- Home

- »

- Medical Devices

- »

-

Sternal Closure Systems Market Size & Share Report, 2030GVR Report cover

![Sternal Closure Systems Market Size, Share & Trends Report]()

Sternal Closure Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Closure Devices, Bone Cement), By Procedure, By Material, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-598-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sternal Closure Systems Market Summary

The global sternal closure systems market size was estimated at USD 2.65 billion in 2023 and is projected to reach USD 3.85 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. The increasing number of older individuals undergoing open-heart surgery through median sternotomy is anticipated to drive market growth.

Key Market Trends & Insights

- North America sternal closure systems market dominated the global industry in 2023 and accounted for the largest revenue share of 34.18% in the same year.

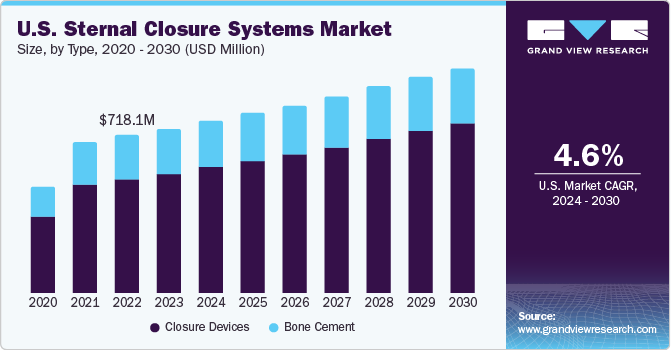

- The sternal closure systems market in the U.S. accounted for the largest share of the North America market in 2023.

- By procedure, the median sternotomy segment dominated the market with a revenue share of 51.05% in 2023.

- By types, the bone cement segment is estimated to witness a CAGR of more than 3.1% from 2024 to 2030.

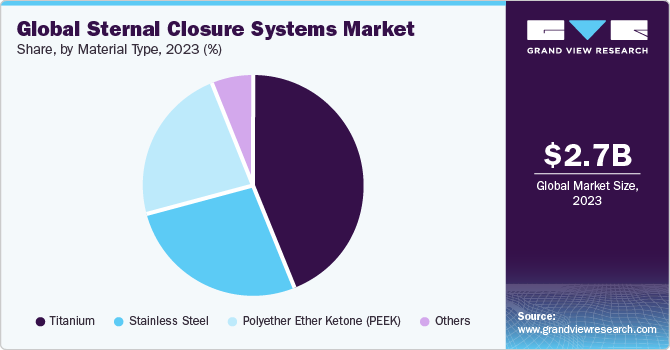

- By material type, the titanium segment accounted for the largest share of 43.71% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.65 Billion

- 2030 Projected Market Size: USD 3.85 Billion

- CAGR (2024-2030): 5.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, the median sternotomy procedure is among the most popular techniques for cardiac exposure, owing to quick and easy access to heart vessels and valves. In addition, the rising geriatric population is anticipated to boost market growth. For instance, the India Ageing Report 2030 estimated that around 347 million people in India will be aged 60 years or over by 2050. Sternotomy and sternal closure occur before and after post-cardiac surgery, respectively. Furthermore, rapid technological advancements, such as using biocompatible polymers, including tritium, pre-sternotomy plates, polyether ether ketone (PEEK), nitinol, and the development of minimal invasive median sternotomy procedures, are anticipated to propel market growth.

Technological breakthroughs in sternotomy techniques and the rising adoption of advanced sternal closure devices also boost industry growth. In addition, an increasing volume of cardiothoracic surgical procedures is anticipated to boost the product demand. According to a study published by the National Library of Medicine in January 2022, around 530,000 general thoracic surgeries are conducted annually in the U.S. by around 4,000 cardiothoracic surgeons. Moreover, another study published by the same source in August 2023 reports that Coronary artery bypass grafting (CABG) is the most common surgical procedure, and approximately 400,000 CABG surgeries are conducted annually. Thus, the rising volume of cardiothoracic surgeries, such as CABG, can boost market growth.

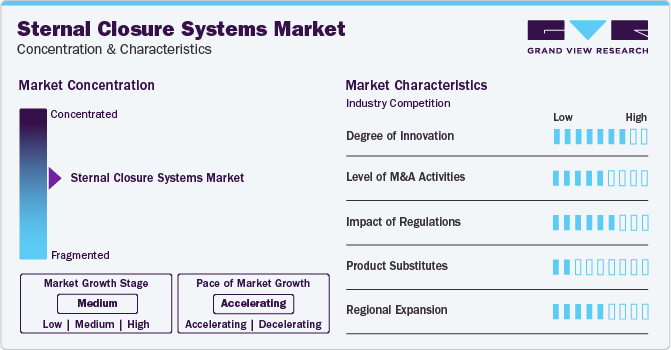

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of its growth is accelerating due to the increasing product launches, the presence of major players offering various types of sternal closure products, and several initiatives undertaken by them.

The degree of innovation is high due to the increasing development of advanced products. Established and emerging companies are innovating continuously to offer better products. In addition, major companies are increasing investments and funding for developing sternal closure products. For instance, in February 2022, Evonik Venture Capital invested in the U.S.-based start-up CircumFix Solutions, which has designed a novel sternal closure instrument to improve patient recovery following open chest surgery. This device is produced of a high-performance polymer and holds and closes the sternum securely after surgery

The industry is also represented by moderate merger and acquisition (M&A) activities. This is due to several factors, including the desire to gain a competitive edge and the requirement to consolidate in a rapidly growing industry. Prominent participants are purchasing smaller firms operating across the industry. For instance, in December 2020, Zimmer Biomet purchased A&E Medical, a manufacturer of sternal closure devices. The company has been acquired for USD 250 million

Regulations are supervised by regulatory bodies, such as the Food & Drug Administration (FDA) in the U.S. and equivalent agencies globally. The authorities have issued a regulatory framework to assure product effectiveness, safety, and quality standards. Moreover, the regulatory bodies are also involved in clinical trials and marketing authorization of sternal closure systems. For instance, in March 2021, the Valkyrie thoracic fixation system received 510(k) clearance from the U.S. FDA. This system was developed for usage in the fixation and stabilization of chest wall fractures, including sternal fixation following sternotomy

Product substitute in this industry include traditional methods using wires and sutures, for less complex procedures. However, these traditional techniques are more time-consuming and carry a higher risk of infection compared to some of the newer closure devices.

Key industry players, such as Johnson & Johnson and Zimmer Biomet, hold substantial shares in the market. Their predominant share is primarily due to their financial position, well-established brands, vast distribution networks, and product portfolios. For instance, Johnson & Johnson provides sternal closure systems, such as the Titanium Sternal Fixation System and Sternal ZIPFIX System, through its subsidiary, Depuy Synthes

The industry is encountering robust global expansion due to the rising volume of surgical procedures conducted and growing focus of industry players on enhancing the accessibility of products in various countries

Types Insights

The closure devices segment accounted for the largest share in 2023. It is also anticipated to witness the fastest growth over the forecast period. Launching products and increasing per capita expenditure in developed and developing economies are key aspects accountable for the dominant share of the segment. These devices have shown advantages, such as decreased postoperative intricacies and infections and faster recovery time, compared to bone cement. In addition, increasing efforts by key players to introduce new techniques and product lines are likely to boost the segment growth. Key products in this segment include Sternal ZIPFIX System by DePuy Synthes, SternaLock 360 and SternaLock Blu by Zimmer Biomet, and Sternal Talon Implants by KLS Martin Group.

The bone cement segment is estimated to witness a CAGR of more than 3.1% from 2024 to 2030. The segment growth can be attributed to the rising number of surgical procedures being performed across the globe. Furthermore, positive outcomes from several studies of using bone cement in treating sternal reconstruction patients are anticipated to boost segment growth. For instance, the study published by the National Library of Medicine in April 2019 concluded that bone cement is a suitable treatment alternative for sternal reconstruction in individuals suffering from recurrent sternal wound infections. It can reconstruct the sternum and achieve good results.

Procedure Insights

The median sternotomy segment dominated the market with a revenue share of 51.05% in 2023. Median sternotomies are often performed osteotomies across the world, as the method offers easy access to the lungs, heart, and nearby structures during heart valve replacement surgery and coronary artery bypass surgery. Median sternotomies also lower post-operative complications and infections, which can help increase the demand for this procedure over the forecast period. In addition, the rising geriatric population, prone to developing chronic cardiac diseases, such as CVDs, is expected to propel the demand for median sternotomy procedures.

The bilateral thoracosternotomy segment is expected to witness the fastest CAGR from 2024 to 2030. This growth can be attributed to the increasing volume of cardiac surgeries performed and growing prevalence of chronic obstructive pulmonary disease (COPD). According to the article published by the WHO in March 2023, globally, COPD is the third major cause of death, and around 3.23 million individuals died due to this disease in 2019.

Material Type Insights

The titanium segment accounted for the largest share of 43.71% in 2023 due to the associated benefits, such as corrosion resistance, the biocompatibility of titanium, and the ability to join human bones effectively. It is also anticipated to grow at the fastest CAGR from 2024 to 2030. Moreover, the non-ferromagnetic property, which permits patients with titanium implants to be inspected safely under a magnetic resonance imaging (MRI) scan, further improves the penetration of these materials in the industry. In addition, the non-toxic nature, high efficacy & stability of the titanium products, and greater economic feasibility coupled with improved affordability for using advanced titanium plates and clips in developing and developed regions are anticipated to strengthen the adoption of titanium-based sternal closure systems.

The PEEK segment is anticipated to grow at a significant CAGR during the forecast period due to technological advancements, increasing R&D investments by key players, and biocompatible properties of the material. Moreover, the major players, such as Johnson and Johnson, offer products made using PEEK. Thus, the availability of products from key market players is anticipated to drive the segment’s growth.

Regional Insights

The North America sternal closure systems market dominated the global industry in 2023 and accounted for the largest revenue share of 34.18% in the same year. This is due to the high prevalence of chronic diseases, such as cardiovascular disorders, and increasing collaborative efforts by key players to improve their product offerings & ensure high-quality standards. According to the article published by the CDC in May 2023, approximately 695,000 individuals in the U.S. died from heart disorders in 2021.

U.S. Sternal Closure Systems Market Trends

The sternal closure systems market in the U.S. accounted for the largest share of the North America market in 2023 due to the presence of key players, favorable reimbursement regulations, and significant investments in research and development. The major market participants like Zimmer Biomet, Johnson & Johnson., and B. Braun Melsungen AG are present in the U.S.

Europe Sternal Closure Systems Market Trends

The Europe sternal closure systems market is anticipated to show lucrative growth in this industry due to the growing volume of cardiothoracic procedures performed and rising focus of industry participants on launching technologically advanced products.

The sternal closure systems market in the UK is anticipated to grow considerably over the forecast period primarily due to the growing geriatric population, which is susceptible to chronic cardiovascular conditions. The Office for National Statistics data estimated that around 3.1 million individuals will be aged 85 years and over by 2045 in the UK.

The France sternal closure systems market is expected to grow over the forecast period due to the increasing number of cardiac surgeries performed and the rising incidences of heart-related conditions. According to a study published by the National Library of Medicine in March 2022, in France, ischemic heart disorder, comprising myocardial infarction (MI), has been recognized as the second major cause of years of life lost (YLL) with around 840,000 YLL in 2019.

The sternal closure systems market in Germany is expected to grow significantly over the forecast period due to the prevalence of chronic diseases, such as cardiovascular and increased associated surgeries. According to the study published by Georg Thieme Verlag KG in June 2023, around 93,913 heart surgical procedures were performed in Germany in 2022.

Asia Pacific Sternal Closure Systems Market Trends

The Asia Pacific sternal closure systems market is anticipated to witness the fastest growth during the forecast period. This growth is driven by the growing geriatric population, advancements in healthcare infrastructure, and rising prevalence of chronic diseases. In addition, the rising number of surgical procedures performed and increasing awareness regarding cardiac diseases and treatment availability are expected to contribute to the region's growth.

The sternal closure systems market in Japan is expected to grow significantly in the coming years due to the rising geriatric population. An article published by the European Parliament in December 2020 reported that approximately 28.7% of the individuals living in Japan are aged 65 years or older.

The China sternal closure systems market is expected to grow over the forecast period due to the rising healthcare expenditure and several initiatives undertaken by industry stakeholders to improve healthcare access. For instance, in February 2020, the Hong Kong Asia Heart Centre revealed that it would offer heart operations at low costs, starting from USD 8.63 million, to make emergency services inexpensive to public hospital patients. Such initiatives increase the patient pool, boosting product demand.

The sternal closure systems market in India is expected to grow over the forecast period due to advancing healthcare infrastructure, a rising aging population, and growing number of surgical procedures performed across the country.

Middle East & Africa Sternal Closure Systems Market Trends

The MEA sternal closure systems market is expected to have moderate growth during the forecast period. Rising geriatric population and increasing prevalence of chronic diseases are some of the factors driving the market growth. Increasing government support to strengthen healthcare service delivery in MEA is one of the factors expected to propel market growth.

The sternal closure systems market in Saudi Arabia is anticipated to grow over the forecast period due to the growing older population of the country, which has led to an augmented demand for advanced medical procedures and surgeries related to the heart.

The Kuwait sternal closure systems market is expected to grow in the coming years due to the rising prevalence of chronic conditions. According to the report prepared by the Ministry of Health Kuwait, United Nations Development Program, World Health Organization, and Gulf Health Council in February 2023, the cases of cardiovascular disorders have increased significantly over the last ten years. They are the major cause of non-communicable disease deaths in Kuwait.

Key Sternal Closure Systems Company Insights

The competitive scenario in the sternal closure systems market is driven by both new entrants and established players. These players are adopting various strategies, such as partnerships, innovative product launches, and mergers & acquisitions. Moreover, increasing investments in developing industry products are anticipated to boost market competition.

Key Sternal Closure Systems Companies:

The following are the leading companies in the sternal closure systems market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson

- Zimmer Biomet

- KLS Martin Group

- Orthofix Medical Inc.

- Kinamed Incorporated

- B. Braun SE

- Acumed LLC

- ABYRX, INC.

- IDEAR S.R.L

- ABLE MEDICAL DEVICES

Recent Developments

-

In September 2023, Abyrx, a market player, acquired expanded FDA approval for its mouldable bone putty, MONTAGE. This expanded approval includes this product for cardiothoracic surgery after sternotomy. MONTAGE can enable heart surgeons to improve sternal repair and closure

-

In May 2022, Granulab’s subsidiary KPOWER introduced Prosteomax, a halal-certified synthetic bone cement in Malaysia. It can be used for dental, orthopedics, cranial, and maxillofacial applications

Sternal Closure Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.80 billion

Revenue forecast in 2030

USD 3.85 billion

Growth Rate

CAGR of 5.4% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, procedure, material type, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Johnson & Johnson; Zimmer Biomet; KLS Martin Group; Orthofix Medical Inc.; Kinamed Inc.; B. Braun SE; Acumed LLC; Abyrx, Inc.; IDEAR S.R.L; ABLE MEDICAL DEVICES

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

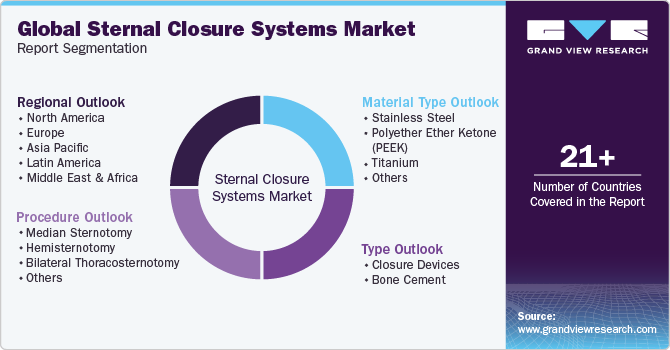

Global Sternal Closure Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sternal closure systems market report based on type, procedure, material type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Closure Devices

-

Bone Cement

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Median Sternotomy

-

Hemisternotomy

-

Bilateral Thoracosternotomy

-

Others

-

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Polyether Ether Ketone (PEEK)

-

Titanium

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the sternal closure systems market with a share of 34.18% in 2023. This is attributable to rising collaborative efforts commenced by key players to improve their product offerings and ensure high-quality standards.

b. Some key players operating in the sternal closure systems market include Depuy Synthes, Zimmer Biomet, KLS Martin Group, Orthofix Holdings, Inc., A&E Medical Corporation, Jace Medical, LLC, Acute Innovations, Abyrx, Inc., Kinamed Incorporated.

b. Key factors that are driving the sternal closure systems market growth include an increase in the number of surgical procedures and technological advancements in sternotomy techniques.

b. The global sternal closure systems market size was estimated at USD 2.65 billion in 2023 and is expected to reach USD 2.8 billion in 2024.

b. The global sternal closure systems market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 3.85 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.