- Home

- »

- Plastics, Polymers & Resins

- »

-

Structural Foam Market Size, Share And Trends Report, 2030GVR Report cover

![Structural Foam Market Size, Share & Trends Report]()

Structural Foam Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Polyethylene, Polypropylene, Polystyrene), By Application (Material Handling, Building & Construction), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-962-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Structural Foam Market Size & Trends

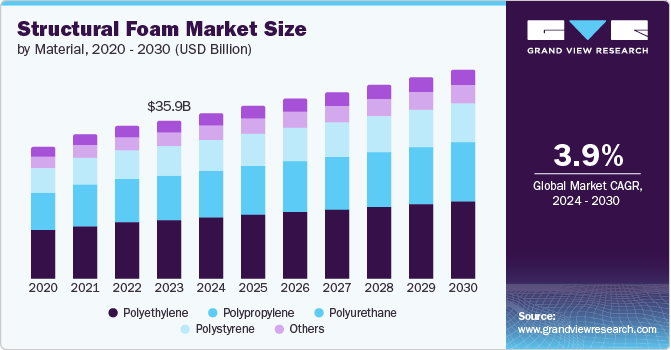

The global structural foam market size was valued at USD 35.9 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. This growth is attributed to the rapid development of the smart building and design sector, as structural foam offers lightweight and energy-efficient solutions for construction. In addition, the rising demand in the automotive, construction, and packaging industries for lightweight materials is fueling market expansion. Furthermore, the growing construction industry, particularly in developing regions, is also a significant factor contributing to the market's growth trajectory.

Apart from the construction and automotive sectors, it is also being utilized in the packaging in the FMCG and electronics industries. Structural foam produces goods that are light in weight with strength, dimensional consistency, and cost-ineffective; all these properties contributed to the growth of the market. In addition, it is also utilized in applications in wind turbines, automotive parts such as structural reinforcements and internal panels, which allows vehicle manufacturers to minimize weight without lowering performance and safety, and insulation of roofs of buildings, columns, and doors.

Consumer awareness of sustainable alternatives and initiatives by governments in many countries to employ environmental care while increasing corporate sustainability goals are further boosting the market’s growth. Moreover, innovations and upgrades by key companies conducting research and development to create enhanced structural foam options with better properties and wide characteristics shape the trajectory of the market.

Material Insights

Polyethylene dominated the market and accounted for the largest revenue share of 36.7% in 2023 pertaining to its extensive and consistent usage in automotive, packaging, electronics, and electrical applications, to make strong, durable, and lightweight items. Furthermore, polyethylene is broadly used as cushions for computers, constructions, and product packaging of consumer goods. The market experiences a rapid increase due to its vibration-resistant, reliable-nature, and protective characteristics that are implemented in many industries.

Furthermore, polyurethane is expected to grow at a CAGR of 4.4% over the forecast period. This growth is attributed to its large-scale adoption and implementation in the construction and building sector. In addition, its various characteristics, such as lightweight, strength, and resilience, make it suitable for use in various temperatures, making the market grow significantly.

Application Insights

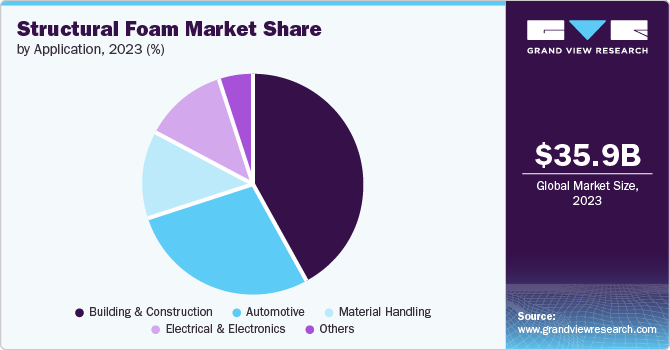

Buildings and construction dominated the market, accounting for a revenue share of 42.4% in 2023 driven by rapid developments in the building and construction sector supported by huge economic growth in terms of urbanization and industrialization, especially in residential construction. In addition, favorable economic and other factors, such as increasing population and rising standard of living, are driving the market.

The automotive segment is expected to grow at a CAGR of 4.3% over the forecast period owing to a focus on improving and innovating specialized materials by continuous research for creating lightweight components for vehicles. In addition, long-term sustainability and the ability to recycle are becoming the choices of industries in the automotive sector. Furthermore, the shifting trend towards automated and highly equipped feature vehicles creates new paths for the structural foam market for its use in battery enclosure and interior designs with the implementation of lightweight and durable materials.

Regional Insights

The North America structural foam market dominated the global market and accounted for the largest revenue share of 46.7% in 2023 owing to the continuous investments in research and development, along with a growing importance on creating lightweight alternatives in broad industries such as automotive, construction and buildings, electrical and electronics, and aerospace. In addition, the eco-friendly properties of the structural foam are enhancing the region’s aim to create sustainable and environmental stewardship, making it a suitable choice for key companies seeking sustainable alternatives, thereby driving the growth of the market.

U. S. Structural Foam Market Trends

The structural foam market in the U. S. dominated the North America market and accounted for the largest revenue share of 46.6% in 2023. This growth is led by advancements in materials science and manufacturing processes, leading to the development of innovative foam formulations with enhanced properties such as strength, durability, and sustainability. Furthermore, ongoing R&D initiatives focused on optimizing foam structures and production techniques to meet the evolving demands of various industries also contributed to the growth of the market in the country.

Asia Pacific Structural Foam Market Trends

Asia Pacific structural foam market is expected to grow with a CAGR of 4.3% over the forecast period. The opportunities for market growth are represented by the rising automotive and construction sectors in countries such as China, India, and Southeast Asian nations. In addition, the implementation of structural foam across various industries is being contributed to by growing investments in manufacturing competencies and technological advancements. Moreover, the demand for structural foam is further boosted in Asia Pacific by the shift of manufacturers towards lightweight and durable materials in sectors such as automotive, packaging, and electronics.

The structural foam market in China is expected to grow rapidly, driven by fast urbanizationandleading infrastructure technology. In addition, the government’s aim to minimize carbon emissions and promote green and environment-sustainable activities is further creating a suitable path for market expansion. Furthermore, increasing demand for lightweight and durable materials in various industries such as construction, automotive, and electronics is fueling the market growth.

India structural foam market is driven as a result of combined economic and industrial progressions with rising awareness of people towards sustainable and cost-effective materials. Furthermore, the development in the construction and building sector, assisted by government initiatives such as the “Housing for All” program with the advancement of smart cities, has given way to betterment and innovation in the structural foam market.

Europe Structural Foam Market Trends

The structural foam market in Europe is expected to grow significantly due to improved infrastructure and reimbursement policies. In addition, growing demand for structural foams in the automobile sector is expected to fuel market growth over the forecast period.

The UK structural foam market accounted for the largest revenue share in 2023, owing to the introduction of lightweight composites in the aerospace sector. In addition, the government aims to minimize greenhouse gas effluents by 80% by 2050 which is contributing to the increasing demand. Furthermore, the rising automotive demand in the UK, where structural foam is extensively used in vehicle components, is significantly driving the market growth.

The structural foam market in Germany is driven by the “Energy Transition” program initiated by the government, which focuses on reducing carbon emissions. In addition, there is a rising demand for insulation items and energy-efficient buildings because of the high-quality nature of the structural foam, thereby driving the growth of the market.

Key Structural Foam Market Company Insights

Some of the key companies in the structural foam market include F. Hoffmann-La Roche Ltd, Novartis AG, Pfizer, Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Gilead Sciences, Inc., Sanofi, Regeneron Pharmaceuticals Inc., AstraZeneca, and Boehringer Ingelheim GmbH. These companies are focusing on development and gaining a competitive edge in the industry.

-

SEKISUI CHEMICAL CO., Ltd. builds and markets the unit residential houses in addition to parcels of land, they also manufacture polyvinyl chloride and other plastic products used for drainage pipes and bathtubs.

-

Tasuns Composite Technology Co. Ltd. has a complete system in R&D, production, sales, and after-service. It deals with making advanced composite manufacturing technology for customized products to meet various requirements, such as autoclave, vacuum bag molding, vacuum infusion, RTM, laminate molding, hand lay-up, and roll-wrapping process.

Key Structural Foam Companies:

The following are the leading companies in the structural foam market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- SABIC

- SEKISUI CHEMICAL CO., Ltd.

- Carpenter Europe

- Tasuns Composite Technology Co. Ltd

- ALSTONE INDUSTRIES PVT. Ltd.

- CELLULAR MOULDINGS Ltd.

- MEGAFLEX Schaumstoff GmbH

- Arnon Plastic Industries Co. Ltd.

- BASF SE

- ARMACELL

Recent Developments

-

In June 2023, Carpenter Co., manufacturers and marketers of comfort products acquired Recticel N.V.’s Foams Division, which includes the previous Foam Partner and Otto Bock processes. This creates the world’s biggest vertically combined manufacturer of specialty polymer products and polyurethane foams. This acquisition will drive future advancements and developments in polyurethane foam technology and immense market growth.

-

In June 2023, Armacell, which offers flexible foam for equipment insulation and engineered foams, augmented with AIS in the engineering, manufacturing, and application of insulation and passive fire protection systems, formed a joint venture for the manufacturing of insulating jackets in the U.S. Furthermore, Armacell AIS, LLC now operates from Armacell’s existing facility in Yukon.

Structural Foam Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.5 billion

Revenue forecast in 2030

USD 47.3 billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, Australia, South Korea, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Evonik Industries AG; SABIC; SEKISUI CHEMICAL CO. Ltd.; Carpenter Europe; Tasuns Composite Technology Co. Ltd.; ALSTONE INDUSTRIES Pvt. Ltd.; CELLULAR MOULDINGS; MEGAFLEX Schaumstoff GmbH.; Arnon Plastic Industries Co. Ltd.; BASF SE; ARMACELL

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Structural Foam Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global structural foam market report based on material, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Polypropylene

-

Polystyrene

-

Polyurethane

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Material Handling

-

Building & Construction

-

Automotive

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U. S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.