV burden in this demographic has led to greater demand for at-home test solutions, supported by public health initiatives and digital healthcare platforms, which make self-test kits more accessible.

The STD self-testing market in Japan is being driven by the rapid rise in syphilis infections, which has created an urgent need for more accessible and frequent testing options. According to the news published in February 2023, Japan recorded around 13,000 syphilis cases at the end of 2022, the highest number since tracking began in 1999, prompting public health experts to advocate for better sex education and expanded testing availability. This surge in infections has increased consumer demand for discreet, convenient, and rapid self-test kits, which allow individuals to monitor their health without visiting clinics. In addiiton, growing government and healthcare initiatives to raise awareness and encourage early detection are fueling the adoption of STD self-testing solutions across the country.

Latin America STD Self-Testing Market Trends

Latin America STD self-testing market was identified as a lucrative region in this industry owing to improving healthcare infrastructure and increasing awareness about several diseases. As governments invest more in healthcare and diagnostic technologies, demand for affordable and accessible STD self-testing is rising.

The STD self-testing market in Brazil is expected to grow over the forecast period. This expansion is largely due to the increasing prevalence of sexually transmitted infections (STIs) and a rising public awareness of the importance of early detection. Government initiatives and public health campaigns have been instrumental in promoting regular testing, thereby reducing stigma and encouraging individuals to utilize self-test kits. Technological advancements have also led to the development of more accessible and user-friendly self-test options, further propelling market growth. In addition, the convenience and privacy offered by self-testing kits align well with the preferences of the population, contributing to their widespread adoption across the country.

Middle East & Africa STD Self-Testing Market Trends

The STD self-testing market in the Middle East and Africa is driven by increasing awareness of sexual health, particularly in countries where stigma around STIs is high. Public health campaigns promoting early detection and confidential testing are boosting demand for self-test kits in the region. The rise of mobile health technology and e-commerce platforms has also made it easier for consumers to access these tests discreetly, further propelling market growth. In addition, government and NGO efforts to combat the spread of STIs in high-risk populations are pushing for more accessible self-testing solutions.

The STD self-testing market in South Africa is driven by driven by government initiatives to expand free and accessible STI testing. Under the fifth HIV, TB, and STI action plan (2023-2028), the South African government is set to introduce free home test kits for gonorrhea, chlamydia, syphilis, and trichomoniasis, making testing more accessible through chronic medicine pick-up points nationwide. In addition, public clinics will roll out same-day STI test results, improving early detection and treatment rates. Previously, the public health system only diagnosed these STIs based on symptoms, leaving many infections undetected. By integrating routine test into public healthcare services, reducing stigma, and improving accessibility, these initiatives are expected to significantly drive demand for STD self-test kits in South Africa.

Key STD Self-Testing Company Insights

Some of the leading players operating in the market include OraSure Technologies, Inc., Selfdiagnostics, Wondfo, bioLytical Laboratories, known for their advanced diagnostic solutions and strong market presence. These companies offer a wide range of STD self testing products catering to point-of-care settings.

Emerging players such as TouchBio are leveraging advances in STD self-testing to create next-generation diagnostic tools that promise enhanced sensitivity and convenience for detecting these diseases.

Key STD Self-Testing Companies:

The following are the leading companies in the STD self-testing market. These companies collectively hold the largest market share and dictate industry trends.

- OraSure Technologies, Inc.

- Selfdiagnostics

- Wondfo

- bioLytical Laboratories

- autotest VIH

- Abbott

- Visby Medical

- PrivaPath Diagnostics (LetsGetChecked)

- NOWDiagnostics

Recent Developments

-

In November 2024, Burnet Institute announced its collaboration with Atomo Diagnostics on a rapid active syphilis point-of-care test, supported by USD 2.44 million in funding from the Australian Government. This test, which uses a finger prick blood sample and Burnet's syphilis antibody assay, is designed for both professional and at-home self-testing with the innovative AtomoRapidTM Pascal cassette.

-

In March 2024, UHS launched a new online STI testing program, aimed at providing students with more convenient and accessible testing options. The program includes evidence-based educational resources to help students make informed decisions about their testing choices.

STD Self-Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.30 billion

Revenue forecast in 2030

USD 1.98 billion

Growth rate

CAGR of 8.75% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

OraSure Technologies, Inc.; Selfdiagnostics; Wondfo; bioLytical Laboratories; autotest VIH; Abbott; Visby Medical; PrivaPath Diagnostics (LetsGetChecked); NOWDiagnostics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global STD Self-Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global STD self-testing market report based on application and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

CT/NG Testing

-

Syphilis Testing

-

HIV Testing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the STD self-testing market include OraSure Technologies, Inc., Selfdiagnostics, Wondfo, bioLytical Laboratories, autotest VIH, Abbott, Visby Medical, PrivaPath Diagnostics (LetsGetChecked), NOWDiagnostics

b. The global STD self-testing market size was estimated at USD 1.21 billion in 2024 and is expected to reach USD 1.30 billion in 2025.

b. The global STD self-testing market is expected to grow at a compound annual growth rate of 8.75% from 2025 to 2030 to reach USD 1.98 billion by 2030.

b. North America dominated the STD self-testing market with a share of 33.40% in 2024. This is attributable to increasing regulatory approvals that expand consumer access to at-home diagnostic solutions.

b. Key factors that are driving the market growth include rising incidence sexually transmitted diseases, diseases, growing demand for privacy and convenience, and technological advancements in rapid diagnostics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.