- Home

- »

- Advanced Interior Materials

- »

-

Steel Market Size, Share, Growth And Trends Report, 2030GVR Report cover

![Steel Market Size, Share & Trends Report]()

Steel Market Size, Share & Trends Analysis Report By Product (Flat, Long), By End-use (Building & Construction, Automotive & Aerospace, Railways & Highways), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-863-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Steel Market Size & Trends

“2030 steel market value to reach USD 2,009.46 billion.”

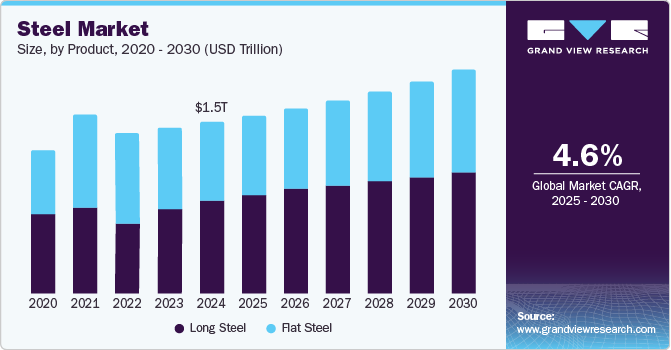

The global steel market size was estimated at USD 1,469.04 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The global steel market is anticipated to be driven by rising investments in construction activities. Infrastructure and construction extensively require massive amounts of steel to enhance the aesthetic appeal and corrosion resistance of the structure. Steel products offer high strength and are 100% recyclable, which makes them applicable in residential, commercial, and infrastructural applications. Growing investments in construction sector is anticipated to augment market growth.

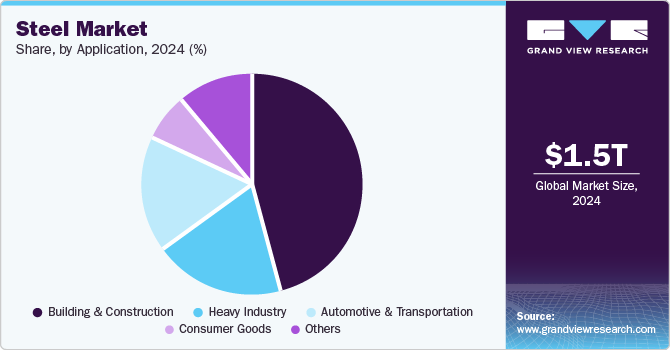

The flat and long steel products are extensively used in the construction industry for applications such as roofing, beams, columns, reinforcement, and others. The use of steel in construction is due to its high strength-to-weight ratio, which supports the weight of massive structures. Moreover, its extensive availability, low cost, and durable characteristics further enhance its applications in construction & infrastructure industry.

Drivers, Opportunities & Restraints

Rising investments in new construction activities across residential and non-residential sectors are among the major growth drivers for the market. The global construction industry is advancing at a moderate pace, marking a major share in the overall economic growth of various countries. For instance, the share of the construction sector in India for FY2023-24 was 8.99% compared to 7.43% in FY2016-17.

Rising investments in green construction are anticipated to present lucrative opportunities for the market to grow further. For instance, the U.S. Department of Energy has announced an investment of USD 6 billion for 33 projects in over 20 states, to decarbonize energy-intensive industries. These projects will be funded by the President’s Bipartisan Infrastructure Law and Inflation Reduction Act.

Shifting inclination towards adoption of lightweight materials such as aluminum, copper, and carbon fibers restrict the consumption of steel products in numerous applications. For example, aluminum is replacing steel in automotive applications to achieve higher fuel efficiency. Also, carbon fiber is known to be five times stronger and two times stiffer than steel. In February 2023, the world’s first carbon concrete building, called Cube, was completed. It is made from concrete reinforced with carbon fiber. It was developed by the German firm Henn and the Technical University of Dresden and is located on the University’s campus.

Steel Price Trends

Steel prices have been rising since mid-2020. The surge in demand in 2021 and limited supply further aided the price hike. The steel prices dropped in 2022 as the supply overtook demand. However, this trend again changed when the Russia-Ukraine war hit demand-supply dynamics, leading to a historic rise in prices. The prices started stabilizing towards end of 2022.

As 2023 began, steel prices witnessed varied performance in different parts of the world. For instance, flat steel prices were observed to rise in the U.S., Europe, and Japan due to high demand from the auto industry, whereas the scenario was different in China owing to the weak performance of residential construction. Steel prices are anticipated to remain passive in 2024, considering the sluggish demand from end-use industries.

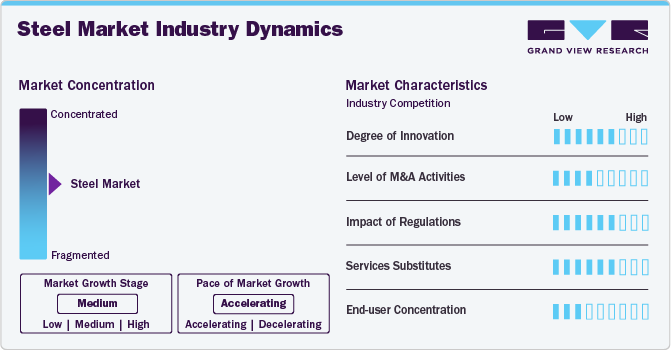

Market Concentration & Characteristics

Global steel market is moderately fragmented, with presence of massive and established players as well. The industry has a large manufacturing base across all parts of the world, with major concentration in the Asia Pacific. The region alone accounted for over 74% of global crude steel production in 2023.

Innovation activities are being observed in the production processes, with key focus towards decarbonization and a pollution-free manufacturing. Green steel production has commenced its path. H2 Green Steel in Sweden has an in-progress facility with contracts and agreements in place. If construction goes as planned, the facility is expected to give out low carbon steel by end of 2025 or early 2026.

Merger and acquisition activities have been active in the steel industry, as the established players always seek to consolidate their shares, expand their presence, and stay ahead in competition in terms of technology and innovation. In December 2023, Nippon Steel announced to acquire U.S. Steel. As of May 2024, both companies have received regulatory approvals outside the U.S. The deal worth USD 14.1 billion however has been postponed for few months as the U.S. Department of Justice requested more documentation.

Product Insights

“Flat steel held the largest revenue share of almost 52% in 2023.”

Finished steel is mostly used for developing long and flat products. Flat steel constitutes items produced in rolling mills using steel slabs or thin steel slabs and flat steel rolls. Steel slabs are rolled into plates, sheets, strips, and structural beams to develop flat steel, which is extensively used in consumer goods, construction applications, and white goods. It is also used to produce cable trays, light bars, truck trailers, tippers, railways, cars, and gratings.

Rebars, wire rods, sections, pipes & tubes constitute the long steel products. The expansion in manufacturing sector, infrastructural developments, and construction of rails & bridges aid the demand for long steel. For instance, steel sections of different sizes and shapes are directly used in the development of bridges and flyovers, depending on applications and design requirements.

The need to replace old infrastructure further aids product demand. For instance, U.S.-based Amtrak will commence construction of a new bridge in 2024, replacing the old two-track Connecticut River bridge. The project is worth USD 1.3 billion, which is majorly funded by Infrastructure Investment & Jobs Act (IIJA). Such investments are anticipated to aid the demand for long steel products over the forecast period.

End-use Insights

“Automotive & Aerospace segment is anticipated to register a revenue CAGR of 5.2% over the forecast period.”

As the advent of new-age electric vehicles is disrupting the existing internal combustion-based vehicles market, manufacturers are investing in the development of new and improved special steel grades for use in these vehicles. To demonstrate advanced steel architectures for future mobility, in 2020 World Auto Steel announced the steel e-motive program. These programs will support the development of new steel compositions, which will lead to the design of lighter electric vehicles. As the demand for electric vehicles increases, demand for such low-density steel will increase in future.

Building & construction accounted for the largest share of the market in 2023 and this trend is projected to grow over the forecast period. Properties such as high tensile strength, durability, flexibility, versatility, cost-effectiveness, sustainability, and easy availability largely employ steel products in the construction industry. Growing construction spending to boost economic growth are anticipated to aid segment growth over the forecast period.

Regional Insights

“China held nearly 70% revenue share of the overall Asia Pacific steel market.”

North America Steel Market Trends

North America held over 10% revenue share in 2023. The governments of respective countries in the region are focused on propelling the economic growth rate by investing in industries such as infrastructure & construction, transport, airport, and ports. Growth in these industries is likely to increase the demand for steel in the region over the forecast period.

U.S. Steel Market Trends

Steel market of the U.S. accounts for largest revenue share of the North America steel market. Investments towards supporting new infrastructure, establishments of new construction, and investments in automotive and aerospace industries is aiding product demand in the country.

Asia Pacific Steel Market Trends

Asia Pacific accounted for largest revenue share of 64.1% in 2023 of the global steel market and this trend is anticipated to continue over the forecast period owing to large manufacturing and consumption base in China. Rising investment in infrastructure development projects is a key factor propelling the market growth. For instance, in January 2023, China Railway Co. announced plans to construct 2,500 km of high-speed railway network. The country plans to expand its transport network by accelerating the construction of its key Southwest Sichuan-Xizhang Railway project.

Europe Steel Market Trends

Europe holds major share of the steel market. Despite the Russia-Ukraine conflict, energy crisis, and tightening of monetary conditions, the Euro area performed well towards the end of 2022 and registered a GDP growth of 3.4% in 2022. Its GDP growth for 2023 was, however, 0.4%. As of April 2024, the real GDP growth of Europe was 1.4%, according to the IMF.

Germany steel market is major market in Europe with strong automotive base and investments in construction sector. The country however faces economic crisis with GDP growth decline of 0.3% in 2023, which is forecasted to grow by 0.1% in 2024 and 1.0% in 2025, according to the European Commission. The construction output was sluggish in 2023 but is expected to recover in 2024.

Central & South America Steel Market Trends

Steel market in Central & South America is anticipated to flourish on account of rising investments by automobile manufacturers and increasing construction activities in the region. For example, in December 2023, the Peruvian government employed NEC4 contracts to execute a USD 1.2 billion program aimed at demolishing and rebuilding 75 state schools across the country within three years.

Middle East Steel Market Trends

The Middle East steel market is expected to witness demand amidst growing construction sector. Countries in the region are showing lucrative growth opportunities on account of the ongoing urbanization and industrialization in the region. For example, the government of the UAE plans to increase the contribution of manufacturing industry to its economy by diversifying its investments in other industries.

Africa Steel Market Trends

Steel production in Africa has been steadily increasing in the past few decades. However, the continent still lags behind other regions. The production of steel in Africa is primarily based on consumption of steel products in construction and infrastructure development. In June 2024, Dinson Iron and Steel Company’s Mvuma steel plant in Zimbabwe commenced pig iron production. The company is subsidiary of China-based Tsingshan Holding Group. The plant is anticipated to commence steel billets production as well with an initial capacity of 600 kilotons a year, which is expected to reach 5 million tons towards the final phase.

Key Steel Company Insights

Some of the key players operating in the market include Nippon Steel Corporation, ArcelorMittal, and Baosteel Grou.

-

Nippon Steel Corporation is Japan’s largest steelmaker. It operates through business segments, namely Steelmaking & Steel Fabrication, Engineering, Chemicals, New Materials, and System Solutions. Its core segment is Steelmaking and Steel Fabrication, which includes Engineering & Construction, Chemicals & Materials, and System Solutions. It delivers diverse products and caters to all key end-user industries of steel.

-

Baosteel Group, an integrated steel producer founded by the Shanghai Baosteel Group Corporation, produces various steel products such as HR steel, CR sheets, heavy plates, pipes & tubes, bars & wire rods, and rail & section steel. It has a total manufacturing capacity of 50.95 Mtpa across 4 plants in China.

Key Steel Companies:

The following are the leading companies in the steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Baosteel Group

- Emirates Steel

- JFE Steel Corporation

- Nippon Steel Corporation

- NUCOR

- Outokumpu

- POSCO

- Tata Steel

- Thyssenkrupp

Recent Developments

-

In June 2024, SteelAsia, inaugurated Compostela Works, largest steel mill of Philippines. It has a production capacity of 1 million tons per annum. The plant will produce high strength rebars and welded rebar mesh.

-

In May 2024, Electra, a startup backed by Bill Gates and Amazon announced about its green steel production plant. The plant in Colorado, U.S. will produce clean metallic iron from high purity ores using renewable energy.

-

In May 2024, Tosyali Algeria, a subsidiary of Turkey’s Tosyal Holding commissioned a new flat-rolled steel plant. It is based on EAF and has a production capacity of 2.2 million tons per year.

Steel Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,476.03 billion

Revenue forecast in 2030

USD 2,009.46 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; China; Japan; India; Indonesia; Philippines; Singapore; Thailand; Malaysia; Brazil; Bahrain; Kuwait; Oman; Qatar; Saudi Arabia; UAE; Tanzania; Rwanda; Zimbabwe; Kenya; Ethiopia; Mozambique

Key companies profiled

ArcelorMittal; Baosteel Group; Emirates Steel; JFE Steel Corporation; Nippon Steel Corporation; NUCOR; Outokumpu; POSCO; Tata Steel; thyssenkrupp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steel Market Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global steel market report on the basis of product, end-use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flat

-

Long

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Aerospace

-

Railways & Highways

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Philippines

-

Singapore

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

Saudi Arabia

-

UAE

-

-

Africa

-

Ethiopia

-

Tanzania

-

Mozambique

-

Rwanda

-

Zimbabwe

-

Kenya

-

-

Frequently Asked Questions About This Report

b. Steel is an extensively used material in various forms in construction, automotive, railways, aerospace, consumer electronics, and other such industries. Its large-scale production base and penetration across numerous applications aids to its market growth.

b. The global steel market size was estimated at USD 1,469.04 billion in 2023 and is expected to reach USD 1,476.03 billion in 2024.

b. The global steel market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 2,009.46 billion by 2030.

b. Based on end use segment, building & construction held the largest revenue share of more than 78.0% in 2023 owing to growth of construction activities in various economies.

b. Some of the key vendors of the global steel market are Tata Steel, Nippon Steel Corporation, POSCO, ArcelorMittal, JFE Steel, Baosteel Group, among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."