- Home

- »

- Medical Devices

- »

-

Structural Heart Occlusion Devices Market Size Report, 2030GVR Report cover

![Structural Heart Occlusion Devices Market Size, Share & Trends Report]()

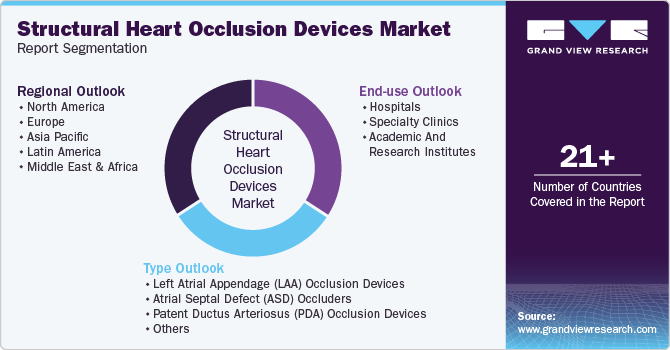

Structural Heart Occlusion Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Left Atrial Appendage (LAA) Occlusion Devices, Atrial Septal Defect (ASD) Occluders), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-566-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

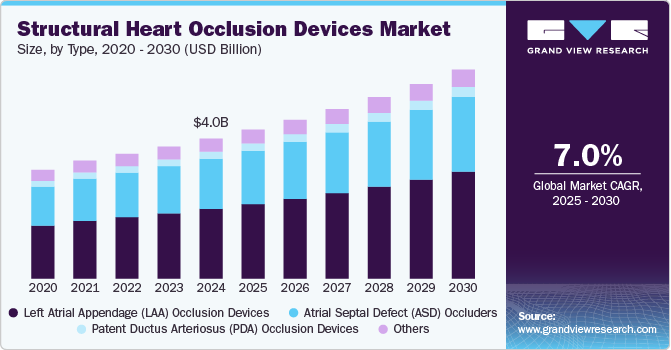

The global structural heart occlusion devices market size was estimated at USD 4.0 billion in 2024 and is projected to grow at a CAGR of 7.0% from 2025 to 2030. The structural heart occlusion devices market is advancing due to the rising burden of structural heart diseases, increasing acceptance of minimally invasive therapies, and favorable regulatory and reimbursement changes. Growing clinical awareness and procedural innovations are expanding the eligible patient pool, reinforcing a strong positive growth outlook.

The increasing prevalence of structural heart diseases is a major driver for the structural heart occlusion devices market. Conditions such as atrial septal defects, patent foramen ovale, and left atrial appendage abnormalities are gaining greater clinical attention as diagnostic technologies continue to advance. The American Heart Association's 2024 Statistical Update projects that the prevalence of atrial fibrillation (AF) in the U.S. will rise from approximately 5.2 million in 2010 to 12.1 million by 2030, underscoring the growing clinical need for effective interventions. As awareness improves and diagnostic pathways become more standardized, the addressable patient population for occlusion therapies is expanding significantly, creating a strong foundation for market growth.

As the prevalence of atrial fibrillation (AF) continues to rise globally, Left Atrial Appendage Occlusion (LAAO) procedures are gaining traction within the Structural Heart Occlusion Devices market. LAAO offers a non-pharmacologic alternative to oral anticoagulants for stroke prevention in patients with non-valvular AF, particularly those at high bleeding risk. A February 2025 article published in the European Heart Journal Supplements focused on the growing adoption of LAAO for patients with contraindications to long-term oral anticoagulant therapy (OAT). The article emphasizes that despite OAT's role in stroke prevention, certain patients, especially those with a history of bleeding events, remain at high risk for ischemic strokes.

Regulatory and reimbursement initiatives are playing an increasingly important role in shaping the structural heart occlusion devices market. Favorable policy environments are essential to encourage clinical adoption, promote investment in innovation, and expand patient access to advanced therapies. In March 2025, the Centers for Medicare & Medicaid Services (CMS) approved the REDUCE-AF clinical trial under Coverage with Evidence Development (CED) to evaluate the LAmbre Plus Left Atrial Appendage Closure System. This decision reflects continued regulatory emphasis on building robust clinical evidence to support device utilization in patients with non-valvular atrial fibrillation.

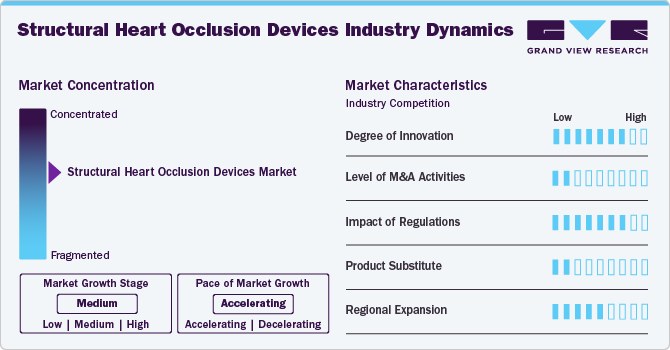

Market Concentration & Characteristics

The structural heart occlusion devices industry is characterized by a high degree of innovation, driven by the ongoing advancements in catheter-based technologies, device miniaturization, and improved biomaterials. Continuous research and development efforts focus on refining these devices to ensure higher efficacy, safety, and ease of use, essential to meet the growing clinical demand. In June 2024, an article highlighted promising clinical outcomes for atHeart Medical's reSept ASD Occluder, a bioresorbable, metal-free device designed for atrial septal defect closure. The device's long-term data, presented at the CSI Frankfurt conference, supports its potential to improve future transseptal treatment options.

The level of mergers and acquisitions (M&A) in the structural heart occlusion devices industry is moderate. Key players are actively pursuing strategic acquisitions to expand their product portfolios, strengthen their technological capabilities, and enhance market access. In November 2023, Johnson & Johnson MedTech acquired Laminar, Inc., focusing on its innovative Left Atrial Appendage Elimination (LAAX) device for stroke prevention in atrial fibrillation patients. This acquisition strengthens J&J MedTech’s portfolio in the growing MedTech market. The LAAX device offers a non-pharmacologic alternative to chronic oral anticoagulants for AFib patients unable to tolerate blood thinners.

Regulations play a critical role in shaping the structural heart occlusion devices industry, with a high impact on product development, approval timelines, and market entry strategies. Stringent regulatory requirements by agencies such as the FDA and EMA ensure that devices meet safety and efficacy standards before reaching the market. These regulations are essential in maintaining high-quality standards but can also lengthen the time to commercialization for new devices, influencing the pace of innovation within the industry.

Product substitutes in the structural heart occlusion devices industry is low. While alternative therapies such as pharmacological treatments for atrial fibrillation exist, occlusion devices offer a more targeted, long-term solution for patients with structural heart defects, especially in high-risk populations. The specialized nature of these devices and the effectiveness of current offerings reduce the threat of viable substitutes, making them a preferred choice in many clinical settings.

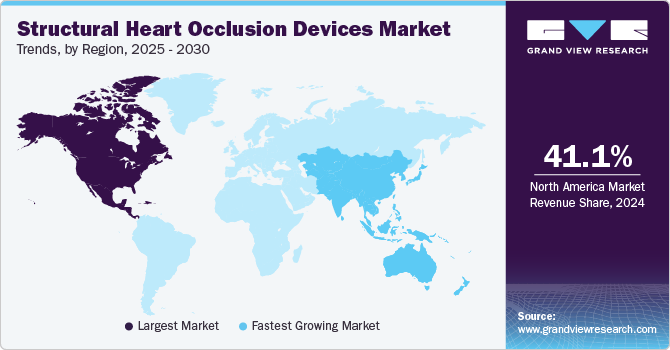

Regional expansion in the structural heart occlusion devices industry is moderate, with companies increasingly focusing on global markets. North America remains the largest market due to its advanced healthcare infrastructure and high adoption rates. However, companies are expanding into emerging regions such as Asia Pacific and Latin America, where rising healthcare awareness and improving medical facilities are driving demand for innovative heart disease treatments. As these regions adopt more advanced therapies, the industry is poised for further growth and penetration.

Type Insights

The left atrial appendage (LAA) occlusion devices segment held the largest share of 49.7% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period due to the growing prevalence of atrial fibrillation (AF), a condition that increases the risk of stroke. Patients with non-valvular atrial fibrillation are at a higher risk for blood clots forming in the left atrial appendage, which can travel to the brain and cause strokes. In January 2025, an article in Structural Heart reviewed advancements in left atrial appendage occlusion (LAAO), emphasizing its effectiveness in reducing stroke risk for atrial fibrillation patients. Improvements in device safety and efficacy, position LAAO as an alternative to oral anticoagulation, and explores its integration with other structural heart procedures.

Advancements in LAA occlusion technology have enhanced the efficacy and safety of these devices, leading to broader adoption. The development of minimally invasive, catheter-based procedures and the introduction of innovative devices such as the Watchman device have played a pivotal role in the segment's dominance. In March 2025, an article in JACC: Clinical Electrophysiology reviewed the growing role of left atrial appendage occlusion (LAAO) in stroke prevention for atrial fibrillation patients. The article discussed advancements in LAAO devices, highlights challenges in patient selection, procedural techniques, and post-procedure complications, and emphasizes ongoing improvements in device efficiency and safety.

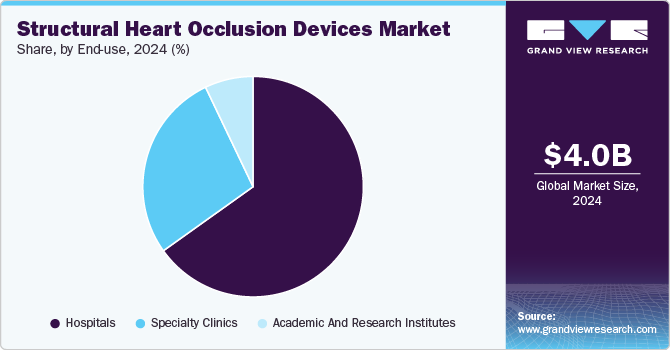

End-use Insights

The hospitals segment held the largest share of over 65.2% in 2024 due to high demand for advanced medical procedures that require specialized care and equipment. Hospitals, particularly those with cardiovascular departments, are the primary settings for complex structural heart interventions, such as LAA occlusion and transcatheter valve procedures. These institutions have the infrastructure, skilled personnel, and access to the latest technologies required for these high-risk procedures, making them the preferred environment for device use. In October 2024, Chinese General Hospital and Medical Center's Heart Institute completed the second Left Atrial Appendage Occlusion (LAAO) procedure in the Philippines, using the Omega Eclipse device to prevent stroke in a patient with Atrial Fibrillation (AF).

The hospitals segment is anticipated to observe lucrative growth during the forecast period. Hospitals benefit from a broader patient base and a continuous influx of patients needing structural heart interventions, contributing to their dominance in the structural heart occlusion devices industry. The growing number of patients diagnosed with conditions like atrial fibrillation and heart valve diseases drives the demand for effective treatment solutions in hospital settings. In March 2025, Journal of Perinatology published a study on patent ductus arteriosus (PDA) management in infants born at 23 to 32 weeks’ gestation. The research revealed increased pharmacotherapy use, especially acetaminophen, and a shift from surgical ligation to transcatheter PDA closure over 12 years.

Regional Insights

North America dominated the structural heart occlusion devices market with a share of 41.1% in 2024, driven by strong demand for advanced medical technologies, particularly in congenital heart defect treatment. In October 2024, Vessel Plus published a review on transcatheter closure of patent ductus arteriosus (PDA), highlighting the use of occlusion techniques like buttoned devices, Gianturco coils, and Amplatzer devices. These innovations reflect the broader trend in North America towards embracing cutting-edge technologies to treat complex cardiovascular conditions.

U.S. Structural Heart Occlusion Devices Market Trends

The U.S. continues to drive growth in North America's structural heart occlusion devices market through advancements in diagnostic and intervention technologies. In November 2024, Revista Cardiovascular de Medicina published a review on the diagnosis and management of ventricular septal defects (VSDs). The article highlighted the importance of echo-Doppler studies for assessing clinical significance and discussed surgical and percutaneous treatments, including the use of Amplatzer VSD Occluders for moderate- to large-sized defects.

Europe Structural Heart Occlusion Devices Market Trends

The structural heart occlusion devices market in Europe held the second-largest revenue market share in 2024. In Europe, the growing demand for safe and effective minimally invasive procedures has driven innovation in the medical device sector. In April 2024, Medicina published a case report on a rare complication of patent foramen ovale (PFO) closure. The study highlighted an unintentional detachment of the closure device, which migrated into the abdominal aorta.

Germany's structural heart occlusion devices market is anticipated to grow at a significant rate in 2024 driven by increasing adoption of innovative therapies. In August 2024, European Heart Journal published an article reviewing the current status and perspectives on left atrial appendage closure (LAAC) for stroke prevention in atrial fibrillation (AF). The article highlights the growing importance of LAAC as an alternative to oral anticoagulation, especially for patients with a high risk of bleeding. It discusses the efficacy and safety of catheter-based LAAC, with advances in device technology, imaging, and implantation techniques improving outcomes.

The structural heart occlusion devices market in UK held a significant market share in 2024 driven by advancements in treatment options. In September 2022, a study from the UK National Registry on post-infarction ventricular septal defects (VSD) was presented at TCT 2022. It was found that while there was no significant difference in 5-year all-cause mortality between surgical and percutaneous treatments, the surgical group had lower in-hospital mortality (44.2% vs. 55%).

Asia Pacific Structural Heart Occlusion Devices Market Trends

The Asia Pacific region is expected to grow fastest during the forecast period. Rapid innovation in device design and rising stroke prevention initiatives are driving Asia Pacific’s structural heart occlusion devices market growth. In March 2025, an editorial in JACC Asia discussed the advancements and ongoing challenges in left atrial appendage occlusion (LAAO) as a stroke prevention method for atrial fibrillation. While newer devices have improved safety, issues such as peridevice leakage and device-related thrombus remain significant. The search for an ideal LAA occluder continues, with newer-generation devices showing promise in reducing complications.

China structural heart occlusion devices market accounted for the largest share in the Asia Pacific region in 2024. Rising innovation and strong clinical adoption are driving growth in China's structural heart occlusion devices market. In January 2025, BMC Cardiovascular Disorders published a study comparing the WATCHMAN and LACbes devices for left atrial appendage closure in atrial fibrillation patients. The LACbes device showed a lower stroke rate (1.8% vs. 3.7%) and fewer bleeding complications (1.8% vs. 9.5%) compared to WATCHMAN, indicating similar efficacy and safety for stroke prevention.

The structural heart occlusion devices market in Japan held the largest market share in the Asia Pacific region. Strong preference for next-generation devices is boosting Japan’s dominance in the structural heart occlusion devices market. In April 2024, Circulation Journal published a study comparing outcomes between the WATCHMAN FLX and WATCHMAN 2.5 devices in Japanese patients undergoing percutaneous left atrial appendage closure. The WATCHMAN FLX showed higher procedural success, lower pericardial effusion rates, and significantly reduced bleeding events at one year compared to the older device.

The India structural heart occlusion devices market is experiencing significant growth driven by advancements in minimally invasive procedures. In July 2023, Kauvery Hospital in Chennai performed India's first intracardiac echo-guided Lambre Left Atrial Appendage (LAA) closure on an 80-year-old patient with atrial fibrillation. The minimally invasive procedure reduced stroke risk without requiring blood-thinning medication.

Latin America Structural Heart Occlusion Devices Market Trends

The Latin America structural heart occlusion devices market is growing due to rising adoption of minimally invasive cardiac procedures, increasing prevalence of atrial fibrillation and congenital heart defects, and expanding access to specialized cardiac care. Improving healthcare infrastructure and the entry of advanced device technologies are also accelerating market momentum across the region.

Brazil's structural heart occlusion devices market is expanding due to growing clinical validation and procedural success rates fueling Brazil’s structural heart occlusion devices market expansion. In October 2022, the article "Left Atrial Appendage Closure with the LAmbre Device - Initial Multicenter Experience in Brazil" was published in Arquivos Brasileiros de Cardiologia. The study on 51 patients showed a 100% procedural success rate with no deaths or strokes during an 18-month follow-up, highlighting the LAmbre device's safety and efficacy in stroke prevention for atrial fibrillation patients.

Middle East & Africa Structural Heart Occlusion Devices Market Trends

The MEA structural heart occlusion devices market is expected to grow lucratively due to increasing investments in healthcare infrastructure, a rising burden of cardiovascular diseases, and greater availability of specialized interventional cardiology services. Emerging private sector initiatives and the gradual uptake of next-generation occlusion technologies are further fueling regional expansion.

Saudi Arabia's structural heart occlusion devices market is expected to grow at a significant CAGR over the forecast period. In Saudi Arabia, the increasing adoption of advanced medical technologies, growing healthcare infrastructure, and a rising prevalence of cardiovascular diseases are key drivers in the market for cardiac devices. In March 2023, Journal of the Saudi Heart Association reported a case of atrial septal defect (ASD) device embolization after MRI, leading to cyanosis and shortness of breath. The incident highlighted concerns over MRI safety with implanted cardiac devices, relevant to interventional cardiology markets.

Key Structural Heart Occlusion Devices Company Insights

Notable companies in the industry include Abbott, Boston Scientific Corporation, and Medtronic. Their strategies focus on analyzing the strengths and weaknesses of leading competitors, predicting upcoming market trends, opportunities, and challenges, and making informed decisions based on emerging technologies and evolving consumer demands. For example, Occlutech and Lifetech Scientific are rising players in the structural heart occlusion devices market.

Key Structural Heart Occlusion Devices Companies:

The following are the leading companies in the structural heart occlusion devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Boston Scientific Corporation

- Occlutech

- Lifetech Scientific

- Medtronic

- W. L. Gore & Associates

- Lepu Medical Technology (Beijing)Co., Ltd

- Emtree Medical (Cardia Inc.)

- Biosense Webster (Johnson & Johnson)

- PFM Medical GMBH

Recent Developments

-

In October 2024, Conformal Medical launched the GLACE Study in Europe to evaluate its next-gen CLAAS AcuFORM device for Left Atrial Appendage Occlusion (LAAO) using intracardiac echocardiography (ICE) imaging. The device simplifies LAAO procedures with just two sizes, aiming to reduce radiation and eliminate general anesthesia, potentially transforming clinical practice for stroke prevention in atrial fibrillation patients.

-

In September 2024, MicroPort CardioFlow Medtech Corporation announced the accelerated rollout of its AnchorMan Left Atrial Appendage Closure (LAAC) System in China. Approved by the National Medical Products Administration (NMPA) in January 2024, the device has already been implanted in 41 cases across 12 provinces. The system combines the benefits of both open and closed LAAC devices, providing enhanced stability and minimizing tissue damage, with plans for global expansion underway, including a pending CE registration for the European market.

-

In January 2024, Occlutech secured FDA approval for its ASD Occluder and Pistol Pusher delivery system, designed to address atrial septal defects (ASDs). This self-expanding nitinol device facilitates the transcatheter closure of ostium secundum-type ASDs, providing a permanent solution for patients.

Structural Heart Occlusion Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.3 billion

Revenue forecast in 2030

USD 6.0 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Boston Scientific Corporation; Occlutech; Lifetech Scientific; Medtronic; W. L. Gore & Associates; Lepu Medical Technology (Beijing)Co.,Ltd; Emtree Medical (Cardia Inc.); Biosense Webster (Johnson & Johnson); PFM Medical GMBH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Structural Heart Occlusion Devices Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global structural heart occlusion devices market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Left Atrial Appendage (LAA) Occlusion Devices

-

Atrial Septal Defect (ASD) Occluders

-

Patent Ductus Arteriosus (PDA) Occlusion Devices

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty clinics

-

Academic and Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global structural heart occlusion devices market size was estimated at USD 4.0 billion in 2024 and is expected to reach USD 4.3 billion in 2025.

b. The global structural heart occlusion devices market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 6.0 billion by 2030.

b. The left atrial appendage (LAA) occlusion devices segment held the largest share of 49.7% in 2024 due to the growing prevalence of atrial fibrillation (AF), a condition that increases the risk of stroke.

b. Some of the major participants in the structural heart occlusion devices market include Abbott; Boston Scientific Corporation; Occlutech; Lifetech Scientific; Medtronic; W. L. Gore & Associates; Lepu Medical Technology (Beijing)Co.,Ltd; Emtree Medical (Cardia Inc.); Biosense Webster (Johnson & Johnson); PFM Medical GMBH.

b. The structural heart occlusion devices market is advancing due to the rising burden of structural heart diseases, increasing acceptance of minimally invasive therapies, and favorable regulatory and reimbursement changes. Growing clinical awareness and procedural innovations are expanding the eligible patient pool, reinforcing a strong positive growth outlook.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.