- Home

- »

- Medical Devices

- »

-

Stents Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Stents Market Size, Share & Trends Report]()

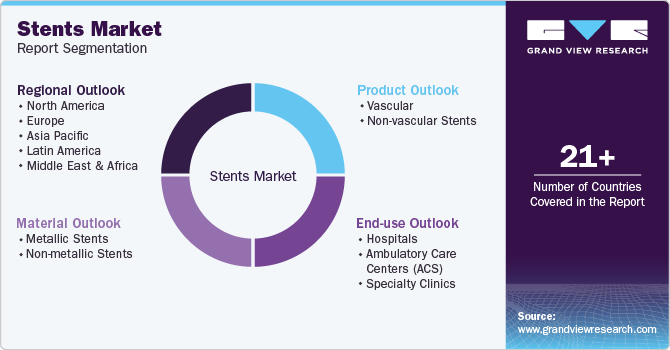

Stents Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Vascular, Non-vascular), By Material (Metallic, Non-metallic), By End-use (Hospitals, Ambulatory Care Centers, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-163-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stents Market Summary

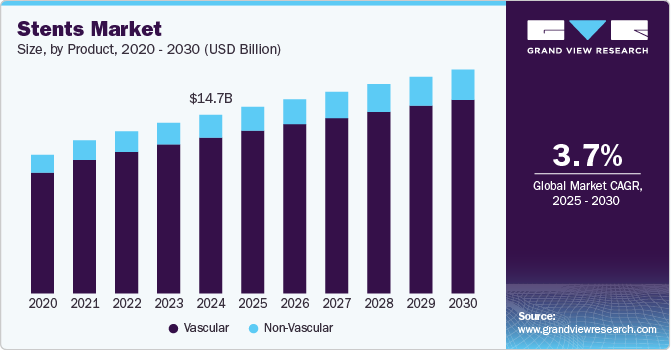

The global stents market size was estimated at USD 14.72 billion in 2024 and is projected to reach USD 18.46 billion by 2030, growing at a CAGR of 3.7% from 2024 to 2030. The prevalence of cardiovascular diseases significantly affects the market. For example, the Centers for Disease Control and Prevention (CDC) noted in 2022 that 371,506 deaths in the U.S. were attributed to coronary heart disease, making it the primary cause of death.

Key Market Trends & Insights

- North America dominated the global stents market with the largest revenue share of 43.6% in 2024.

- By product, the vascular stents segment led the market, holding the largest revenue share of 87.8% in 2024.

- By material, the non-metallic stents segment is projected to expand at a significant CAGR from 2025 to 2030.

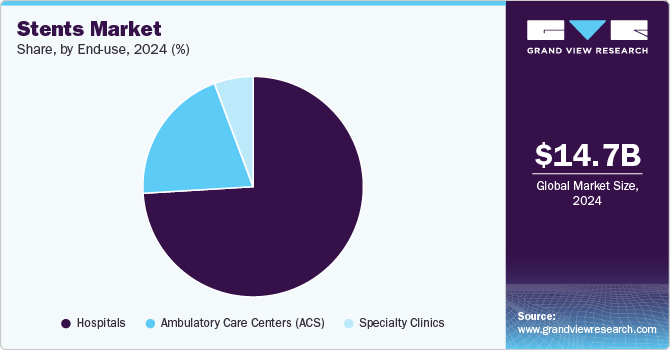

- By end use, the hospitals segment led the market, holding the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.72 Billion

- 2030 Projected Market Size: USD 18.46 Billion

- CAGR (2025 to 2030): 3.7%

- North America: Largest market in 2024

About 5% of individuals aged 20 and older suffer from coronary artery disease (CAD). Globally, CVDs have emerged as a critical public health concern, driven by various factors, including unhealthy lifestyles, hypertension, diabetes, and stress. The escalating number of deaths related to CVD underscores the urgent need for effective measures in prevention, diagnosis, and treatment.

The market witnessed growth due to several companies investing in developing new products. The focus on launching innovative products and obtaining regulatory approvals is expected to improve the availability of advanced options, encourage wider usage of stents, and further boost the market's growth. In March 2022, S3V Vascular Technologies announced an investment of USD 30.0 million at the Medical Devices Park in Hyderabad, India. The investment is aimed at manufacturing high-end critical lifesaving cardiac and neuromedical devices. The company manufactures bioresorbable vascular scaffolds and drug-eluting stents to reduce re-procedure rates.

Advancements in stent technology and materials, along with increasing elderly population worldwide, are expected to impact the market growth significantly. According to the World Health Organization (WHO), the proportion of people aged 60 years or older worldwide will increase to one in six by 2030. This means that people aged 60 years and over will rise from 1 billion in 2020 to 1.4 billion. Elderly individuals are more susceptible to conditions such as atherosclerosis, coronary artery disease, and peripheral arterial disease. These conditions often require stents for medical intervention. With increasing age, arteries become narrower and more prone to blockages due to plaque accumulation. This phenomenon highlights the importance of stents frequently employed to open these narrowed blood vessels and ensure proper blood flow.

Key market players have a vital role in driving the adoption of technological advancements in the market. These companies actively integrate such innovations into their product offerings to enhance patient outcomes and expand access to advanced treatment options. In August 2022, Medtronic launched the Onyx Frontier drug-eluting stent (DES), its latest offering in the market, after receiving CE Mark approval. The Onyx Frontier DES stands out for its innovative delivery system and incorporates the Resolute Onyx drug-eluting stent's acute performance and clinical data.

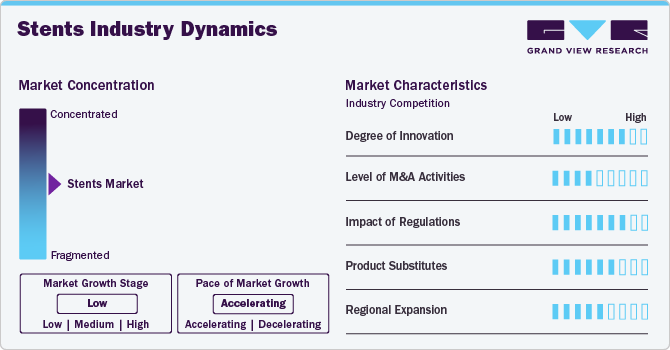

Market Concentration & Characteristics

The degree of innovation in the stents market is currently high. The market is witnessing new innovations such as introduction of specialized and advanced products like the Onyx Frontier drug-eluting stent reinforces these companies' market position and competitiveness. The global stents industry is buzzing with innovation, showcasing a continuous stream of new ideas and advanced approaches. These stents have become quite popular because of their minimal invasiveness and the relief they offer with reduced pain. Companies are actively investing in inventive technologies and procedures to meet the growing demand, staying on the cutting edge of progress in this field.

The level of mergers and acquisitions (M&A) activities within the stents market is moderate. Market players, such as Abbott Laboratories, Boston Scientific Corporation, BD, and Medtronic, are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories. In January 2024, Olympus Corporation, a leading MedTech company, recently finalized its purchase of Taewoong Medical Co., Ltd., a South Korean manufacturer known for its specialized gastrointestinal metallic stents. This strategic move has allowed Olympus to enhance its gastrointestinal EndoTherapy offerings, promising better patient care and innovative treatment solutions.

Impact of regulations on the stent market is high as regulations play a crucial role in shaping the stents market, influencing both product development and market entry. Stringent regulations from bodies like the FDA and EMA ensure stents adhere to safety and efficacy criteria before market release, which might slow their introduction. Yet, such standards also promote innovation, pushing manufacturers to enhance research and development for better and safer devices.

Stents offer a minimally invasive approach to treating narrowed arteries, with several product substitutes in certain cases. These alternatives include balloon angioplasty, endovascular stents, stent-grafts, and vascular surgery. Additionally, lifestyle modifications such as smoking cessation, weight management, exercise, and a balanced diet can play a crucial role in preventing or slowing the progression of stenotic disease.

Regional expansion within the stents market is assessed as moderate. The regional expansion of the stents market is significantly influenced by varying healthcare infrastructure and economic conditions across different areas. In regions with advanced healthcare systems, such as North America and Europe, there is a high demand for innovative stent technologies driven by an aging population and increasing prevalence of cardiovascular diseases. Conversely, emerging markets in Asia-Pacific and Latin America present moderate growth opportunities due to rising healthcare investments but face challenges like lower awareness of advanced medical technologies. In June 2022, Boston Scientific acquired a 64% major investment in M.I.Tech Co., Ltd., through a agreement with Synergy Innovation. M.I.Tech focusses on HANAROSTEN technology, and non-vascular for endoscopic & urologic procedures.

Product Insights

The vascular stents segment, categorized by product, held the largest market share of 87.8% in 2024. The market is witnessing growth due to the prevalence of unhealthy and hectic lifestyles in the society. Sedentary routines, poor dietary choices, and increased stress levels have led to an alarming rise in lifestyle-related conditions, particularly cardiovascular diseases. For instance, according to the World Health Organization (WHO), tobacco use causes 1.9 million deaths due to heart disease annually. The healthcare industry has seen a significant rise in the use of advanced technology, and people are now more aware of the negative impact of unhealthy lifestyles on their bodies. As a result, there is an increase in the number of individuals seeking medical treatment for their cardiovascular issues. This has increased demand for vascular stents and related interventional procedures. Increasing clinical studies to evaluate the safety and efficacy of vascular stents will accelerate the market growth. In June 2023, Gore announced the enrollment of the first U.S. patient in a study evaluating the Gore Viafort vascular stent for iliofemoral venous obstruction.

The non-vascular stents segment is predicted to grow substantially during the forecast period. The increasing incidence of chronic diseases such as pancreatic cancer, lung cancer, stroke, colon/colorectal cancer, asthma, and Chronic Obstructive Pulmonary Disease (COPD), among others, is expected to fuel demand for non-vascular stents. For instance, lung cancer affected approximately 238,340 people in the U.S. in 2023, making it the leading cause of cancer deaths worldwide. Similarly, about 26,500 new cases of stomach cancer are estimated in the U.S. Furthermore, increasing healthcare spending will escalate market growth. For instance, as per the American Medical Association report, healthcare spending in the U.S. reached USD 4.3 trillion in 2021, a 2.7% increase from the previous year, equating to USD 12,914 per person.

Material Insights

In 2024, metallic stents held the largest market share of 61.2% in 2024. These stents are widely used in critical applications, especially coronary and peripheral artery interventions, due to their durability and structural integrity. They provide immediate structural support and help maintain vessel patency, which is crucial in life-threatening situations such as acute myocardial infarctions and severe peripheral artery disease. The reliability and predictability of metallic stents have made them a popular choice as a primary treatment option. Continuous innovation in stent design and material technology has led to the development of thinner struts and drug-eluting variations, which have further enhanced their efficacy and safety. Metallic stents can be adapted to various anatomical locations and disease presentations, which has led to their growth in the market.

The non-metallic stents segment is anticipated to witness significant growth in the market during the forecast period. Non-metallic stents are becoming popular in the medical field due to their flexibility and adaptability in various medical applications. These stents are usually made from silicone, polyurethane, or bioabsorbable polymers. One significant advantage of non-metallic stents over metallic stents is the reduced risk of metal allergies or hypersensitivity reactions, which can concern some patients.

Furthermore, growing initiatives to make non-metallic stents are expected to boost market growth. In September 2024, Nature published an article detailing the development of a novel, long, and biodegradable stent, measuring up to 118 mm, created from a metal-polymer composite. The researchers utilized magnetic levitation to uniformly apply a coating via ultrasonic spraying on the lengthy stent. The first human implantation occurred in a below-the-knee artery, with 13 months of follow-up showing promising results for the stent's clinical application feasibility.

End Use Insights

The hospitals segment dominated the market with a share of 74.1% in the year 2024. The demand for stent procedures is increasing due to the growing prevalence of cardiovascular and other stent-requiring conditions. Hospitals have the necessary infrastructure and expertise to diagnose, treat, and manage various medical conditions, including advanced interventional cardiology and endovascular procedures. As a result, hospitals are becoming the primary location for stent placements, where patients can receive the necessary medical care. Hospitals have a dedicated team of specialists, state-of-the-art equipment, and a comprehensive healthcare environment to ensure patient safety. As a result, hospitals play a critical role in driving the growth of the market.

The ambulatory care centers segment is expected to grow at the fastest CAGR during the forecast period due to itsability to provide cost-effective, convenient, and efficient outpatient procedures. The healthcare industry increasingly emphasizes outpatient care and ambulatory care centers are well-suited to meet the rising demand for minimally invasive procedures such as stent placements. ACCs can perform stent procedures for various conditions, such as coronary and peripheral artery disease, thereby supplementing market growth.

Regional Insights

In 2024, North America stent market held the predominant position in the industry with a share of 43.6% due to rising prevalence of chronic diseases, a growing elderly population, the strong presence of industry players in the region, a well-developed healthcare infrastructure, and increased awareness among the public and healthcare stakeholders regarding available technologies. Furthermore, active participation from key market players and regional research institutions, focusing on developing innovative stents for various medical conditions, is expected to drive market growth.

For instance, in November 2022, MicroPort Scientific Corporation announced that the Quebec Heart Lung Institute in Quebec, Canada, had completed the enrollment of the last patient for the TARGET IV-NA clinical trial. The trial involved 1,720 patients across 66 clinical sites in the U.S., Europe, and Canada. Its purpose was to evaluate the safety and effectiveness of the Firehawk Target Eluting Stent system in comparison with currently approved second-generation drug-eluting stents (DES). Such ongoing clinical trials by key market players are fostering advancements in the field.

U.S. Stents Market Trends

The U.S. stent market accounted for the largest share of the stents industry in North America in 2024. The U.S. faces a significant burden of chronic obstructive pulmonary disease (COPD), According to the CDC, 16 million adults are affected, and a substantial number are unaware of their condition. This prevalent prevalence, specifically among women, linked with the unmet demands in managing severe airway obstructions, has emerged as a key driver for the growth of the U.S. market.

Europe Stents Market Trends

Europe stent market is anticipated to grow at a significant rate over the forecast period due to increasing prevalence of cardiovascular diseases, which necessitates advanced medical interventions. The aging population across European countries contributes significantly to this trend, as older individuals are more susceptible to heart-related ailments. Additionally, technological advancements in stent design and materials, such as drug-eluting stents that reduce restenosis rates, have enhanced treatment outcomes and patient satisfaction

The UK stents market is expected to grow over the forecast period. The market is driven by a combination of factors including an increasing incidence of coronary artery disease (CAD) and a growing elderly population. The National Health Service (NHS) has been proactive in adopting innovative medical technologies, which facilitates access to advanced stenting options for patients.

The stents market in Germany is expected to grow over the forecast period. The market is characterized by its robust healthcare system and high expenditure on medical technologies. Key drivers include a significant rise in cardiovascular diseases due to lifestyle changes and an aging demographic. The country is known for its strong emphasis on research and development within the medical device sector, leading to continuous innovation in stent technology such as bioresorbable stents that offer improved patient outcomes.

France stents market is expected to grow over the forecast period. In France, the drivers of the stents market include a high prevalence of cardiovascular conditions coupled with an aging population that demands effective treatment solutions. The French healthcare system is well-established with a focus on integrating advanced technologies into routine care practices; this includes widespread use of drug-eluting stents which have shown superior results compared to bare-metal alternatives.

Asia Pacific Stents Market Trends

The Asia Pacific stents marketis expected to experience rapid growth, with a projected CAGR of 4.2% from 2025 to 2030. Asia Pacific region is expected to grow at the fastest rate during the forecast period, due to several contributing factors. The increasing aging population in countries such as China and India is anticipated to boost market growth. For instance, according to the United Nations Population Fund and the International Institute for Population Sciences report, As of July 2022, there were 149 million individuals aged 60 years and above in India, accounting for approximately 10.5% of the population.

By 2050, this demographic is estimated to double by 20.8%, with an absolute count of 347 million. The report also projects that by the end of the century, the elderly population will comprise more than 36% of the country's population. In addition, due to the high prevalence of CVDs in China and India, the market is a crucial segment in the region due to its large population. This high prevalence of cardiovascular diseases will accelerate the market growth.

The China stents market is anticipated to grow over the forecast period. The stents market in China is primarily driven by the increasing prevalence of cardiovascular diseases, which has led to a growing demand for minimally invasive procedures. The rapid urbanization and aging population contribute significantly to this trend, as older individuals are more susceptible to heart-related ailments.

Stents market in Japan is expected to witness a rapid growth over the forecast period. The market is primarily driven by an aging population that is experiencing a rise in cardiovascular diseases, leading to increased demand for interventional procedures. In May 2022, Biosensors International Group, Ltd. has PMDA approval for BioFreedom Ultra in Japan and FDA Approval for BioFreedom in the U.S. This strategic initiative has expanded the company’s customer base and product offerings.

India stents market is anticipated to grow at a rapid rate over the forecast period due to rising incidence of lifestyle-related diseases such as diabetes and hypertension, which are major risk factors for cardiovascular conditions. The growing awareness about heart health among the population has led to increased screening and diagnosis rates. Moreover, the Indian government’s efforts to enhance healthcare accessibility through various schemes have made cardiac interventions more affordable.

Latin America Stents Market Trends

In Latin America, the stents market is witnessing a significant trend. In Latin America, the stents market is influenced by several factors, including increasing prevalence of lifestyle-related diseases such as obesity and diabetes, which contribute to cardiovascular conditions. Economic growth in various countries has led to improved healthcare infrastructure and access to medical devices. Moreover, government initiatives to improve healthcare services and increase awareness about heart diseases are propelling the demand for stenting procedures.

The stents market in Brazil is expected to grow over the forecast period. Brazil represents a significant portion of the Latin American stents market due to its large population and high incidence of cardiovascular diseases. Key drivers include ongoing investments in healthcare infrastructure and technology by both public and private sectors, which enhance access to advanced medical treatments. The Brazilian government’s focus on expanding universal health coverage has also facilitated greater availability of cardiac interventions.

Middle East And Africa Stents Market Trends

The stents market in the Middle East and Africa is poised to grow in the near future. The growing healthcare infrastructure and increased government spending on health services contribute significantly to market growth. Rising awareness about preventive healthcare and the availability of minimally invasive procedures are encouraging more patients to seek treatment for heart-related ailments.

The stents market in Saudi Arabia is expected to grow over the forecast period. In Saudi Arabia, the stents market is propelled by a high incidence of coronary artery disease linked to risk factors such as obesity, diabetes, and hypertension prevalent among the population. The government’s commitment to improving healthcare services through Vision 2030 initiatives has resulted in enhanced access to advanced medical technologies and facilities.

Kuwait stents market is anticipated to grow over the forecast period. The market is influenced by a combination of rising cardiovascular disease rates and a robust healthcare system that prioritizes modern treatment options. The Kuwaiti government invests heavily in healthcare infrastructure, ensuring that hospitals are equipped with state-of-the-art technology for cardiac interventions. There is a growing trend towards early diagnosis and intervention for heart diseases among the population, supported by public health campaigns aimed at educating citizens about cardiovascular risks.

Key Stents Company Insights

Boston Scientific, BD, Medtronic, and Abbott Laboratories are some of the dominant players operating in the market.

-

Boston Scientific, a unit to tackle healthcare challenges, impacting over 100 countries. Their mission: reduce costs, boost efficiency, and broaden healthcare access.

-

Abbott has a portfolio of technologies that bridge the spectrum of healthcare, with commanding businesses and products in medical devices, nutrition, diagnostics, and branded generic medicines.

-

BIOTRONIK is a global medical technology manufacturer dedicated to improving patient well-being for over six decades. With a focus on cardiovascular, endovascular, and neuromodulation therapies, BIOTRONIK's innovative products and services have helped millions of people live longer, healthier lives.

Terumo Corporation and W.L Gore & Associates, are some emerging market players functioning in the market.

-

Terumo is a global medical device company committed to quality and innovation. Founded in Japan in 1921, Terumo has expanded its reach to over 160 countries and regions worldwide.

-

Veryan Medical is an established medical device company that has taken an innovative approach to vascular stents, drawing inspiration from nature's ingenious designs.

Key Stents Companies:

The following are the leading companies in the stents market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- B. Braun Melsungen AG

- Biotronik SE & Co. KG

- Biosensors International Group, Ltd.

- Boston Scientific Corporation

- Elixir Medical Corporation

- Medtronic Plc

- Meril Life Science

- MicroPort Scientific Corporation

- Stryker

- Terumo Corporation

- W.L Gore & Associates

- BD

Recent Developments

-

In September 2024, Translumina Therapeutics, the leading coronary stent provider, launched operations in the UAE. Their collaboration with the esteemed German Heart Centre has produced advanced drug-eluting stent technologies, including the globally most extensively studied DES, backed by over a decade of safety and efficacy research.

-

In July 2024, MicroPort Scientific Corporation announced that its subsidiary, Shanghai MicroPort Medical (Group) Co., Ltd., had received market approval from the NMPA for Firesorb, the first next-generation fully bioresorbable cardiac stent. Pre-market studies had shown that Firesorb matched the performance of permanent drug-eluting stents in crucial clinical measures, such as success rates and late lumen loss.

-

In May 2024, Abbott launched the XIENCE Sierra, a new coronary stent system in India, designed to treat people with blocked arteries. This addition to the XIENCE family offers improved safety for complex cardiac cases. Abbott's innovations have consistently advanced the field of angioplasty, a procedure to open narrowed or blocked arteries, typically involving stent placement to keep the artery open.

Stents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.38 billion

Revenue forecast in 2030

USD 18.46 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Abbott Laboratories; B. Braun Melsungen AG; Biotronik SE & Co. KG; Biosensors International Group; Ltd.; Boston Scientific Corporation; Elixir Medical Corporation; Medtronic Plc; Meril Life Science; MicroPort Scientific Corporation; Stryker; Terumo Corporation; W.L Gore & Associates; and BD

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stents Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stents market report based on product, material, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vascular

-

Coronary Stents

-

Peripheral Stents

-

Iliac Artery Stents

-

Femoral Artery Stents

-

Carotid Artery Stents

-

Renal Artery Stents

-

Other Peripheral Stents

-

-

Neurovascular Stents

-

Intracranial Stents

-

Flow Diverters

-

-

-

Non-vascular Stents

-

Gastrointestinal Stents

-

Biliary

-

Duodenal

-

Colonic

-

Pancreatic

-

Esophageal Stents

-

-

Pulmonary (Airway) Stents

-

Silicone Airway

-

Metallic Airway

-

-

Urological Stents

-

Others

-

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metallic Stents

-

Non-metallic Stents

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers (ACS)

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The market's growth can be attributed to the increasing prevalence of chronic diseases, such as peripheral vascular diseases (PVDs) and coronary artery diseases (CAD).

b. The global stents market size was estimated at USD 14.72 billion in 2024 and is expected to reach USD 15.38 billion in 2025.

b. The global stents market is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2030, reaching USD 18.46 billion by 2030.

b. The vascular stents segment dominated the market in 2024, holding the largest share of 87.3%. The increasing prevalence of cardiovascular diseases is anticipated to escalate market growth.

b. Key market players include Abbott Laboratories, B. Braun Melsungen AG, Biotronik SE & Co. KG, Biosensors International Group, Ltd., Boston Scientific Corporation, Elixir Medical Corporation, Medtronic Plc, Meril Life Science, MicroPort Scientific Corporation, Stryker, BD, Abbott, Terumo Corporation, Conmed Corporation, and W.L Gore & Associates

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.