- Home

- »

- Next Generation Technologies

- »

-

Storage As A Service Market Size, Industry Report, 2033GVR Report cover

![Storage As A Service Market Size, Share & Trends Report]()

Storage As A Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Cloud Backup, Cloud Archiving), By Deployment Model (Public Cloud, Private Cloud), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-768-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Storage As A Service Market Summary

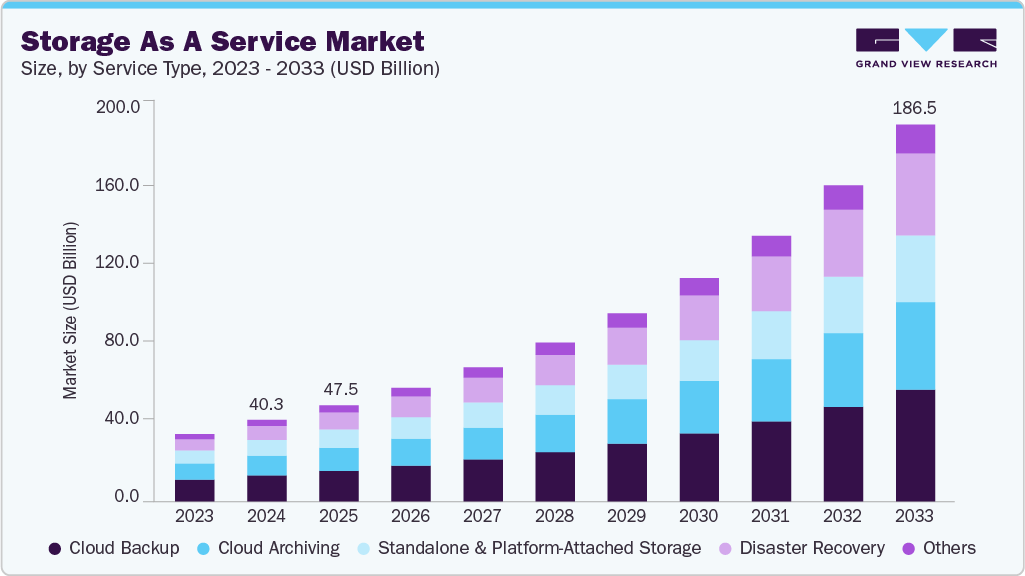

The global storage as a service market size was estimated at USD 40.34 billion in 2024 and is projected to reach USD 186.48 billion by 2033, growing at a CAGR of 18.6% from 2025 to 2033. The rapid growth of digital technologies, IoT devices, and AI applications is generating massive amounts of data.

Key Market Trends & Insights

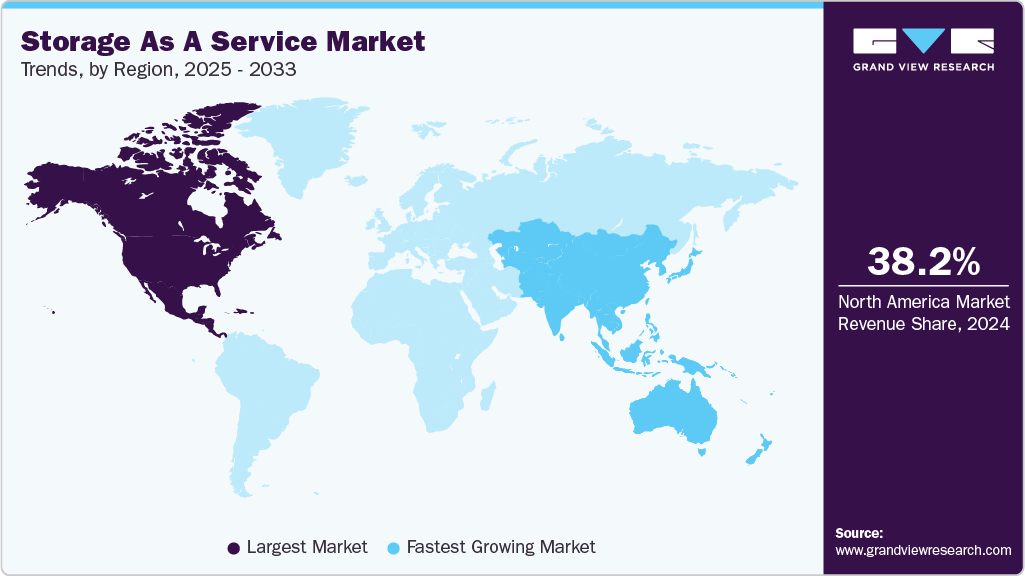

- North America dominated the storage as a service (STaaS) market with the largest revenue share of 38.2% in 2024.

- The storage as a service market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By service type, the cloud backup segment led the market with the largest revenue share of 32.0% in 2024.

- By deployment model, the public cloud segment led the market with the largest revenue share of 44.2% in 2024.

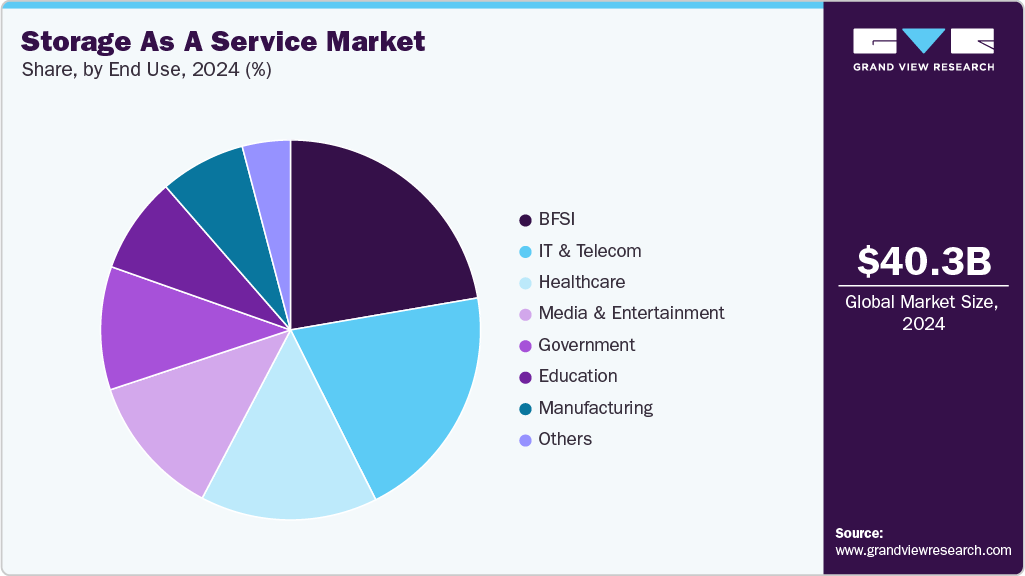

- By end use, the media & entertainment segment is expected to grow at the fastest CAGR of 21.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 40.34 Billion

- 2033 Projected Market Size: USD 186.48 Billion

- CAGR (2025-2033): 18.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

This increasing data volume is driving the need for more scalable and flexible storage solutions. Storage-as-a-Service (STaaS) provides businesses with on-demand, cloud-based storage that can easily adapt to changing requirements. Consequently, enterprises are progressively adopting STaaS to manage and secure their growing data assets efficiently.The STaaS industry is witnessing strong growth due to rising demand for flexible and scalable storage solutions. Enterprises are prioritizing models that reduce the burden of managing on-premises infrastructure. Fully managed offerings are gaining traction as they provide simplified operations and lower maintenance requirements. Consumption-based models are becoming popular because they align costs with actual usage. This helps organizations optimize budgets and avoid overprovisioning. Businesses are also adopting these solutions to improve agility in handling large volumes of data.

For instance, in March 2025, IBM Corporation launched IBM Storage Ceph as a Service. This software-defined storage solution delivers block, file, and object storage through a fully managed, flexible consumption model for on-premises environments. This offering simplifies infrastructure management, reduces operational costs, and provides the scalability and efficiency of cloud storage while allowing IT teams to focus on business priorities.

The storage as a service industry is witnessing increased demand for specialized storage solutions. Organizations are handling growing volumes of data from AI applications, research projects, and long-term archives. Traditional storage systems often struggle to meet the performance, scalability, and cost requirements of these workloads. Businesses need solutions that can efficiently store and manage large datasets while remaining accessible. Cloud-such as storage models, provides flexibility and easier integration with existing IT infrastructure. For instance, in November 2024, Geyser Data, a U.S.-based cloud storage company, collaborated with Spectra Logic to launch its Tape-as-a-Service (TaaS) solution, offering an S3-compatible, cloud-based tape storage platform called TAPAS. Positioned as a cost-effective alternative to traditional cloud archival services, the platform provides dedicated tape storage with transparent pricing, no egress fees, and strong sustainability benefits for data-intensive workloads.

The growth of new technologies is creating a strong demand for advanced storage solutions. IoT devices are generating massive volumes of data that need to be stored, processed, and analyzed efficiently. Edge computing requires storage close to data sources to reduce latency and support real-time decision-making. High-resolution media content, such as 4K and 8K video, is producing large file sizes that traditional storage systems struggle to manage. Organizations need solutions that can scale rapidly to accommodate these expanding datasets. Storage systems must also handle complex data structures and formats used in modern applications. Reliability and availability are critical, as downtime can disrupt continuous data streams. Security and compliance are increasingly important to protect sensitive data generated by IoT and media workloads. Cloud-based and hybrid storage models offer the flexibility required to support these emerging workloads. Storage solutions are evolving to meet the demands of fast-growing, diverse, and high-volume data environments.

Service Type Insights

The cloud backup segment led the market with the largest revenue share of 32.0% in 2024, due to its essential role in protecting business data. Organizations use it to guard against accidental deletion, cyberattacks, and system failures. Automated backup processes reduce manual effort and operational risks. Its scalability allows businesses to expand storage as data volumes grow. Cloud backup supports regulatory compliance by securely retaining historical data. Accessibility from anywhere enhances operational flexibility for businesses. These factors collectively make cloud backup the leading service in the market.

The disaster recovery segment is anticipated to grow at the fastest CAGR during the forecast period, as businesses focus on continuity. Cloud-based disaster recovery enables quick restoration of data and applications during disruptions. It reduces downtime and mitigates potential financial losses for organizations. Scalable, on-demand resources minimize the need for heavy upfront infrastructure investments. Automated recovery processes simplify management and reduce the risk of errors. Enhanced security and compliance features add further value to the service. Disaster recovery is increasingly adopted to ensure operational resilience and reliability.

Deployment Model Insights

The public cloud segment accounted for the largest market revenue share in 2024, due to its wide adoption, scalability, and accessibility. Organizations prefer it for its ability to provide on-demand storage without heavy upfront infrastructure investment. It offers high flexibility, easy integration with other cloud services, and simplified management for IT teams. Security, compliance features, and global availability make it a reliable choice for enterprises. Cost-efficiency and pay-as-you-go models further enhance its appeal. The extensive ecosystem of applications and tools strengthens its position as the leading deployment model.

The hybrid cloud segment is anticipated to grow at the fastest CAGR during the forecast period, as organizations seek a balance between on-premises control and cloud flexibility. It allows sensitive or critical data to remain on-premises while utilizing cloud resources for scalability and cost efficiency. Hybrid solutions provide seamless integration across environments, supporting business continuity and disaster recovery. They offer enhanced security, compliance, and performance optimization tailored to specific workloads. The model supports dynamic data management, enabling enterprises to adapt quickly to changing business needs. Increasing adoption is driven by the need for flexibility, control, and hybrid IT strategies.

End Use Insights

The BFSI segment accounted for the largest market revenue share in 2024, due to its critical need for secure, reliable, and scalable data storage. Financial institutions generate massive volumes of sensitive data, including transaction records, customer information, and regulatory reports, which require robust backup and recovery solutions. Compliance with strict regulatory frameworks drives the adoption of secure and auditable storage services. Cloud-based solutions offer flexibility, cost-efficiency, and accessibility across branches and remote teams. Automated management reduces operational overhead and mitigates risks associated with data loss or breaches. The growing focus on digital banking, fintech innovations, and real-time analytics further reinforces the demand for storage services.

The media & entertainment segment is anticipated to grow at the fastest CAGR during the forecast period, due to the surge in high-resolution content and digital media production. Increasing adoption of 4K, 8K, VR, and streaming platforms generates massive data volumes that require scalable and efficient storage solutions. Cloud-based storage allows teams to collaborate remotely and access content globally. Cost-effective, consumption-based models help manage storage expenses for large media files. High-performance storage supports real-time rendering, editing, and content delivery. Enhanced security and backup capabilities ensure content protection and regulatory compliance.

Regional Insights

North America dominated the storage as a service market with the largest revenue share of 38.2% in 2024, due to widespread cloud adoption and advanced IT infrastructure. Enterprises in the region are increasingly leveraging scalable and flexible storage solutions. High demand from the BFSI, IT, and media sectors drives significant market growth. Strong presence of major STaaS providers enhances service availability and innovation. Supportive regulatory frameworks and technological advancements further strengthen North America’s leading position in the market.

U.S. Storage As A Service Market Trends

The STaaS market in the U.S. is growing rapidly as enterprises increasingly adopt cloud-based storage solutions. Organizations are turning to STaaS for scalable and flexible data management. The model helps businesses reduce costs while efficiently handling growing data volumes. Strong IT infrastructure and advanced service offerings support continued market expansion.

Europe Storage As A Service Market Trends

The storage as a service market in Europe is witnessing steady growth due to increasing digital transformation initiatives across enterprises. Organizations are adopting cloud-based storage to enhance flexibility, scalability, and cost efficiency. Strong regulatory frameworks, such as GDPR, are driving demand for secure and compliant storage solutions. The region also benefits from the presence of established IT infrastructure and major STaaS providers supporting hybrid and multi-cloud deployment.

Asia Pacific Storage As A Service Market Trends

The STaaS market in the Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, driven by rapid digitalization and increasing IT adoption across industries. Expanding data volumes from sectors such as BFSI, manufacturing, and e-commerce are fueling demand for scalable and flexible storage solutions. Investments in cloud infrastructure and cost-effective service offerings are accelerating adoption. Enterprises and governments are utilizing STaaS to efficiently manage data, support remote operations, and enhance overall business performance.

Key Storage As A Service Company Insights

Some of the key companies in the storage as a service (STaaS) industry include Amazon Web Services, Inc., Dell Inc., Geyser Data, Google LLC, Hewlett Packard Enterprise (HPE), and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Amazon Web Services, Inc. is expanding its Storage-as-a-Service offerings with solutions such as Amazon S3 and Glacier, providing scalable and secure storage for enterprises. The company focuses on improving data accessibility, lifecycle management, and integration with analytics and AI workloads. AWS also emphasizes cost-efficiency and flexible consumption models to meet diverse business needs. Continuous infrastructure investments ensure high availability and support for growing global data demands.

-

Google Cloud is advancing its storage services, including Cloud Storage and Persistent Disk, offering fully managed and flexible solutions for organizations. The company enhances performance, security, and scalability to support enterprise workloads. Integration with AI, machine learning, and analytics tools helps businesses extract value from stored data. Google Cloud continues to invest in global infrastructure to provide reliable, accessible, and cost-effective storage solutions.

Key Storage As A Service Companies:

The following are the leading companies in the storage as a service (STaaS) market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Dell Inc.

- Geyser Data

- Google LLC

- Hewlett Packard Enterprise (HPE)

- Hitachi Vantara LLC

- IBM Corporation

- Microsoft

- NetApp

- Veeam Software

Recent Developments

-

In July 2025, Google LLC, in collaboration with DDN, a U.S.-based technology company, launched Google Cloud Managed Lustre, a fully managed, high-performance parallel file system designed for AI, HPC, and data-intensive workloads. The service delivers scalable, low-latency, and high-throughput storage, enabling enterprises to accelerate workloads, reduce operational overhead, and seamlessly integrate with cloud and hybrid environments.

-

In July 2025, Amazon Web Services, Inc., introduced Amazon S3 Vectors, a cloud storage solution with native support for large-scale vector data, enabling fast, cost-effective AI-ready storage. It integrates with Amazon Bedrock, SageMaker, and OpenSearch to support generative AI, semantic search, and other data-intensive applications.

Storage As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.55 billion

Revenue forecast in 2033

USD 186.48 billion

Growth rate

CAGR of 18.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Service type, deployment model, end use, Region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Amazon Web Services, Inc.; Dell Inc.; Geyser Data; Google LLC; Hewlett Packard Enterprise (HPE); Hitachi Vantara LLC; IBM Corporation; Microsoft; NetApp; Veeam Software

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

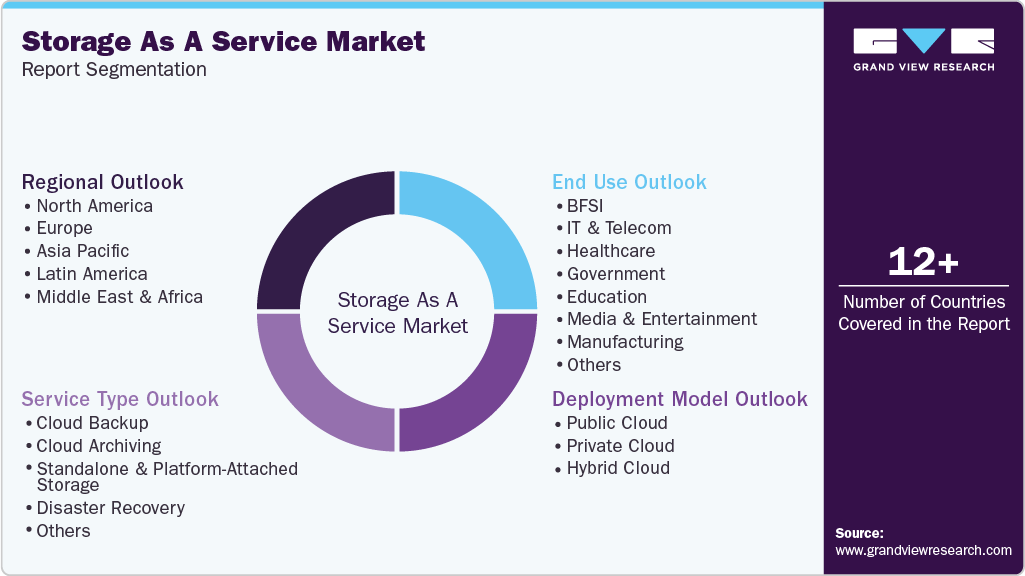

Global Storage As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global storage as a service market report based on service type, deployment model, end use, and region:

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud Backup

-

Cloud Archiving

-

Standalone & Platform-Attached Storage

-

Disaster Recovery

-

Others

-

-

Deployment Model Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Healthcare

-

Government

-

Education

-

Media & Entertainment

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global storage as a service market size was estimated at USD 40.34 billion in 2024 and is expected to reach USD 47.55 billion in 2025.

b. The global storage as a service market is expected to grow at a compound annual growth rate of 18.6% from 2025 to 2033 to reach USD 186.48 billion by 2033.

b. North America dominated the storage as a service market with a share of 38.2% in 2024. This is attributable to the strong presence of cloud service providers and the rapid adoption of advanced data storage solutions across enterprises in the region.

b. Some key players operating in the storage as a service market include Amazon Web Services, Inc, Dell Inc., Geyser Data, Google LLC, Hewlett Packard Enterprise (HPE), Hitachi Vantara LLC, IBM Corporation, Microsoft, NetApp, and Veeam Software.

b. Key factors that are driving the market growth include increasing demand for scalable storage solutions, rapid digital transformation across industries, and rising data generation from cloud computing and IoT applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.