- Home

- »

- Distribution & Utilities

- »

-

Submarine Power Cable Market Size, Industry Report, 2033GVR Report cover

![Submarine Power Cable Market Size, Share & Trends Report]()

Submarine Power Cable Market (2026 - 2033) Size, Share & Trends Analysis Report By Current Type (HVAC, HVDC), By Voltage, By Application (Offshore Wind Export Cables, Submarine Interconnector Cables), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-851-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Submarine Power Cable Market Summary

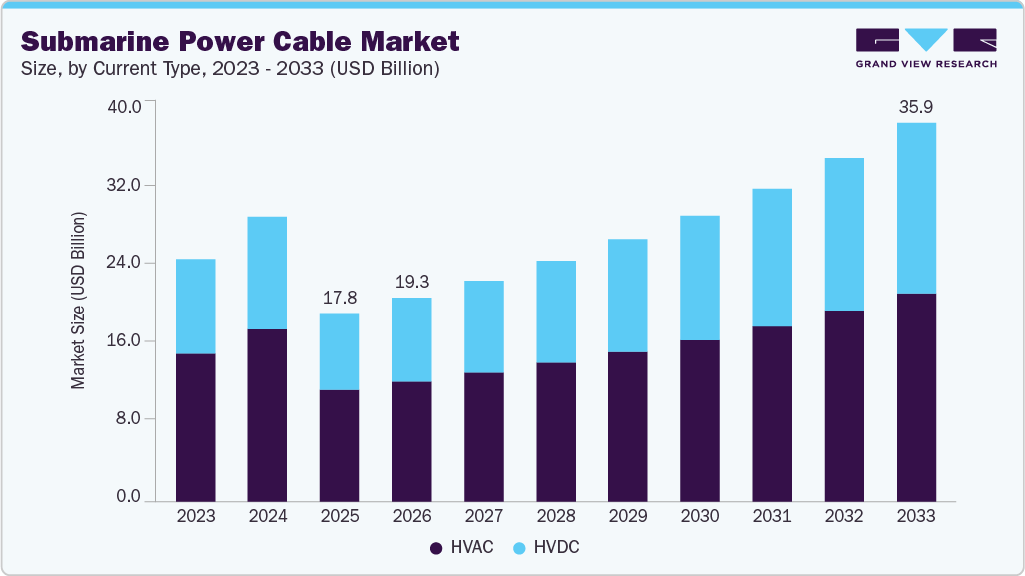

The global submarine power cable market size was estimated at USD 17.80 billion in 2025 and is projected to reach USD 35.88 billion in 2033, growing at a CAGR of 9.25% from 2026 to 2033. The market growth is driven by the rapid expansion of offshore wind capacity, the development of cross-border submarine interconnectors, and demand for reliable long-distance electricity transmission to support energy security and grid stability.

Key Market Trends & Insights

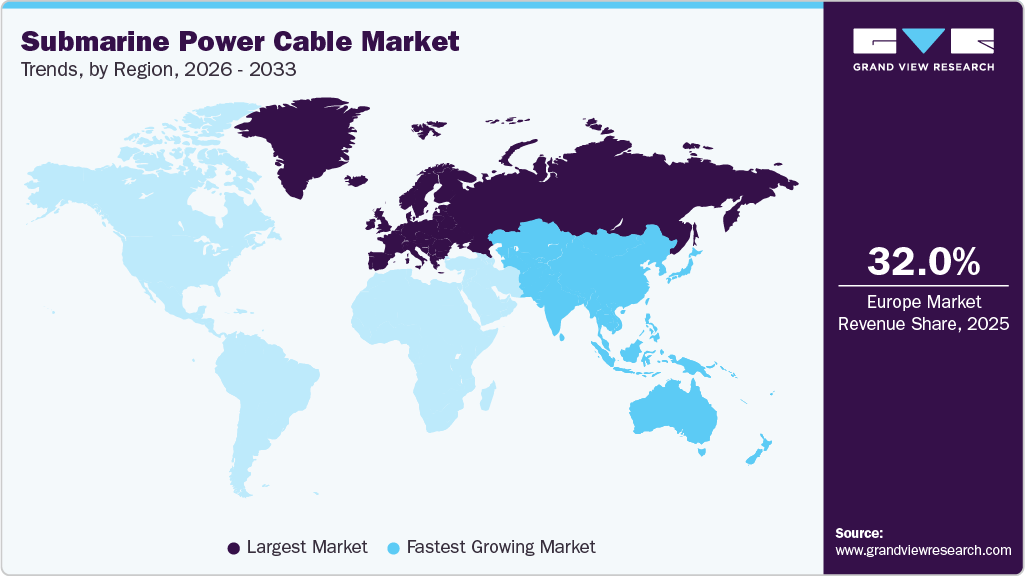

- The Europe submarine power cable market held the largest global revenue share of over 32.0% in 2025.

- The submarine power cable market in Germany is expected to register significant CAGR over the forecast period.

- Based on voltage, the High Voltage (66-220 kV) segment held the largest revenue share in 2025.

- Based on current type, the HVAC segment held the largest market share of over 60.0% in 2025.

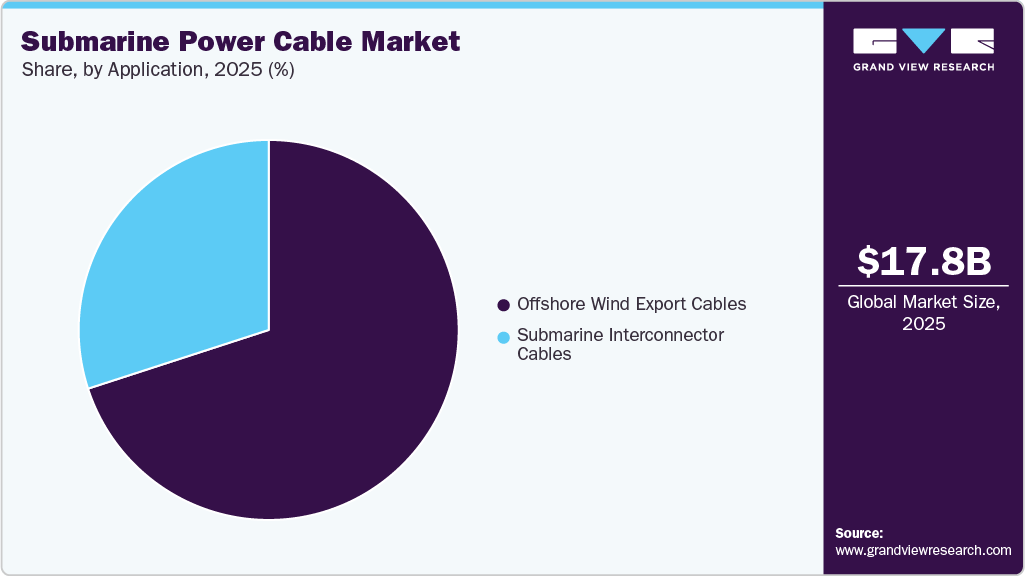

- Based on application, the Offshore Wind Export Cables segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 17.80 Billion

- 2033 Projected Market Size: USD 35.88 Billion

- CAGR (2026-2033): 9.25%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

Utilities and offshore wind developers are prioritizing high-capacity transmission infrastructure to enable efficient power evacuation from offshore generation sites and strengthen regional power networks. Technological advancements in HVAC and HVDC submarine cable systems, including improved insulation materials, higher-voltage cable designs, and enhanced mechanical protection for harsh marine environments, are supporting longer transmission distances and improved operational reliability. Government-led renewable energy targets, offshore wind auctions, and interconnection initiatives across Europe, North America, and Asia-Pacific are accelerating project deployment. Additionally, strategic partnerships between cable manufacturers, utilities, offshore wind developers, and EPC contractors are strengthening execution capabilities and supporting the continued growth of submarine power cable installations worldwide.

Drivers, Opportunities & Restraints

The growth of the submarine power cable industry is driven by the rapid expansion of offshore wind projects, the increasing deployment of cross-border submarine interconnectors, and rising demand for high-capacity, reliable underwater electricity transmission to strengthen grid stability and energy security. The market is further supported by growing investments in HVAC and HVDC transmission infrastructure to enable the integration of renewable energy and long-distance power evacuation from offshore generation sites.

Opportunities are emerging from the development of far-offshore wind farms, increasing adoption of high-voltage HVDC submarine cable systems, and rising investments in grid interconnection projects across Europe, North America, and the Asia-Pacific. Additionally, advancements in cable insulation technologies, enhanced armoring solutions, and the expansion of manufacturing capacity by key suppliers are creating new growth potential in the market.

High upfront project costs, long lead times for manufacturing and installation, limited availability of specialized cable-laying vessels, complex marine permitting requirements, and risks related to cable damage and repair in harsh subsea environments continue to restrain market growth, particularly in regions with lower infrastructure investment and slower offshore renewable development.

Current Type Insights

HVAC accounted for nearly 60.0% revenue share of the submarine power cable market in 2025, primarily due to its widespread use in offshore wind export cable connections and near-to-mid distance subsea transmission projects. HVAC submarine cables remain a preferred choice for many coastal and offshore developments because of their proven performance, relatively lower system complexity compared to HVDC, and strong suitability for integrating offshore generation into onshore grids. Growing investments in offshore wind farms, along with continued upgrades in regional transmission networks, are supporting steady demand for HVAC submarine cable deployments.

The HVDC segment is expected to register the fastest CAGR of 10.8% over the forecast period, driven by increasing development of long-distance submarine interconnectors and the rising need to transmit larger power capacities efficiently across seas and water bodies. HVDC submarine cable systems are gaining traction as countries expand cross-border power exchange, strengthen grid resilience, and connect far-offshore renewable energy projects where HVAC becomes less efficient over longer distances. Advancements in high-voltage HVDC cable technology and expanding interconnector project pipelines across Europe, North America, and Asia-Pacific are further accelerating HVDC adoption globally.

Voltage Insights

High Voltage (66-220 kV) accounted for nearly 57% of the submarine power cable industry in 2025, supported by its extensive deployment in offshore wind export cable connections and medium-distance subsea power transmission projects. HV submarine cables are widely adopted due to their strong balance of transmission capability, technical maturity, and cost-effectiveness, making them a preferred choice for utilities and offshore wind developers aiming to connect offshore generation to onshore grids efficiently.

The Extra High Voltage (>220 kV) segment is expected to register the fastest CAGR of 11.5% over the forecast period, driven by the growing need for high-capacity, long-distance underwater power transmission through HVDC interconnectors and the integration of far-offshore renewable energy. As more countries invest in cross-border power trading and large-scale offshore wind projects located farther from shore, demand for higher-voltage submarine cable systems is accelerating to improve transmission efficiency, reduce losses, and support grid stability.

Application Insights

Offshore Wind Export Cables accounted for nearly 70% of the submarine power cable market in 2025, driven by the rapid expansion of offshore wind farm installations and the increasing need to transmit electricity efficiently from offshore generation sites to onshore grids. Export cables form a critical link in offshore wind infrastructure, and their demand continues to rise as governments and utilities accelerate renewable energy integration, strengthen grid connectivity, and support large-scale offshore wind capacity additions across key markets.

The Submarine Interconnector Cables segment is expected to register the fastest CAGR of 11.3% over the forecast period, supported by growing investments in cross-border electricity transmission links and long-distance subsea power networks. Increasing focus on energy security, grid balancing, and regional power trading is driving interconnector development, particularly through high-capacity HVDC projects that enable efficient transmission over longer underwater distances and enhance overall grid resilience.

Regional Insights

Europe submarine power cable market accounted for the largest share of 32% in the global industry, supported by the region’s strong pipeline of offshore wind export cable deployments and large-scale development of cross-border submarine interconnectors. Increasing focus on renewable energy integration, energy security, and grid resilience is driving continued investments in HVAC and HVDC submarine transmission infrastructure across major European markets.

North America Submarine Power Cable Market Trends

North America is witnessing steady growth in the submarine power cable industry, supported by increasing investments in offshore wind export connections, grid reliability upgrades, and the development of high-capacity transmission infrastructure. The region is increasingly focusing on strengthening coastal power networks and integrating renewable energy into the grid, which is driving demand for advanced submarine cable systems across key markets.

In the United States, the submarine power cable industry is primarily driven by the growing development of offshore wind projects and the need to build reliable export cable connections to onshore grids. Rising investments in coastal transmission upgrades, renewable energy integration, and grid modernization initiatives are accelerating the deployment of submarine power cables, particularly across major offshore wind development zones.

Asia Pacific Submarine Power Cable Market Trends

Asia Pacific is expected to register the fastest CAGR of 11.87% over the forecast period, driven by the rapid expansion of offshore wind capacity, rising investments in high-voltage grid infrastructure, and increasing demand for long-distance underwater power transmission. Countries such as China, Japan, South Korea, and India are accelerating the integration of renewables and the development of coastal transmission, creating strong growth opportunities for submarine power cable deployment across the region.

Latin America Submarine Power Cable Market Trends

In Latin America, the submarine power cable industry is developing gradually, supported by selective investments in power transmission infrastructure, offshore energy development, and regional grid connectivity initiatives. The market is expected to grow steadily as countries strengthen electricity networks, improve grid stability, and explore offshore renewable potential over the long term.

Middle East & Africa Submarine Power Cable Market Trends

The Middle East & Africa (MEA) submarine power cable industry is in an emerging phase, driven by increasing investments in power infrastructure, rising electricity demand, and the growing need for reliable cross-water electricity transmission. Ongoing development of renewable energy projects and regional grid interconnection initiatives is expected to support the gradual adoption of submarine power cable systems across the region.

Key Submarine Power Cable Company Insights

The key companies operating in the submarine power cable industry are actively engaged in the design, manufacturing, and supply of submarine power cable systems, including HVAC and HVDC cables, to support critical applications such as offshore wind export transmission, cross-border interconnectors, and island grid connections. Market participants are focusing on capacity expansion, the development of higher-voltage, longer-distance cable solutions, enhanced insulation and armoring technologies, and improved reliability for harsh marine environments, along with strategic partnerships with utilities, offshore wind developers, and EPC contractors. Additionally, investments in project execution capabilities, specialized marine logistics, and end-to-end cable system delivery are helping these players strengthen their global presence and support the transition toward renewable energy integration and long-distance underwater power transmission infrastructure.

Key Submarine Power Cable Companies:

The following key companies have been profiled for this study on the submarine power cable market.

- ABB

- Furukawa Electric

- Hengtong Group

- LS Cable & System

- Nexans

- NKT

- Prysmian Group

- Sumitomo Electric Industries

- TFKable

- ZTT Group

Recent Developments

-

In January 2026, Nexans achieved a world record for the deepest high-voltage subsea cable installation on the Tyrrhenian Link project in Italy, successfully installing a 500 kV HVDC subsea cable, demonstrating advanced deep-water installation capabilities for long-distance interconnector infrastructure.

-

In December 2025, NKT announced that its joint venture in Taiwan inaugurated an offshore power cable factory, strengthening regional manufacturing capacity to support growing demand from offshore wind export cable and interconnector projects across Asia Pacific.

-

In December 2025, Sumitomo Electric Industries secured a contract to supply and install a 525 kV HVDC submarine cable for the UK’s Sea Link project, supporting the expansion of cross-border and domestic high-capacity power transmission networks.

Submarine Power Cable Market Report Scope

Report Attribute

Details

Market definition

The Submarine Power Cable market size represents the global revenue generated from the manufacturing and sale of submarine power cables, including HVAC and HVDC underwater transmission cables, deployed for offshore wind export connections and cross-border submarine interconnectors to enable reliable electricity transmission across seas and water bodies.

Market size value in 2026

USD 19.31 billion

Revenue forecast in 2033

USD 35.88 billion

Growth rate

CAGR of 9.25% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

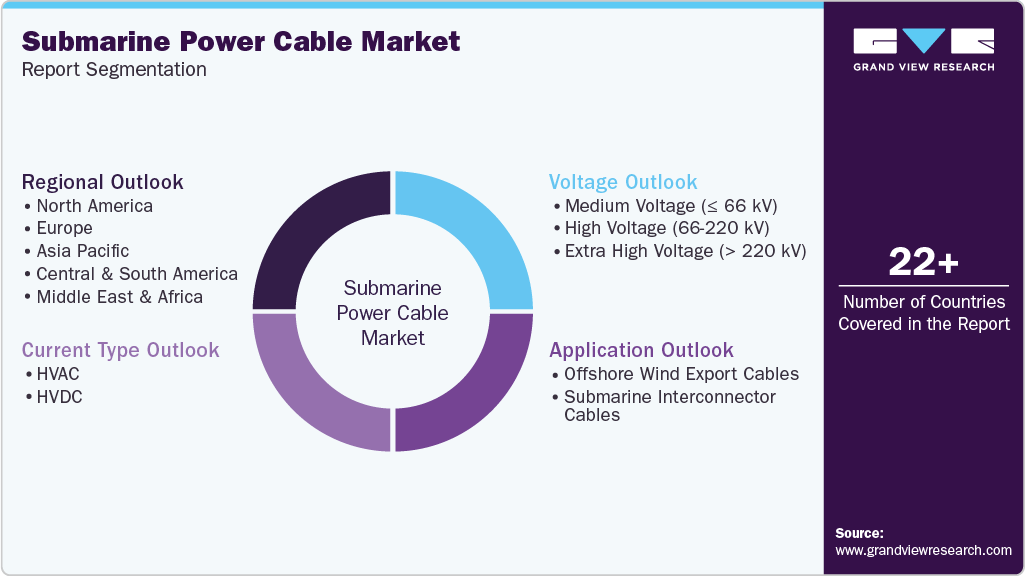

Application, current type, voltage, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan;South Korea; Brazil; Argentina; UAE

Key companies profiled

ABB; Furukawa Electric; Hengtong Group; LS Cable & System; Nexans; NKT; Prysmian Group; Sumitomo Electric Industries; TFKable; ZTT Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Submarine Power Cable Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global submarine power cable market report based on application, current type, voltage, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Offshore Wind Export Cables

-

Submarine Interconnector Cables

-

-

Current Type Outlook (Revenue, USD Million, 2021 - 2033)

-

HVAC

-

HVDC

-

-

Voltage Outlook (Revenue, USD Million, 2021 - 2033)

-

Medium Voltage (≤ 66 kV)

-

High Voltage (66-220 kV)

-

Extra High Voltage (> 220 kV)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global submarine power cable market size was estimated at USD 17.80 billion in 2025 and is expected to reach USD 19.31 billion in 2026.

b. The global submarine power cable market is expected to grow at a compound annual growth rate of 9.25% from 2026 to 2033 to reach USD 35.88 billion by 2033.

b. Based on the current type segment, HVAC held the largest revenue share of over 60% in the submarine power cable market in 2025.

b. Some of the key vendors operating in the global submarine power cable market include Prysmian Group, Nexans, NKT, Sumitomo Electric Industries, LS Cable & System, Furukawa Electric, Hengtong Group, ZTT Group, ABB, and TFKable among others.

b. The key factors driving the submarine power cable market include the rapid expansion of offshore wind power projects, increasing deployment of cross-border submarine interconnectors, rising demand for long-distance high-capacity power transmission, growing focus on grid reliability and energy security, and continuous investments in HVAC and HVDC submarine cable infrastructure to support renewable energy integration and modernize transmission networks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.