- Home

- »

- Next Generation Technologies

- »

-

Subscriber Data Management Market, Industry Report, 2030GVR Report cover

![Subscriber Data Management Market Size, Share & Trends Report]()

Subscriber Data Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution, By Network Type, By Application, By Deployment Mode, By Organization Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-576-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Subscriber Data Management Market Summary

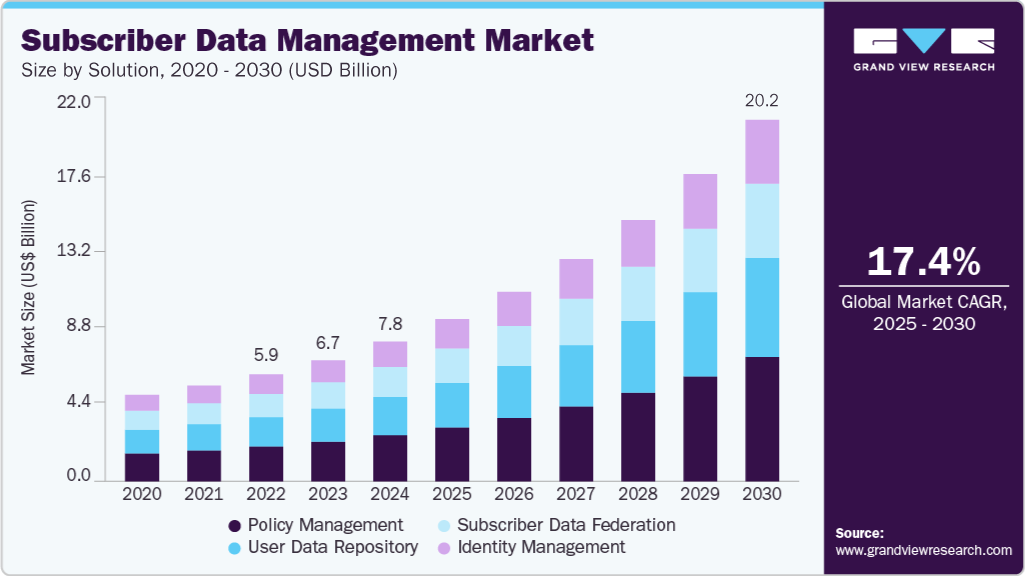

The global subscriber data management market size is estimated at USD 7.8 billion in 2024 and is projected to reach USD 20.2 billion by 2030, growing at a CAGR of 17.4% from 2025 to 2030. The market is driven by several key factors, including the rising prevalence of infectious diseases among companion and livestock animals, increasing pet ownership, and growing awareness of animal health.

Key Market Trends & Insights

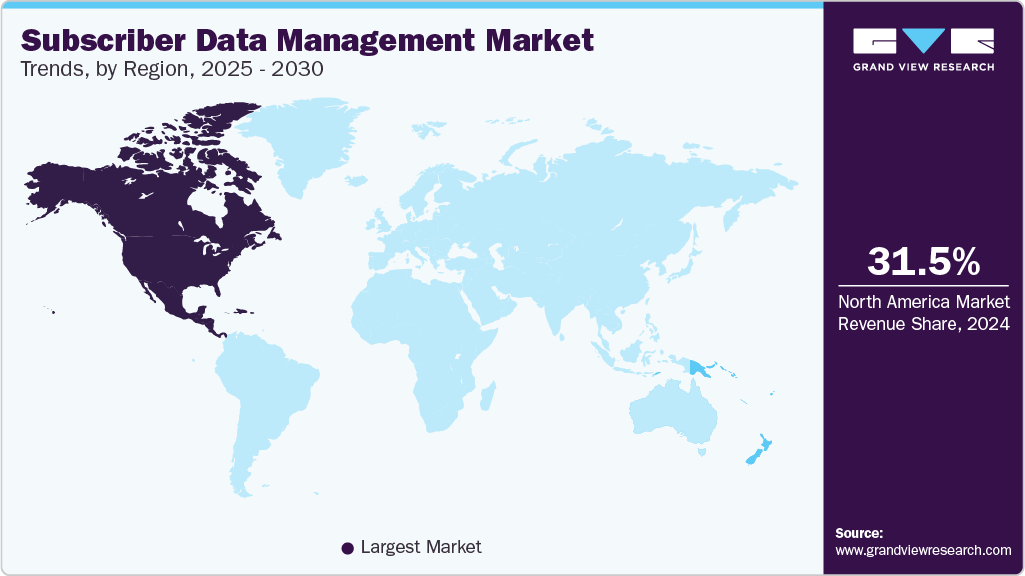

- The North America dominated the subscriber data management market with the largest revenue share of 31.5% in 2024.

- The subscriber data management market in the U.S. held a dominant position in 2024.

- By solution, the policy management segment led the market with the largest revenue share of 33.1% in 2024.

- By network type, the mobile networks segment accounted for the largest market revenue share in 2024.

- By application, the mobile segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.8 Billion

- 2030 Projected Market Size: USD 20.20 Billion

- CAGR (2025-2030): 17.4%

- North America: Largest market in 2024

In addition, the increasing shift toward cloud and hybrid cloud deployments is enabling telecom operators to adopt scalable and flexible SDM solutions. However, the high implementation cost of advanced SDM platforms, particularly for small and mid-sized operators, remains a key challenge. The growing demand for fixed mobile convergence (FMC) and VoIP services presents a major growth opportunity for the market.In addition, the increasing shift toward cloud and hybrid cloud deployments is enabling telecom operators to adopt scalable and flexible SDM solutions. However, the high implementation cost of advanced SDM platforms, particularly for small and mid-sized operators, remains a key challenge. The growing demand for fixed mobile convergence (FMC) and VoIP services presents a major growth opportunity for the market.

The increasing demand for 5G networks and Internet of Things (IoT)is a significant driver for the growth of the SDM market. 5G’s higher speeds and lower latency create new opportunities across industries, from autonomous vehicles to smart cities. To manage the surge in connected devices and services, operators require robust SDM solutions to ensure efficient data handling, security, and seamless user experiences. For instance, in August 2022, Orange Egypt extended its partnership with Nokia to modernize its SDM infrastructure, ensuring readiness for 5G services and enhancing operational efficiency. This reflects the growing importance of SDM in supporting advanced network architectures and the increased complexity of managing large-scale 5G and IoT ecosystems.

The shift to cloud and hybrid cloud deployments is accelerating the demand for SDM solutions, as these environments offer scalability, flexibility, and efficient real-time data handling. For instance, in January 2025, Microsoft announced a USD 3 billion investment in AI and cloud infrastructure in India, underscoring the rising importance of cloud technologies. This investment is set to enhance regional cloud capacities and accelerate the digital transformation of businesses. As more enterprises transition to cloud-based models, they require robust SDM solutions to securely manage growing volumes of subscriber data, streamline operations, and ensure compliance. Consequently, this shift is driving significant growth in the SDM market as companies seek solutions to meet the demands of modern cloud environments.

The rising demand for fixed mobile convergence (FMC) and VoIP services is creating strong growth opportunities for the SDM industry. FMC enables seamless communication across fixed and mobile networks, while VoIP relies on IP-based voice transmission. Both trends require robust SDM solutions to manage unified subscriber profiles, streamline authentication, and ensure consistent service quality. As operators converge networks to offer flexible, cost-effective communication, the need for scalable SDM systems increases, thereby supporting market growth.

High implementation costs pose a significant restraint in the subscriber data management industry. Deploying advanced SDM systems, especially cloud-native and geo-redundant architectures, can cost millions for large-scale operators. These costs include software licensing, hardware procurement, integration with legacy networks, and data center infrastructure. In addition, cloud migration and network function virtualization demand specialized skill sets, increasing training and operational expenses. For instance,in August 2022, Jazz selected Nokia’s SDM software to support over 123 million subscribers and deployed it across four major data centers in Pakistan. While exact figures were undisclosed, such nationwide, cloud-based deployments typically cost between USD 5 million to 20 million. These high upfront costs pose barriers for smaller telecom operators and emerging markets, limiting widespread adoption despite the operational advantages SDM offers.

Solution Insights

The policy management segment led the market with the largest revenue share of 33.1% in 2024. Factors such as the increasing adoption of 5G core networks and the need for dynamic, real-time control of data sessions and services. Operators are deploying advanced policy control functions (PCF) to support differentiated services, QoS enforcement, and slicing strategies in 5G environments. For instance, in February 2024, Alepo partnered with Italtel to deliver private 5G networks using Alepo’s cloud-native 4G-5G core solutions, which feature integrated SDM and policy control. This reflects a growing industry focus on bundled, software-driven solutions to enable fast, efficient 5G rollouts across industrial and enterprise use cases.

The user data repository (UDR) segment is expected to grow at the fastest CAGR from 2025 to 2030, owing to the rising demand for centralized data platforms that support both 4G and 5G networks. As telecom operators adopt converged network architectures, UDR solutions enable unified access, storage, and management of subscriber profiles, authentication data, and service entitlements. The growth of IoT ecosystems and fixed-mobile convergence (FMC) services is further supporting the need for real-time data access and low-latency communication, which UDR systems address efficiently.

Network Type Insights

The mobile networks segment accounted for the largest market revenue share in 2024, primarily driven by the rapid expansion of 5G deployments, rising mobile data traffic, and the growing number of mobile subscribers. The adoption of cloud-native mobile cores and network slicing is also pushing mobile operators to invest heavily in advanced SDM platforms that can support real-time subscriber data processing, dynamic policy control, and seamless mobility.

The fixed networks segment is expected to grow at the fastest CAGR from 2025 to 2030. Factors such as the growing rollout of fiber-to-the-home (FTTH) infrastructure and the integration of Fixed-Mobile Convergence (FMC) strategies are contributing to segment growth. Also, the rising adoption of VoIP, home IoT ecosystems, and cloud gaming platforms over fixed broadband networks which requires low-latency and high-reliability data management systems, boosting the demand for SDM in fixed environments.

Application Insights

The mobile segment accounted for the largest market revenue share in 2024, drivenby the rapid adoption of 5G networks, increased mobile data consumption, and the growing number of mobile-based applications such as streaming, gaming, and e-commerce. According to the GSM Association, the number of unique mobile subscribers will grow from 5.8 billion in 2024 to 6.5 billion by 2030, highlighting the continuing global expansion of mobile services. As mobile operators expand their networks to support 5G and IoT devices, the demand for advanced SDM solutions to manage mobile subscribers, devices, and traffic in real-time continues to rise.

The voice over IP (VoIP) and video over IP segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by the increasing shift toward IP-based communication services and cloud communications. The growing demand for seamless voice and video calling, especially in business communications, remote work environments, and global collaborations, is spurring the need for robust SDM solutions capable of handling large volumes of voice and video traffic. As businesses and consumers continue to migrate to VoIP platforms including Zoom, Microsoft Teams, and WhatsApp, SDM systems are essential for managing subscriber identities, enabling service personalization, and ensuring quality of service (QoS) across both mobile and broadband networks.

Deployment Mode Insights

The on-premises segment accounted for the largest market revenue share in 2024. Factors such as the increasing demand for full control over data security and compliance are contributing to this segment's growth. Traditional infrastructures, especially in legacy systems, still dominate many industries where data privacy, regulatory requirements, and control are paramount. Many enterprises prefer on-premises solutions because they offer more control over sensitive data and security. In addition, the initial capital investment in on-premises infrastructure is a long-term investment for many businesses, particularly those in regulated sectors, including finance and healthcare.

The cloud-based segment is expected to grow at the fastest CAGR from 2025 to 2030. The increasing shift to cloud and hybrid cloud infrastructures driven by cost optimization, flexibility, and scalability is fueling this growth. As businesses move toward digital transformation, cloud-based solutions offer agility, lower operational costs, and faster deployment times. The rising demand for real-time data processing, driven by 5G, IoT, and AI, further boosts the adoption of cloud infrastructures over on-premises solutions.

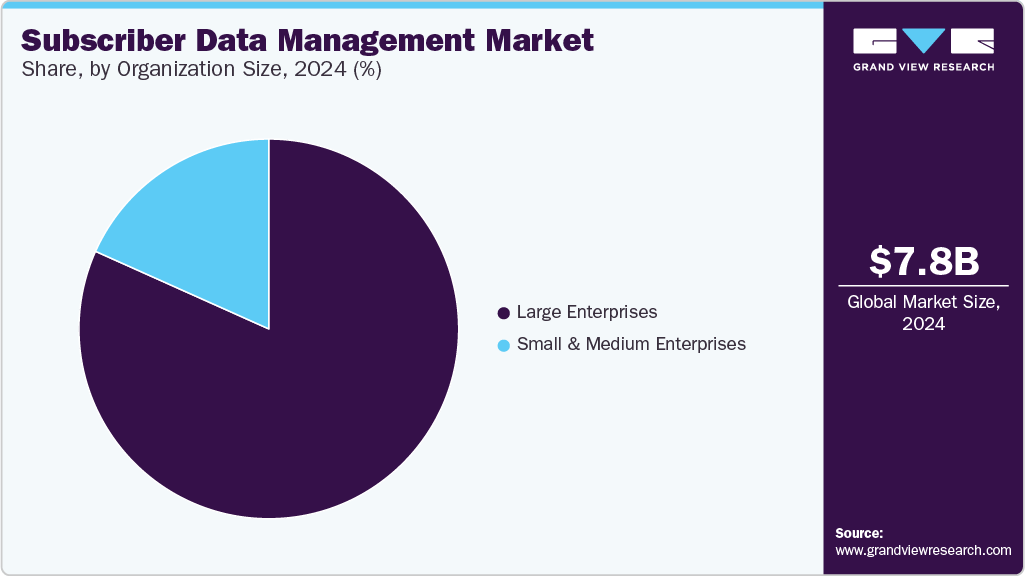

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024, driven by the growing need for advanced data management systems, high-volume subscriber data processing, and regulatory compliance. These enterprises typically have larger technology budgets and require tailored SDM solutions to meet their specific business needs. Their capacity to invest in sophisticated, enterprise-grade SDM systems, along with the complex data management and security requirements, supports the ongoing demand and adoption of these solutions, reinforcing their leading position in the SDM market.

The small and medium enterprises (SMEs) segment is expected to grow at the fastest CAGR from 2025 to 2030. The increasing digital transformation efforts among SMEs and the affordability of cloud-based SDM solutions are driving this growth. As SMEs increasingly adopt cloud solutions for scalability and cost efficiency, they are recognizing the importance of efficient subscriber data management to enhance customer service, reduce churn, and streamline operations. Also, the growing accessibility of affordable and easy-to-implement SDM platforms is making it easier for SMEs to integrate these solutions, leading to rapid market expansion in this segment.

Regional Insights

North America dominated the subscriber data management market with the largest revenue share of 31.5% in 2024. The market in North America is being driven by rapid expansion of 5G networks and the increasing demand for efficient data management solutions to handle growing subscriber data. In addition, the widespread adoption of cloud-native core networks by major telecom operators, including AT&T and Verizon, is fueling the need for scalable SDM platforms to support real-time data synchronization and policy control. According to the 5G Americas Report, North America is a leader in the adoption of wireless 5G, with 108 million 5G and 506 million LTE connections by Q3 2022. 5G penetration is approaching 30% in the region, further boosting the need for advanced SDM systems to manage subscriber data at scale.

U.S. Subscriber Data Management Market Trends

The subscriber data management market in the U.S. held a dominant position in 2024. The market in the U.S. is witnessing significant transformation, driven by the rapid deployment of 5G networks, the growing demand for private 5G networks across industries, and increasing regulatory requirements around data privacy. According to Ericsson, over 300 million people in the U.S. are covered by low-band 5G from all major tier-1 operators, and 210-300 million are covered by mid-band 5G, with mmWave available in key metro areas. These expansive deployments necessitate highly scalable SDM systems to manage increased data volumes, mobility, and service continuity across multiple network layers. In addition, tightening U.S. regulations around data privacy and cybersecurity, such as the evolving state-level data protection laws (e.g., CCPA and Virginia CDPA), are prompting telecom operators to adopt SDM platforms that offer advanced compliance, data governance, and real-time policy enforcement capabilities.

The Canada subscriber data management market is anticipated to grow at a significant CAGR during the forecast period. In Canada, the growing adoption of 5G and the proliferation of IoT devices are significantly driving demand for advanced SDM solutions. In addition, government initiatives to boost 5G infrastructure are accelerating this trend. For instance, in March 2025, Innovation, Science and Economic Development Canada announced the release of millimeter wave spectrum to support high-capacity, localized 5G services. This spectrum is expected to enable applications such as smart manufacturing, private networks, and rural fixed wireless access. These developments require scalable and secure SDM platforms to manage complex subscriber data, support seamless provisioning, and ensure real-time authentication across evolving network environments.

The subscriber data management market in Mexico is anticipated to grow at a substantial CAGR during the forecast period. In Mexico, growing investments in telecom infrastructure and digital transformation are accelerating the demand for robust SDM platforms. Leading operators, including Telcel and AT&T Mexico, are expanding 5G networks and upgrading core systems to manage rising data traffic and a growing subscriber base. As mobile services diversify, operators increasingly require advanced SDM solutions to manage subscriber identities, maintain service continuity across technologies, and meet evolving data governance and cybersecurity standards.

Asia Pacific Subscriber Data Management Market Trends

The subscriber data management market in Asia Pacific held a substantial market share in 2024, driven by the increasing adoption of 5G networks, the rapid growth of IoT devices, rising demand for mobile broadband services, and expanding e-commerce platforms. In addition, governments in the region are investing heavily in telecom infrastructure to support digital transformation, further fueling the demand for advanced SDM solutions. In Australia, the rollout of 5G networks, coupled with growing mobile data consumption, is accelerating the need for robust SDM systems. Meanwhile, in South Korea, the surge in smart city initiatives and the widespread use of connected devices are driving significant demand for efficient data management platforms. These developments are set to boost the SDM market across the region significantly.

The China subscriber data management market held a substantial market share in 2024. The market in China is experiencing rapid growth, driven by the rapid expansion of 5G networks, increased 5G subscriptions, government initiatives to enhance connectivity, and a surge in mobile data consumption. According to the Ministry of Industry and Information Technology (MIIT), China surpassed 4.39 million 5G base stations by March 2024, with 5G user penetration reaching 75.9%. With over 1 billion 5G mobile phone subscriptions, China now leads globally in 5G deployment. The government’s focus on expanding 5G coverage, especially in rural and remote areas, further contributes to the demand for advanced SDM solutions to handle the growing volume of subscriber data. In addition, the increasing number of IoT devices and digital services across industries, combined with the country's 5G infrastructure development, is fueling the need for robust and scalable SDM platforms to ensure data security, management, and compliance.

The subscriber data management market in Japan held a significant share in 2024. In Japan, the market is influenced by the steady adoption of 5G networks, growing IoT applications, regulatory advancements, and the increasing demand for mobile data services. According to the Ministry of Internal Affairs and Communications (MIC), Japan has approximately 81 million 5G subscribers, representing 37% of the total mobile subscriptions, with a population penetration rate of over 60%. By the end of 2022, Japan's 5G coverage reached 96.6%, with the government targeting 99.9% coverage by 2030. This extensive 5G rollout is driving the need for advanced SDM solutions to manage large volumes of subscriber data, ensure compliance with data protection regulations, and support seamless connectivity across diverse applications, from consumer services to industrial IoT use cases.

Europe Subscriber Data Management Market Trends

The subscriber data management market in Europe was identified as a lucrative region in 2024. The European market is witnessing significant transformation, driven by the rapid adoption of 5G networks, growing mobile internet penetration, and increasing demand for advanced data governance solutions. According to the GSM Association report, by the end of 2024, 520 million people in Europe (88% of the population) subscribed to a mobile service, with 79% of the population using mobile internet, totaling 471 million users. This growth has been supported by the expansion of mobile broadband networks, with only a 1% coverage gap remaining. In addition, 5G adoption in Europe reached 30% of mobile connections, amounting to over 200 million 5G connections, with markets like Denmark, Finland, Germany, Norway, Switzerland, and the UK leading the charge. This surge in 5G connections is driving the need for sophisticated SDM systems to manage the complex and growing data traffic, ensure seamless service delivery, and comply with regulatory requirements across the region.

The Germany subscriber data management market is being shaped by the rapid deployment of 5G networks, increasing mobile data consumption, growing adoption of IoT solutions, and strict data protection regulations. Germany's 5G rollout is progressing quickly, with a focus on enhancing connectivity and supporting new services. This, in turn, accelerates demand for SDM systems capable of managing large volumes of data and ensuring service continuity. In addition, the rise of IoT applications in sectors like automotive, manufacturing, and healthcare is pushing the need for scalable and flexible SDM solutions.

The subscriber data management market in the UK has experienced substantial growth, fueled by the rapid deployment of 5G infrastructure, increasing adoption of IoT devices, higher mobile data consumption, and the need for robust data security and privacy compliance. This growth necessitates advanced SDM solutions capable of efficiently handling massive volumes of subscriber data. For instance, in October 2020, Telefónica UK selected Nokia as the sole provider of cloud-native SDM software to support its 3G, 4G, 5G, and IoT services. This deployment aims to enhance security, enable more efficient data management, and support the operator’s transition to a cloud-based network infrastructure, positioning Telefónica for future technological advancements.

Key Subscriber Data Management Company Insights

Some of the key players operating in the market include Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Nokia Corporation, Oracle Corporation, and Cisco Systems, Inc.

-

Founded in 1876 and headquartered in Stockholm, Sweden, Telefonaktiebolaget LM Ericsson is a prominent player in telecommunications and subscriber data management solutions. The company provides end-to-end network infrastructure, cloud-native software, and managed services to telecom operators. Ericsson’s SDM portfolio includes products for unified data management, policy control, and user data consolidation across 4G, 5G, and IoT networks. With a strong global footprint, Ericsson supports mobile operators in over 180 countries and plays a key role in advancing 5G deployment and digital transformation.

-

Founded in 1987 and headquartered in Shenzhen, China, Huawei Technologies Co., Ltd. is a global provider of information and communications technology (ICT) infrastructure and smart devices. In the subscriber data management space, Huawei offers cloud-native SDM solutions designed to support multi-access, high concurrency, and distributed deployment across 5G, IoT, and converged networks. The company’s portfolio spans core network products, data management systems, and digital services, with operations in more than 170 countries.

Key Subscriber Data Management Companies:

The following are the leading companies in the subscriber data management market. These companies collectively hold the largest market share and dictate industry trends.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Oracle Corporation

- Cisco Systems, Inc.

- Amdocs Limited

- Hewlett Packard Enterprise Company

- ZTE Corporation

- Samsung Electronics Co., Ltd.

- Mavenir Systems, Inc.

Recent Developments

-

In February 2023, Enea AB joined the Microsoft Azure Operator Nexus Ready Program, integrating its SDM and traffic management solutions, such as the Subscription Manager and Stratum Data Layer, into the Azure ecosystem to support cloud-native 4G and 5G deployments.

-

In January 2022, Ericsson integrated a Hardware Security Module (HSM) into its 5G Unified Data Management (UDM) solution to enhance authentication security. The integration strengthens cryptographic key protection, addressing the increased security demands of 5G networks and ensuring secure user data management across diverse access networks.

-

In October 2021, Enea introduced virtualized SDM solutions for the 5G core, helping mobile operators cut infrastructure costs by up to 50% through smarter data synchronization and reduced server usage, while also supporting sustainability goals and faster 5G service rollout.

-

In June 2021, Orange collaborated with HPE and other tech partners to launch Europe’s first fully cloud-native 5G standalone network in France, featuring a cloud-based Subscriber Data Management (SDM) system to support automated, AI-driven network operations

Subscriber Data Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.06 billion

Revenue forecast in 2030

USD 20.20 billion

Growth rate

CAGR of 17.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Solution, network type, application, deployment mode, organization size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Telefonaktiebolaget LM Ericsson; Huawei Technologies Co., Ltd.; Nokia Corporation; Oracle Corporation; Cisco Systems, Inc.; Amdocs Limited; Hewlett Packard Enterprise Company; ZTE Corporation; Samsung Electronics Co., Ltd.; Mavenir Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Subscriber Data Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global subscriber data management market report based on solution, network type, application, deployment mode, organization size, and region.

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Policy Management

-

Subscriber Data Federation

-

Identity Management

-

User Data Repository

-

-

Network Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Networks

-

Fixed Networks

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile

-

Fixed Mobile Convergence (FMC)

-

Voice over IP (VoIP) and Video over IP

-

Other Applications

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Cloud-Based

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global subscriber data management market size was estimated at USD 7.8 billion in 2024 and is expected to reach USD 9.06 billion in 2025.

b. The global subscriber data management market is expected to grow at a compound annual growth rate of 17.4% from 2025 to 2030 to reach USD 20.2 billion by 2030.

b. North America dominated the subscriber data management market with a share of 31.5% in 2024.

b. Some key players operating in the subscriber data management market include Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Nokia Corporation, Oracle Corporation, Cisco Systems, Inc., Amdocs Limited, Hewlett Packard Enterprise Company, ZTE Corporation, Samsung Electronics Co., Ltd., Mavenir Systems, Inc.

b. Key factors that are driving the market growth include rising demand for 5G networks and IoT ecosystems is significantly boosting the need for robust subscriber data platforms capable of managing vast, dynamic, and real-time user data across various network slices. Additionally, the increasing shift toward cloud and hybrid cloud deployments is enabling telecom operators to adopt scalable and flexible SDM solutions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.